Unlocking Stock Market Insights: A Beginner’s Introduction

Yahoo Finance stands as a prominent and reliable source for a wide spectrum of financial data. Investors and analysts regularly leverage its extensive resources to inform their decisions. The platform delivers diverse data types, encompassing real-time stock prices, comprehensive historical data, and fundamental company information. This includes financial statements, key ratios, and other essential metrics. Learning how to download data from Yahoo Finance can unlock significant advantages for analyzing market trends and company performance. Understanding how to download data from Yahoo Finance empowers users to conduct in-depth research and build robust financial models.

The readily accessible data on Yahoo Finance serves various crucial purposes. For investors, it facilitates tracking portfolio performance, identifying investment opportunities, and making informed trading decisions. Analysts use the data to evaluate company valuations, assess financial health, and develop investment recommendations. The historical data allows for examining past market behavior and identifying patterns. This capability is invaluable for forecasting future trends and managing risk. Exploring how to download data from Yahoo Finance is therefore a foundational skill for anyone involved in financial analysis or investment management. The availability of such comprehensive data contributes to more transparent and efficient financial markets.

Before diving into the specifics of how to download data from Yahoo Finance, it’s important to recognize the value it provides. The ability to easily access and analyze financial information levels the playing field. It allows individual investors and smaller firms to compete with larger institutions. This accessibility promotes informed decision-making and contributes to a more equitable investment landscape. Mastering the techniques of how to download data from Yahoo Finance opens doors to a wealth of insights, empowering users to navigate the complexities of the financial world with greater confidence and understanding.

How to Extract Historical Stock Prices from Yahoo Finance

To effectively harness stock market insights, understanding how to download data from Yahoo Finance is crucial. Several avenues exist for acquiring historical stock price data, each catering to different levels of technical expertise and data requirements. This section elucidates these methods, ensuring accessibility for both novice and seasoned users.

One straightforward approach involves utilizing the Yahoo Finance website to manually download CSV files. This method is particularly suitable for obtaining data for single stocks over specific periods. Simply navigate to the desired stock’s page, locate the “Historical Data” tab, specify the date range, and initiate the download. Alternatively, for users seeking automated data retrieval, Python libraries such as `yfinance` offer a powerful solution. These libraries enable programmatic access to Yahoo Finance data, facilitating efficient downloads for multiple stocks and customizable data ranges. Learning how to download data from Yahoo Finance using `yfinance` can significantly streamline data acquisition processes.

While APIs (Application Programming Interfaces) represent another avenue for data retrieval, the focus here remains on readily accessible methods for beginners. Mastering the manual download process and exploring Python libraries provide a solid foundation for accessing and utilizing historical stock price data. These methods empower users to efficiently gather the necessary information for informed investment decisions and comprehensive financial analysis. Therefore, understanding how to download data from Yahoo Finance via its website and Python libraries are key skills for financial enthusiasts. The choice between manual download and automated scripts depends largely on the volume of data required and the user’s comfort level with programming. Regardless of the chosen method, proper data handling and cleaning are crucial steps prior to analysis.

Leveraging the Power of Python for Data Retrieval

Python offers powerful tools for automating the process of retrieving financial data. This section provides a practical example of using the `yfinance` library to download data, demonstrating how to bypass manual downloads and access information efficiently. This method shows how to download data from Yahoo Finance by using open source code.

First, ensure the `yfinance` library is installed. This can be done using pip, Python’s package installer, with the command `pip install yfinance`. Once installed, the library can be imported into a Python script. Here’s a code snippet illustrating how to download historical stock data for Apple Inc. (AAPL) for a specific date range:

import yfinance as yf

# Define the stock symbol

ticker = "AAPL"

# Define the date range

start_date = "2023-01-01"

end_date = "2023-12-31"

# Download the data

data = yf.download(ticker, start=start_date, end=end_date)

# Print the data

print(data)

In this code, `yf.download()` is the key function. It takes the stock ticker symbol, the start date, and the end date as arguments. The function then retrieves the historical data from Yahoo Finance and stores it in a Pandas DataFrame. The DataFrame, stored in the variable `data`, contains the date, open, high, low, close, adjusted close, and volume data for the specified period. Analyzing how to download data from Yahoo Finance by utilizing Python provides insights into data trends and patterns. This streamlined approach simplifies data collection, allowing for more focused analysis and decision-making in financial contexts. This process of how to download data from Yahoo Finance is very efficient, as the alternative is doing manually. The user needs to be aware of the limitations and intellectual property rights when downloading the data. This is a simple demonstration that helps the user learn how to download data from yahoo finance.

