Understanding Bonds and Coupon Payments: A Simple Guide to Calculating Annual Coupon Rate

A bond is essentially a loan you make to a government or corporation. In return for lending your money, they promise to pay you back the principal (the original amount you lent) at a specified date in the future. They also typically make regular interest payments, known as coupon payments. These payments represent the interest earned on your investment. The annual coupon rate is the yearly interest rate stated on the bond, calculated as a percentage of the bond’s face value. Understanding how to calculate this rate is vital for investors assessing potential returns. For example, imagine a bond with a face value of $1,000 and an annual coupon rate of 5%. This means the bond will pay $50 in interest each year, assuming annual payments. Learning how to calculate annual coupon rate empowers investors to make informed decisions.

The annual coupon rate is a crucial figure for any bond investor. It directly reflects the return on investment based on the bond’s face value. However, it’s important to remember that the actual return might vary based on factors such as when you buy the bond (at a premium or discount to its face value), the bond’s maturity date, and prevailing market interest rates. A higher annual coupon rate generally indicates a potentially higher return, but this must be weighed against the risks associated with that particular bond. Understanding how to calculate annual coupon rate is the first step toward a deeper understanding of bond investment. Investors should always carefully review all bond details, including the issuer’s creditworthiness, before investing.

It is important to remember that while the annual coupon rate provides valuable information, it doesn’t paint the complete picture of a bond’s potential return. Market conditions and the timing of the purchase influence the overall return an investor realizes. Therefore, a thorough understanding of how to calculate annual coupon rate, coupled with an assessment of other relevant factors, is crucial for making sound investment decisions. Learning how to calculate annual coupon rate is a fundamental skill for anyone interested in fixed-income investments. The ability to quickly and accurately determine this key metric is essential for comparing different investment opportunities and making informed choices aligned with your financial objectives. Knowing how to calculate annual coupon rate provides a solid foundation for navigating the bond market.

Identifying Key Bond Information: Face Value and Coupon Payment

To learn how to calculate annual coupon rate, one must first understand the essential information needed. This involves identifying two key figures from the bond’s documentation: the face value and the periodic coupon payment amount. The face value, also known as the par value, represents the amount the issuer will repay the bondholder at maturity. This information is clearly stated on the bond certificate itself. Finding the face value is straightforward; it’s usually prominently displayed. For example, a bond might have a face value of $1,000. This means the investor will receive $1,000 when the bond matures. The coupon payment, on the other hand, represents the periodic interest payment the bondholder receives. This payment is usually expressed as a percentage of the face value, known as the coupon rate. Locating this information might require reviewing a bond certificate or checking a brokerage account statement. The coupon payment amount is usually stated as a dollar amount per period (e.g., $30 per half-year). Understanding how to locate both the face value and the coupon payment is the crucial first step in calculating the annual coupon rate.

Knowing how to calculate annual coupon rate efficiently involves understanding where to find the relevant data. Brokerage statements clearly show both the face value and the periodic coupon payment. These statements often display the bond’s details in a tabular format, with columns for the bond’s name, face value, coupon rate, and the payment schedule. The face value is typically listed as ‘Par Value’ or a similar term. The periodic coupon payment is often shown as a currency amount for a specific period, like a six-month period. For instance, a statement might show a semi-annual payment of $25. It’s essential to note that if only the coupon rate is listed (as a percentage), the coupon payment amount can be calculated by multiplying the face value by the coupon rate and dividing by the number of payments per year (e.g., for a semi-annual payment, divide by 2). Accurate identification of these values is paramount for a correct calculation, which forms the foundation of understanding how to calculate annual coupon rate.

Let’s clarify how to calculate annual coupon rate with a practical example. Suppose a bond has a face value of $1,000 and pays a semi-annual coupon payment of $30. To find the annual coupon payment, one simply multiplies the semi-annual payment by 2, giving us an annual coupon payment of $60. With this information, we can now easily compute the annual coupon rate using the formula: (Annual Coupon Payment / Face Value) * 100%. Substituting the values, we obtain: ($60 / $1000) * 100% = 6%. This signifies that the bond yields a 6% annual coupon rate. Understanding this calculation is key to assessing the return of an investment; remembering how to calculate annual coupon rate makes one a better-informed investor.

