What is the Russell 2000 Index and Why Does it Matter?

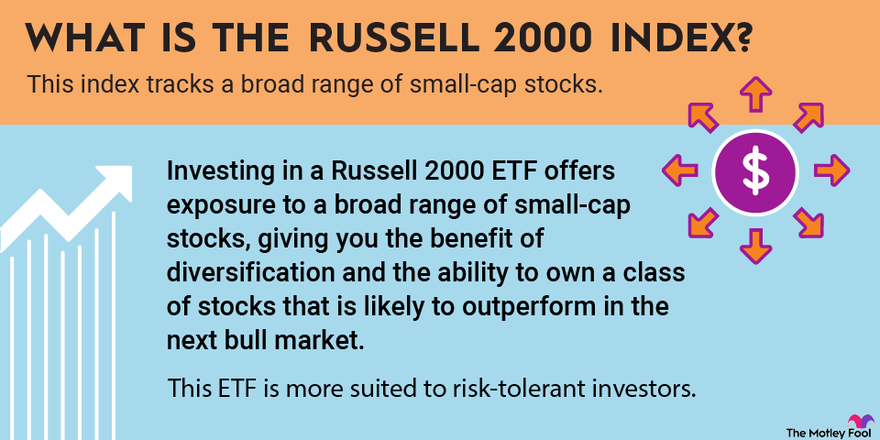

The Russell 2000 index serves as a leading benchmark for the performance of small-cap stocks within the United States equity market. It includes approximately 2,000 of the smallest companies in the Russell 3000 index, representing about 8% of the total Russell 3000 market capitalization. Unlike the S&P 500, which is weighted by market capitalization, the Russell 2000 utilizes a float-adjusted market capitalization weighting methodology. This means the index considers only the shares available to the public, providing a more accurate reflection of the investable universe of small-cap stocks. Understanding the Russell 2000 is crucial for investors and businesses seeking exposure to the small-cap segment of the US market, and tracking a list of companies in russell 2000.

The index acts as a performance indicator and a tool for investment professionals. Its composition offers insights into the dynamics of smaller, often higher-growth potential companies. A list of companies in russell 2000 offers diversified exposure to various sectors. These companies often exhibit distinct characteristics compared to their large-cap counterparts. They may possess higher growth rates, be more sensitive to economic fluctuations, and carry increased risk. Investors use the Russell 2000 to gauge the overall health of the small-cap market and to construct portfolios that align with their risk tolerance and investment objectives.

The companies within the Russell 2000 typically represent a diverse range of industries. Many are in early stages of development. They often focus on niche markets. Investors seeking to identify potential growth opportunities closely monitor the list of companies in russell 2000. The index’s reconstitution process, which occurs annually, can significantly impact stock prices as companies are added or removed. This event creates opportunities and challenges for investors. Understanding the weighting methodology, the typical characteristics of its constituents, and the dynamics of the Russell 2000 index is essential for navigating the small-cap investment landscape. The list of companies in russell 2000 is very important for investment analysis.

Navigating the Universe of Small-Cap Businesses

The landscape of small-cap businesses is vast and dynamic. Compiling a definitive, real-time list of companies in russell 2000 is an exercise in futility. This is due to the constant flux in market capitalizations and the frequent rebalancing of the index itself. Companies constantly graduate into or are relegated from the Russell 2000 based on their market cap, making any static list of companies in russell 2000 inherently outdated shortly after its creation. The dynamic nature of the stock market makes maintaining a truly current list of companies in russell 2000 extremely challenging.

While a perpetually updated list of companies in russell 2000 remains elusive, several resources offer snapshot views. Financial websites and brokerage platforms often provide lists of current Russell 2000 constituents. However, users must acknowledge the inherent limitations of these resources. Lag time between index changes and list updates is a common issue. Potential inaccuracies can also arise due to data processing delays. These lists can still provide a starting point for research. However, relying solely on them without further verification is not recommended. These lists should be considered a general guide, not an absolute authority on the current list of companies in russell 2000. Investors looking for the most up-to-date information should consult the official Russell index data and verify information from multiple sources.

