Decoding Options: Understanding the Building Blocks

Options are financial contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). There are two primary types of options: call options and put options. A call option gives the holder the right to buy the asset, while a put option gives the holder the right to sell the asset. Traders employ options for various purposes, including speculation, hedging, and income generation. Understanding the basics of options is crucial before delving into metrics like open interest vs volume options.

A single options contract typically represents 100 shares of the underlying asset. The price of an option, known as the premium, is what the buyer pays to the seller for this right. The value of an option is influenced by several factors, including the underlying asset’s price, the strike price, time to expiration, volatility, and interest rates. Because of their leverage and flexibility, options play a significant role in the financial markets. Examining open interest vs volume options will further clarify their importance.

The relationship between open interest vs volume options provides valuable insights into market sentiment and potential price movements. Options trading strategies are diverse, ranging from simple directional bets to complex combinations designed to profit from specific market conditions. Before implementing any options strategy, it’s essential to have a solid grasp of the underlying principles and the associated risks. A key component of effective options trading includes thoroughly analyzing metrics like open interest vs volume options to gauge market activity and exposure.

What is Open Interest in Options Trading?

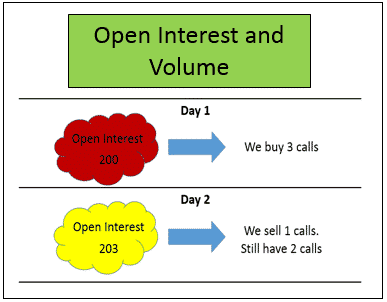

Open interest is a crucial metric in options trading. It precisely indicates the total number of outstanding options contracts. These contracts can be either calls or puts. Open interest only accounts for contracts that have not been exercised, expired, or offset by a closing transaction. Therefore, open interest vs volume options are distinct measures of market activity. Open interest provides a clear view of the market’s exposure to a specific option contract at any given time. It reflects the aggregate position held by all market participants.

Understanding open interest vs volume options is vital for gauging market sentiment. Changes in open interest can signal shifts in traders’ expectations. A high open interest suggests strong interest in a particular option. Conversely, low open interest may indicate less participation. This measure offers insights into the potential liquidity and depth of the options market. The concept of open interest is fundamental when analyzing options market dynamics. New contracts increase open interest. Closing positions reduce it. Therefore, it’s a dynamic figure that reflects evolving market conditions.

Open interest vs volume options both serve unique purposes. Volume tracks the number of contracts traded in a day. Open interest shows the contracts held at the end of the day. Active traders closely monitor open interest. This allows them to asses the potential impact of future price movements. A significant increase in open interest, especially alongside a price move, can confirm a developing trend. Open interest vs volume options should be used in combination. This combined usage contributes to more informed trading decisions. Keep in mind, open interest does not indicate whether positions are net long or short. It simply reflects the total number of outstanding contracts.

Volume Demystified: Gauging Transaction Activity

Options volume represents the total number of options contracts that have been bought and sold during a specific period. This period is usually a single trading day. Understanding volume is crucial when analyzing options, as it reflects the level of trading activity. High volume indicates strong interest in a particular option, while low volume may suggest a lack of interest. Volume is a key component when understanding open interest vs volume options, as it provides different insights.

Unlike open interest, which measures outstanding contracts, volume focuses solely on the number of transactions. Each buy and sell order contributes to the total volume. Therefore, a single options contract can be counted multiple times in the volume if it changes hands several times during the day. This distinction is vital when comparing open interest vs volume options. Analyzing volume spikes can reveal important information about market sentiment and potential price movements. Significant volume often accompanies price breakouts or reversals.

Traders use volume to confirm trends or identify potential turning points. For example, a sharp increase in volume alongside a price increase might validate the strength of an upward trend. Conversely, high volume during a price decline could indicate a potential bottom. However, it’s important to note that high volume doesn’t always guarantee a specific outcome. It simply suggests increased participation and conviction among traders. When considering open interest vs volume options, remember that volume reflects current trading activity, while open interest represents the cumulative outstanding positions. Together, these metrics offer a more complete picture of the options market.

Open Interest Vs Volume: Key Differences and How They Work Together

The concepts of open interest and volume are distinct yet interconnected metrics in options trading. Understanding the nuances of each, and how they relate, is crucial for informed decision-making. Volume reflects the total number of options contracts traded during a specific period, typically a trading day. It represents the intensity of buying and selling activity. Open interest, on the other hand, represents the total number of outstanding options contracts that have not been exercised, expired, or offset. It indicates the market’s exposure to a particular option. The main keyword, “open interest vs volume options,” is a vital consideration when analyzing market data.

