What is a Forward Rate Agreement?

A Forward Rate Agreement (FRA) is a popular over-the-counter (OTC) contract used to manage interest rate risk. It essentially allows parties to determine the interest rate to be paid or received on a notional principal amount for a specific period in the future. The FRA is a cash-settled agreement, meaning that no actual principal changes hands. Instead, the difference between the agreed-upon forward rate and the actual interest rate at the time of settlement is paid by one party to the other. These agreements are powerful tools for hedging against interest rate fluctuations and are widely used by corporations, financial institutions, and investors.

The main function of an FRA is to lock in a future interest rate today. For example, a company expecting to borrow funds in three months might enter into a FRA to protect itself from potential increases in interest rates. Conversely, a company expecting to receive funds might use an FRA to protect against falling interest rates. One key application of FRAs involves the concept of the “5 year 5 year forward” rate. This refers to a forward rate agreement that begins five years from now and lasts for a period of five years. It reflects the market’s expectation of the average interest rate over that future five-year period. The 5 year 5 year forward rate is a key indicator used by economists and investors to assess long-term interest rate expectations and potential changes in monetary policy. Because the FRA is settled in cash, it offers a flexible and efficient way to manage interest rate exposure without the need for physical delivery of funds.

Understanding the nuances of FRAs is crucial for anyone involved in financial markets. They provide a valuable mechanism for managing risk and offer insights into market expectations. The “5 year 5 year forward” rate, in particular, is an important benchmark for long-term interest rate forecasting and strategic financial planning. By utilizing FRAs effectively, businesses and investors can better navigate the complexities of interest rate movements and achieve their financial objectives with greater confidence. Remember that while FRAs offer a hedge against interest rate volatility, they also involve counterparty risk, which should be carefully considered before entering into such agreements.

How to Calculate a Forward Rate: Understanding the Formula

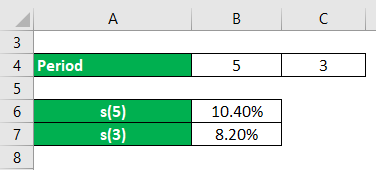

The forward rate calculation is crucial for understanding future interest rate expectations. It allows market participants to estimate what the interest rate for a specific period in the future should be, based on current spot rates. The formula uses spot rates to derive the implied forward rate. This rate represents the expected interest rate for a future period, implied by today’s yield curve. The formula helps in understanding the relationship between current and future interest rates, and the 5 year 5 year forward rate.

The formula to calculate the forward rate is as follows:

F = [(1 + S₂)T₂ / (1 + S₁)T₁]1/(T₂-T₁) – 1

Where:

- F = The forward rate

- S₁ = The spot rate for the shorter period (expressed as a decimal)

- T₁ = The length of the shorter period (in years)

- S₂ = The spot rate for the longer period (expressed as a decimal)

- T₂ = The length of the longer period (in years)

For example, to calculate the 5 year 5 year forward rate, let’s assume the following:

- S₁ = 4% (0.04) is the spot rate for 5 years (T₁ = 5)

- S₂ = 6% (0.06) is the spot rate for 10 years (T₂ = 10)

Plugging these values into the formula:

F = [(1 + 0.06)10 / (1 + 0.04)5]1/(10-5) – 1

F = [(1.06)10 / (1.04)5]1/5 – 1

F = [1.7908 / 1.2167]0.2 – 1

F = [1.4719]0.2 – 1

F = 1.0798 – 1

F = 0.0798 or 7.98%

This calculation suggests that the market expects the interest rate to be approximately 7.98% for a 5-year period, starting five years from now. It’s a critical metric for assessing market sentiment and pricing financial instruments, like understanding the 5 year 5 year forward rate agreement. Keep in mind that this is just an implied rate and not a guarantee of what future spot rates will actually be.

The Significance of the Implied Forward Rate

Implied forward rates hold significant importance in financial markets. They reflect the market’s collective expectation of future interest rate movements. The 5 year 5 year forward rate, for example, provides insights into what the market anticipates interest rates will be five years from today, for a five-year period. This forward-looking perspective is valuable for various financial activities.

The yield curve, which plots interest rates across different maturities, is closely linked to forward rates. An upward-sloping yield curve typically suggests that the market expects interest rates to rise in the future. This expectation is embedded in the higher forward rates observed for longer time horizons. Conversely, a downward-sloping or inverted yield curve may indicate anticipated declines in interest rates, leading to lower forward rates. Financial professionals carefully analyze the shape of the yield curve and the corresponding forward rates to understand prevailing market sentiment.

It’s crucial to remember that implied forward rates are not guarantees or precise predictions of future spot rates. They represent market expectations, which are influenced by various factors, including economic forecasts, inflation expectations, and risk premiums. While forward rates provide valuable information, actual future spot rates may differ due to unforeseen events or changes in market conditions. The 5 year 5 year forward rate, therefore, should be viewed as a market-based estimate rather than a definitive forecast. Furthermore, traders utilize the 5 year 5 year forward as benchmark to price other kind of swaps or derivatives.

