Grasping the Basics of Interest Accrual

Accrued interest represents the interest that has been earned on a principal amount but has not yet been paid out. It’s a crucial concept for both borrowers and lenders because it accurately reflects the true cost of borrowing or the actual return on an investment. Understanding how to calculate accrued interest allows individuals and institutions to make informed financial decisions. Accrued interest plays a significant role in various financial instruments, including bonds, loans, and savings accounts. It’s essential to differentiate accrued interest from simple interest. Simple interest is calculated only on the principal amount, while accrued interest considers the compounding effect of interest over time, reflecting the interest earned since the last payment date.

For example, in bonds, accrued interest is the interest that has accumulated since the last coupon payment. This is added to the price of a bond when it is sold between coupon dates. In loans, it represents the interest that has accumulated on the outstanding principal but hasn’t yet been included in a regular payment. Even savings accounts accrue interest daily, monthly, or quarterly, which adds to the principal. Knowing how to calculate accrued interest is fundamental to understanding the actual yield of such accounts. This differs significantly from simple interest, which doesn’t compound. Accrued interest represents interest earned but not yet paid, while simple interest is only calculated on the principal.

Understanding how to calculate accrued interest is particularly vital when dealing with financial transactions occurring between payment periods. Accurately calculating accrued interest ensures that both parties are treated fairly. This knowledge is essential for anyone involved in lending, borrowing, or investing. It is a key component in various financial scenarios. By understanding accrued interest, one can better assess the true cost or return of a financial product. Gaining a firm grasp of accrued interest principles promotes sound financial practices. Knowing how to calculate accrued interest empowers better financial planning.

Unlocking the Formula for Accrued Interest Calculation

The core formula to understand how to calculate accrued interest is: Principal x Interest Rate x Time. Each component plays a vital role in determining the total accrued interest. This formula is fundamental in various financial calculations. It applies to loans, bonds, and other interest-bearing accounts. Understanding each element allows for accurate financial planning.

The ‘Principal’ represents the initial amount of the loan or investment. The ‘Interest Rate’ is the percentage charged or earned on the principal. It is typically expressed as an annual percentage rate (APR). For example, an APR of 5% means that 5% of the principal is charged or earned annually. When learning how to calculate accrued interest, ensure that you understand the APR, which dictates the yearly cost of borrowing or the yield from an investment. To find the periodic interest rate, divide the annual rate by the number of periods per year. ‘Time’ refers to the period for which the interest is being calculated. It can be measured in days, months, or years. The key is to align the time unit with the interest rate’s period.

The ‘Time’ component is crucial when exploring how to calculate accrued interest. If the interest rate is annual, the time must be expressed in years. For example, if calculating accrued interest for six months, the time would be 0.5 years. If calculating for a specific number of days, the time would be the number of days divided by 365 (or 360, depending on the day-count convention). Accurately determining the ‘Time’ variable is vital for achieving a precise accrued interest calculation. This detailed approach to understanding the formula ensures a solid foundation in mastering how to calculate accrued interest.

Navigating Different Time Periods in Accrued Interest

The “time” component in the how to calculate accrued interest formula is not always straightforward. Its calculation depends heavily on the specific financial instrument and the agreed-upon conventions. Understanding these variations is crucial for accurate accrued interest calculations. This section will explain how to determine the correct time period for various scenarios.

One key aspect is calculating the number of days within a given period. This is especially relevant when dealing with months of varying lengths. Several day-count conventions exist, each with its own method. The “actual/365” convention uses the actual number of days in the period as the numerator and 365 days as the denominator. This method is commonly used for many types of bonds and loans. Another convention, “actual/360,” uses the actual number of days in the period as the numerator but assumes a year has only 360 days. This is sometimes used for money market instruments and some types of loans. A third convention, “30/360,” assumes that each month has 30 days, regardless of its actual length. This convention is primarily used for corporate bonds and some mortgages. When calculating accrued interest, selecting the proper day-count convention according to the terms of the agreement is essential; also, knowing how to calculate accrued interest with different conventions is very important.

Choosing the right day-count convention is vital for accurate how to calculate accrued interest results. The documentation for the financial product, such as a bond indenture or loan agreement, will usually specify which convention to use. If the documentation is unclear, consulting a financial professional is advisable. Failing to use the correct convention can lead to significant errors in the accrued interest calculation, affecting both the borrower and the lender. Different financial products require different time calculations. For example, bonds often require the calculation of days between coupon payments, while loans might require calculating the number of days since the last payment. For calculating accrued interest accurately, it’s essential to identify the start and end dates of the accrual period and determine the appropriate day-count convention.

Step-by-Step: An Example Calculation of Accrued Interest

To illustrate how to calculate accrued interest, consider a hypothetical scenario. Imagine a loan with a principal of $10,000, an annual interest rate of 5%, and a term of 180 days. The goal is to determine the accrued interest over this 180-day period. This example will provide a clear, step-by-step guide on how to calculate accrued interest in a practical situation.

