Navigating the Universe of Publicly Held Corporations

The world of finance includes a vast list of every publicly traded company. To be “public” means a company has offered shares of its ownership to the general public. These shares are bought and sold on stock exchanges. This allows anyone to invest in the company. Understanding this landscape is key to navigating financial markets.

The journey to becoming a public company often starts with an Initial Public Offering (IPO). An IPO is when a private company offers shares to the public for the first time. Companies choose to go public for many reasons. These include raising capital for expansion, paying off debt, or providing liquidity to early investors. The IPO process is complex. It involves investment banks, regulatory filings, and marketing the company to potential investors. A successful IPO can significantly boost a company’s profile and financial resources.

Stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ serve as marketplaces. Here, investors can buy and sell shares of publicly traded companies. The value of a company is often reflected in its market capitalization. Market capitalization, or market cap, represents the total value of a company’s outstanding shares. It is calculated by multiplying the stock price by the number of outstanding shares. Market capitalization is a key metric for understanding the size and scope of a list of every publicly traded company. It helps investors compare companies and assess their potential investment risk and reward. The list of every publicly traded company is extensive and diverse, encompassing businesses of all sizes and industries across the globe.

How to Find Comprehensive Corporate Stock Listings

Finding a comprehensive list of every publicly traded company requires navigating various resources, each with its own strengths and weaknesses. One primary source is the Securities and Exchange Commission (SEC) EDGAR database. This database contains filings from all publicly traded companies in the United States, offering a wealth of information. However, the sheer volume of data in EDGAR means that users must filter and sort information to extract a usable list of every publicly traded company. Despite this challenge, EDGAR provides the most complete and official record.

Stock exchange websites, such as those of the New York Stock Exchange (NYSE) and the NASDAQ, also offer lists of companies traded on their respective exchanges. These lists are typically well-organized and easily accessible, providing essential information like ticker symbols and company names. However, it’s important to remember that these lists only include companies listed on that specific exchange. To compile a complete list of every publicly traded company, one would need to consult multiple exchange websites. These websites are valuable resources and a good starting point for investors and researchers seeking information. Using the stock exchange websites may require cross referencing to ensure accuracy to generate your list of every publicly traded company.

Financial data providers like Bloomberg and Refinitiv offer curated lists of publicly traded companies, often with advanced filtering and analysis tools. These services provide comprehensive data, including financial statements, analyst ratings, and news feeds. The lists are typically well-maintained and accurate but usually require a subscription. While the cost may be a barrier for some, the ease of use and the depth of information can be invaluable for serious investors and financial professionals. These platforms allow users to narrow down companies, generating a more focused list of every publicly traded company based on specific criteria. These tools are essential for those needing a detailed and regularly updated source, offering a significant advantage when looking for a list of every publicly traded company.

Exploring Different Categories of Publicly Traded Businesses

Understanding the diverse landscape of the stock market requires recognizing that publicly traded companies are not a monolithic entity. These businesses are categorized into various industry sectors, allowing investors and analysts to compare companies within similar fields. One of the most widely used classification systems is the Global Industry Classification Standard (GICS). GICS, developed by MSCI and Standard & Poor’s, provides a standardized framework for categorizing companies into sectors, industry groups, industries, and sub-industries. This hierarchical structure offers a granular view, enabling a deeper understanding of the business environment. Determining the list of every publicly traded company by sector helps investors construct diversified portfolios and conduct targeted research.

The GICS system features 11 sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Information Technology, Communication Services, Utilities, and Real Estate. Each sector encompasses various industry groups, industries, and sub-industries. For instance, the Information Technology sector includes industry groups like software and services, and hardware, storage, and peripherals. Within these industry groups are specific industries such as application software or technology hardware, storage & peripherals. Examples of prominent companies within these sectors include Apple (Technology), Johnson & Johnson (Healthcare), JPMorgan Chase (Financials), and Procter & Gamble (Consumer Staples). Each of these fits into the list of every publicly traded company.

