Gauging Market Sentiment: Understanding the Volatility Index

The VIX volatility index historical data serves as a crucial gauge of market sentiment and implied volatility. Often referred to as the “fear gauge,” the VIX, or Volatility Index, reflects the market’s expectation of volatility over the next 30 days. It is derived from the prices of S&P 500 index options, providing a forward-looking perspective on market risk. Traders and investors closely monitor the VIX to assess the level of uncertainty and potential for significant price swings in the near term. A high VIX typically indicates heightened fear and anticipation of market turbulence, while a low VIX suggests complacency and a belief in market stability. Understanding the VIX volatility index historical data is essential for navigating the complexities of the financial markets.

The calculation of the VIX is complex, involving a weighted average of the prices of various S&P 500 call and put options. The Chicago Board Options Exchange (CBOE) developed and maintains the VIX, ensuring its reliability and accuracy. The VIX is not directly tradable in its raw form. Instead, investors use VIX options and exchange-traded funds (ETFs) to speculate on or hedge against changes in volatility. A strong inverse relationship generally exists between the VIX volatility index historical data and the S&P 500. When the S&P 500 declines, the VIX tends to rise, reflecting increased investor anxiety. Conversely, when the S&P 500 rises, the VIX often falls, indicating reduced market risk.

Paying close attention to the VIX volatility index historical data offers valuable insights into market dynamics. It helps investors understand the prevailing sentiment and anticipate potential shifts in market direction. By tracking the VIX, traders can better assess the risk-reward profile of their investments and make more informed decisions. The VIX volatility index historical data acts as a barometer of market stress. It signals potential buying opportunities when fear is high and caution when complacency prevails. Analyzing the VIX in conjunction with other market indicators can significantly enhance investment strategies and improve overall portfolio performance. The VIX volatility index historical data ultimately empowers investors to navigate market volatility with greater confidence.

Delving into Historical Volatility: Accessing Past VIX Values

Obtaining vix volatility index historical data is crucial for understanding market behavior and making informed investment decisions. Several avenues exist for accessing this information, each with its own set of advantages and disadvantages. Financial data providers like Refinitiv and Bloomberg offer comprehensive datasets, often including intraday vix volatility index historical data, advanced analytics, and sophisticated charting tools. These platforms are generally subscription-based and cater to professional traders and institutional investors. While providing the most detailed and reliable vix volatility index historical data, the cost can be a barrier for individual investors.

Online charting platforms such as TradingView and Yahoo Finance provide more accessible options for retrieving vix volatility index historical data. These platforms typically offer free tiers with basic charting functionality and historical data, while premium subscriptions unlock more advanced features. The data quality is generally good, although it may not be as granular as that offered by professional data providers. Investors can readily visualize historical vix volatility index historical data, identify trends, and perform basic technical analysis on these platforms. However, it’s essential to verify the data source and ensure its accuracy before making any investment decisions. The Chicago Board Options Exchange (CBOE), the creator of the VIX, is another primary source. The CBOE website provides historical vix volatility index historical data, along with detailed information about the index’s methodology and calculations. This is a reliable source for end-of-day data and official VIX-related information.

The choice of data source depends largely on the user’s needs and budget. For professional traders requiring the highest level of data granularity and analytical tools, financial data providers are the preferred option. Individual investors with limited budgets can find valuable vix volatility index historical data and charting tools on online platforms. Regardless of the chosen source, it’s crucial to understand the data’s limitations and to use it in conjunction with other forms of analysis. Analyzing vix volatility index historical data requires careful consideration of factors such as data frequency, potential data errors, and the impact of market events on volatility levels. By carefully evaluating these factors, investors can gain valuable insights into market sentiment and potential future volatility.

Unveiling Trends: Analyzing Volatility Index Over Time

Analyzing vix volatility index historical data is crucial for understanding market risk. By examining past vix volatility index historical data values, traders can identify trends, patterns, and cycles that may provide insights into future market movements. Several statistical measures are invaluable in this analysis. The mean, or average, VIX value over a specific period gives a sense of the typical volatility level. Standard deviation quantifies the dispersion of VIX values around the mean, indicating the degree of volatility. A higher standard deviation suggests greater fluctuations in the vix volatility index historical data, while a lower value implies more stable market conditions. Moving averages smooth out short-term fluctuations in the vix volatility index historical data, making it easier to identify longer-term trends.