First, identify each component of the formula: Principal ($10,000), Interest Rate (5% or 0.05), and Time (180 days). Next, determine the appropriate day-count convention. For simplicity, let’s assume an actual/365 day-count convention. This means we’ll use the actual number of days (180) divided by 365. Now, apply the formula: Accrued Interest = Principal x Interest Rate x Time. Substituting the values, we get: Accrued Interest = $10,000 x 0.05 x (180/365). Performing the calculation, 180 divided by 365 equals approximately 0.493. Multiplying this by 0.05 gives 0.02465. Finally, multiplying this result by $10,000 yields $246.50. Therefore, the accrued interest on the $10,000 loan over 180 days is $246.50. This example demonstrates how to calculate accrued interest using the core formula and a step-by-step approach.

Understanding how to calculate accrued interest is crucial for both borrowers and lenders. This example highlights the importance of accurately applying the formula and considering the relevant time period. Different day-count conventions can impact the final accrued interest amount, so careful attention should be paid to the specific terms of the loan or bond agreement. By following these steps, anyone can confidently determine the accrued interest in various financial scenarios. Learning how to calculate accrued interest empowers individuals to make informed financial decisions, whether they’re managing loans, bonds, or other interest-bearing accounts.

Calculating Accrued Interest on Bonds

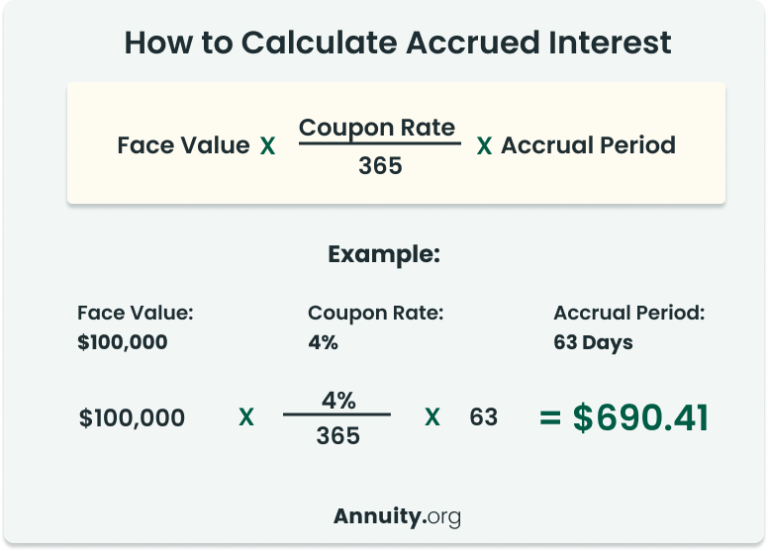

Accrued interest on bonds requires understanding coupon payments and their relation to the bond’s value. Coupon payments are periodic interest payments made to the bondholder. Accrued interest represents the interest that has accumulated since the last coupon payment date. Knowing how to calculate accrued interest is vital for both bond buyers and sellers. The formula for accrued interest on bonds is similar to the general accrued interest formula but requires careful consideration of the coupon payment schedule.

To calculate accrued interest on bonds, determine the number of days from the last coupon payment date to the settlement date (the date the bond changes ownership). Bond conventions often use a 30/360 day-count method, where each month is considered to have 30 days and each year 360 days, or the actual/actual day-count method, which reflects the actual days between dates. Multiply the bond’s coupon rate (annual interest rate) by the face value of the bond to find the annual coupon payment. Divide the annual coupon payment by the number of coupon payments per year (e.g., semi-annually means two payments) to determine the amount of each coupon payment. Finally, multiply the per-payment coupon amount by the fraction of the coupon period that has passed since the last payment. This fraction is calculated using the applicable day-count convention. Knowing how to calculate accrued interest ensures fair bond transactions.

For example, consider a corporate bond with a face value of $1,000 and a coupon rate of 5%, paid semi-annually. If the last coupon payment was 60 days ago and the settlement date is today, and assuming a 30/360 day count, the accrued interest would be calculated as follows: Annual coupon payment = $1,000 * 5% = $50. Semi-annual coupon payment = $50 / 2 = $25. Fraction of coupon period = 60 days / 180 days (assuming 180 days per semi-annual period using 30/360). Accrued interest = $25 * (60/180) = $8.33. This amount is added to the bond’s price when it is sold between coupon payment dates. Government bonds and other bond types may have slightly different conventions, so understanding the specific terms of the bond is essential to understand how to calculate accrued interest correctly.

Tools and Resources for Effortless Accrued Interest Calculation

Several online calculators and spreadsheet templates can greatly simplify the process of figuring out how to calculate accrued interest. These tools are designed to automate the calculation, reducing the risk of manual errors. Online calculators typically require you to input the principal amount, the annual interest rate, and the time period. The calculator then uses the standard accrued interest formula to provide the result. These calculators are particularly useful for quick estimations and for those who are not comfortable with manual calculations. They demonstrate how to calculate accrued interest without complex formulas.