Categorization by industry sector provides valuable insights into the performance drivers and risk factors that affect different businesses. For example, companies in the Energy sector are often influenced by commodity prices and geopolitical events, while those in the Healthcare sector may be affected by regulatory changes and patent expirations. Analyzing companies within specific sectors helps investors assess their relative strengths and weaknesses. Investors trying to compile a list of every publicly traded company may find this sector-based approach helpful for organization and analysis. Understanding these classifications is essential for anyone navigating the universe of publicly traded companies and building a well-informed investment strategy. For those seeking to refine their knowledge, focusing on specific sectors is a strategic path to grasping the nuances of the list of every publicly traded company.

Deciphering Stock Symbols and Company Identifiers

Every publicly traded company is assigned a unique identifier, crucial for tracking its performance and distinguishing it from others. The most recognizable of these is the stock ticker symbol. This short code, often a combination of letters, represents the company on stock exchanges. For example, AAPL signifies Apple Inc. Finding a complete list of every publicly traded company requires understanding how to utilize these symbols.

Beyond ticker symbols, other identifiers like CUSIP numbers (Committee on Uniform Securities Identification Procedures) and ISINs (International Securities Identification Numbers) provide further layers of identification. CUSIPs are primarily used in North America, while ISINs offer a globally recognized standard. These identifiers are particularly helpful when dealing with a large list of every publicly traded company, ensuring accuracy and preventing confusion, especially when companies have similar names or operate in the same sector. To locate a company’s ticker symbol, a reliable method is to visit the investor relations section of the company’s official website. This section typically provides key information for shareholders, including the ticker symbol, CUSIP, and ISIN.

Online financial databases, such as Yahoo Finance, Google Finance, and Bloomberg, are also valuable resources for finding ticker symbols and other company identifiers. These platforms usually have a search function that allows you to look up a company by name and quickly retrieve its corresponding ticker symbol, CUSIP, and ISIN. A comprehensive list of every publicly traded company can be compiled by cross-referencing information from these different sources. Remember that some companies may have different ticker symbols on different exchanges, especially if they are cross-listed. Therefore, confirming the exchange associated with the ticker symbol is also important when building or referencing a list of every publicly traded company. By understanding and effectively using these identifiers, investors and researchers can accurately track and analyze publicly traded companies.

Analyzing Market Capitalization: Understanding Company Size

Market capitalization, often shortened to market cap, is a crucial metric for understanding the size and value of a publicly traded company. It’s calculated by multiplying a company’s stock price by its total number of outstanding shares. This calculation provides a snapshot of the total dollar value the market places on the company. Understanding market capitalization is vital for investors, as it offers insights into a company’s potential for growth and its associated investment risk. The “list of every publicly traded company” can be further refined by sorting entities based on their market cap, offering valuable insights.

Market capitalization is typically categorized into several tiers. Large-cap companies generally have a market cap of $10 billion or more. These are often well-established companies with stable earnings and consistent dividend payouts. Mid-cap companies typically range from $2 billion to $10 billion in market cap. They may offer more growth potential than large-cap companies, but they also carry slightly higher risk. Small-cap companies usually have a market cap between $300 million and $2 billion. They represent even greater growth opportunities but also come with increased volatility and risk. Micro-cap companies have a market cap below $300 million. These are often speculative investments with the potential for high returns or significant losses. Nano-cap companies, with even smaller market caps, are also sometimes included in the “list of every publicly traded company,” although they represent the riskiest investment category. The “list of every publicly traded company” demonstrates a wide range of market capitalizations.

The relationship between market cap and investment risk is significant. Generally, larger market caps are associated with lower risk, while smaller market caps are associated with higher risk. Large-cap companies are typically more stable and less prone to dramatic price swings, while small-cap and micro-cap companies can be more volatile. However, higher risk can also translate to higher potential returns. Investors should carefully consider their risk tolerance and investment goals when selecting companies based on market capitalization. Examining a “list of every publicly traded company” categorized by market cap allows investors to diversify their portfolios across different risk levels and potentially optimize their returns. Investors may seek the “list of every publicly traded company” to evaluate companies of different sizes.