Using Forward Rates for Hedging Interest Rate Risk

Forward Rate Agreements (FRAs) are valuable instruments for companies and investors seeking to manage interest rate risk. They allow parties to lock in a specific interest rate for a future period, regardless of actual market fluctuations. This can be particularly useful in volatile economic environments where interest rate uncertainty prevails. The 5 year 5 year forward rate can be instrumental in long term financial planning.

Borrowers often utilize FRAs to protect themselves against rising interest rates. For example, a company anticipating the need to borrow funds in six months can enter into an FRA that fixes the interest rate for that future loan. If interest rates rise above the agreed-upon FRA rate, the FRA will pay the borrower the difference, effectively offsetting the increased borrowing costs. Conversely, if interest rates fall, the borrower still pays the agreed-upon FRA rate, forgoing potential savings but gaining the certainty they desired. This strategy provides predictability and helps in budgeting and financial planning. Hedging with the 5 year 5 year forward rate allows for a secure long term interest rate plan.

Lenders can also use FRAs to hedge against falling interest rates. Consider a bank expecting to receive a large sum of money in three months that it plans to invest. The bank can enter into an FRA to lock in a lending rate for that future investment. Should interest rates decline, the FRA will compensate the bank for the difference between the agreed-upon rate and the lower market rate. This ensures that the bank achieves a minimum return on its investment, protecting its profitability. Furthermore, understanding the nuances of the 5 year 5 year forward rate is paramount for effective risk mitigation. By utilizing FRAs strategically, both borrowers and lenders can effectively mitigate interest rate risk and enhance their financial stability, contributing to more robust financial planning and risk management.

Forward Rates vs. Spot Rates: Key Differences Explained

Spot rates and forward rates represent distinct approaches to interest rate agreements. Spot rates are interest rates applicable for immediate transactions, representing the cost of borrowing or lending money right now. Conversely, forward rates are interest rates agreed upon today for a transaction that will occur at a specified future date. The critical distinction lies in the timing: spot rates are for immediate delivery, while forward rates are contractual agreements for future exchanges of funds. Understanding this difference is crucial for navigating financial markets effectively.

The relationship between spot and forward rates is influenced by several factors, most notably, expectations about future interest rates, inflation, and risk premiums. For instance, if the market anticipates rising interest rates, forward rates will typically be higher than spot rates. This reflects the compensation demanded by lenders for tying up their funds over a longer period, accounting for the anticipated increase in rates. Similarly, inflation expectations play a significant role. Higher anticipated inflation tends to push both spot and forward rates upward, with a potentially more pronounced effect on longer-term forward rates. The risk premium, reflecting the uncertainty associated with future economic conditions, also impacts the spread between spot and forward rates. A higher risk premium widens this spread, especially for distant forward rates. For example, the expectations of the 5 year 5 year forward will determine investment decisions.

To further clarify, consider a scenario where the current spot rate for a one-year bond is 5%, and the forward rate for a one-year bond, one year from now, is 6%. This implies that the market expects interest rates to rise over the next year. Investors who believe rates will remain stable might find an opportunity to profit by investing in the one-year spot rate. Conversely, borrowers who fear rising rates might prefer to lock in the 6% forward rate to protect themselves from potential increases. A 5 year 5 year forward rate represents the rate expected five years from now, for a loan that will mature in five additional years. The difference between spot rates and forward rates provides valuable information about market sentiment and future expectations, assisting financial professionals in making informed decisions. Financial instruments like Forward Rate Agreements (FRAs) are built upon these forward rates.

Analyzing the Relationship Between Yield Curve Slope and Forward Rates

The yield curve, a graphical representation of interest rates across different maturities, holds significant information about future interest rate expectations. Its shape directly correlates with forward rates, offering insights into market sentiment. An upward-sloping yield curve, where longer-term interest rates are higher than shorter-term rates, typically suggests that the market anticipates rising interest rates in the future. This expectation is reflected in higher forward rates. Investors demand a premium for lending money over longer periods, expecting higher returns to compensate for inflation and other risks. Consequently, the implied forward rates, derived from the yield curve, are elevated to reflect these anticipated increases. The 5 year 5 year forward rate, for example, would be higher than current spot rates if the yield curve is upward sloping, indicating an expectation that interest rates five years from now will be higher than they are today. This is a common scenario in growing economies.

Conversely, an inverted yield curve, where short-term interest rates are higher than long-term rates, often signals an economic slowdown or recession. In this situation, forward rates are typically lower than current spot rates. The market expects interest rates to decline in the future, perhaps due to anticipated monetary policy easing by central banks to stimulate the economy. An inverted yield curve is often seen as a predictor of economic downturns, although it is not a foolproof indicator. The relationship between the yield curve and forward rates is dynamic. Changes in economic conditions, inflation expectations, and monetary policy can all influence the shape of the yield curve and, consequently, the level of forward rates. The 5 year 5 year forward rate can provide valuable information. The steeper the inversion, the stronger the market expectation of falling rates.