Determining the Coupon Payment Frequency: Annual, Semi-annual, Quarterly

Understanding how to calculate annual coupon rate involves recognizing that coupon payments aren’t always annual. Many bonds pay interest semi-annually, meaning twice a year, or even quarterly, meaning four times a year. The payment frequency significantly impacts the calculation of the annual coupon rate. For example, a bond with a semi-annual coupon payment will have two payments per year. To determine the annual coupon rate, one must first calculate the total annual payment by adding the payments for the year. A bond with a quarterly coupon payment will have four payments per year. The total annual payment is the sum of these four payments. Ignoring the payment frequency will lead to an incorrect annual coupon rate. This is a crucial factor when learning how to calculate annual coupon rate accurately.

To illustrate, consider a bond with a stated annual coupon rate of 6% and a face value of $1,000. If the bond pays interest annually, the annual coupon payment is simply 6% of $1,000, or $60. However, if the bond pays semi-annually, each payment will be $30 ($60/2), and the total annual payment remains $60. If the bond pays quarterly, each payment is $15 ($60/4), and the annual payment remains $60. The formula for calculating the annual coupon rate remains the same regardless of the payment frequency; however, the annual coupon payment value must reflect the sum of all payments made within a year. This careful consideration of payment frequency is critical when learning how to calculate annual coupon rate precisely. Understanding this aspect ensures accuracy in your calculations.

In summary, when learning how to calculate annual coupon rate, always check the bond’s documentation or your brokerage statement to determine the payment frequency. This information is crucial for accurately calculating the total annual coupon payment, which is a fundamental component of the annual coupon rate calculation. Using the correct annual coupon payment ensures an accurate representation of the bond’s yearly return and is essential for informed investment decisions. Remember that while the formula itself is straightforward, understanding the nuances of coupon payment frequency is vital for a correct result. How to calculate annual coupon rate efficiently and accurately depends heavily on this detail.

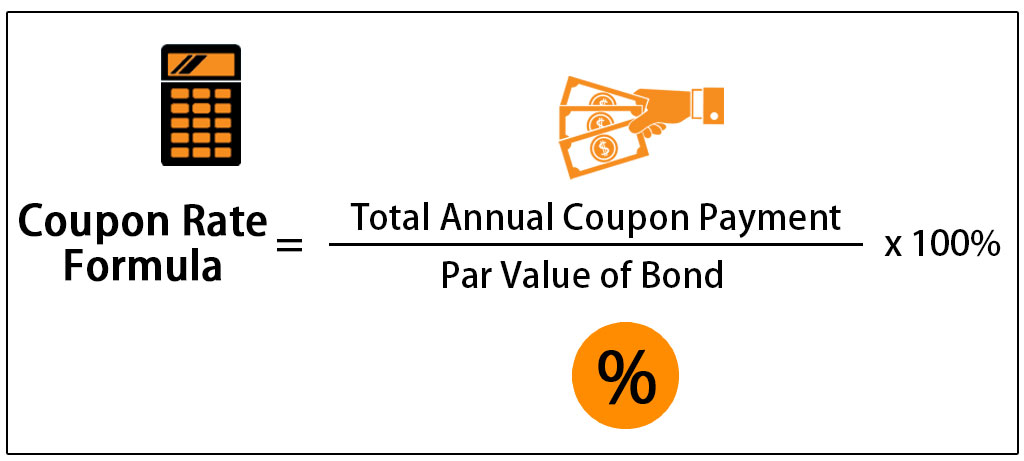

The Calculation: Formula and Step-by-Step Guide to How to Calculate Annual Coupon Rate

To learn how to calculate annual coupon rate, you need a simple formula. The annual coupon rate is calculated using this formula: (Annual Coupon Payment / Face Value) * 100%. This formula provides a straightforward method for determining the yearly return on a bond investment. Understanding how to calculate annual coupon rate is essential for assessing the potential profitability of a bond. The calculation itself is quite simple, focusing on two key inputs: the annual coupon payment and the bond’s face value.

