Gauging Market Strength: Understanding S&P 500 Company Size

Market capitalization, often shortened to market cap, is a crucial metric for understanding a company’s size and influence, especially when examining the list of S&P 500 companies by market cap. The S&P 500 is a stock market index that represents the performance of 500 of the largest publicly traded companies in the United States. It serves as a benchmark for the overall health of the U.S. equity market and, by extension, the broader economy.

A company’s market capitalization is calculated by multiplying its total number of outstanding shares by the current market price of a single share. This figure represents the total dollar value of a company’s equity. Within the list of S&P 500 companies by market cap, larger market caps typically indicate greater stability and influence. These companies often have well-established business models, strong brand recognition, and significant market share. Tracking the list of S&P 500 companies by market cap offers insight into which companies are leading the market and driving economic growth. A high market cap can reflect strong investor confidence in a company’s future prospects, as investors are willing to pay a premium for its shares. Conversely, a declining market cap may signal concerns about a company’s performance or the broader economic outlook. The list of S&P 500 companies by market cap is a dynamic one, constantly changing as stock prices fluctuate in response to market forces.

The aggregate market capitalization of the S&P 500 is also used as an indicator of overall economic health. A rising aggregate market cap suggests a bullish market, where investors are optimistic about the future. A falling aggregate market cap may indicate a bearish market, where investors are more cautious. Monitoring the list of S&P 500 companies by market cap, and analyzing changes in individual company valuations, allows investors and analysts to assess the overall sentiment and direction of the market. The list of S&P 500 companies by market cap provides a valuable snapshot of the relative size and importance of these companies within the U.S. economy. Market capitalization data can be used to inform investment decisions, assess market trends, and gain a deeper understanding of the forces shaping the financial landscape. The list of S&P 500 companies by market cap is a fundamental tool for anyone seeking to understand the dynamics of the stock market and the performance of leading U.S. corporations.

How to Analyze S&P 500 Constituents by Market Value

Analyzing the S&P 500 companies by market cap is a straightforward process, thanks to readily available online resources. Several reputable financial websites offer regularly updated lists of S&P 500 constituents, sorted by their market capitalization. These resources provide investors and researchers with a clear view of the relative size and influence of each company within the index. Understanding how to access and interpret this data is crucial for informed decision-making.

To find the current list of S&P 500 companies by market cap, one can visit well-known financial news and data platforms. Websites maintained by reputable sources, such as major financial news outlets or investment analysis firms, typically provide this information. Many offer both free and premium data services. Free services usually provide a basic list with market capitalization figures, while premium subscriptions may offer more detailed data, historical trends, and advanced analytical tools. Investors can use these platforms to track the ever-changing landscape of the S&P 500 and the relative positions of its constituent companies. When evaluating data sources, consider the frequency of updates and the reliability of the provider.

When using these resources to analyze the list of S&P 500 companies by market cap, remember that market capitalization is just one piece of the puzzle. It reflects the total market value of a company’s outstanding shares, but it doesn’t tell the whole story about its financial health or future prospects. However, analyzing the list of S&P 500 companies by market cap can offer valuable insights into market trends and the relative strength of different sectors. Supplement this data with other financial metrics and qualitative analysis to gain a more comprehensive understanding of investment opportunities. Always verify the data’s source and consider consulting with a financial professional before making any investment decisions. Analyzing the list of S&P 500 companies by market cap effectively requires a critical and informed approach.