A flat yield curve, where interest rates are relatively consistent across different maturities, suggests that the market has no strong expectations for future interest rate movements. In this case, forward rates would be similar to current spot rates. However, even a flat yield curve can mask underlying uncertainties. Small changes in market sentiment or economic data releases can quickly alter the shape of the curve and, consequently, the forward rate environment. Financial professionals closely monitor the yield curve and forward rates to assess market sentiment and make informed decisions about investments and risk management. For example, the 5 year 5 year forward rate is a key metric to analyze to understand if medium-term interest rate expectations are changing. Understanding these relationships is crucial for navigating the complexities of the financial markets.

Evaluating Market Sentiment with Forward Rate Spreads

Forward rate spreads offer valuable insights into market sentiment and expectations concerning future monetary policy decisions. These spreads, calculated as the difference between forward rates for different maturities, reflect the market’s collective view on the trajectory of interest rates. Analyzing the magnitude and direction of these spreads can provide clues about the perceived risks and opportunities in the financial markets. For example, a widening spread between a short-term forward rate and a longer-term forward rate might suggest that investors anticipate a period of rising interest rates, potentially driven by inflationary pressures or a strengthening economy. Conversely, a narrowing spread, or even a negative spread (inversion), could signal expectations of future rate cuts due to concerns about economic slowdown or deflation. Market participants closely monitor these spreads to refine their investment strategies and risk management practices. The analysis of these spreads often incorporates macroeconomic data, central bank communications, and geopolitical events to develop a comprehensive understanding of the prevailing market sentiment. The 5 year 5 year forward rate is a key metric here.

Changes in forward rate spreads can also reflect shifts in risk appetite. During periods of heightened uncertainty, such as economic recessions or financial crises, investors typically demand a higher premium for lending money over longer periods. This increased risk aversion can lead to a widening of forward rate spreads, as investors seek greater compensation for the perceived risks. Conversely, in more stable and optimistic environments, risk premiums tend to compress, resulting in narrower spreads. Central bank policies play a crucial role in influencing forward rate spreads. For example, if a central bank signals a commitment to maintaining low interest rates for an extended period, this can lead to a flattening of the yield curve and a narrowing of forward rate spreads. Unexpected policy announcements or shifts in the central bank’s communication strategy can trigger significant movements in these spreads, as market participants reassess their expectations. The 5 year 5 year forward rate is the expectation of the market of what will be the rate in 5 years for a 5 year investment.

Forward rate spreads are not foolproof indicators, and should be interpreted with caution. Various factors, such as supply and demand imbalances in the bond market, regulatory changes, and global economic conditions, can also influence these spreads, making it essential to consider a wide range of information when evaluating market sentiment. Despite these limitations, forward rate spreads remain a valuable tool for financial professionals seeking to understand the complex dynamics of the financial markets and make informed investment decisions. For instance, a trader might use changes in the 5 year 5 year forward rate spread to anticipate movements in bond prices and adjust their trading strategies accordingly. A corporate treasurer might monitor these spreads to assess the attractiveness of issuing debt at different maturities. Portfolio managers also consider these spreads when allocating assets across different sectors and asset classes, incorporating the implied market expectations into their overall investment framework.

How Financial Professionals Utilize Forward Rates: Real-World Applications

Financial professionals leverage forward rates across various functions, playing a crucial role in managing risk and optimizing investment strategies. Traders use forward rates to price and hedge interest rate derivatives, seeking to profit from anticipated movements in the yield curve. For instance, a trader might use a series of forward rate agreements to construct a synthetic forward starting swap, capitalizing on perceived mispricings in the market. Portfolio managers incorporate forward rates into their asset allocation decisions, using them to forecast future returns on fixed-income investments. By analyzing the implied forward rates, they can assess the attractiveness of different maturities and adjust their portfolios accordingly. Understanding the 5 year 5 year forward rate, for example, helps them gauge long-term market expectations.

Corporate treasurers utilize forward rate agreements to manage their companies’ interest rate exposure. If a company anticipates borrowing funds in the future, it can use an FRA to lock in the interest rate, protecting itself from potential rate increases. Conversely, if a company expects to have surplus cash to invest, it can use an FRA to secure a future interest rate on that investment. This is particularly relevant when considering the 5 year 5 year forward rate, which provides insights into rates several years into the future. Consider a scenario where a company plans to issue bonds in three years. By analyzing the current yield curve and the implied forward rates, the treasurer can estimate the likely interest rate on those bonds and make informed decisions about the timing and structure of the issuance.

Investment banks also rely heavily on forward rates for pricing new bond issues and structuring complex financial products. When underwriting a bond, the bank uses the yield curve and implied forward rates to determine the appropriate yield for the bond, ensuring that it is attractive to investors while still providing a reasonable return for the issuer. In structured finance, forward rates are used to create customized products that meet the specific needs of investors. These products may involve hedging interest rate risk or providing exposure to specific segments of the yield curve. The 5 year 5 year forward rate serves as a benchmark for many of these long-term transactions, reflecting the market’s consensus view on interest rates in the distant future. Overall, forward rates are an indispensable tool for financial professionals, enabling them to navigate the complexities of the interest rate market and make informed decisions that benefit their clients and organizations.