Understanding Working Capital’s Impact on Cash Flow

Working capital, calculated as current assets minus current liabilities, is a crucial indicator of a company’s short-term financial health and liquidity. A change in net working capital directly influences free cash flow. Increases in working capital, such as a rise in inventory or accounts receivable, typically reduce free cash flow because cash is tied up in these assets. Conversely, a decrease in working capital, like a reduction in inventory or faster collection of receivables, generally boosts free cash flow. Understanding this dynamic is vital for accurate financial analysis and effective cash management. The relationship between working capital and free cash flow is complex, and its implications are far-reaching for financial decision-making. Changes in working capital directly impact a company’s ability to meet its short-term obligations and fund future growth. Ignoring the impact of change in net working capital on free cash flow can lead to inaccurate financial forecasts and poor resource allocation.

Consider a retail company increasing its inventory levels to meet anticipated holiday demand. This increase in current assets (inventory) represents an outflow of cash, reducing free cash flow in the short term. Similarly, extending credit to customers increases accounts receivable, tying up cash and negatively affecting the change in net working capital free cash flow. Conversely, efficient inventory management, reducing excess stock, frees up cash, thereby positively impacting free cash flow. Prompt collection of accounts receivable also improves cash flow. The impact of the change in net working capital free cash flow is a key consideration for investors and creditors evaluating a company’s financial strength and performance. Effective working capital management ensures a company maintains sufficient liquidity while optimizing its use of financial resources.

Analyzing the change in net working capital free cash flow requires examining both the balance sheet and the cash flow statement. The balance sheet shows changes in current assets and liabilities, providing insights into working capital fluctuations. The cash flow statement directly reflects the cash inflows and outflows related to these changes. For example, a decrease in inventory will show up as a positive cash flow from operating activities on the cash flow statement. By understanding these relationships, one can accurately assess the impact of working capital management on a company’s overall financial health and free cash flow. Mastering this analysis provides valuable insights into improving free cash flow and profitability.

How Increased Working Capital Can Actually Reduce Your Free Cash Flow

An increase in working capital, while seemingly positive, can paradoxically reduce a company’s free cash flow. This occurs because a rise in working capital represents a larger investment in current assets like inventory or accounts receivable. These assets tie up cash that could otherwise be used for other purposes, directly impacting the change in net working capital free cash flow. For example, a retailer significantly increasing inventory levels before a major sales event sees a cash outflow, thus reducing their immediate free cash flow, even if future sales are expected to be higher. This highlights the crucial interplay between working capital changes and free cash flow.

Consider the manufacturing sector. Companies often build up raw materials and work-in-progress inventory to meet anticipated demand. This increase in current assets requires significant upfront investment, immediately lowering available free cash flow. The impact of this change in net working capital free cash flow becomes even more pronounced during periods of slower-than-anticipated sales, where the excess inventory remains unsold, further tying up capital. Effective management mitigates these negative impacts, ensuring that the increase in working capital is aligned with anticipated sales and revenue generation. Businesses must carefully balance inventory levels against cash flow to avoid situations where increased working capital reduces free cash flow, a critical aspect of change in net working capital free cash flow management.

Extending credit to customers also increases working capital (accounts receivable) but decreases immediate cash flow. While increased sales are the eventual goal, the delayed payment collection directly reduces free cash flow. This impact is particularly relevant in industries with long sales cycles or where credit risk is higher. The change in net working capital free cash flow in this scenario underscores the importance of credit policy, collection efficiency, and accurate credit risk assessment in maintaining healthy cash flow levels. Analyzing the change in net working capital free cash flow associated with credit extension is crucial for maintaining a strong financial position.

How Decreased Working Capital Can Boost Your Free Cash Flow

A decrease in working capital directly increases free cash flow. This happens because less cash is tied up in current assets. For example, efficiently collecting accounts receivable frees up cash previously tied up in outstanding invoices. This positive change in net working capital free cash flow improves the company’s liquidity and ability to invest in growth opportunities or return capital to shareholders. Businesses that excel at managing working capital often see a significant positive impact on their bottom line. Understanding this dynamic is crucial for financial analysis and effective decision-making. A reduction in inventory levels also contributes to a positive change in net working capital free cash flow, as excess inventory represents a cash outflow that is recovered when sales are made. This improvement in efficiency positively affects the cash flow statement. The relationship between working capital and free cash flow is bidirectional: improvements in working capital management lead to increased free cash flow.

Consider a manufacturing company that successfully reduces its inventory holding period. By optimizing production and sales forecasting, the company minimizes excess inventory. This decrease in current assets translates to a reduction in working capital. The freed-up cash improves the company’s cash flow, providing more resources for other activities. This is a clear example of how efficient working capital management directly influences the change in net working capital free cash flow. Conversely, a company struggling with slow-moving inventory experiences a negative impact. The cash tied up in unsold goods diminishes its ability to meet operational needs and invest in growth initiatives. The resulting negative change in net working capital free cash flow demonstrates the importance of effective inventory management.

