Understanding Option Strategies: A Foundation for Backtesting

Mastering how to backtest option strategies begins with a solid understanding of the strategies themselves. Various options strategies exist, each with unique risk and reward profiles. Calls grant the right to buy an underlying asset at a specific price (the strike price) by a certain date (the expiration date). Puts grant the right to sell. Spreads involve simultaneously buying and selling options of the same type (calls or puts) with different strike prices or expiration dates. A bull call spread profits from rising prices, limiting risk. A bear put spread profits from falling prices, again limiting risk. Straddles involve buying both a call and a put with the same strike price and expiration date, profiting from large price movements in either direction. Strangles are similar but use different strike prices, requiring a larger price movement for profitability. Understanding these strategies’ payoff diagrams is crucial. These diagrams visually represent the profit or loss at different underlying asset prices at expiration. Visualizing these payoffs helps determine which strategies suit specific market outlooks and risk tolerances, a key element in effective backtesting. How to backtest option strategies effectively depends greatly on this foundational knowledge. The process of learning how to backtest option strategies involves understanding these profiles intimately.

Successfully implementing how to backtest option strategies requires recognizing the nuances within each. For example, the maximum profit of a bull call spread is limited, while the maximum loss is defined by the net premium paid. Conversely, a long call position offers unlimited profit potential but limited loss (the premium paid). Understanding these boundaries is essential for setting realistic expectations during backtesting. Different strategies react differently to implied volatility, time decay (theta), and underlying asset price movements. A thorough grasp of these dynamics informs the selection of appropriate backtesting parameters. Furthermore, the choice of strategy is heavily influenced by market conditions. In volatile markets, strategies like straddles or strangles might be favored, while in calmer markets, spreads might be more suitable. Understanding how each strategy behaves under different market regimes is fundamental when learning how to backtest option strategies.

Before diving into the mechanics of how to backtest option strategies, remember that each strategy has unique characteristics that significantly impact backtesting. For instance, the effectiveness of a covered call strategy (selling calls against long stock positions) hinges on the underlying asset’s price behavior and volatility. Conversely, a protective put (buying a put option to protect against losses in a long stock position) offers downside protection at the cost of the premium paid. These varying risk-reward dynamics influence the metrics used to evaluate the performance of a strategy during backtesting. Consequently, knowing how to backtest option strategies correctly involves understanding and factoring in these distinct features to provide realistic results. Analyzing these factors helps optimize the strategy selection process for successful trading and reinforces the importance of a comprehensive understanding of options strategies.

Choosing the Right Backtesting Software or Platform for How to Backtest Option Strategies

Selecting the appropriate software is crucial when learning how to backtest option strategies. Several options exist, each with its strengths and weaknesses. Spreadsheet software like Microsoft Excel can be used for basic backtesting. Excel’s capabilities include data manipulation, formula creation, and charting, allowing users to perform simpler backtests. However, more sophisticated strategies require dedicated platforms. OptionVue offers advanced features specifically designed for options trading and backtesting, providing detailed analysis and visualization tools. Thinkorswim, a popular platform, integrates charting, strategy building, and backtesting capabilities. It is user-friendly and offers extensive data, but its features can be overwhelming for beginners. TradeStation provides professional-grade tools, including powerful backtesting capabilities and a wide range of options data. However, it might come with a higher learning curve and cost. The ideal platform depends on individual needs and technical expertise. Consider factors like ease of use, cost, data availability, and the complexity of strategies you plan to backtest when making your choice. Choosing the right tools significantly impacts the accuracy and efficiency of the backtesting process for how to backtest option strategies.

When deciding how to backtest option strategies, a key consideration is the platform’s data handling capabilities. Access to reliable historical option data is essential for accurate backtests. The chosen platform should offer a broad range of underlying assets and sufficient historical data points. Data quality is critical; inaccuracies can lead to misleading results. The chosen software should allow for easy import and export of data in various formats, such as CSV or Excel files. Furthermore, the platform should facilitate efficient data cleaning and handling of potential gaps or inconsistencies in historical data. Features like automated data updates and error detection are beneficial. Robust data management is critical for developing reliable backtests and gaining actionable insights. Consider the platform’s ability to manage large datasets and handle complex calculations efficiently when learning how to backtest option strategies.

