Gauging Option Price Movements: What is Delta?

Delta, a cornerstone of options trading, provides a crucial measure of an option’s price sensitivity to changes in the underlying asset’s price. Understanding the definition of delta in finance is essential for effective risk management. A higher delta signifies a greater price change in the option for each point movement in the underlying asset. Essentially, delta quantifies the option’s responsiveness to price fluctuations, offering valuable insight into potential gains or losses. The definition of delta in finance highlights its role as a predictive tool, enabling traders to gauge the probable impact of price shifts on their option positions. This is paramount in formulating informed trading decisions and managing inherent risks.

Options traders use delta to estimate the potential profit or loss resulting from price changes. A delta of 0.5, for example, suggests a $50 change in the option’s price for every $100 movement in the underlying asset’s price. This sensitivity is dynamic, changing constantly based on factors such as time to expiration, implied volatility, and the distance between the option’s strike price and the underlying asset’s current market price. Understanding the definition of delta in finance allows for informed strategies that capitalize on anticipated price movements and effectively mitigate potential risks. Traders constantly monitor delta to adjust their positions, optimizing their strategies in response to market changes and minimizing potential losses.

The practical application of delta extends beyond simple price prediction. It forms the basis of sophisticated hedging techniques. By carefully analyzing delta, traders can construct portfolios that minimize their exposure to unwanted price fluctuations. The definition of delta in finance underscores its integral role in mitigating risk and building robust, resilient trading strategies. Mastering the concept of delta is therefore crucial for navigating the complexities of options trading and achieving consistent success. The significance of this key metric cannot be overstated in achieving profitability and minimizing risk in this dynamic market.

How to Calculate Delta: A Practical Guide

Delta, a key component in the definition of delta in finance, quantifies an option’s price sensitivity to changes in the underlying asset’s price. It’s expressed as a number between -1 and +1. A delta of 0.5 means a $1 increase in the underlying asset’s price should theoretically increase the option’s price by $0.50. Conversely, a delta of -0.5 suggests a $1 increase would decrease the option’s price by $0.50. The calculation isn’t simple for complex options but for simpler options, it involves sophisticated mathematical models and often relies on computer-based calculations. The precise formula depends on the option type (call or put) and factors like the underlying asset price, strike price, time to expiration, and volatility. However, the core principle remains consistent: delta measures the rate of change of the option price relative to the underlying asset price.

Understanding the definition of delta in finance requires grasping its relationship with probability. A delta of 0.7 for a call option, for example, suggests a roughly 70% probability of the option expiring in-the-money. This probability is not a precise prediction but a statistical measure based on the option’s pricing model. Therefore, a delta close to 1 indicates a high probability of the option expiring in-the-money (for call options), while a delta near 0 implies a low probability. Similarly, for put options, a delta close to -1 implies a high probability of expiring in-the-money. This probabilistic interpretation of delta adds another layer to its importance in risk management. The definition of delta in finance highlights its role as a crucial tool in options trading.

A simplified example illustrates the concept. Imagine a call option with a delta of 0.6. If the underlying asset’s price increases by $1, the option’s price is expected to increase by approximately $0.60. This is a simplified illustration and actual price movements can vary due to other factors influencing option prices. Remember, delta is a dynamic measure; it changes constantly as time passes, the underlying asset’s price fluctuates, and volatility changes. Therefore, regularly monitoring an option’s delta is crucial for effective risk management. A deep understanding of the definition of delta in finance empowers traders to make informed decisions and manage their risk exposure effectively. This sensitivity measure remains a core concept in options trading.

Delta Values Explained: Interpreting the Range

Delta values provide vital insights into an option’s price sensitivity. Understanding the range of these values is crucial for effective options trading. For call options, delta typically ranges from 0 to 1. For put options, the range is from -1 to 0. The definition of delta in finance is the measure of how much an option price is expected to move for every $1 change in the price of the underlying asset.

