What is Return on Invested Capital and Why Does It Matter?

Return on Invested Capital (ROIC) is a crucial financial metric that reveals how efficiently a company uses its invested capital to generate profits. In essence, it quantifies the return a company achieves for every dollar invested. ROIC is a key performance indicator (KPI) for both investors and business owners, providing valuable insights into a company’s operational effectiveness. Understanding how do you calculate ROIC and interpreting its value is essential for making informed decisions about resource allocation and investment strategies. A higher ROIC generally indicates that a company is adept at converting its investments into profits, making it an attractive prospect for investors.

For investors, ROIC serves as a powerful tool for evaluating the profitability and capital efficiency of different companies. By comparing the ROIC of companies within the same industry, investors can identify those that are generating the most value from their invested capital. This metric helps in assessing whether a company’s management is effectively deploying capital to maximize returns. It is important to learn how do you calculate ROIC to properly evaluate companies. Furthermore, ROIC can be used to assess the sustainability of a company’s competitive advantage. A consistently high ROIC may indicate that a company possesses a strong moat, protecting it from competitors and allowing it to generate superior returns over time.

Business owners can leverage ROIC to gain a deeper understanding of their company’s financial performance and identify areas for improvement. By analyzing ROIC, businesses can pinpoint inefficiencies in their operations and optimize their capital allocation strategies. For example, a low ROIC may indicate that a company is investing in projects that are not generating sufficient returns or that it is carrying too much debt. In such cases, management can take steps to improve profitability, reduce costs, or reallocate capital to more productive areas. Learning how do you calculate ROIC is paramount. Ultimately, ROIC helps business owners make data-driven decisions that enhance profitability, improve capital efficiency, and drive long-term value creation. By actively monitoring and managing ROIC, companies can unlock their full potential and achieve sustainable growth.

Deciphering Invested Capital: Understanding the Components

Invested capital represents the total amount of funds used to finance a company’s operations. Understanding its components is crucial for investors and business owners alike. It primarily consists of two main elements: debt and equity. Both play significant roles in funding a company’s assets and driving its growth. To understand how do you calculate ROIC, you must first understand invested capital.

Debt includes all interest-bearing obligations, such as loans, bonds, and notes payable. It represents the capital borrowed by the company from external sources. Equity, on the other hand, signifies the owners’ stake in the company. It comprises common stock, preferred stock, and retained earnings. Retained earnings represent the accumulated profits that have not been distributed as dividends but reinvested back into the business.

To calculate the total invested capital, sum up the value of all debt and equity components. Common balance sheet items included in this calculation are: Total Debt (short-term and long-term), Common Stock, Preferred Stock, and Retained Earnings. For instance, a company might have $5 million in total debt, $2 million in common stock, and $3 million in retained earnings. In this case, the invested capital would be $10 million ($5 million + $2 million + $3 million). Knowing how do you calculate ROIC is essential, but correctly identifying invested capital is the foundational step. A clear understanding of how do you calculate ROIC begins with identifying invested capital.

Net Operating Profit After Tax: Pinpointing the True Profitability

Net Operating Profit After Tax (NOPAT) represents a company’s after-tax profit generated from its core operations. It’s a crucial metric for assessing operational efficiency because it excludes the impact of debt financing and non-operating activities. NOPAT offers a clearer picture of a company’s ability to generate profits from its business activities compared to net income. Understanding how do you calculate roic starts with calculating NOPAT.

NOPAT differs from net income primarily because net income includes interest expense (net of tax) and other non-operating items, such as gains or losses from the sale of assets. These items can distort the true profitability of a company’s core operations. To calculate NOPAT, begin with earnings before interest and taxes (EBIT). Next, multiply EBIT by (1 – tax rate). This calculation removes the tax savings a company achieves due to its debt financing. This provides a standardized view of profitability, irrespective of a company’s capital structure. The formula is: NOPAT = EBIT x (1 – Tax Rate). For instance, if a company has EBIT of $1,000,000 and a tax rate of 25%, NOPAT would be $1,000,000 x (1 – 0.25) = $750,000.

NOPAT is a more accurate reflection of operational profitability because it isolates the earnings directly attributable to a company’s business operations. When analyzing how do you calculate roic, NOPAT serves as the numerator. It provides investors and managers with a better understanding of how efficiently a company is using its capital to generate profits from its core business. By excluding the effects of financing decisions, NOPAT allows for a more apples-to-apples comparison between companies, regardless of their debt levels. When considering how do you calculate roic, it is important to note that NOPAT’s focus on operational profit makes it superior to net income for assessing a company’s fundamental performance and its ability to generate sustainable returns on invested capital.