The success of your backtesting exercise, particularly when learning how to backtest option strategies, relies heavily on the platform’s user interface and functionality. A user-friendly interface simplifies the process and reduces the time spent on technical aspects. Intuitive navigation and clear presentation of backtesting results are vital. The platform’s ability to visualize data through charts and graphs is also important. Clear visualizations enhance understanding and interpretation of results. Some platforms offer advanced features like automated strategy optimization or simulated trading environments. These features can be beneficial but may require a higher level of technical proficiency. Remember to prioritize a platform that aligns with your skill level and the complexity of the option strategies you wish to analyze for more accurate results on how to backtest option strategies. This ultimately determines your overall efficiency and ability to derive valuable insights from your backtests.

Gathering Historical Data: The Cornerstone of Accurate Backtesting

Reliable historical option price data forms the bedrock of effective backtesting for option strategies. Several sources provide this crucial data. Brokerage platforms often offer historical data downloads, though the extent and format may vary. Dedicated data providers like OptionMetrics specialize in supplying comprehensive, high-quality financial data, including option prices. Data typically comes in formats like CSV or Excel, readily importable into backtesting software. Choosing the right data source significantly impacts the accuracy and reliability of the backtesting process. How to backtest option strategies effectively hinges on this critical first step. Data accuracy is paramount; inconsistencies or gaps can skew results. Thorough data validation is essential before commencing the backtest.

When acquiring historical option data for how to backtest option strategies, consider the level of detail needed. Factors such as the underlying asset’s price, option strike price, expiration date, implied volatility, and open interest are all relevant. The frequency of data points (e.g., daily, hourly) influences the granularity of the backtest. More frequent data allows for a more detailed analysis but increases the computational demands. Data gaps present a challenge. Strategies for handling these gaps include linear interpolation, which estimates missing values based on surrounding data points, or simply excluding periods with missing data from the backtesting timeframe. The method chosen will affect the final results, so transparency in this area is vital. Thorough data cleaning is an important step in how to backtest option strategies accurately.

Understanding the nuances of option data is crucial for accurate backtesting. Option prices are not static; they fluctuate continuously based on several market factors. Therefore, using reliable, high-frequency data is best for a precise representation of real-world trading conditions. This helps to simulate the complexities of option trading and gives a more accurate assessment of a strategy’s performance. Remember, the goal of how to backtest option strategies effectively is to generate insights for improved future performance. Using flawed or incomplete data directly undermines this goal. Obtaining and preparing high-quality data is the first and arguably most important step in the backtesting process.

How to Set Up Your Backtesting Parameters for Option Strategies

Successfully learning how to backtest option strategies hinges on carefully defining backtesting parameters. The time period significantly impacts results. A longer period (e.g., 5 years) provides more data, potentially revealing patterns hidden in shorter tests (e.g., 1 year). However, market regimes change; a strategy thriving in one era might fail in another. Choosing the right timeframe requires considering market stability and strategy characteristics. How to backtest option strategies effectively also involves selecting the trading frequency. Daily backtesting offers granular detail, capturing short-term price fluctuations. Weekly backtesting smooths out noise, focusing on longer-term trends. The optimal frequency depends on the strategy’s holding period and trading style. Transaction costs, including commissions and slippage, are critical. Failing to account for these realistically biases results, creating an overly optimistic view of profitability. These costs should reflect real-world trading conditions, not idealized scenarios. Accurate cost modeling is essential for understanding actual strategy performance. Finally, capital allocation influences risk exposure. How to backtest option strategies successfully necessitates setting a realistic starting capital. This determines position sizing, influencing risk and potential returns. Proper capital allocation mitigates risk and ensures the backtest accurately reflects real-world constraints. Careful parameter selection is crucial for realistic and meaningful backtest results.