Let’s break down each step involved in calculating the annual coupon rate. First, identify the annual coupon payment. This represents the total amount of interest the bond pays annually. It’s crucial to note that coupon payments are not always made annually. Some bonds pay semi-annually or quarterly. If the bond’s payment frequency is not annual, you must adjust the calculation accordingly, which is covered later. Second, determine the bond’s face value, also known as its par value. This is the amount the investor will receive at the bond’s maturity. These two figures are typically found on the bond certificate or via your brokerage account statement. Once you have both values, insert them into the formula. For example, if the annual coupon payment is $60 and the face value is $1000, the calculation is: ($60 / $1000) * 100% = 6%. This means the annual coupon rate for this bond is 6%. Understanding how to calculate annual coupon rate in this manner allows investors to quickly assess the bond’s return.

Remember, this formula provides a fundamental understanding of how to calculate annual coupon rate. However, for a more comprehensive picture of a bond’s return, you also need to consider other factors, such as the bond’s current market price, maturity date, and the prevailing market interest rates. These factors influence the yield to maturity (YTM), a more nuanced measure of return. While knowing how to calculate annual coupon rate is important, it should always be considered alongside these additional metrics for a truly informed investment decision. Learning how to calculate annual coupon rate is a critical first step in understanding bond investment returns. The process, as shown, is relatively straightforward, but remember to always double check your calculations and consider the overall financial implications before investing in any bond.

Calculating the Annual Coupon Rate: Practical Examples

Let’s illustrate how to calculate the annual coupon rate with a few examples. First, consider a bond with a face value of $1,000 and an annual coupon payment of $50. To determine the annual coupon rate, one applies the formula: (Annual Coupon Payment / Face Value) * 100%. In this case, ($50 / $1,000) * 100% = 5%. This bond offers a 5% annual coupon rate. This straightforward calculation shows how to calculate annual coupon rate for bonds with annual payments.

Now, let’s examine a bond paying semi-annual coupons. Suppose a bond has a face value of $1,000 and pays a semi-annual coupon of $25. Since there are two payments per year, the annual coupon payment is $25 * 2 = $50. Applying the formula, ($50 / $1,000) * 100% = 5%. Again, the annual coupon rate is 5%. This example demonstrates how to calculate annual coupon rate when payments are semi-annual. Remember, always annualize the coupon payments before calculating the rate. Learning how to calculate annual coupon rate accurately is crucial for informed investment decisions.

Finally, let’s consider a bond with quarterly payments. Assume a $1,000 face value bond pays a quarterly coupon of $12.50. The annual coupon payment equals $12.50 * 4 = $50. Applying the familiar formula, ($50 / $1,000) * 100% = 5%. The annual coupon rate remains 5%. This illustrates the process of how to calculate annual coupon rate for bonds making quarterly payments. These examples highlight the importance of considering payment frequency when determining the annual coupon rate. Understanding how to calculate annual coupon rate for various payment schedules is essential for investors seeking to compare different bond offerings effectively. Mastering this calculation improves your ability to assess bond investment opportunities.

Interpreting Your Results: What the Annual Coupon Rate Tells You

The annual coupon rate, calculated using the method described in “how to calculate annual coupon rate”, represents the yearly return on a bond’s face value, based solely on the stated interest payments. It’s a straightforward measure of the bond’s income potential. A higher annual coupon rate indicates a larger yearly interest payment relative to the bond’s face value. Investors seeking higher income may favor bonds with higher coupon rates. However, it’s crucial to remember that this rate doesn’t account for fluctuations in the bond’s market price.

Understanding the annual coupon rate is a key step in assessing a bond’s potential return. While a high rate is attractive, investors should consider the bond’s maturity date. A bond maturing sooner provides a quicker return of the principal investment. Further, the current market interest rates heavily influence bond prices. If market rates rise after purchasing a bond, the bond’s market price may fall, impacting the overall return. Conversely, if market rates fall, the bond’s price might rise. Therefore, the annual coupon rate alone does not fully capture the bond’s investment performance; it’s just one piece of the puzzle in evaluating bond investment opportunities. This calculation is crucial when learning how to calculate annual coupon rate.