Top Performers and Market Leaders within the S&P 500

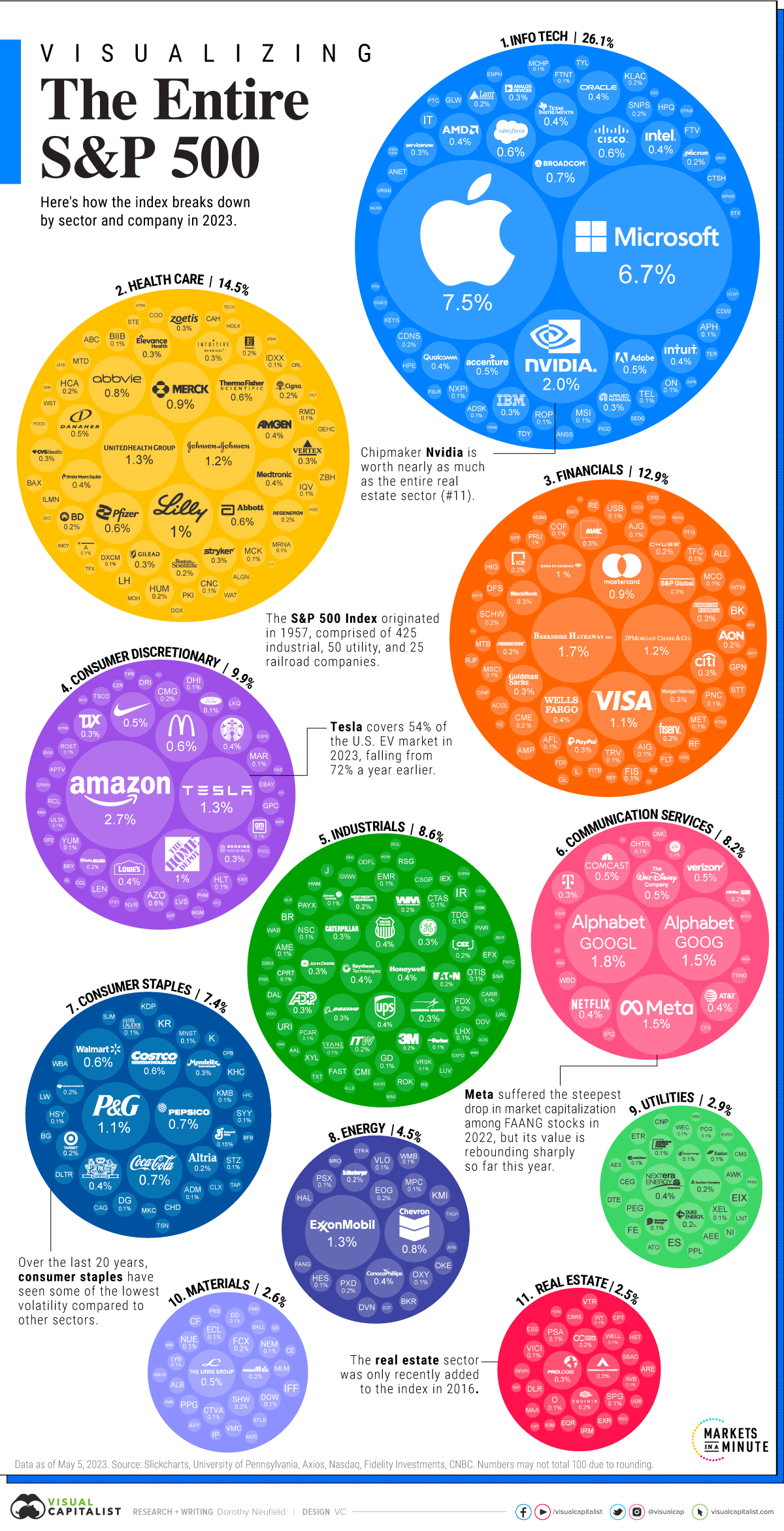

The S&P 500 is a capitalization-weighted index, meaning the companies with the largest market capitalization have the greatest influence on the index’s performance. Examining the top companies by market capitalization provides valuable insight into current market trends and economic powerhouses. This section highlights some of the typical leaders in the list of sp500 companies by market cap, focusing on the sectors they represent and the factors driving their high valuations. The list of sp500 companies by market cap is not static, and positions can change frequently.

Technology companies often occupy top spots in the list of sp500 companies by market cap. These firms frequently demonstrate substantial growth and innovation. They also command high valuations, driven by factors such as strong earnings, large addressable markets, and dominant positions in their respective niches. These companies have substantial influence on the overall S&P 500 index due to their size. Furthermore, these companies often reinvest heavily in research and development, which fuels continued growth and innovation, further solidifying their positions.

Beyond technology, the financial sector also consistently features prominently in the list of sp500 companies by market cap. Large banks, investment firms, and insurance companies contribute significantly to the index’s overall valuation. Their high market capitalizations are often underpinned by stable earnings, vast asset holdings, and crucial roles in the global economy. Healthcare is another important sector within the S&P 500. Pharmaceutical companies, medical device manufacturers, and healthcare providers contribute substantially to the index’s overall market cap. Finally, it is important to remember that the list of sp500 companies by market cap is subject to change based on market conditions and individual company performance.

