Navigating the World of Monetary Aggregates

Monetary aggregates are crucial for understanding the overall money supply within an economy. These aggregates represent different measures of the total amount of money available. Economists and policymakers track these various measures to gain insights into economic activity and inflation. The money supply m1 vs m2 dynamic is closely watched. They use this data to make informed decisions. Understanding these aggregates is essential for effective economic management.

The Federal Reserve plays a central role in monitoring and, to some extent, controlling the money supply. It analyzes trends in monetary aggregates to assess the health of the economy. This analysis helps the Fed make decisions about interest rates and other monetary policy tools. These tools are used to influence economic growth and stability. The money supply m1 vs m2 relationship provides valuable signals. These signals help the Fed anticipate potential inflationary pressures or economic slowdowns. Accurate measurement and interpretation of monetary aggregates are vital for the Fed’s mission.

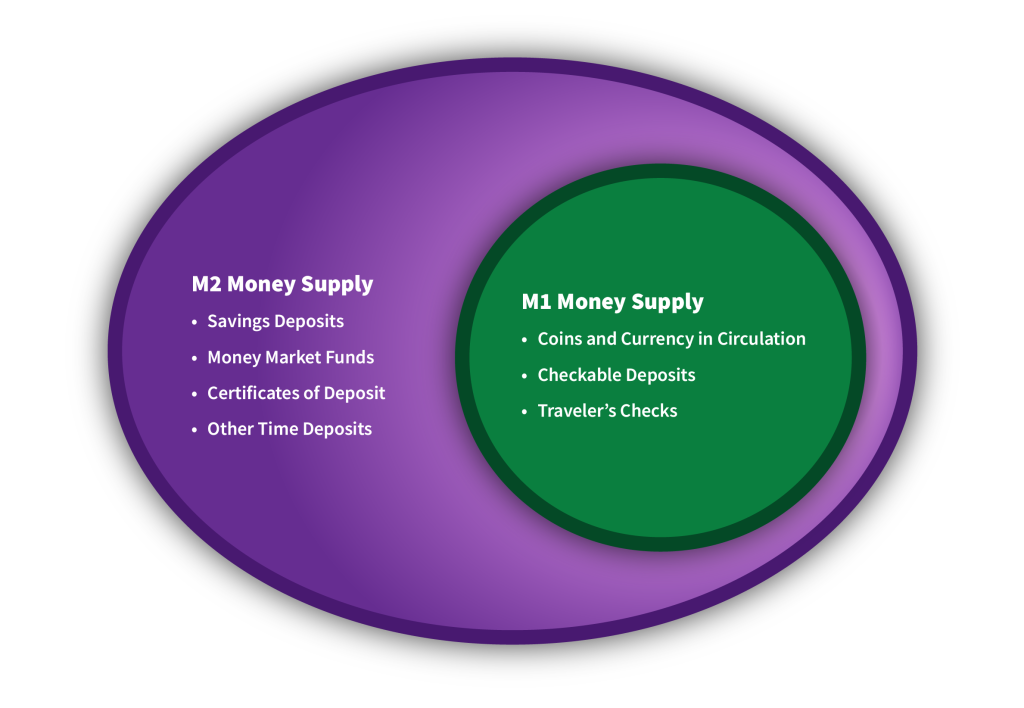

Different measures of money supply, such as M1 and M2, offer varying perspectives on the liquidity and availability of funds. M1 represents the most liquid forms of money. M2 includes M1 plus less liquid assets that can be easily converted to cash. The distinction between money supply m1 vs m2 is important. It helps economists understand how readily money is available for spending and investment. By monitoring these aggregates, policymakers can make more informed decisions about the money supply m1 vs m2 and its impact on the economy.

What’s Included in the Narrowest Measure of Money?

The narrowest measure of money, commonly known as M1, focuses on the most liquid forms of money within an economy. Understanding M1 is crucial for grasping the basics of the money supply m1 vs m2 dynamic. The primary components of M1 include physical currency in circulation, demand deposits, and other checkable deposits.

Physical currency encompasses coins and paper money held by the public. These are the tangible forms of money used daily for transactions. Demand deposits are funds held in checking accounts at commercial banks. These funds are readily available and can be accessed on demand via checks, debit cards, or electronic transfers. Other checkable deposits include accounts that offer similar check-writing or electronic transfer capabilities, blurring the lines of money supply m1 vs m2, allowing for easy access to funds.

A key characteristic of M1 components is their high liquidity. Liquidity refers to the ease with which an asset can be converted into cash without significant loss of value. The assets within M1 are exceptionally liquid, meaning they can be used immediately for transactions. This immediate usability is what defines M1 as the narrowest and most readily available form of the money supply. Because of its liquid nature, M1 is a key indicator when analyzing money supply m1 vs m2.

Exploring a Broader View of the Money Supply

M2 offers a broader perspective on the money supply compared to M1. It is a critical indicator for economists. Understanding M2 is crucial for grasping the total amount of liquid assets in an economy. The money supply m1 vs m2 comparison reveals significant differences. While M1 focuses on the most liquid forms of money, M2 includes less liquid, yet readily accessible, assets. M2 encompasses all components of M1. It adds other types of accounts that represent savings and short-term investments. This broader measure offers a more complete picture of the funds available for spending and investment. The money supply m1 vs m2 distinction is vital for economic analysis.