Efficient working capital management is a key performance indicator (KPI) for many businesses. Analyzing changes in working capital helps assess a company’s operational efficiency and financial health. A consistent pattern of decreased working capital suggests strong management practices. This, in turn, leads to a higher and more reliable free cash flow. Companies regularly evaluate their working capital efficiency. They use various metrics to determine how effectively they manage current assets and liabilities. Tracking the change in net working capital free cash flow is vital for forecasting and planning. It allows businesses to identify areas for improvement and make strategic decisions to optimize cash flow. Focusing on this relationship helps create a more robust and financially stable business.

Analyzing the Impact of Working Capital Changes on Financial Statements

Understanding the interplay between working capital and free cash flow requires a thorough analysis of financial statements. The balance sheet provides the data needed to calculate changes in working capital. This calculation involves subtracting current liabilities from current assets. A positive change indicates an increase in working capital, while a negative change signifies a decrease. This change in net working capital directly impacts the free cash flow calculation. The cash flow statement offers another perspective, showing the actual cash inflows and outflows related to operating activities. Analyzing both statements allows for a comprehensive view of how working capital fluctuations affect the overall free cash flow. Free cash flow is ultimately the cash available after covering all operating expenses and capital expenditures. A significant change in net working capital free cash flow can indicate operational efficiency or inefficiency.

To illustrate, consider a company that experiences a significant increase in inventory. This increase represents a rise in working capital, as current assets grow. However, this increase simultaneously reduces free cash flow because cash is tied up in unsold inventory. The impact of this change in net working capital free cash flow is clearly reflected in both the balance sheet and the cash flow statement. Conversely, a decrease in working capital, perhaps due to efficient accounts receivable management, frees up cash, boosting free cash flow. This is because the company is collecting cash more quickly. Therefore, monitoring changes in working capital and their effect on free cash flow provides crucial insights into a company’s financial health and liquidity. Careful examination of the change in net working capital free cash flow allows for effective financial planning and decision-making.

Calculating the impact is straightforward. First, determine the change in working capital from one period to the next. Then, incorporate this change into the free cash flow calculation. Remember that an increase in working capital reduces free cash flow, while a decrease increases it. This direct relationship is crucial for accurate financial analysis. This analysis of the change in net working capital free cash flow reveals valuable information about a firm’s operational efficiency and its ability to generate cash. Businesses can utilize this information to make informed choices regarding inventory management, credit policies, and payment terms to optimize their free cash flow. Analyzing the change in net working capital free cash flow is a vital tool for effective financial management.

How to Improve Free Cash Flow Through Strategic Working Capital Management

Optimizing working capital is crucial for boosting free cash flow. A change in net working capital directly impacts free cash flow. Efficient management involves a multifaceted approach, focusing on key areas like inventory, receivables, and payables. By strategically adjusting these components, businesses can significantly influence their cash position. Effective inventory management minimizes storage costs and reduces obsolete stock, freeing up capital. This is vital for a positive change in net working capital free cash flow.

Improving accounts receivable collection is another critical element. Prompt and efficient collection reduces the amount of capital tied up in outstanding invoices. Strategies like implementing robust credit policies, utilizing technology for automated reminders, and offering early payment discounts can accelerate cash inflows. This positive change in net working capital free cash flow can lead to improved financial health. Conversely, extending payable terms strategically can provide short-term financing, allowing businesses to maintain operations without immediate cash outlays. Negotiating favorable payment terms with suppliers can create additional flexibility, again impacting the change in net working capital free cash flow.

Technology plays a significant role in optimizing working capital. Enterprise Resource Planning (ERP) systems provide real-time visibility into inventory levels, receivables, and payables. This data-driven approach enables proactive management, preventing cash flow issues. Furthermore, advanced analytics can predict future working capital needs, allowing for proactive planning. This predictive capability is essential for anticipating fluctuations and maintaining a healthy free cash flow. A well-managed change in net working capital free cash flow enhances a company’s overall financial performance and resilience.

The Importance of Forecasting Working Capital Changes

Accurately forecasting changes in working capital is crucial for creating reliable free cash flow projections. A precise understanding of how working capital will fluctuate directly impacts the accuracy of free cash flow predictions. Ignoring this aspect can lead to significant miscalculations and flawed financial planning. Businesses must consider various factors, including seasonal trends, the overall economic climate, and planned business expansion, when forecasting change in net working capital free cash flow. For example, a retail company might anticipate a substantial increase in inventory during the holiday season, leading to a temporary decrease in free cash flow due to increased working capital needs. This effect on change in net working capital free cash flow must be accounted for.