The core difference between open interest and volume options lies in what they measure. Volume measures *transactions*, the number of times contracts change hands. Open interest measures *outstanding contracts*, the number of contracts held by investors. A helpful analogy is to think of volume as the number of cars passing a specific point on a highway, while open interest represents the total number of cars currently on that highway. Each trade either increases, decreases, or leaves open interest unchanged. When a buyer and seller create a new position, open interest increases. When a buyer and seller close existing positions, open interest decreases. If a buyer opens a new position by purchasing from a seller closing their position, open interest remains the same. Considering “open interest vs volume options” provides a deeper understanding of market dynamics.

To further clarify the relationship between “open interest vs volume options,” imagine the following scenarios. High volume with stable open interest suggests significant trading activity without a net increase in open positions. This could indicate a battle between bulls and bears, with many traders entering and exiting positions. High volume combined with increasing open interest implies new positions are being established, potentially signaling the start of a trend. Low volume with declining open interest might mean traders are liquidating positions, perhaps anticipating a shift in market direction. By carefully considering the interplay between open interest and volume, traders can gain valuable insights into market sentiment and potential price movements. Analyzing both metrics in tandem, especially focusing on “open interest vs volume options,” can lead to more robust trading strategies.

How to Interpret Open Interest Changes: Signals and Insights

Understanding changes in open interest offers valuable insights into market sentiment. Open interest represents the number of outstanding options contracts. Analyzing its fluctuations, in conjunction with price movement, can reveal potential shifts in trader positioning and conviction. This is a critical component when evaluating open interest vs volume options.

An increase in open interest suggests new positions are being opened. If the price of the underlying asset is also rising, it may indicate a bullish sentiment is gaining traction. Traders are likely opening new long positions (buying calls) or shorting puts, anticipating further price increases. Conversely, increasing open interest coupled with decreasing prices may signal a bearish outlook. Traders might be opening new short positions (buying puts) or shorting calls, expecting prices to decline. A careful study of open interest vs volume options will give a better insight of the market. However, it’s crucial to avoid hasty conclusions. Market dynamics are complex, and these interpretations are not always definitive.

Decreasing open interest implies that traders are closing existing positions. If open interest declines while the price increases, it could suggest that short positions are being covered or long positions are taking profits. This might signal a weakening of the previous bearish trend. Conversely, a decrease in open interest alongside falling prices could indicate that long positions are being liquidated or short positions are taking profits, potentially weakening a bullish trend. When looking at open interest vs volume options, consider volume to see how fast the open interest is changing. Always remember to consider other technical indicators and conduct thorough due diligence before making any trading decisions. Remember that options trading involves risk, and no single metric guarantees success. The relationship between open interest and volume options should be viewed holistically within a broader analysis.

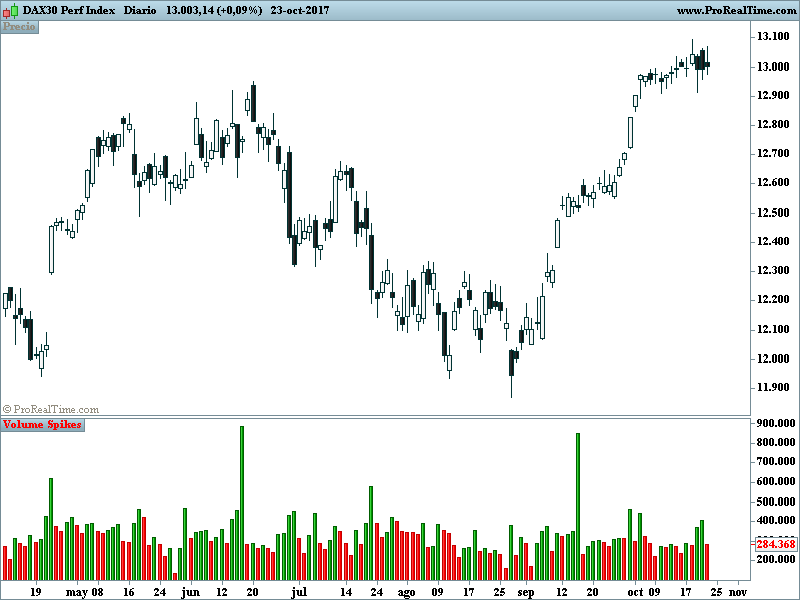

Analyzing Volume Spikes: Identifying Potential Turning Points

Options volume represents the total number of options contracts bought and sold during a specific period. Understanding volume spikes is crucial when analyzing open interest vs volume options, as it can provide insights into potential turning points in the market. High volume often indicates increased interest or conviction in a particular option’s direction. It signifies that a large number of traders are actively participating in the market for that specific option contract. Analyzing volume in conjunction with open interest vs volume options can give a trader an edge.

Unusually high volume can signal potential price breakouts or reversals. For example, if an option experiences a significant increase in volume while the underlying asset’s price is also rising, it might suggest a strong bullish sentiment and a potential breakout above a resistance level. Conversely, high volume during a price decline could indicate strong bearish sentiment and a potential breakdown below a support level. However, it’s important to exercise caution and avoid making definitive conclusions based solely on volume spikes. The interpretation of volume should always be considered in conjunction with other technical indicators and market context when looking at open interest vs volume options.