Navigating Yahoo Finance’s Website for Manual Data Downloads

To effectively learn how to download data from yahoo finance manually, one must understand the step-by-step process. This method allows users to acquire historical stock prices and other financial information directly through the Yahoo Finance website. While this approach is suitable for obtaining data for a limited number of stocks, it may not be ideal for large-scale data retrieval.

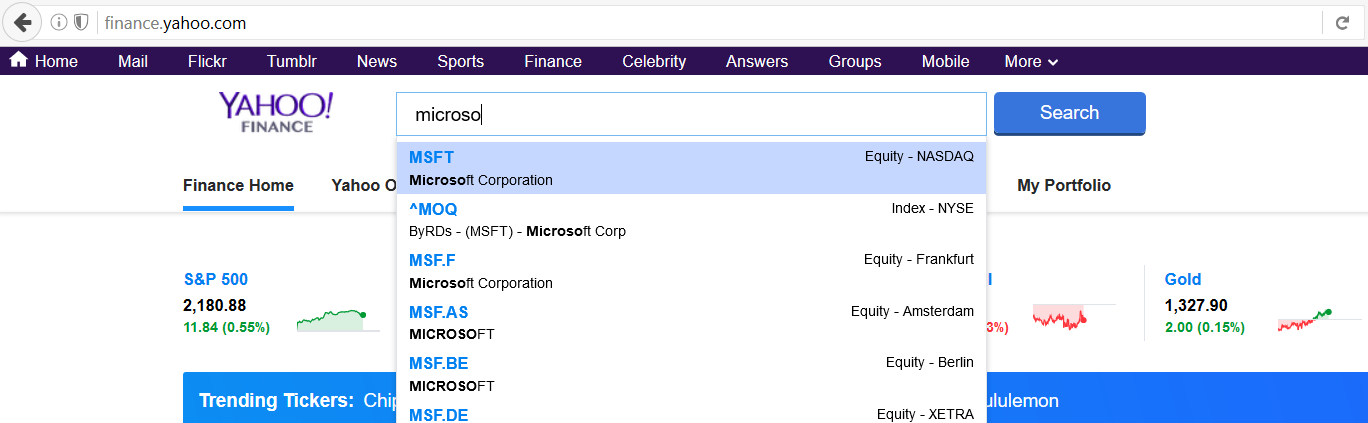

First, navigate to the Yahoo Finance website. In the search bar, enter the ticker symbol of the stock for which you want to download data. For instance, if you’re interested in Apple Inc., enter “AAPL”. Once you’ve located the desired stock, look for the “Historical Data” tab, typically found below the stock’s chart. Click on this tab to access the historical data page. Next, specify the date range for which you need the data. Use the provided start and end date fields to define your desired period. You can select from predefined ranges like “1d,” “5d,” “1mo,” “6mo,” “1y,” “5y,” or “Max,” or enter a custom date range. After selecting the date range, choose the “Apply” button to update the data displayed. To download the data, locate the “Download” button, usually positioned near the top or bottom of the historical data table. Click this button to initiate the download of a CSV file containing the historical stock prices. This file will include the date, open, high, low, close, adjusted close, and volume data for the specified period. Understanding how to download data from yahoo finance through this manual method is the basis for the next step of the analysis.

Despite its simplicity, manual downloading has limitations. It is time-consuming to download data for numerous stocks individually. Each download requires repetition of these steps, making it less efficient than automated methods, especially when managing large datasets. If you consistently download data for a large number of stocks, explore alternatives such as using Python libraries for a more streamlined approach of how to download data from yahoo finance. These automated methods enable efficient and faster data retrieval, freeing up time for analysis. Note that adjustments in date ranges or dealing with specific data nuances can sometimes present challenges, but these can often be resolved with careful attention to the settings on the “Historical Data” page. Furthermore, mastering how to download data from yahoo finance manually can provide a solid foundation for understanding the structure and content of financial data, which is beneficial when transitioning to automated methods.

