Understanding Treasury Bills: An Introduction

Treasury bills, commonly known as T-bills, represent short-term debt obligations issued by a government. These bills serve as a vital instrument for governments to raise funds and manage their short-term financial needs. T-bills are highly regarded for their safety, backed by the full faith and credit of the issuing government, making them a low-risk investment option. Furthermore, they offer excellent liquidity, meaning they can be easily bought and sold in the secondary market before their maturity date. For investors seeking a secure and liquid avenue to park their funds for a short period, T-bills present a compelling choice. Learning how to calculate interest on treasury bills is an essential skill for any investor considering this option.

The types of T-bills vary primarily based on their maturity periods. Common maturities range from a few weeks to one year. The most frequently issued T-bills have maturities of 4, 8, 13, 17, 26, and 52 weeks. Investors can select the maturity that aligns best with their investment timeline and financial goals. Understanding how to calculate interest on treasury bills across these different maturities allows investors to make informed decisions based on potential returns and their individual liquidity needs. The process of how to calculate interest on treasury bills remains consistent regardless of the specific maturity period.

Investing in T-bills involves purchasing them at a discount to their face value. The difference between the purchase price and the face value represents the interest earned. This unique characteristic differentiates T-bills from other investments that pay periodic interest payments. The return on a T-bill is determined by how much lower the purchase price is compared to the face value and the length of the holding period. Therefore, understanding how to calculate interest on treasury bills accurately is critical for evaluating the profitability of this investment. Investors who know how to calculate interest on treasury bills can effectively compare T-bill yields with those of other short-term investment options.

Essential Elements for Figuring Out T-Bill Profits

To understand how to calculate interest on treasury bills and determine the profits from investing in them, it’s crucial to grasp the key elements involved. These elements are the purchase price, the face value, and the holding period. The purchase price, also known as the discounted price, is the amount an investor pays to acquire the T-bill. The face value, or maturity value, is the amount the investor receives when the T-bill matures. The holding period refers to the length of time the investor holds the T-bill before it matures.

The relationship between these elements is fundamental to understanding how to calculate interest on treasury bills. T-bills are purchased at a discount, meaning the purchase price is lower than the face value. The difference between the face value and the purchase price represents the investor’s earnings. The holding period influences the annualized yield; a shorter holding period results in a lower overall return compared to holding the T-bill until maturity. Investors need to carefully consider these interconnected components to accurately assess potential profits. Understanding how to calculate interest on treasury bills involves analyzing the difference between what you pay now and what you’ll receive later, factoring in the time you hold the investment.

In essence, the profit from a T-bill investment is derived from the discount at which it was purchased. A larger discount, meaning a bigger difference between the face value and the purchase price, translates to a higher potential return. The holding period serves as a crucial factor in annualizing this return, allowing investors to compare T-bill yields with other investment options. Therefore, to properly understand how to calculate interest on treasury bills, one must analyze the interplay of the purchase price, face value, and holding period. Accurately determining these components is the first step toward successfully navigating the T-bill market and maximizing potential earnings.

Decoding the Discount Rate: How It Affects Your Return

The discount rate is a crucial concept when learning how to calculate interest on treasury bills. It represents the difference between the T-bill’s face value, which is the amount you receive at maturity, and the purchase price, or the discounted price you pay upfront. Understanding this difference is fundamental to grasping how T-bills generate returns. The discount rate is essentially the interest earned, but it’s expressed as an annualized percentage of the face value.

A higher discount rate generally indicates a higher potential return on the investment. This is because you are purchasing the T-bill at a greater discount from its face value. For example, if a T-bill with a face value of $1,000 is purchased for $980, the discount is $20. This $20 represents your earnings before considering the time to maturity. The prevailing market conditions, economic outlook, and demand for T-bills influence the discount rate. When the demand for T-bills is high, the discount rate tends to be lower, and vice versa. Investors need to monitor discount rates closely to make informed decisions about their investments, and how to calculate interest on treasury bills effectively.

The discount rate isn’t the actual yield you receive. The yield considers the time to maturity. To accurately determine your return, you must annualize the discount based on the holding period. Therefore, while a higher discount rate suggests a better return, the actual yield depends on how long you hold the T-bill. This is why understanding how to calculate interest on treasury bills involves more than just looking at the discount; it requires a complete yield calculation. Keep in mind that changes in prevailing interest rates can affect the attractiveness of T-bills purchased at different discount rates. It is important to consider all these factors when assessing if T-bills align with your investment objectives.

A Step-by-Step Approach to Calculating T-Bill Yield

This section provides a clear guide on how to calculate interest on treasury bills. The yield calculation is essential for understanding the potential return on investment. Follow these steps to accurately determine your T-bill yield.