Utilizing Financial News and Data Platforms to Track Stocks

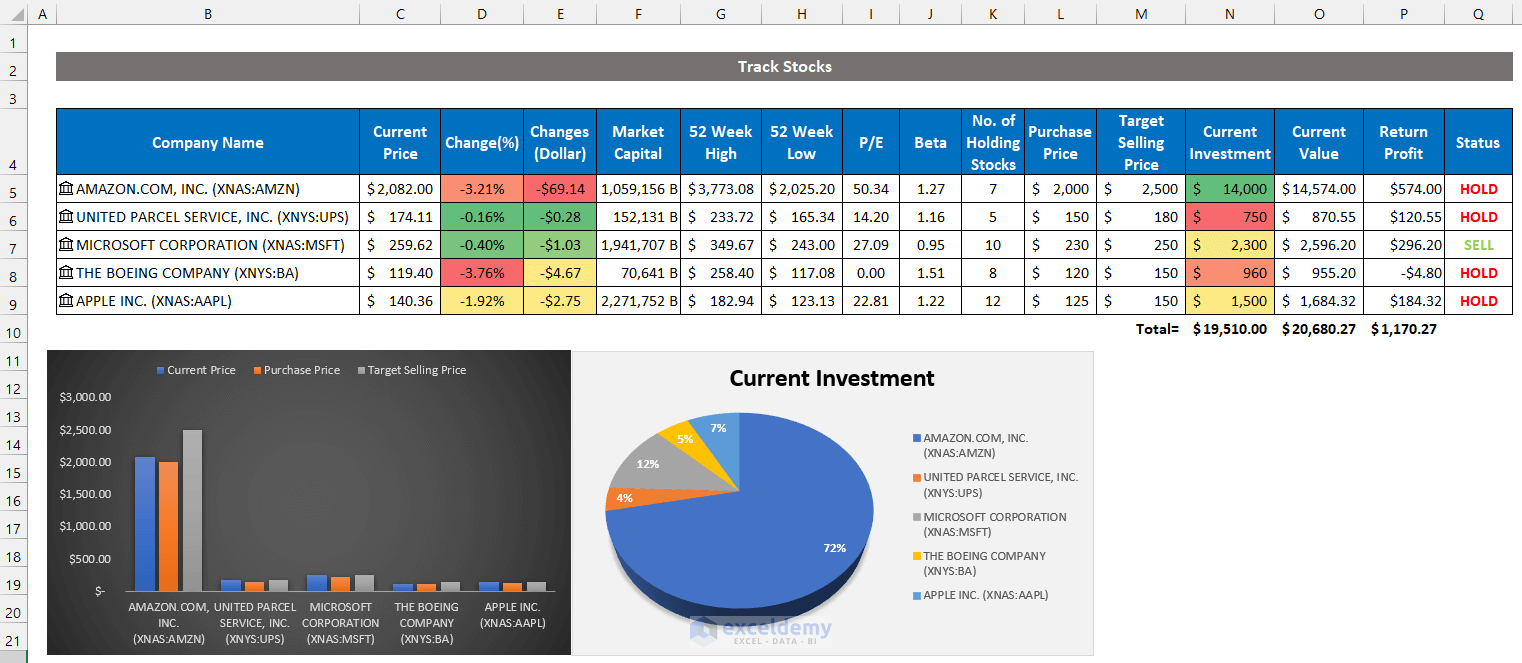

Numerous financial news and data platforms offer valuable tools for tracking the performance of publicly traded companies. Platforms like Yahoo Finance, Google Finance, and MarketWatch are popular resources. They provide real-time stock quotes, historical data, financial statements, and news releases. These platforms are essential for anyone seeking to monitor the list of every publicly traded company and understand market trends.

These platforms allow users to track specific companies and indices. Users can create customized watchlists to monitor the performance of their chosen stocks. Accessing financial statements, such as balance sheets, income statements, and cash flow statements, is straightforward. These statements offer insights into a company’s financial health and performance. Monitoring news releases ensures users stay informed about significant events that could affect stock prices. Learning how to filter and customize data within these platforms is crucial for efficient analysis. Users interested in tracking the list of every publicly traded company can leverage these tools to gain a competitive edge.