The additional components in M2 include savings accounts. These accounts allow individuals to store money while earning interest. Money market deposit accounts (MMDAs) are also part of M2. MMDAs offer higher interest rates than traditional savings accounts. However, they may have some restrictions on withdrawals. Small-denomination time deposits, or certificates of deposit (CDs), are another component. CDs typically have fixed terms and interest rates. They require the depositor to keep the money in the account for a specified period. These components of M2 are less liquid than the components of M1. Yet, they can be easily converted into cash.

The inclusion of these additional assets makes M2 a more comprehensive measure. It reflects the total amount of “near money” available in the economy. This is crucial because these assets can be quickly turned into cash for transactions. Changes in M2 can indicate shifts in consumer savings behavior. They also reflect changes in investment preferences. Monitoring M2 alongside M1 provides a more nuanced understanding. This understanding helps to analyze the overall health and direction of the economy. The money supply m1 vs m2, therefore, provides different but complementary insights into the economy’s monetary state. Examining the broader M2 helps to predict inflation and economic growth. It’s essential to consider both M1 and M2 to gain a complete view of the money supply m1 vs m2 dynamics.

M1 Versus M2: Key Distinctions and Differences

Understanding the nuances between M1 and M2 is crucial for interpreting monetary policy and its potential economic impacts. While both are measures of the money supply, they differ significantly in their composition and liquidity. The core distinction lies in the types of assets included. M1 represents the most liquid forms of money, readily available for transactions. In contrast, M2 encompasses M1 plus less liquid assets that can be quickly converted into cash.

M1 primarily consists of physical currency in circulation, such as coins and paper money held by the public. It also includes demand deposits, which are checking accounts that allow for immediate withdrawal of funds. Other checkable deposits also fall under the M1 umbrella. These components share the characteristic of being directly and immediately usable for payments. The money supply m1 vs m2 is an important distinction to make. M2, on the other hand, broadens the scope to include savings accounts, money market deposit accounts (MMDAs), and small-denomination time deposits (CDs). These assets, while not directly used for transactions like M1 components, can be easily converted into cash. The ease of conversion makes them near-money assets, contributing to M2’s broader measure of the money supply.

To illustrate the differences, consider this comparison: M1 focuses on money readily available for transactions, while M2 includes M1 plus savings accounts and other similar assets. The money supply m1 vs m2 dynamic shows that M2 is always larger than M1 because it encompasses all of M1’s components plus additional, less liquid forms of money. Changes in M1 reflect shifts in transaction demand, while changes in M2 reflect shifts in both transaction demand and savings behavior. The money supply m1 vs m2 is important because economists analyze these changes to understand economic trends and the effectiveness of monetary policy. Therefore, understanding the money supply m1 vs m2 is essential for any insightful economic or financial analysis.

How to Interpret Changes in M1 and M2 Data

Interpreting changes in M1 and M2 data is crucial for understanding the health and direction of the economy. Analyzing these shifts in the money supply m1 vs m2 provides insights into potential inflationary pressures, economic growth, and the likely trajectory of interest rates. An increase in either M1 or M2 suggests that more money is available in the economy, while a decrease indicates a contraction of available funds. However, it is the *relative* changes and the underlying economic conditions that truly determine the implications.

A rising M1, driven by increased demand deposits, often signals heightened transactional activity. Businesses and consumers are actively using their checking accounts, potentially indicating increased spending and economic confidence. A rising M2, on the other hand, might reflect a broader increase in savings and less liquid investments. If M2 is growing faster than M1, it *could* suggest that people are shifting funds from readily spendable accounts to savings or money market accounts, possibly due to attractive interest rates or a more cautious economic outlook. Rapid M2 growth, if unmatched by a corresponding increase in economic output, *can* lead to inflation. This occurs because there is more money chasing the same amount of goods and services, driving up prices. Central banks closely monitor these trends to adjust monetary policy accordingly.

Conversely, a decrease in the money supply m1 vs m2 *can* signal an economic slowdown. A falling M1 might indicate reduced consumer spending and business investment, while a declining M2 *could* point to decreased savings and overall economic activity. It’s important to consider other economic indicators, such as GDP growth, employment figures, and inflation rates, to get a complete picture. The Federal Reserve uses M1 and M2 data to inform its decisions about interest rate adjustments and other monetary policy tools. By influencing the money supply m1 vs m2, central banks aim to maintain price stability, promote full employment, and foster sustainable economic growth. The relationship between changes in the money supply m1 vs m2 and economic outcomes is complex and *can* be influenced by various factors, requiring careful analysis and interpretation.

The Impact of Money Supply on the Economy

Changes in the money supply have broad economic implications. Both M1 and M2 influence inflation, economic growth, and employment levels. Central banks manage the money supply to achieve macroeconomic goals. These goals often include price stability and full employment.