Remember that the annual coupon rate only considers the fixed interest payments promised by the bond. It does not factor in potential capital gains or losses from price fluctuations in the bond market. These price changes can significantly impact the total return an investor experiences. To get a more comprehensive view of the potential return, investors should also examine metrics like Yield to Maturity (YTM). YTM takes into account the bond’s current market price, its face value, the time to maturity, and the coupon rate, giving a more realistic picture of the bond’s overall return. Understanding how to calculate annual coupon rate is a foundation for more advanced bond analyses.

Comparing Bond Yields: Annual Coupon Rate vs. Yield to Maturity

While the annual coupon rate provides a straightforward measure of a bond’s periodic interest payments, it offers an incomplete picture of the bond’s overall return. Understanding how to calculate annual coupon rate is only the first step. Investors need to consider the Yield to Maturity (YTM) for a more comprehensive assessment. YTM accounts for several crucial factors the annual coupon rate ignores. These factors include the bond’s current market price and its remaining time until maturity.

The annual coupon rate simply represents the stated interest payment relative to the bond’s face value. It doesn’t factor in fluctuations in the bond’s market price. A bond’s market price can change based on various factors such as prevailing interest rates and creditworthiness of the issuer. If you buy a bond at a discount to its face value, your actual return will be higher than the annual coupon rate suggests. Conversely, buying a bond at a premium results in a lower return. YTM incorporates these price variations into the calculation, providing a more accurate reflection of your potential return over the life of the bond. It considers the total return including both the coupon payments and the difference between the purchase price and the face value at maturity.

Calculating YTM is more complex than calculating the annual coupon rate. It involves more sophisticated financial calculations that account for the timing of cash flows. Several online calculators and financial software programs are readily available to assist with YTM calculations. Understanding how to calculate annual coupon rate is essential, but incorporating YTM into the investment decision-making process provides a significantly more refined and realistic estimate of your potential return. Remember, both figures provide valuable information; however, YTM offers a more holistic perspective for informed investment choices. Always consult with a financial advisor before making significant investment decisions.

Beyond the Basics: Advanced Considerations for Bond Investors

Understanding how to calculate annual coupon rate is foundational, yet it’s crucial to acknowledge that bonds present complexities beyond simple calculations. Callable bonds, for instance, offer issuers the option to redeem the bond before its maturity date. This feature impacts an investor’s potential return, as the bond may be called away before the investor receives all expected coupon payments. Therefore, the initially calculated annual coupon rate may not reflect the actual return if the bond is called. Investors should carefully review the bond’s terms and conditions, paying close attention to call provisions to assess potential risks and rewards.

Inflation significantly influences bond returns. While knowing how to calculate annual coupon rate provides the nominal interest earned, the real return—the return after accounting for inflation—is what truly matters to investors. High inflation erodes the purchasing power of future coupon payments and the bond’s face value at maturity. This means that a seemingly attractive annual coupon rate might deliver a disappointing real return if inflation outpaces the nominal yield. Investors should analyze inflation forecasts and consider inflation-protected securities to mitigate this risk. To accurately assess the real return, investors need to adjust the calculated annual coupon rate for the expected inflation rate during the bond’s life.

Furthermore, understanding bond pricing and how market interest rates affect it is vital. Changes in interest rates influence a bond’s market price. If prevailing interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive, thus reducing their market price. Conversely, falling interest rates increase the value of existing bonds. Therefore, the annual coupon rate alone doesn’t provide a comprehensive picture of a bond’s return. Investors must consider factors like yield to maturity (YTM), which accounts for the bond’s current market price and remaining time to maturity, to gauge a more realistic return. Understanding how to calculate annual coupon rate is a starting point but shouldn’t be the sole factor guiding investment decisions. Sophisticated bond investors delve deeper into these dynamic market forces before committing to any bond purchase.