Understanding the Downloaded Data: A Guide to CSV Files

After learning how to download data from Yahoo Finance, understanding the structure and content of the downloaded CSV files is crucial. These files contain valuable historical stock market information, and interpreting them correctly is essential for accurate analysis. The data is typically organized in a tabular format, with each row representing a specific date and each column representing a different attribute of the stock’s performance on that day. Knowing how to download data from Yahoo Finance and then interpreting it is a powerful combination.

The standard CSV file downloaded from Yahoo Finance includes the following columns: ‘Date’, ‘Open’, ‘High’, ‘Low’, ‘Close’, ‘Adj Close’, and ‘Volume’. The ‘Date’ column indicates the trading date. ‘Open’ represents the stock’s price at the beginning of the trading day. ‘High’ and ‘Low’ indicate the highest and lowest prices reached during the trading day, respectively. ‘Close’ is the stock’s price at the end of the trading day. ‘Adj Close’ (Adjusted Close) is the closing price adjusted for dividends and stock splits, providing a more accurate reflection of the stock’s total return over time. Finally, ‘Volume’ represents the number of shares traded during the day. Understanding these columns is vital for effectively using the data. Knowing how to download data from Yahoo Finance is only the first step; interpreting it is equally important.

To open and analyze the CSV files, several tools can be employed. Spreadsheet software like Microsoft Excel or Google Sheets provides a user-friendly interface for viewing, manipulating, and visualizing the data. These tools allow you to create charts, calculate statistics, and perform basic analysis. For more advanced analysis, Python with the Pandas library is a powerful option. Pandas provides data structures and functions specifically designed for working with tabular data, enabling efficient data cleaning, transformation, and analysis. Regardless of the tool chosen, familiarity with the structure of the CSV file and the meaning of each column is essential for extracting meaningful insights. Remember that knowing how to download data from Yahoo Finance is useless without understanding the downloaded data itself, so take the time to learn how it is structured.

Troubleshooting Common Data Retrieval Issues

Encountering issues while trying to figure out how to download data from yahoo finance is not uncommon. One frequent problem arises from using incorrect stock symbols. A simple typo can lead to no data being returned. Always double-check the stock symbol against a reliable source before attempting to download. Ensure the symbol is correct for the exchange you’re interested in. Another issue involves data availability. Data for certain time periods, particularly for less liquid or newly listed stocks, might be incomplete or unavailable. Yahoo Finance’s data coverage can vary. It’s advisable to check directly on the Yahoo Finance website for the specific stock and date range to confirm data exists before attempting automated downloads. This will help you determine how to download data from yahoo finance effectively.

When using Python libraries like `yfinance`, errors can sometimes occur due to network connectivity problems or temporary outages on Yahoo Finance’s servers. If you encounter an error, try running the script again after a few minutes. Ensure your internet connection is stable. Python library versions may also be outdated, causing compatibility issues. Keep your libraries updated using pip: `pip install –upgrade yfinance`. Furthermore, be mindful of the rate limits when making frequent requests to Yahoo Finance’s API. Excessive requests in a short period might lead to temporary blocking of your IP address. Implement delays in your script to avoid overwhelming the server. Understanding these potential problems is crucial for how to download data from yahoo finance successfully.

Sometimes, even with the correct stock symbol and a stable internet connection, you might still face issues downloading data. This could stem from changes in Yahoo Finance’s website structure or API. If you’re using a web scraping approach, the HTML structure might have changed, breaking your scraper. If using `yfinance` and facing issues on how to download data from yahoo finance, check the library’s documentation or online forums for reported issues and potential workarounds. The library might need updates to accommodate these changes. In some cases, alternative data sources might be necessary if Yahoo Finance consistently fails to provide the required data. Always verify your code and data sources to ensure accuracy and reliability in your financial analysis.

Data Preparation and Cleaning for Analysis

Data preparation and cleaning are vital steps after learning how to download data from yahoo finance. These steps ensure the reliability and accuracy of subsequent analysis. Raw data often contains inconsistencies that can skew results and lead to incorrect conclusions. Addressing these issues proactively improves the quality and validity of your findings.

Common data quality issues include missing values, incorrect data types, and outliers. Missing values can arise from various reasons, such as data collection errors or incomplete records. Incorrect data types occur when data is stored in the wrong format (e.g., a date stored as text). Outliers are extreme values that deviate significantly from the rest of the data. Identifying and handling these issues is crucial for ensuring data integrity. Different techniques exist for handling missing values. One approach is to fill them with estimated values, such as the mean, median, or mode of the dataset. Alternatively, you can remove rows or columns containing missing values. The choice depends on the amount of missing data and its impact on the analysis. Converting data types involves changing the format of the data to the correct one (e.g., converting a text field representing a date to a date format). This allows for proper calculations and comparisons. How to download data from yahoo finance correctly and transform it is a key step for any data scientist.