Spreadsheet templates offer a more customizable approach to understanding how to calculate accrued interest. These templates, often created in programs like Microsoft Excel or Google Sheets, allow you to input the same data as online calculators but also offer the flexibility to perform more complex analyses. For instance, you can create a table to calculate accrued interest over multiple periods or compare different interest rates. Some templates may also incorporate day-count conventions, allowing for more accurate calculations. To effectively use these templates, understanding the underlying formulas and how they apply to your specific situation is important. This reinforces how to calculate accrued interest accurately.

While these tools can be incredibly helpful, it’s crucial to remember that they are not infallible. Always double-check the results obtained from any calculator or template to ensure accuracy. Input the data carefully and verify that the tool is using the correct day-count convention and interest rate. Even with the aid of technology, a solid understanding of the principles of how to calculate accrued interest is essential for verifying the results and making informed financial decisions. Some reliable and user-friendly resources include financial websites that offer calculators and tutorials. Financial institutions may also provide tools or educational materials on their websites to help customers understand how to calculate accrued interest related to their products. Remember, knowing how to calculate accrued interest empowers you to manage your finances effectively.

Common Pitfalls to Avoid When Calculating Accrued Interest

Several common mistakes can occur when determining how to calculate accrued interest, potentially leading to inaccurate financial assessments. One frequent error involves selecting the incorrect day-count convention. Understanding whether to use actual/365, actual/360, or 30/360 is crucial for accurate calculations. Failing to do so will skew the accrued interest figure. To avoid this, always verify the specific convention stipulated in the loan or bond agreement.

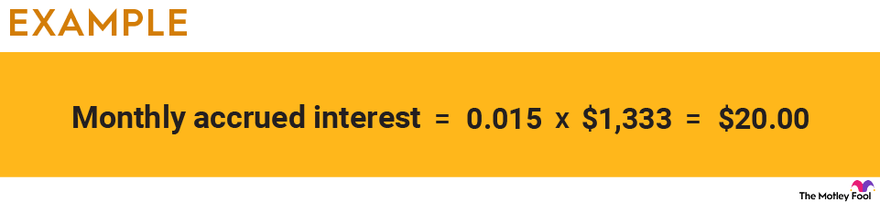

Misinterpreting the stated interest rate is another pitfall. Interest rates are typically expressed as an annual percentage rate (APR). However, the calculation period might be less than a year. It’s important to adjust the interest rate accordingly for the specific time frame. For instance, when calculating accrued interest for a month, divide the annual interest rate by 12. Ignoring this adjustment will result in a significantly incorrect accrued interest amount. Therefore, pay careful attention to the interest rate’s annualization and the period for which you are calculating accrued interest. Using online calculators can simplify how to calculate accrued interest, but always double-check the inputs and results.

Furthermore, accurately calculating the “time” component of the accrued interest formula can be challenging. This is especially true when dealing with months of varying lengths or irregular payment schedules. One should utilize the correct number of days in the relevant period. Errors in determining the precise time period introduce inaccuracies. Always double-check the start and end dates. Also confirm the specific day-count method to prevent miscalculations in how to calculate accrued interest. Accuracy remains paramount in financial calculations, as even small errors can compound over time, leading to substantial discrepancies. Understanding these pitfalls empowers individuals to calculate accrued interest more effectively.

Applying Accrued Interest Knowledge in Real-World Scenarios

Understanding accrued interest has practical applications across various financial landscapes. It significantly impacts investment returns, loan repayments, and tax considerations. Accrued interest directly influences the total return on investments like bonds and fixed-income securities. Knowing how to calculate accrued interest allows investors to accurately assess the actual yield they receive, considering the interest earned between payment dates.

In loan repayments, accrued interest affects the total cost of borrowing. For instance, understanding how to calculate accrued interest on a mortgage or personal loan helps borrowers anticipate the interest portion of their payments, aiding in budgeting and financial planning. Accrued interest also plays a crucial role in determining the payoff amount if a loan is repaid before its maturity date. Grasping how to calculate accrued interest empowers borrowers to make informed decisions about loan refinancing or early repayment options, potentially saving money on interest expenses.

Tax implications are another area where understanding accrued interest is vital. In many jurisdictions, accrued interest is taxable income, even if it hasn’t been received yet. This is particularly relevant for investments like savings bonds and certificates of deposit (CDs). Knowing how to calculate accrued interest allows taxpayers to accurately report their income and avoid potential penalties. Furthermore, understanding how to calculate accrued interest can help individuals and businesses optimize their tax strategies. By making informed financial decisions, individuals can effectively manage their investments and minimize their tax liabilities. It is a valuable skill that directly contributes to better financial outcomes, echoing the importance of understanding this concept for both borrowers and lenders.