Rather than focusing on static lists of companies in russell 2000, a more insightful approach involves exploring key sectors and identifying top performers within those sectors. By understanding the broad trends driving different segments of the small-cap market, investors can gain a more nuanced perspective. Analyzing sectors like Healthcare, Technology, or Consumer Discretionary can reveal compelling investment opportunities. This sector-based approach offers a more dynamic and relevant understanding of the small-cap universe. It allows investors to identify companies with growth potential and assess their performance relative to their peers, and find a list of companies in russell 2000 in that sector of interest. This method proves far more beneficial than relying on a simple, and often outdated, list of companies in russell 2000.

Exploring Key Sectors Represented in the Russell 2000

The Russell 2000 index offers exposure to a diverse range of sectors, reflecting the breadth of the U.S. small-cap market. Understanding these sectors is crucial for investors seeking to identify potential opportunities and manage risk. Each sector possesses unique characteristics and growth drivers, influencing the performance of the list of companies in russell 2000 within it. The index includes a significant representation from the Financials sector, encompassing banks, insurance companies, and other financial service providers. These companies are often influenced by interest rates, regulatory changes, and overall economic conditions. Their growth can be driven by factors such as loan demand, investment performance, and expansion into new markets.

Healthcare is another prominent sector within the Russell 2000. It includes biotechnology firms, pharmaceutical companies, healthcare providers, and medical device manufacturers. Innovation, drug approvals, and demographic trends often fuel growth within this sector. The Information Technology sector also holds a substantial presence. Software companies, IT service providers, and hardware manufacturers are all represented. The rapid pace of technological change drives growth, along with increased demand for digital solutions across various industries. Consumer Discretionary companies form another key segment. Retailers, restaurants, and entertainment providers are examples. Consumer spending habits and economic conditions heavily influence this sector’s performance. The list of companies in russell 2000 includes many consumer discretionary businesses.

Furthermore, the Industrials sector includes companies involved in manufacturing, transportation, and construction. Infrastructure spending, global trade, and industrial production impact this sector. The Materials sector comprises companies that produce raw materials like chemicals, metals, and paper. Global demand, commodity prices, and supply chain dynamics influence their performance. Examining the sector allocation within the Russell 2000, and understanding the types of companies each sector comprises, is a critical step in evaluating the list of companies in russell 2000. Remember that these sectors provide just an overview, and each individual company possesses unique characteristics requiring careful evaluation. It is imperative to investigate each element from the list of companies in russell 2000 thoroughly.

How to Find Publicly Traded Small-Cap Enterprises

Locating data on companies in the Russell 2000 requires utilizing reputable financial resources. Several financial websites and brokerage platforms offer index screeners and company databases designed to filter and identify specific stocks. These tools allow investors to search for a list of companies in russell 2000 and refine their search based on various criteria, such as sector, industry, market capitalization, and financial ratios. It is crucial to verify information obtained from any single source by cross-referencing with other reliable platforms. This verification process ensures accuracy and reduces the risk of making investment decisions based on incomplete or outdated information. The dynamic nature of the stock market necessitates a cautious approach to data collection and analysis.

Index screeners available on financial websites and brokerage platforms are valuable tools for generating a list of companies in russell 2000 and narrowing the search. These screeners provide filters to identify companies based on specific criteria. Investors can input parameters related to financial performance, such as revenue growth, earnings per share (EPS), and return on equity (ROE), to identify companies that meet their investment criteria. Additionally, filters related to market capitalization, price-to-earnings (P/E) ratio, and price-to-sales (P/S) ratio can help investors find undervalued or growth-oriented companies. The ability to customize search criteria allows for a targeted approach to identifying potential investment opportunities within the small-cap universe.