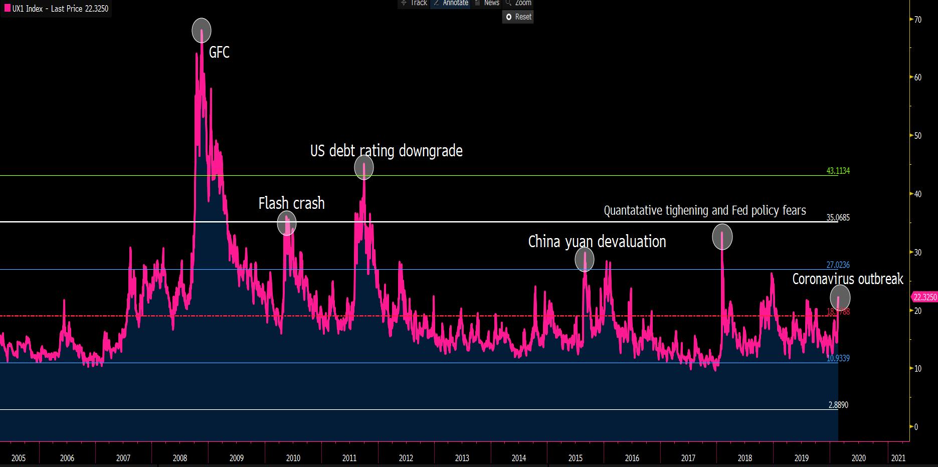

These measures offer clues about potential future volatility spikes. For example, periods where the VIX consistently trades above its historical mean may suggest heightened market uncertainty. Examining historical volatility events provides valuable context. The 2008 financial crisis saw the VIX reach record highs, reflecting extreme fear and uncertainty in the market. Similarly, the onset of the COVID-19 pandemic in early 2020 caused a significant spike in the VIX as global markets reacted to the unprecedented disruption. By studying these past events and their corresponding vix volatility index historical data, investors can gain a better understanding of how the VIX behaves during periods of market stress and how it can be used to gauge investor sentiment. Understanding vix volatility index historical data patterns is key to anticipate market behaviors.

Consider the period leading up to the dot-com bubble burst in the early 2000s. While the VIX remained relatively stable for much of the late 1990s, subtle increases in volatility began to emerge in the months prior to the market crash. Analyzing these early warning signs could have helped investors mitigate their losses. Another example is the European debt crisis in the early 2010s. As concerns about sovereign debt levels in countries like Greece and Italy intensified, the VIX experienced several spikes, reflecting increased market anxiety. Analyzing vix volatility index historical data from these periods can help investors identify key thresholds and patterns that may signal future market downturns. Therefore, studying vix volatility index historical data with statistical tools provides critical insights into market risk assessment.

How to Utilize Volatility Data for Strategic Decision-Making

Historical VIX volatility index historical data offers valuable insights for shaping investment strategies. It plays a crucial role in portfolio risk management. Hedging strategies can be developed using VIX data. Investors can mitigate potential losses during market downturns. VIX options and ETFs provide tools for managing volatility exposure. These instruments allow traders to profit from anticipated changes in volatility. The VIX volatility index historical data also assists in market timing. It helps identify potential buying or selling opportunities.

One practical application involves using the VIX volatility index historical data to gauge market sentiment. Elevated VIX levels often signal heightened fear and potential market bottoms. Conversely, low VIX levels may indicate complacency and increased risk of a correction. Integrating VIX analysis with other market indicators enhances decision-making. For instance, combining VIX data with S&P 500 price action can provide a more comprehensive view. A divergence between the VIX volatility index historical data and the S&P 500 may suggest an impending trend reversal. Rising VIX values alongside a rising S&P 500 might indicate underlying market instability.

VIX volatility index historical data can be effectively used in options trading strategies. Traders employ VIX options to speculate on future volatility movements. For example, buying VIX call options can be a way to profit if volatility is expected to increase. VIX ETFs offer another avenue for gaining exposure to volatility. These ETFs track VIX futures contracts. They can be used to hedge portfolios or speculate on volatility. Furthermore, analyzing historical VIX patterns can inform option pricing models. This can help traders identify potentially mispriced options. By understanding how the VIX has behaved in different market conditions, investors can make more informed decisions about managing risk and seeking opportunities.

Visualizing Volatility: Charting the Index’s Historical Performance

Visualizing the VIX volatility index historical data is crucial for understanding market trends. Charts and graphs offer a clear picture of the index’s behavior over time. This helps traders and investors identify patterns that might otherwise be missed. Effective visualization is key to unlocking the insights hidden within the vix volatility index historical data. Selecting the appropriate charting method is the first step in this process.

Line charts are excellent for displaying the overall trend of the vix volatility index historical data. They clearly show how the VIX has moved over extended periods. Candlestick charts provide more detailed information. They display the open, high, low, and close for each period. This allows for a more granular analysis of price action. Key levels, support and resistance zones, and trend lines become more apparent when using candlestick charts with vix volatility index historical data. Identifying these levels can help in making informed trading decisions. Furthermore, consider adding moving averages to your charts. These smooth out the data and highlight the underlying trend, making it easier to identify potential turning points. Remember that the goal is to present the vix volatility index historical data in a way that is both informative and easy to interpret.

Beyond basic chart types, explore different timeframes to gain a comprehensive view of volatility trends. Analyzing daily, weekly, and monthly charts can reveal different aspects of the vix volatility index historical data. Experiment with different charting techniques to see what works best for your analytical style. Effective visualization transforms raw data into actionable insights, empowering you to make more informed decisions when trading or investing. The vix volatility index historical data provides invaluable insights into market sentiment. Charts make this data accessible and understandable, which ultimately improves your ability to navigate volatile market conditions. Visualizing historical data is a cornerstone of sound investment strategy, particularly when dealing with market volatility. Consistently monitoring and analyzing charts of the VIX will enhance your understanding of market dynamics.