Understanding how to backtest option strategies involves more than just selecting a timeframe. The chosen parameters directly affect the backtest’s accuracy and interpretation. For instance, daily trading frequency requires more data processing and potentially reveals more short-term noise. Conversely, weekly data smooths out volatility but might miss short-term opportunities. Transaction costs significantly impact profitability. High commission fees might render a profitable strategy unprofitable in reality. Slippage, the difference between expected and actual execution price, further erodes returns. Ignoring these factors leads to unrealistic results. Capital allocation is crucial for managing risk. Insufficient capital can lead to early margin calls and distort the outcome. Conversely, excessive capital might mask inherent risk within the strategy. How to backtest option strategies effectively requires testing different parameter settings. Running multiple backtests with varied parameters reveals how sensitive the strategy is to external factors. Comparing these scenarios provides valuable insight into the strategy’s robustness and limitations, offering a more nuanced view of its potential.

When learning how to backtest option strategies, remember that data quality influences the results. Inaccurate or incomplete data leads to unreliable conclusions. Using data from a reputable source is vital for ensuring accuracy and avoiding biases. Furthermore, consider data limitations. Historical data may not reflect future market behavior. Understanding this limitation is crucial for interpreting the findings of any backtest. Always remember that backtesting is just one tool for evaluating a trading strategy. It should complement other analytical methods, such as fundamental or technical analysis. Furthermore, consider factors like implied volatility when evaluating results. Implied volatility is a key factor impacting option pricing, making its consideration essential for a realistic assessment. The ability to accurately model implied volatility in backtesting is another crucial element of successful strategy evaluation. In essence, choosing appropriate parameters and rigorously testing your strategy’s sensitivity to them are crucial components of how to backtest option strategies effectively and reliably.