For more in-depth analysis, consider exploring financial data providers like Bloomberg Terminal or FactSet. These platforms offer comprehensive data and analytical tools, but they typically come with a subscription cost. Another valuable resource is the Securities and Exchange Commission (SEC) filings. Companies are required to file reports such as 10-K (annual report) and 10-Q (quarterly report), which contain detailed financial information and management discussions. These filings provide insights into a company’s financial performance, business operations, and risk factors. Analyzing SEC filings is an essential step in conducting thorough due diligence before investing in any publicly traded company and to maintain an updated list of companies in russell 2000. By utilizing a combination of online resources, financial data providers, and SEC filings, investors can gain a comprehensive understanding of companies within the Russell 2000 index.

Analyzing Top Performing Companies Within the Index

Identifying top-performing companies within the Russell 2000 requires a systematic approach. The focus should be on employing robust analysis methodologies. This avoids relying on specific company names that quickly become outdated. Evaluating companies requires examining several key metrics.

Revenue growth is a primary indicator. It shows a company’s ability to increase sales. Earnings growth demonstrates profitability improvements. Return on equity (ROE) reveals how efficiently a company generates profits from shareholders’ equity. Stock price appreciation reflects investor confidence and market perception. Examining both short-term and long-term performance is essential. Short-term gains might be speculative. Long-term performance indicates sustainable growth. Comparing companies within the same sector ensures relevant insights. This allows for a fair assessment of relative performance. The goal is to find consistent top performance within the list of companies in russell 2000, and also comparing them to other companies on the list of companies in russell 2000 in the same sector. Consider a hypothetical scenario. Imagine two software companies within the Russell 2000. Company A shows a 20% revenue growth over the past three years, with a stable ROE of 15%. Company B, shows a 30% revenue growth, but ROE is volatile, fluctuating between 5% and 20%. While Company B’s revenue growth is higher, Company A’s consistent ROE suggests a more stable and potentially more reliable investment. This exemplifies how to assess performance without citing specific company names from the list of companies in russell 2000.

Furthermore, it’s crucial to analyze the underlying drivers of performance. Is revenue growth organic, or driven by acquisitions? Is earnings growth due to cost-cutting measures, or increased efficiency? A sustainable competitive advantage is also vital. Does the company possess unique technology, brand recognition, or a strong distribution network? Analyzing these qualitative factors provides a deeper understanding of a company’s potential. Remember, past performance is not necessarily indicative of future results. Thorough due diligence is always required before making investment decisions. The list of companies in russell 2000 is long, but it’s worth filtering those companies through analysis methodologies.

Understanding the Risks and Rewards of Small-Cap Investments

Investing in small-cap stocks, particularly those within the Russell 2000 index, presents a unique set of opportunities and challenges. The potential for higher returns is a primary draw. Small-cap companies, due to their size and growth stage, often possess the agility to expand rapidly compared to their large-cap counterparts. This growth can translate into significant stock price appreciation, offering substantial gains for investors. However, this potential for increased returns comes with inherent volatility. The stock prices of small-cap companies are typically more susceptible to market fluctuations and economic downturns. This increased sensitivity means that the Russell 2000 index, as a whole, can experience more pronounced swings than indices composed of larger, more established companies. A comprehensive list of companies in russell 2000, while extensive, underscores the breadth of this market segment.

Several factors contribute to the volatility of small-cap stocks. Market sentiment plays a significant role; during periods of economic uncertainty, investors may flock to the perceived safety of large-cap stocks, leading to a sell-off in the small-cap sector. Economic conditions, such as interest rate changes or inflation, can disproportionately impact smaller companies that may have limited access to capital or be more vulnerable to changes in consumer spending. Company-specific events, such as earnings misses or product recalls, can also have a more dramatic effect on the stock price of a small-cap company than on a large-cap company with more diversified operations. A list of companies in russell 2000 represents a diverse range of businesses, each with its unique risk profile.