The formula for calculating the yield on a T-bill is: (Face Value – Purchase Price) / Purchase Price * (360 / Days to Maturity) * 100. Let’s break down each element: The “Face Value” represents the amount you will receive at maturity. The “Purchase Price” is the discounted price you paid for the T-bill. The “Days to Maturity” is the number of days until the T-bill matures. The constant “360” represents the number of days in a year for this calculation, following standard financial conventions. Multiplying by “100” converts the result into a percentage. To calculate interest on treasury bills, subtract the purchase price from the face value. This difference represents your profit. Divide this profit by the purchase price to get the return as a decimal. Adjusting for the time period involves dividing 360 by the number of days to maturity, effectively annualizing the return. Finally, multiplying by 100 converts the decimal to a percentage, giving you the annual yield. This percentage shows the return on your investment. A higher yield usually signals a more profitable investment, but it also may be related to higher risk.

Here’s a simple example: Suppose you purchase a T-bill with a face value of $10,000 for a purchase price of $9,800. The T-bill matures in 180 days. Using the formula: (($10,000 – $9,800) / $9,800) * (360 / 180) * 100. First, calculate the difference between the face value and purchase price: $10,000 – $9,800 = $200. Next, divide this by the purchase price: $200 / $9,800 = 0.0204. Then, divide 360 by the days to maturity: 360 / 180 = 2. After that, multiply these results together: 0.0204 * 2 = 0.0408. Finally, multiply by 100 to express the yield as a percentage: 0.0408 * 100 = 4.08%. Therefore, the annual yield on this T-bill is 4.08%. Investors should learn how to calculate interest on treasury bills to evaluate returns and make sound investment decisions.

Illustrative Examples: Real-World Scenarios for Earning Calculation

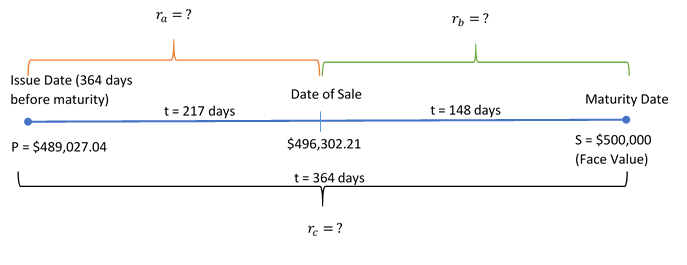

Understanding how to calculate interest on treasury bills requires practical application. Here are several examples demonstrating how to calculate interest on treasury bills with varying parameters to clarify the process. These examples illustrate different potential earnings based on purchase price, face value, and holding period. Let’s examine different scenarios to understand how these factors interplay.

Example 1: An investor purchases a T-bill with a face value of $10,000 for a discounted price of $9,800. The T-bill matures in 180 days. To calculate the yield: ($10,000 – $9,800) / $9,800 * (360 / 180) * 100 = 4.08%. In this instance, the annualized yield is approximately 4.08%. This showcases how to calculate interest on treasury bills, considering a standard maturity period. Example 2: Suppose an individual buys a T-bill for $9,900 with a face value of $10,000, maturing in 90 days. Applying the formula: ($10,000 – $9,900) / $9,900 * (360 / 90) * 100 = 4.04%. Even with a smaller discount, the annualized yield remains competitive. This underscores the impact of the holding period when learning how to calculate interest on treasury bills. Example 3: Consider a scenario where a T-bill with a $1,000 face value is purchased for $995 and matures in 270 days. The calculation is as follows: ($1,000 – $995) / $995 * (360 / 270) * 100 = 2.01%. This illustrates how a smaller difference between the purchase price and face value, combined with a longer maturity, affects the final yield. Example 4: An investor buys a T-bill for $9,750 with a face value of $10,000 that matures in 360 days. In this case, the calculation will be: ($10,000 – $9,750) / $9,750 * (360 / 360) * 100 = 2.56%.

These examples highlight the importance of understanding the relationship between the purchase price, face value, and days to maturity when determining potential T-bill earnings. These scenarios provide a clearer picture of how to calculate interest on treasury bills in various situations. The discount rate plays a crucial role; a larger discount generally leads to a higher yield, assuming all other factors remain constant. When considering how to calculate interest on treasury bills, remember to annualize the yield for accurate comparisons between T-bills with different maturity periods. By examining diverse scenarios, investors gain a more profound understanding of the dynamics involved in T-bill investments and how to calculate interest on treasury bills effectively.

Tools and Resources for Simplified Calculations

Calculating treasury bill (T-bill) yields can seem complex, but several tools and resources are available to simplify the process. Investors seeking to understand how to calculate interest on treasury bills can leverage these aids for quicker and more accurate results. These tools can significantly streamline the process, especially for those new to T-bill investments. The use of these tools helps investors understand how to calculate interest on treasury bills with greater ease.