The Ever-Changing Landscape: Dynamics of Market Cap Shifts

The market capitalization of S&P 500 companies is far from static. It is a dynamic figure, constantly fluctuating in response to a multitude of factors. Understanding this inherent volatility is crucial for anyone tracking the list of sp500 companies by market cap and seeking to interpret market trends.

Earnings reports are a primary driver of market cap movement. A company exceeding expectations can witness a surge in its stock price, consequently increasing its market capitalization. Conversely, disappointing earnings can lead to a decline. Economic conditions also play a significant role. Broad economic growth often lifts the valuations of many companies within the S&P 500, while recessions can have the opposite effect. Industry trends, such as technological advancements or shifts in consumer preferences, can significantly impact specific sectors and the companies within them, thereby altering the list of sp500 companies by market cap. Companies adapting swiftly to change often experience market cap growth. Those lagging may see their valuations diminish.

Geopolitical events, regulatory changes, and even unforeseen circumstances like natural disasters can trigger market volatility, affecting the list of sp500 companies by market cap. Investor sentiment, which can be influenced by news headlines and overall market psychology, can also lead to rapid shifts in valuation. Therefore, the list of sp500 companies by market cap reflects a snapshot in time. It should be viewed as a constantly evolving landscape. Savvy investors and market analysts recognize that yesterday’s top performer may not necessarily hold the same position tomorrow. Continuous monitoring and analysis are essential to understanding the dynamics of market capitalization and the forces that shape the composition of the S&P 500.

Beyond the Numbers: Interpreting Market Capitalization Data

Market capitalization data, while a valuable metric, should not be considered in isolation. A comprehensive understanding of a company’s financial health requires integrating market cap with other financial indicators. Examining the list of sp500 companies by market cap alongside metrics like revenue, earnings, and debt levels provides a more nuanced perspective. This holistic approach enables a more informed assessment of a company’s true value and potential.

One crucial metric to consider alongside market capitalization is the Price-to-Earnings (P/E) ratio. The P/E ratio compares a company’s stock price to its earnings per share. A high P/E ratio might suggest that investors have high expectations for future growth. However, it could also indicate that the stock is overvalued. Conversely, a low P/E ratio might suggest undervaluation or that the market has concerns about the company’s future prospects. Analyzing the P/E ratio in conjunction with the list of sp500 companies by market cap helps to gauge whether the market’s valuation aligns with the company’s actual earnings performance.

Furthermore, factors like debt-to-equity ratio, return on equity (ROE), and cash flow are vital for assessing a company’s financial stability and profitability. A company with a high market capitalization but also a high debt-to-equity ratio might be considered riskier than a company with a similar market cap and a lower debt burden. Similarly, a strong ROE indicates efficient use of shareholder equity to generate profits. Examining these metrics alongside the list of sp500 companies by market cap offers a more complete picture of a company’s financial strength and long-term viability. By combining market capitalization data with other key financial indicators, investors and analysts can make more informed decisions and gain a deeper understanding of the true value of companies within the S&P 500. Analyzing the list of sp500 companies by market cap combined with other factors is the best approach.

Factors Influencing Valuation: Decoding Market Cap Movements

A company’s market capitalization, a key metric for understanding its size and value, is not static. It’s a dynamic figure influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for investors and anyone tracking the list of sp500 companies by market cap.

Internal factors encompass a company’s financial performance, strategic decisions, and operational efficiency. Strong earnings reports generally lead to an increase in market capitalization, reflecting investor confidence in the company’s profitability and growth potential. Conversely, disappointing earnings can trigger a decline. Innovation plays a significant role. Companies that successfully develop and launch new products or services often see their market cap rise as investors anticipate future revenue streams. Management decisions, such as mergers, acquisitions, or divestitures, can also significantly impact valuation. Legal and regulatory matters also play a crucial role; a significant lawsuit against a company can negatively affect the company’s valuation. Changes in company leadership or strategic direction can influence investor sentiment and, consequently, market capitalization. Keeping an eye on the list of sp500 companies by market cap requires constant awareness of these internal shifts.