A Step-by-Step Approach: How to Determine Your Company’s ROIC

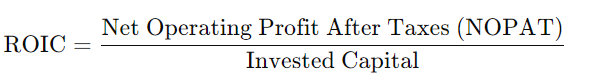

Calculating Return on Invested Capital (ROIC) provides valuable insights into a company’s profitability and efficiency. This step-by-step guide clarifies how do you calculate ROIC effectively. The formula is straightforward: ROIC = NOPAT / Invested Capital. NOPAT represents Net Operating Profit After Tax, and Invested Capital is the total capital employed by the business.

Let’s illustrate how do you calculate ROIC with an example. Suppose a company has a NOPAT of $500,000 and Invested Capital of $2,500,000. The ROIC calculation would be: ROIC = $500,000 / $2,500,000 = 0.20 or 20%. This suggests that for every dollar of invested capital, the company generates 20 cents in profit after tax. To fully understand how do you calculate ROIC you have to understand the numbers used. The higher the ROIC, the better, as it signifies more efficient capital utilization.

Once you’ve calculated ROIC, understanding its implications is crucial. If the ROIC is higher than the company’s cost of capital, it indicates the company is creating value. Conversely, if the ROIC is lower than the cost of capital, the company is destroying value. Consider a few different options. A high ROIC (above 15%) often signals a strong competitive advantage. An ROIC between 10% and 15% suggests average performance. An ROIC below 10% may warrant further investigation into operational inefficiencies or strategic challenges. Benchmarking ROIC against industry peers provides a more contextualized understanding of a company’s performance. This helps to contextualize how do you calculate ROIC in terms of what is a good ROIC. This provides a comprehensive understanding of how do you calculate ROIC and how to use it.

Benchmark Your Performance: What is Considered a Good ROIC?

Understanding whether a company’s ROIC is strong requires benchmarking. Comparing a company’s ROIC to industry averages provides valuable context. A seemingly low ROIC might be perfectly acceptable within a capital-intensive industry, while a higher ROIC could indicate underperformance in a sector known for high returns. Industry databases and financial analysis reports offer benchmarks. Remember that size matters; larger companies often exhibit lower ROICs than smaller, more agile competitors. Risk profiles also play a significant role. Higher-risk businesses should generate higher ROICs to compensate investors. How do you calculate ROIC accurately? It involves determining NOPAT and invested capital precisely. Remember, a “good” ROIC is relative. It depends on the industry, company size, and the risk involved. Analyzing trends over time is crucial; a declining ROIC, even if initially high, signals potential problems.

Factors influencing ROIC interpretation extend beyond simple comparisons. Consider economic cycles. During economic booms, ROICs generally rise; conversely, downturns usually depress them. Management efficiency significantly impacts ROIC. Effective operational strategies increase profitability, boosting the numerator in the ROIC calculation. Similarly, shrewd capital allocation strategies—investing in high-return projects and avoiding capital-intensive ventures with low returns—enhance ROIC. How do you calculate ROIC when faced with varying capital structures? Accurate calculation requires understanding the complexities of debt and equity financing. Financial leverage, the proportion of debt financing, also influences ROIC. High financial leverage can amplify ROIC, but it also increases risk. Thoroughly evaluating a company’s financial statements is necessary for an accurate ROIC assessment.

Setting realistic ROIC targets involves considering historical performance and projected growth. Companies should aim for ROIC exceeding their cost of capital. This signifies that the company generates returns exceeding the cost of funding its operations. Consistent improvement in ROIC indicates a healthy business generating value for shareholders. This sustained increase in ROIC is a testament to effective management and smart business decisions. How do you calculate ROIC to inform strategic decision-making? Regular ROIC monitoring allows companies to identify areas needing improvement. It guides investment choices and helps in assessing the profitability of new projects. Remember, ROIC is only one metric among many for evaluating overall financial health, but a consistently strong ROIC strongly indicates a well-managed and profitable enterprise. Understanding how do you calculate ROIC properly is crucial for using this metric effectively.

Driving ROIC Improvement: Strategies for Enhanced Performance

Businesses can employ various strategies to improve their Return on Invested Capital (ROIC) and enhance performance. Increasing profitability through operational efficiency is a primary focus. This involves streamlining processes, reducing waste, and optimizing resource allocation. Identifying areas where costs can be cut without sacrificing quality is essential. Negotiating better deals with suppliers, implementing lean manufacturing principles, and automating repetitive tasks can significantly impact profitability. By improving efficiency, a company can generate more profit from the same level of invested capital, thereby boosting its ROIC. How do you calculate ROIC improvements by making such changes? Track all changes and the impact of each on the business profits.