Online T-bill calculators are readily accessible and provide a user-friendly interface for computing yields. These calculators typically require inputting the face value, purchase price, and days to maturity. After entering this information, the calculator automatically computes the yield, saving time and reducing the risk of manual calculation errors. Many financial websites offer these calculators free of charge. Always verify the calculator’s accuracy by comparing its output with manual calculations, especially when learning how to calculate interest on treasury bills. Understanding the underlying formula remains crucial, even when using these convenient tools. Furthermore, some brokerage platforms offer built-in calculators that automatically display the yield when you’re considering purchasing a T-bill, making the investment decision process even more straightforward. Government websites that auction T-bills often provide educational resources and calculators, too. These resources can be invaluable for understanding the nuances of how to calculate interest on treasury bills.

Spreadsheet software like Microsoft Excel or Google Sheets can also be used to create custom T-bill yield calculators. This approach allows for greater flexibility and customization. You can input the T-bill yield formula directly into a cell and then easily change the input values (face value, purchase price, days to maturity) to see how the yield changes. Creating your own calculator in a spreadsheet helps reinforce your understanding of how to calculate interest on treasury bills. Moreover, this method allows you to incorporate other factors into your calculations, such as the impact of taxes or inflation. This comprehensive approach provides a more complete picture of the potential return on your T-bill investment, and will increase your understanding of how to calculate interest on treasury bills. Before relying solely on any tool, double-check the results to ensure accuracy. Being able to use a variety of resources when researching how to calculate interest on treasury bills will lead to better informed investments.

Beyond the Basics: Considering Taxes and Inflation

Understanding how to calculate interest on treasury bills is crucial, but it’s equally important to consider the impact of taxes and inflation on your returns. Taxes can significantly reduce the actual profit earned from T-bill investments. The interest income from T-bills is typically subject to federal income tax, and depending on your state and local tax laws, it may also be subject to state and local taxes.

The effect of taxes means that a portion of the interest earned will go to the government, reducing the net return. Investors should factor in their estimated tax bracket when evaluating the attractiveness of T-bill yields. It is important to know how to calculate interest on treasury bills after accounting for tax implications, and how this influences your overall investment strategy. Strategies exist to mitigate the impact of taxes, such as holding T-bills within tax-advantaged accounts like IRAs or 401(k)s. However, this might not always be the best course of action, as it depends on your broader financial goals and tax situation.

Inflation is another key consideration. It erodes the purchasing power of your investment returns. If the inflation rate is higher than the yield on your T-bill, the real return (the return after accounting for inflation) will be negative. Even if the nominal return is positive, the investor’s purchasing power decreases. For example, if a T-bill yields 2% and inflation is running at 3%, the real return is -1%. Understanding how to calculate interest on treasury bills in conjunction with inflation rates offers a more realistic view of the investment’s profitability. Investors need to consider the prevailing inflation rate and expectations for future inflation when deciding whether to invest in T-bills. While T-bills are considered low-risk investments, the impact of taxes and inflation can diminish the overall return, and understanding how to calculate interest on treasury bills while considering these factors is vital for making sound financial decisions.

Making Informed Decisions: Evaluating T-Bill Investments

When evaluating treasury bill investments, several key factors warrant careful consideration. Understanding these elements will empower investors to make informed decisions aligned with their financial goals and risk tolerance. A primary consideration is the yield offered by the T-bill. This represents the return on investment and should be compared to other investment options to assess its competitiveness. Investors should know how to calculate interest on treasury bills to accurately compare different T-bill offerings.

Risk tolerance plays a crucial role in the decision-making process. T-bills are generally considered low-risk investments due to the backing of the government. However, it’s essential to acknowledge that all investments carry some level of risk, including the potential for inflation to erode returns. Investment goals also influence the suitability of T-bills. If the objective is to preserve capital and generate a modest return over a short period, T-bills can be a suitable option. However, for long-term growth, other investment avenues may be more appropriate. Investors should understand how to calculate interest on treasury bills in order to forecast their earnings.

The prevailing economic environment significantly impacts T-bill investments. Factors such as interest rate trends, inflation expectations, and overall economic growth can affect the attractiveness of T-bills. Monitoring these indicators can help investors make informed decisions about when to buy or sell T-bills. Furthermore, it is always prudent to conduct thorough research and seek guidance from a qualified financial advisor before making any investment decisions. A financial advisor can provide personalized advice tailored to your specific circumstances and help you navigate the complexities of the financial markets. Knowing how to calculate interest on treasury bills is essential, but professional guidance can provide a broader perspective and support informed investment choices. Remembering how to calculate interest on treasury bills is vital for making sound investment comparisons.