External factors exert a broader influence on market capitalization. Economic conditions, such as interest rates, inflation, and overall economic growth, play a vital role. Rising interest rates can make borrowing more expensive for companies, potentially impacting their profitability and leading to a decrease in market capitalization. Industry trends and technological advancements can also shift valuations. For example, the rise of electric vehicles has significantly impacted the market capitalization of both established automakers and new entrants in the EV space. Geopolitical events, such as trade wars or political instability, can create uncertainty and volatility in the market, affecting company valuations. Investor sentiment, driven by news, social media, and overall market psychology, can also influence market capitalization, sometimes leading to irrational exuberance or panic selling. Analyzing the list of sp500 companies by market cap involves understanding how these large economic forces are affecting individual companies. These conditions constantly reshape the list of sp500 companies by market cap, showing the ever-evolving valuations within the index. It’s important to remember that understanding these various factors offers a more complete perspective on market dynamics.

S&P 500: The Index, The Committee, The Purpose

Standard & Poor’s (S&P) plays a crucial role in maintaining the S&P 500 index. This involves not only calculating the index’s value but also determining which companies are included. The S&P 500 is a market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States. The index is widely used as a benchmark for the overall health of the U.S. equity market. Understanding how S&P manages the index provides insight into the dynamics of the stock market. One key aspect is understanding how the list of sp500 companies by market cap is determined.

The selection of companies for the S&P 500 is not solely based on market capitalization. While market cap is a significant factor, other criteria are also considered. These include financial viability, liquidity, and sector representation. A company must be based in the U.S., have a public float of at least 10% of its shares, and meet specific profitability requirements to be eligible for inclusion. The goal is to ensure the index accurately reflects the U.S. economy and provides a reliable measure of market performance. A committee at S&P Dow Jones Indices is responsible for making decisions about additions and deletions to the index. This committee meets regularly to review the composition of the index and consider potential changes. The committee’s decisions are based on a combination of quantitative data and qualitative judgment. The committee also considers the impact of potential changes on the index’s overall representation of the U.S. economy. The list of sp500 companies by market cap is one input, but not the only determining factor.

The committee’s decisions regarding index composition can have a significant impact on individual companies. When a company is added to the S&P 500, it often experiences a surge in its stock price. This is due to increased demand from index funds and other institutional investors that track the index. Conversely, when a company is removed from the S&P 500, its stock price may decline. The S&P 500 serves several important purposes. It provides investors with a diversified portfolio of large-cap U.S. stocks. It serves as a benchmark for investment performance. It offers insights into the overall health of the U.S. economy. The S&P 500, therefore, is more than just a list of sp500 companies by market cap; it’s a dynamic reflection of the American economic landscape, carefully curated and managed. The continuous monitoring and recalibration of the list of sp500 companies by market cap ensures the S&P 500 remains a relevant and representative benchmark.

Using Market Cap Data to Understand Industry Trends

Analyzing the market capitalization of companies within the S&P 500 can offer valuable insights into broader industry trends and shifts in the economic landscape. The list of sp500 companies by market cap provides a snapshot of which sectors are currently leading in valuation, reflecting investor sentiment and future growth expectations. This information is invaluable for understanding where the economy is heading.

For example, a significant increase in the market capitalization of electric vehicle (EV) manufacturers within the S&P 500 could signal a broader shift towards sustainable transportation. Observing the list of sp500 companies by market cap, one might notice a rise in the ranking of companies involved in battery technology or charging infrastructure, indicating a growing interest in the EV ecosystem. Similarly, a surge in the valuation of companies specializing in artificial intelligence (AI) and machine learning suggests a growing demand for these technologies across various industries. Investors are increasingly recognizing the potential of AI to transform sectors ranging from healthcare to finance, leading to higher valuations for companies at the forefront of this revolution. Furthermore, shifts in market capitalization can highlight the growing importance of cloud computing. The list of sp500 companies by market cap often features prominent cloud service providers at the top, reflecting the increasing reliance of businesses on cloud-based infrastructure and solutions. This trend underscores the ongoing digital transformation and the shift towards more agile and scalable IT environments.

By carefully monitoring the list of sp500 companies by market cap, analysts and investors can identify emerging trends and potential investment opportunities. A decline in the market capitalization of traditional energy companies, coupled with the rise of renewable energy firms, may suggest a long-term shift towards cleaner energy sources. Staying informed about these trends can help individuals and institutions make more informed decisions and adapt to the ever-changing economic environment. Examining the list of sp500 companies by market cap provides a dynamic view of the market, reflecting continuous innovation and adaptation across different sectors. Shifts in rankings highlight where capital is flowing and provide valuable insights into future economic developments.