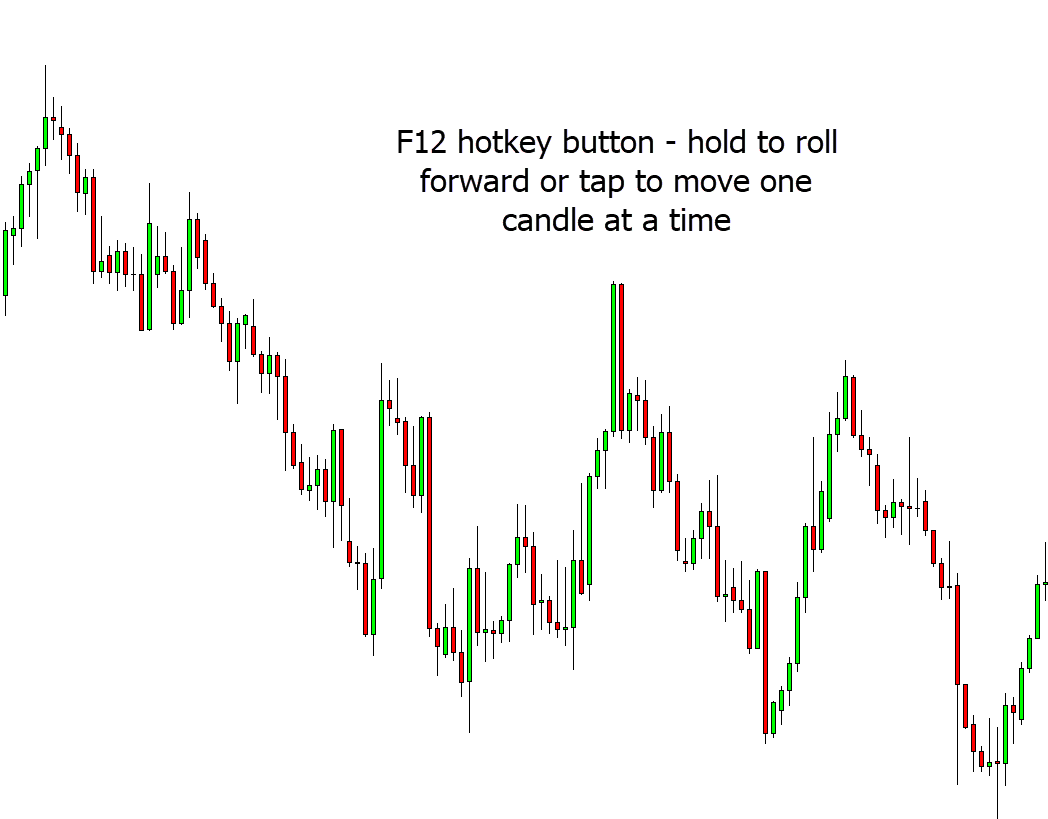

Performing the Backtest: A Step-by-Step Walkthrough of How to Backtest Option Strategies

This section details how to backtest an option strategy using readily available software and historical data. We will illustrate the process using a bull call spread as an example. First, select a backtesting platform. Many platforms offer robust tools for options trading; some examples include Excel (with appropriate add-ins), OptionVue, Thinkorswim, and TradeStation. Each platform’s interface differs, but the core principles remain consistent. The choice depends on user preference and available resources. Learning how to backtest option strategies efficiently requires selecting the right tool for the job. For this example, we will assume the use of a spreadsheet program with a suitable add-in or custom functions for option pricing.

Next, gather historical option and underlying asset price data. This data should encompass the period you intend to backtest. Sources include brokerage platforms and dedicated financial data providers. The data must be accurate and complete to avoid skewed results. Ensure the data format is compatible with your chosen platform, usually CSV or Excel. How to backtest option strategies effectively necessitates accurate, reliable data. Input this data into your chosen platform. For the bull call spread example, enter the prices of the underlying asset and the relevant option contracts (both calls) for each day within your specified backtesting period. Define the spread parameters: the strike prices of the calls, the expiration date, and the number of contracts. The platform then calculates the theoretical price for the spread for each day.

To complete the backtest, incorporate transaction costs. These include commissions, slippage, and any applicable fees. Subtract these costs from the calculated profits or add them to the losses. The platform will then show the daily P&L for your bull call spread strategy. Remember that transaction costs significantly impact profitability. Analyzing this P&L data allows you to evaluate the strategy’s performance throughout the backtesting period. This provides key insights into the strategy’s effectiveness. Finally, analyze the results using key metrics like net profit, win rate, maximum drawdown, Sharpe ratio, and Sortino ratio. These metrics provide a comprehensive assessment of the strategy’s risk-adjusted return and overall performance. This step is crucial in understanding how to backtest option strategies properly and making informed trading decisions. Remember that backtesting provides a historical view. Forward testing with real capital is vital for confirming the results.

Analyzing Backtesting Results: Key Metrics and Interpretations

Understanding how to backtest option strategies effectively involves meticulous analysis of the results. Several key metrics provide valuable insights into a strategy’s performance. Net profit represents the overall gain or loss after all transactions. The win rate indicates the percentage of profitable trades. Maximum drawdown shows the largest peak-to-trough decline during the backtesting period. This metric is crucial for assessing risk. The Sharpe ratio measures risk-adjusted return, comparing excess returns to the standard deviation of returns. A higher Sharpe ratio suggests better risk-adjusted performance. The Sortino ratio is similar to the Sharpe ratio but only considers downside deviation, focusing on negative returns. These metrics, when considered together, paint a holistic picture of strategy performance. Analyzing these figures helps to understand a strategy’s potential profitability and stability.

To effectively interpret backtesting results for how to backtest option strategies, one must compare the performance of different strategies. This comparative analysis helps identify strengths and weaknesses. For example, a strategy with a high win rate but low net profit may indicate small profits on winning trades and substantial losses on losing trades. Conversely, a strategy with a lower win rate but higher net profit suggests larger profits outweigh the losses. Identifying these patterns allows for informed decisions about strategy selection and refinement. Visualizing the data through charts and graphs can significantly enhance the understanding of performance trends and aid in the identification of critical points, such as periods of high volatility or significant drawdowns. This visual representation makes it easier to assess how the strategy performed across different market conditions. Remember to consider the time period covered in the backtest; longer periods usually provide more robust results.