Optimizing capital allocation is another crucial strategy. This involves carefully evaluating investment opportunities and prioritizing those with the highest potential returns. Companies should regularly assess their existing assets and divest those that are not generating adequate returns. Investing in projects that align with the company’s strategic goals and offer attractive ROIC prospects is vital. Furthermore, efficient working capital management plays a significant role. Minimizing inventory levels, shortening the accounts receivable cycle, and extending payment terms with suppliers can free up capital that can be used for more productive investments. Such measures will also improve, how do you calculate ROIC changes overtime.

Reducing the cost of capital can also lead to ROIC improvement. This involves optimizing the company’s capital structure by finding the right balance between debt and equity financing. Securing lower interest rates on debt, refinancing existing debt, and managing equity dilution can lower the overall cost of capital. Additionally, improving the company’s credit rating can make it easier to access capital at more favorable terms. Implementing these strategies requires a thorough understanding of the company’s financial position and a commitment to continuous improvement. By focusing on profitability, capital allocation, and cost of capital, businesses can drive ROIC improvement and create long-term value. It is imperative to continue asking, how do you calculate ROIC changes after implementing each of these strategies?

ROIC vs. Other Financial Metrics: A Comparative Analysis

Return on Invested Capital (ROIC) stands as a powerful tool, but understanding its relationship to other financial metrics is crucial. Two commonly encountered metrics are Return on Equity (ROE) and Return on Assets (ROA). While all three assess profitability, they offer distinct perspectives. ROE focuses on the return generated for shareholders’ equity. ROA, on the other hand, measures how efficiently a company uses its total assets to generate earnings. A key difference lies in how each metric treats debt. ROE can be inflated by leveraging debt, potentially masking underlying inefficiencies. ROA considers all assets, but doesn’t isolate the performance of invested capital specifically.

The strength of ROIC lies in its focus on invested capital, encompassing both debt and equity. This provides a more comprehensive view of how effectively a company is allocating its resources to generate profits. It directly addresses how efficiently a company utilizes all the capital invested in the business, not just equity or total assets. Understanding how do you calculate ROIC offers unique insights. While ROE highlights returns to shareholders and ROA reflects asset utilization, ROIC hones in on the true profitability derived from invested capital. Each metric has its limitations. ROE can be skewed by financial leverage. ROA might not fully capture the cost of capital. How do you calculate ROIC provides a balanced view, reflecting the profitability of all invested capital.

For a holistic assessment of a company’s financial health and value creation, ROIC often emerges as the superior metric. It directly links profitability to the capital invested, offering a clear picture of how efficiently a company generates returns from its investments. While ROE and ROA are valuable in their own right, ROIC provides a more nuanced understanding of capital allocation and overall business performance. How do you calculate ROIC to gain a competitive advantage and drive long-term value creation. How do you calculate ROIC allows investors and managers to better use this KPI. When comparing companies, ROIC offers a more reliable basis for evaluating their ability to generate sustainable profits and create value for stakeholders. Investors can leverage this for informed decisions.

Practical Application: Leveraging ROIC for Informed Decision-Making

Return on Invested Capital (ROIC) is a powerful tool that extends beyond simple performance tracking. It provides critical insights for making informed decisions across various business functions. Understanding how to calculate ROIC and using it effectively can lead to better investment choices and improved operational strategies.

One crucial application lies in investment decisions. Investors can use ROIC to evaluate the potential profitability of different companies. A company with a consistently high ROIC suggests efficient capital allocation and strong value creation. Comparing the ROIC of potential investment targets allows investors to identify businesses that are likely to generate superior returns. Similarly, companies can utilize ROIC to assess potential acquisitions. By analyzing the target company’s ROIC, the acquiring company can determine whether the acquisition will enhance its overall financial performance. A low ROIC might signal inefficiencies or overvaluation, making the target less attractive. Furthermore, understanding how do you calculate ROIC can help in internal project evaluation. Before committing capital to new projects, businesses should estimate the expected ROIC. This allows them to prioritize projects with the highest potential return and avoid those that may erode shareholder value. How do you calculate ROIC allows companies to make better informed decisions based on potential profitability.

Managers can also leverage ROIC to drive operational improvements and gain a competitive advantage. By dissecting the components of ROIC—NOPAT and Invested Capital—managers can identify areas for enhancement. For example, if ROIC is low due to a high cost of capital, strategies to reduce debt or optimize the capital structure may be warranted. If NOPAT is the culprit, initiatives to improve operational efficiency, increase sales, or reduce expenses should be considered. Regular monitoring of ROIC and its underlying drivers enables managers to track the effectiveness of these initiatives and make necessary adjustments. Moreover, ROIC can be integrated into performance-based compensation plans. By tying executive compensation to ROIC targets, companies can align management’s interests with those of shareholders and incentivize value-creating behavior. In essence, ROIC serves as a compass, guiding businesses towards more profitable ventures and sustainable growth. Knowing how do you calculate ROIC helps businesses to improve profitability and enhance long-term value creation.