An increase in the money supply, whether measured by money supply m1 vs m2, can stimulate economic activity. More money available to businesses and consumers can lead to increased spending and investment. This can drive economic growth and create jobs. However, if the money supply grows too quickly, it can lead to inflation. Inflation erodes the purchasing power of money. Too much money chasing too few goods and services drives up prices. The relationship between money supply m1 vs m2 and inflation is a key concern for central banks.

Central banks use various tools to manage the money supply. These tools include setting interest rates and reserve requirements for banks. They also engage in open market operations, buying and selling government securities. By adjusting these tools, central banks can influence the amount of money available in the economy. The goal is to maintain a balance between stimulating economic growth and controlling inflation. Monitoring money supply m1 vs m2 is crucial. A contraction in the money supply can slow economic growth and potentially lead to a recession. Conversely, an excessive expansion of the money supply can fuel inflation. The careful management of money supply m1 vs m2 is essential for a stable and healthy economy. Understanding the dynamics of money supply m1 vs m2 is vital for policymakers. The impact of money supply m1 vs m2 extends to various sectors of the economy.

Factors Influencing the Composition of Money Supply

The composition of the money supply, particularly regarding money supply m1 vs m2, is not static. Various factors constantly exert influence, shifting the balance between the more liquid components of M1 and the less liquid, yet readily accessible, components of M2. These factors include fluctuations in interest rates, evolving consumer behavior, and ongoing technological advancements in the financial sector.

Changes in interest rates play a significant role. When interest rates on savings accounts, money market deposit accounts (MMDAs), and small-denomination time deposits (CDs) rise, consumers and businesses are incentivized to transfer funds from their checking accounts (a component of M1) into these higher-yielding accounts (components of M2). This is because the opportunity cost of holding money in a low-interest or non-interest-bearing checking account increases. Conversely, if interest rates decline, there may be less incentive to keep funds in savings accounts, potentially leading to a shift back into the more liquid M1 components. Therefore, interest rate movements directly impact the money supply m1 vs m2 ratio.

Consumer behavior also significantly impacts the money supply m1 vs m2. Shifts in spending habits, driven by factors like economic confidence or changing preferences, can alter the demand for different types of accounts. For instance, increased online shopping and electronic payments might lead to a decrease in the demand for physical currency (a component of M1) and a greater reliance on digital payment methods linked to checking accounts or other readily accessible funds. Technological advancements, such as the proliferation of mobile banking and online investment platforms, further blur the lines between different types of accounts and affect how individuals manage their money. The ease with which funds can be transferred between checking, savings, and investment accounts influences the perceived liquidity of assets and, consequently, the composition of the money supply. Furthermore, the rise of fintech companies and digital currencies adds another layer of complexity, potentially impacting the traditional definitions and measurements of money supply m1 vs m2 in the long run. Overall, understanding these factors is crucial for interpreting changes in money supply m1 vs m2 data and assessing their implications for the economy.

Practical Applications of Understanding Money Supply Data

Understanding money supply m1 vs m2 data offers practical benefits for individuals, businesses, and investors alike. This knowledge empowers informed financial decisions, refines investment strategies, and enhances economic forecasting accuracy. By monitoring the money supply m1 vs m2, individuals can gain insights into potential inflationary pressures, interest rate fluctuations, and overall economic health. For example, if M2 is growing rapidly, it might signal future inflation. Individuals might then consider investing in inflation-protected securities or tangible assets. Conversely, a contracting money supply m1 vs m2 could indicate a potential economic slowdown, prompting more conservative spending and investment strategies.

Businesses can leverage insights from money supply m1 vs m2 data to optimize their operations and financial planning. A growing money supply m1 vs m2 often indicates increased consumer demand. Businesses may respond by increasing production, expanding their workforce, or investing in new technologies. Monitoring the relationship between money supply m1 vs m2 and interest rates helps businesses make informed borrowing decisions. A rising money supply m1 vs m2 *can* lead to lower interest rates, making it more attractive to borrow money for expansion or investment. Conversely, a tightening money supply m1 vs m2 could signal higher interest rates, prompting businesses to delay borrowing or seek alternative financing options. Effective cash flow management and strategic inventory control become critical in adapting to changing monetary conditions.

Investors find value in tracking money supply m1 vs m2 data to refine their investment strategies and anticipate market trends. Changes in the money supply m1 vs m2 can influence asset prices, including stocks, bonds, and real estate. A rising money supply m1 vs m2 *can* fuel stock market rallies as increased liquidity flows into investments. Bond yields might rise if the market anticipates inflation. Real estate prices may also increase due to heightened demand fueled by an expanding money supply m1 vs m2. Savvy investors carefully monitor the relationship between money supply m1 vs m2 data, inflation indicators, and central bank policies to make informed asset allocation decisions. For example, an investor observing rapid M2 growth and rising inflation expectations might reduce their bond holdings and increase their allocation to inflation-protected assets or commodities. Understanding the nuances of money supply m1 vs m2 provides a valuable tool for navigating the complexities of the financial markets and achieving long-term investment goals.