Potential Pitfalls: Limitations of Using Historical Data

Relying solely on historical VIX data to make investment decisions carries inherent risks. The VIX volatility index historical data provides valuable insights, but it’s crucial to understand its limitations. Past performance of the VIX volatility index historical data is not necessarily indicative of future results. Market dynamics are constantly evolving, and unforeseen events can significantly impact volatility levels, rendering historical patterns less reliable.

One major pitfall is the assumption that historical relationships between the VIX volatility index historical data and other market indicators will persist. Economic conditions, geopolitical events, and investor sentiment can all shift, altering these relationships. For example, a historically high VIX might have previously signaled an imminent market correction. However, in a new market environment, the same VIX level might not trigger the same response. Furthermore, changes in market structure and the introduction of new financial products can also affect the VIX’s behavior. Algorithmic trading and the proliferation of VIX-linked exchange-traded products (ETPs) can amplify or dampen volatility spikes, making it difficult to interpret historical data accurately. The VIX volatility index historical data should not be viewed as a crystal ball; instead, consider it as one piece of a larger puzzle.

To mitigate these pitfalls, it’s essential to use VIX analysis in conjunction with other fundamental and technical analysis techniques. Fundamental analysis involves examining macroeconomic factors, company earnings, and industry trends. Technical analysis involves studying price charts and other technical indicators to identify potential trading opportunities. By combining these approaches, investors can gain a more comprehensive understanding of market conditions and make more informed decisions. Furthermore, stay informed about global economic and political events that could influence volatility levels. Unexpected news or policy changes can trigger sudden market movements, regardless of what historical VIX data might suggest. Therefore, while the VIX volatility index historical data offers valuable context, it should always be interpreted with caution and in conjunction with a broader range of analytical tools and market awareness.

Forecasting Instability: Predicting Future Volatility Spikes

Methods for forecasting future volatility spikes using vix volatility index historical data involve a blend of statistical analysis and market awareness. The concept of volatility clustering suggests that periods of high volatility tend to be followed by more periods of high volatility. Analyzing vix volatility index historical data can reveal these clusters, providing insights into potential future instability. However, it’s crucial to remember that these are probabilities, not guarantees.

Statistical models, such as GARCH (Generalized Autoregressive Conditional Heteroskedasticity), are commonly used in volatility forecasting. These models analyze vix volatility index historical data to identify patterns and predict future movements. GARCH models account for the time-varying nature of volatility, recognizing that it tends to fluctuate in predictable ways. Additional relevant indicators, such as economic news releases, geopolitical events, and changes in interest rates, can be incorporated into forecasting models to improve accuracy. Keep in mind that unforeseen events significantly impact volatility levels, regardless of the sophistication of the forecasting method. Therefore, relying solely on models and historical data is risky.

Forecasting volatility is inherently challenging due to the complex interplay of market forces. While vix volatility index historical data provides valuable context, it’s just one piece of the puzzle. The accuracy of any forecast depends on the quality of the data, the appropriateness of the model, and the ability to anticipate unexpected events. The inherent uncertainties associated with volatility forecasting underscore the importance of using a diversified approach. This means combining statistical analysis with fundamental market research and risk management strategies. Investors should use volatility forecasts as a tool for informing their decisions, not as a definitive prediction of future market behavior. A well-rounded perspective, coupled with prudent risk management, is essential for navigating volatile markets successfully.

Refining Strategies: Adapting to Evolving Market Conditions

The importance of continuous monitoring of the VIX and adapting investment strategies to evolving market conditions cannot be overstated. Understanding the interplay between the VIX volatility index historical data and various market factors is critical for informed decision-making. A deep dive into historical volatility, accessed through vix volatility index historical data, allows for a more nuanced comprehension of market behavior. Investors should strive to cultivate this understanding to navigate the complexities of the financial landscape effectively.

Staying informed about global economic and political events that could influence volatility levels is also key. These events can trigger unexpected shifts in market sentiment, directly impacting the VIX volatility index historical data. By analyzing the historical reactions of the VIX to similar events, investors can gain insights into potential future movements. Remember, consistent monitoring of vix volatility index historical data will enable a faster and more accurate understanding of the actual market situation. This proactive approach allows for timely adjustments to investment strategies, mitigating risks and capitalizing on emerging opportunities. Developing a keen awareness of the VIX and its historical patterns is paramount for success.

Moreover, continuous learning is essential for thriving in volatile markets. The financial world is constantly evolving, and new factors can influence volatility. By consistently researching and expanding their knowledge of the VIX volatility index historical data, investors can refine their strategies and improve their decision-making abilities. A commitment to ongoing learning and adaptation is crucial for long-term success in the dynamic world of trading and investing. Remember that successful navigation of volatile markets requires both a solid understanding of the VIX volatility index historical data and a willingness to adapt to evolving conditions. This continuous learning process, combined with vigilant monitoring of the VIX, will empower investors to refine their strategies.