Outlier detection methods include statistical techniques and domain knowledge. Statistical methods involve calculating measures such as the standard deviation or interquartile range (IQR) and identifying values that fall outside a predefined range. Domain knowledge involves using expert knowledge to identify unusual or impossible values. Once outliers are identified, they can be removed, transformed, or analyzed separately. Remember that data cleaning is an iterative process. It may require multiple rounds of inspection and correction. Effective data preparation and cleaning are essential for conducting meaningful financial analysis and making informed decisions. By addressing data quality issues, you can enhance the reliability and accuracy of your insights. Knowing how to download data from yahoo finance is just the beginning; proper data handling ensures your analysis is sound.

Beyond Stock Prices: Exploring Other Available Datasets

Yahoo Finance is more than just a source for historical stock prices. It offers a wealth of financial information for investors and analysts. Understanding how to download data from Yahoo Finance extends beyond stock prices. Users can access fundamental company data, analyst ratings, and relevant news articles. These resources provide a comprehensive view of a company’s financial health and market sentiment.

Fundamental data includes financial statements like balance sheets, income statements, and cash flow statements. This data is essential for performing financial ratio analysis and valuation. Analyst ratings provide insights into the opinions of professional analysts regarding a stock’s potential. News articles offer context and can highlight events that may impact stock prices. Learning how to download data from Yahoo Finance, including these diverse datasets, allows for more informed decision-making. Investors can gain a deeper understanding of a company’s performance and future prospects by exploring these alternative datasets.

To effectively use Yahoo Finance, exploring the range of available data is crucial. While knowing how to download data from Yahoo Finance focusing on historical stock prices is a great start, consider delving into these other areas. Accessing and analyzing fundamental data can reveal trends and insights not immediately apparent from stock prices alone. Analyst ratings can provide a consensus view of expert opinions. Monitoring news articles can help investors stay informed about important developments. By leveraging these resources, investors and analysts can maximize the value of Yahoo Finance for in-depth financial analysis and improve how to download data from Yahoo Finance, thus achieving a broader understanding of the market.

Advanced Data Analysis Techniques Using Yahoo Finance Data

Context_9: After acquiring and preparing the data, discuss various analysis techniques that can be applied. This section explores methods for analyzing stock prices downloaded from Yahoo Finance. It includes technical analysis, fundamental analysis, and statistical modeling. Each technique offers unique insights into market trends and investment opportunities. Understanding these methods can significantly improve decision-making for investors and analysts. It’s also relevant to understand how to download data from yahoo finance in order to perform your analysis, since downloading data is the first step to these advanced techniques.

Technical analysis involves using historical price and volume data to identify patterns and predict future price movements. Common tools include moving averages, trendlines, and oscillators. These indicators can help identify potential buy and sell signals. Fundamental analysis focuses on evaluating a company’s financial health and intrinsic value. This involves analyzing financial statements, such as the balance sheet, income statement, and cash flow statement. Key metrics include earnings per share (EPS), price-to-earnings (P/E) ratio, and debt-to-equity ratio. Investors can use this information to determine if a stock is overvalued or undervalued. To effectively do this, you need to know how to download data from yahoo finance. Statistical modeling involves using mathematical models to analyze and forecast stock prices. Examples include regression analysis, time series analysis, and machine learning algorithms. These models can help identify relationships between different variables and predict future outcomes. By combining these different analysis techniques, investors and analysts can gain a more comprehensive understanding of the stock market and improve their investment decisions.

Furthermore, exploring the data requires a solid understanding of analytical tools. Spreadsheet software is used to handle, analyze, and visualize data. Programming languages allow for automation of data retrieval and analysis. Specific functions let users extract, transform, and load financial data. This is relevant because you will need to know how to download data from yahoo finance to get the information that will then be reviewed by these tools. Effective data analysis allows you to recognize market trends. Identifying key performance indicators are relevant for fundamental analysis. Furthermore, it improves risk management via statistical modeling. All this will help to refine your investing skills and help your portfolio.