Several factors can contribute to volume spikes in options trading. News events, earnings announcements, or significant market fluctuations can all trigger increased trading activity. Furthermore, large institutional investors entering or exiting positions can also lead to substantial volume increases. Therefore, it’s essential to investigate the potential causes behind a volume spike to gain a better understanding of its implications. While high volume can be a valuable indicator, it is not always predictive. False signals can occur, and it’s crucial to confirm the signal with other indicators and analysis techniques when analyzing open interest vs volume options. Combining volume analysis with open interest data can provide a more comprehensive view of market sentiment and potential price movements.

Leveraging Both Metrics: A Combined Approach to Options Trading

Traders can significantly enhance their decision-making process by using open interest and volume in tandem. Examining these metrics together provides a more holistic view of market sentiment and potential price movements. The interplay between open interest vs volume options can confirm or deny signals generated by either metric alone, leading to more robust trading strategies.

For instance, consider a scenario where a stock’s price is rising alongside a simultaneous increase in both open interest and volume. The increasing open interest suggests that new positions are being opened, indicating a growing conviction among traders that the upward trend will continue. The high volume reinforces this signal, confirming strong market participation in the price movement. Conversely, if the price rises on high volume but open interest remains stagnant or declines, it could suggest that existing positions are being closed, potentially signaling a weakening of the uptrend. In another example, if there is high volume but open interest remains relatively unchanged, it could signify a battle between buyers and sellers, leading to potential volatility. Analyzing open interest vs volume options together allows traders to assess the strength and sustainability of price trends.

In practice, traders can incorporate open interest and volume analysis into their existing trading strategies. For example, a trader might identify a potential breakout using technical analysis. They can then use open interest and volume to confirm or invalidate this signal. High volume accompanying the breakout, coupled with increasing open interest, would provide stronger confirmation than high volume alone. Conversely, a breakout on low volume and decreasing open interest might be viewed with skepticism, suggesting a higher probability of failure. By carefully observing the relationship between open interest vs volume options, traders can filter out false signals, improve the timing of their entries and exits, and ultimately increase the effectiveness of their trading strategies. Open interest vs volume options are essential tools for informed options trading.

Practical Application: Using Open Interest and Volume on Trading Platforms

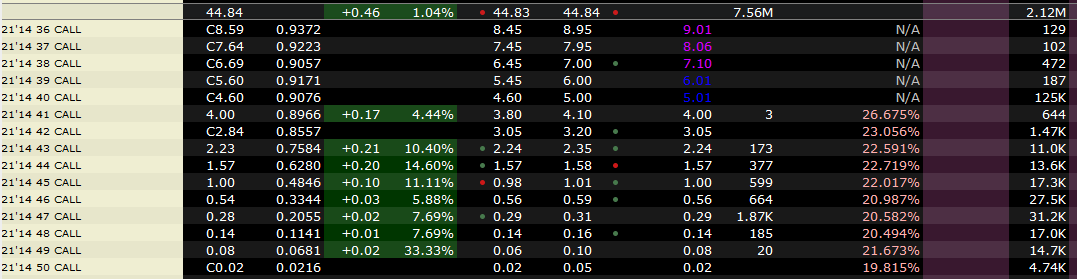

Many popular trading platforms provide easy access to open interest and volume data, empowering traders to analyze options effectively. Platforms such as thinkorswim and Interactive Brokers display these metrics prominently within their options chains. Understanding how to locate and interpret this information is crucial for informed decision-making when analyzing the open interest vs volume options.

On thinkorswim, for example, traders can find open interest and volume figures directly in the options chain display. These values are typically listed alongside other key data points like the strike price, bid/ask prices, and expiration date. To filter and sort the options chain, traders can use the platform’s built-in tools to identify contracts with unusually high volume or significant open interest. This involves setting filters based on volume thresholds or sorting the chain by open interest to quickly identify the most active contracts. Interactive Brokers offers similar functionalities, presenting open interest and volume data in its Option Trader tool. Traders can customize the display to show the metrics that are most relevant to their strategy when studying the open interest vs volume options.

These platforms often provide charting tools that allow traders to visualize the historical trends of open interest and volume alongside price movements. By observing these relationships, traders can gain valuable insights into market sentiment and potential trading opportunities. For instance, a sudden spike in volume accompanied by a corresponding increase in open interest might indicate a strong conviction among traders regarding the direction of the underlying asset. Conversely, high volume with declining open interest could suggest that existing positions are being closed, potentially signaling a change in the prevailing trend. Actively exploring and utilizing these platform features enables a more nuanced understanding of open interest vs volume options dynamics, enhancing trading strategies and risk management.