Effectively using these platforms involves mastering their filtering and customization options. Users can set up alerts to receive notifications about price movements or news events. They can also compare the performance of different companies within the same industry. Examining analyst ratings and price targets can provide additional perspectives. These platforms often include tools for charting stock prices and identifying trends. Investors can use these charts to make informed decisions about buying or selling stocks. These platforms are invaluable resources for anyone seeking to navigate the complexities of the stock market and manage their investments related to the list of every publicly traded company.

The Role of Regulatory Agencies in Overseeing Public Companies

Regulatory agencies play a crucial role in maintaining the integrity and fairness of the stock market. These agencies, most notably the Securities and Exchange Commission (SEC) in the United States, act as watchdogs over publicly traded companies. Their primary objective is to protect investors from fraud and ensure a level playing field for all market participants. The SEC’s mandate encompasses several key areas, all contributing to a stable and transparent financial environment for the list of every publicly traded company.>

One of the SEC’s core functions is to enforce regulations related to financial reporting. Publicly traded companies are required to file regular reports, such as quarterly (10-Q) and annual (10-K) filings, that provide detailed information about their financial performance and condition. The SEC ensures that these reports are accurate, complete, and presented in accordance with established accounting standards. This transparency allows investors to make informed decisions about buying, selling, or holding stock in a particular company. The SEC also oversees the IPO process, ensuring that companies seeking to go public provide accurate and comprehensive prospectuses to potential investors. These regulations surrounding financial disclosures are vital for maintaining investor confidence in the list of every publicly traded company.

Furthermore, the SEC actively investigates and prosecutes cases of insider trading. Insider trading occurs when individuals with non-public information about a company use that information to gain an unfair advantage in the stock market. Such activities undermine the fairness and integrity of the market and can erode investor trust. The SEC’s enforcement actions against insider trading send a clear message that such behavior will not be tolerated. In addition to financial reporting and insider trading, the SEC also regulates other aspects of the securities industry, including broker-dealers, investment advisors, and stock exchanges. The SEC strives to maintain fair and efficient markets, facilitate capital formation, and protect investors. Therefore, understanding the role of the SEC and other regulatory agencies is essential for anyone navigating the complex world of the list of every publicly traded company.

Understanding the Dynamic Nature of Public Company Listings

The landscape of publicly traded companies is in constant flux. The list of every publicly traded company is not a static entity. New companies enter the market through Initial Public Offerings (IPOs), while others disappear due to mergers, acquisitions, bankruptcies, or decisions to go private (delisting). Understanding this dynamism is crucial for anyone working with or investing in publicly traded stocks. This constant change means that relying on outdated information can lead to inaccurate assessments and potentially poor decisions. Keeping abreast of these changes requires continuous monitoring and verification of data from reliable sources.

Several factors contribute to the evolving list of every publicly traded company. IPOs introduce new players, expanding the market and offering investors fresh opportunities. Mergers and acquisitions consolidate existing companies, reshaping industry landscapes and altering market capitalization. Bankruptcies, while unfortunate, remove companies from the public market. Delistings occur when a company no longer meets the exchange’s listing requirements or chooses to return to private ownership. Each of these events impacts the composition of the list of every publicly traded company, demanding vigilance from investors and analysts alike. The inherent volatility underscores the importance of using real-time or near real-time data feeds.

To navigate this ever-changing environment effectively, individuals should prioritize reliable sources and verification methods. Regularly update your information from reputable financial data providers, SEC filings, and stock exchange websites. Cross-reference data from multiple sources to ensure accuracy and completeness. Be wary of outdated information, as it may not reflect the current status of a company or its stock. By acknowledging the dynamic nature of the market and employing diligent research practices, you can maintain a current and accurate view of the list of every publicly traded company, mitigating risks and maximizing opportunities. Remember that thorough and updated information is paramount when dealing with the list of every publicly traded company.>

https://www.youtube.com/watch?v=T37YvxMTofc