Given the inherent risks, a diversified portfolio is crucial for managing exposure to the Russell 2000. Diversification involves spreading investments across different sectors and asset classes, mitigating the impact of any single investment performing poorly. Thorough due diligence is also essential before investing in individual companies within the index. This includes analyzing financial statements, understanding the company’s business model, and assessing the competitive landscape. Furthermore, investors should be aware of their own risk tolerance and investment time horizon before allocating capital to small-cap stocks. A list of companies in russell 2000 provides a starting point for research, but careful analysis is paramount. While the potential rewards of investing in the Russell 2000 can be substantial, understanding and managing the associated risks is paramount for long-term investment success. A comprehensive list of companies in russell 2000 requires constant monitoring due to market dynamics.

Key Considerations Before Investing in Russell 2000 Companies

Evaluating several crucial factors is essential before investing in individual companies within the Russell 2000. A thorough analysis can help mitigate risks. It also assists in making informed investment decisions. One must rigorously examine financial health, business models, management teams, and the competitive landscape. Independent research is vital to assess the viability and potential of each investment.

Analyzing a company’s financial health involves scrutinizing its balance sheet, income statement, and cash flow statement. Look for consistent revenue growth, profitability, and manageable debt levels. Understanding the business model helps investors determine how a company generates revenue and sustains its operations. A clear and sustainable business model is more likely to succeed in the long term. Assessing the management team involves evaluating their experience, track record, and strategic vision. A capable and trustworthy management team is crucial for guiding a company through challenges and opportunities. Understanding the competitive landscape means analyzing the company’s position within its industry. Consider the presence of competitors, barriers to entry, and potential disruptions. Investors searching for a list of companies in russell 2000 should prioritize firms with strong competitive advantages.

Seeking advice from qualified financial advisors before making investment decisions is always a prudent step. Valuation metrics, such as the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio, are valuable tools for assessing potential value. Comparing these ratios to industry averages can help determine whether a company is overvalued or undervalued. The list of companies in russell 2000 offers a wide array of investment possibilities. Therefore, applying due diligence is important for successful investing. A well-informed investor is better equipped to navigate the complexities of the market and identify promising opportunities. Examining these factors assists investors searching for a list of companies in russell 2000 to make well-informed and rational decisions. Investors who use these insights can improve their chances of success in the small-cap market. Careful consideration of these elements is vital when creating your own list of companies in russell 2000 for potential investment.

Staying Updated on Russell 2000 Index Changes

Remaining informed about changes to the Russell 2000 index composition is crucial for investors. The index undergoes annual reconstitutions, also known as rebalancing. These changes can significantly affect the stock prices of companies included or excluded from the index. Tracking these shifts is essential for adapting investment strategies.

The annual reconstitution process involves reassessing the market capitalization of eligible companies. This ensures the index accurately reflects the small-cap market segment. Companies that no longer meet the size criteria may be removed. Simultaneously, others that have grown sufficiently may be added. These changes trigger buying and selling activity. This can create opportunities and risks for investors. A list of companies in russell 2000 changes frequently. Therefore, monitoring announcements is vital.

Several resources provide information on Russell 2000 index changes. The Frank Russell Company, the index provider, publishes announcements and updates. Reputable financial news outlets and brokerage platforms also report on these changes. Investors can find detailed information on company additions and deletions through these channels. A list of companies in russell 2000 is dynamic. Consequently, ongoing monitoring and analysis are necessary. Understanding the typical timeline of Russell reconstitutions is also important. The reconstitution typically occurs in June. Anticipating these changes can influence investment decisions. However, caution is advised against “front-running” the index changes. This involves attempting to profit from anticipated price movements before the changes take effect. Such practices can be risky and may not yield the desired results. A list of companies in russell 2000 requires constant monitoring to make informed investment decisions. Always verify information from multiple sources and consult a financial advisor.