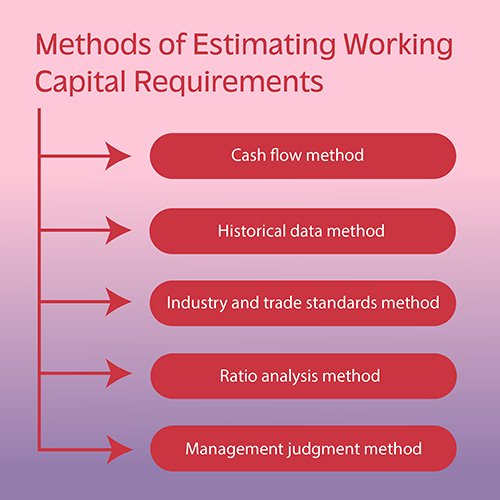

Several methods can help businesses forecast working capital changes. These include analyzing historical trends, using statistical modeling techniques, and incorporating qualitative assessments of future market conditions and business strategies. Sophisticated financial models often incorporate these various forecasting approaches to generate a comprehensive picture. Understanding the interplay between sales projections, inventory turnover rates, and payment terms is critical. A company experiencing rapid growth might need to forecast significantly larger increases in working capital to support increased production and sales. Accurate forecasting of the change in net working capital free cash flow is essential for making informed decisions about investments, financing, and overall business strategy. Accurate forecasting minimizes financial surprises and enables proactive financial management.

Forecasting working capital changes requires a collaborative effort between finance, sales, operations, and other relevant departments. Sales projections form the foundation of any working capital forecast. These projections, combined with realistic assumptions regarding inventory management, accounts receivable collection, and accounts payable cycles, will produce a reasonable forecast. Regularly reviewing and updating these forecasts is vital, especially in dynamic business environments. Changes in economic conditions or unexpected shifts in consumer demand can significantly impact working capital needs. By regularly monitoring actual results against the forecast and making necessary adjustments, businesses can significantly improve the accuracy of their free cash flow projections. This proactive approach helps mitigate risks associated with inaccurate forecasting of change in net working capital free cash flow.

Case Studies: Real-World Examples of Working Capital Management

Company A, a large retailer, experienced significant growth but struggled with cash flow. Inventory levels ballooned, leading to a substantial increase in working capital. This change in net working capital reduced free cash flow, hindering expansion plans. The company subsequently implemented a just-in-time inventory system, reducing storage costs and improving cash flow. This strategic shift demonstrates how effectively managing inventory directly impacts change in net working capital free cash flow.

In contrast, Company B, a tech startup, prioritized efficient accounts receivable management. They implemented robust invoicing and collection processes. This resulted in a decrease in working capital and a corresponding increase in free cash flow. The change in net working capital free cash flow allowed them to invest in research and development, fueling further growth. This case highlights how streamlined processes can positively affect change in net working capital free cash flow.

Company C, a manufacturing firm, initially faced challenges with managing its working capital. Long payment terms from customers and inefficient inventory management led to a substantial increase in working capital. This resulted in a negative change in net working capital free cash flow. Through renegotiating payment terms with suppliers and implementing lean manufacturing practices, they reduced their working capital significantly. The resulting positive change in net working capital free cash flow strengthened the company’s financial position. This demonstrates the potential for process improvements to improve change in net working capital free cash flow. Analyzing these diverse examples reveals the crucial role that effective working capital management plays in shaping a company’s financial health and its change in net working capital free cash flow.

Key Takeaways and Next Steps for Optimizing Your Cash Flow

Understanding the intricate relationship between working capital and free cash flow is crucial for any business aiming for financial health. A change in net working capital directly impacts free cash flow. Increases in working capital, such as building inventory or extending credit, often reduce free cash flow as cash is tied up in assets. Conversely, decreases in working capital, achieved through efficient receivables collection or inventory reduction, boost free cash flow. Analyzing financial statements reveals the impact of these changes, allowing for informed decision-making.

Strategic working capital management is key to optimizing free cash flow. This involves carefully balancing inventory levels, streamlining accounts receivable processes, negotiating favorable payment terms with suppliers, and forecasting future working capital needs. Accurate forecasting, incorporating seasonal variations and economic factors, is essential for creating realistic free cash flow projections. Successfully managing the change in net working capital free cash flow impact requires continuous monitoring and proactive adjustments to adapt to changing market conditions and business growth. Proactive management minimizes negative impacts from change in net working capital free cash flow.

Effective working capital management isn’t a one-time fix; it’s an ongoing process. Regularly review key performance indicators, such as days sales outstanding and inventory turnover. Identify areas for improvement and implement strategies to optimize cash flow. By consistently monitoring and adjusting working capital practices, businesses can enhance their financial performance and secure a stronger financial future. The ability to predict and manage the change in net working capital free cash flow contributes significantly to a company’s overall financial strength and resilience. Remember that change in net working capital free cash flow is a dynamic relationship requiring constant attention.