It is vital to acknowledge the limitations inherent in backtesting option strategies. Backtests rely on historical data, which may not accurately reflect future market behavior. Overfitting, where a strategy performs exceptionally well during the backtest but poorly in live trading, is a common issue. Data-snooping bias, where the strategy selection is influenced by the analysis of the data itself, can also skew results. Survivorship bias, which occurs when only successful strategies are considered in the dataset, can lead to overly optimistic estimates. Therefore, interpreting backtesting results requires a cautious approach. Backtests provide valuable insights but should not be the sole basis for trading decisions. Forward testing, where the strategy is used in live trading with small sums, is essential to validate the findings. This helps in determining its practical applicability and robustness in real-market conditions. Careful consideration of these factors is crucial for making informed trading decisions based on your backtesting results. Understanding how to backtest option strategies correctly is critical for success.

Optimizing Your Strategy: Refining Your Approach Based on Results

Backtesting option strategies provides invaluable insights for refining trading approaches. Analyzing the results reveals areas for improvement. For example, a consistently losing trade setup might indicate a need to adjust entry or exit parameters. Perhaps stricter risk management is necessary. Or maybe the underlying assumptions about market behavior driving the strategy are inaccurate, requiring a complete overhaul. How to backtest option strategies effectively involves iterative refinement. One should focus on what the backtest reveals, not just on the overall profitability.

The process of optimization is iterative. It involves repeated cycles of backtesting, analysis, modification, and re-testing. Each backtest informs the next iteration. Data-driven adjustments ensure the strategy becomes more robust and profitable over time. For example, if the backtest shows a high maximum drawdown, a trader might incorporate tighter stop-loss orders to mitigate risk. If the win rate is low but average profits on winning trades are high, one could consider a more selective entry strategy. Remember that how to backtest option strategies is a continuous learning process; consistent optimization is crucial.

Successful optimization often involves experimenting with different variations. This might mean altering the chosen option strategy itself. For instance, instead of a simple bull call spread, a trader might explore a more complex strategy like an iron condor. Alternatively, it might involve adjusting variables such as the time horizon or implied volatility assumptions. How to backtest option strategies successfully often requires experimentation with multiple variations to identify the most effective approach. The goal is to maximize returns while minimizing risk. This iterative process of refining the strategy through repeated backtesting forms the core of successful option trading. Effective optimization leads to improved performance and greater confidence in one’s trading system.

Avoiding Common Backtesting Pitfalls and Biases in How to Backtest Option Strategies

Backtesting option strategies, while invaluable for strategy development, is susceptible to biases that can lead to inaccurate conclusions. One significant concern is survivorship bias. This occurs when backtests only include options that are still actively traded. Options that failed in the past are excluded, creating an overly optimistic view of strategy performance. To mitigate this, access the broadest possible dataset, including those that have expired. Consider using a data provider that maintains a comprehensive historical record of all options contracts, even those that are no longer traded. Accurate backtesting of option strategies requires a complete picture.

Data-snooping bias is another common pitfall. This occurs when testers repeatedly analyze data, searching for patterns that support preconceived notions. Repeatedly adjusting parameters until a profitable strategy appears is a form of data mining. This inflates the apparent success rate. To prevent this, establish clear testing parameters *before* starting the backtest. Adhere strictly to these parameters, avoiding any adjustments based on initial results. How to backtest option strategies effectively demands rigorous discipline in parameter selection and adherence.

Overfitting is a related issue. A strategy might perform exceptionally well on historical data, but fail to generalize to future market conditions. This happens when a strategy is too finely tuned to the specific characteristics of the backtested data. The strategy essentially memorizes the past, failing to adapt to new market dynamics. To counter this, employ robust out-of-sample testing. Test the strategy on a separate dataset not used in the initial backtest. A successful strategy should maintain its performance when applied to unseen data. Understanding how to backtest option strategies requires a balanced approach, recognizing the limits of historical data and the importance of rigorous testing to achieve realistic expectations.