A delta close to 0 indicates that the option’s price will not be significantly affected by small changes in the underlying asset’s price. These options are less likely to expire in the money. A delta of 0.5 suggests the option price will move about 50 cents for every $1 move in the underlying asset. This is often seen in at-the-money options, where there is roughly a 50% probability of expiring in the money. A delta close to 1 (for calls) or -1 (for puts) means the option’s price will move almost dollar-for-dollar with the underlying asset. These options are highly likely to expire in the money and behave similarly to the underlying asset itself. The definition of delta in finance is also influenced by factors like time to expiration and volatility.

Interpreting delta values also involves considering the probability of an option expiring in the money. A higher delta (closer to 1 or -1) suggests a greater probability. Conversely, a delta near 0 indicates a lower probability. These probabilities are not absolute certainties, but rather estimations. They help traders assess the potential risk and reward of an option position. The definition of delta in finance allows traders to better manage and mitigate risk. By understanding the meaning behind different delta values, traders can make more informed decisions. These decisions are regarding buying, selling, or hedging options positions. Delta is a dynamic measure, as it shifts with changes in the underlying asset’s price, time decay, and volatility. Keeping abreast with these changing values is essential for successful options trading. The sensitivity to the definition of delta in finance is related to these factors.

Delta Hedging: Mitigating Price Risk in Options Positions

Delta hedging is a risk management strategy used in options trading to create a portfolio that is neutral to small movements in the price of the underlying asset. The core principle involves offsetting the delta of an options position with an equal and opposite delta in the underlying asset. This strategy aims to protect the portfolio from short-term price fluctuations, effectively neutralizing the directional risk. The definition of delta in finance becomes critically important when employing delta hedging techniques.

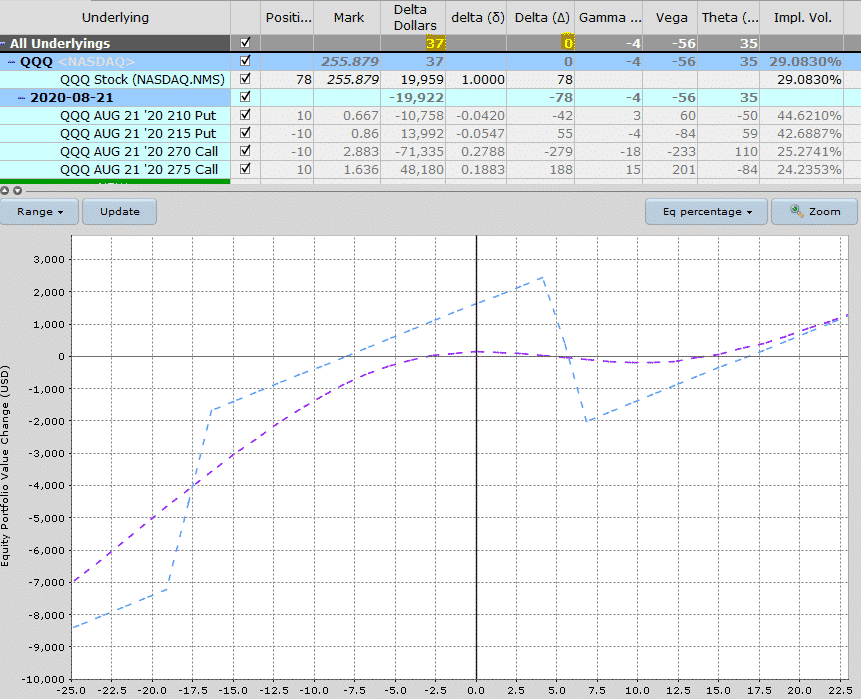

The process of delta hedging involves calculating the overall delta of a portfolio, which includes options and the underlying asset. If the portfolio has a positive delta, it means the portfolio’s value will increase if the underlying asset’s price increases, and vice versa. To neutralize this risk, a trader would sell shares of the underlying asset to create a negative delta that offsets the positive delta of the options. Conversely, if the portfolio has a negative delta, the trader would buy shares of the underlying asset to create a positive delta that offsets the negative delta of the options. The goal is to maintain a net delta close to zero, thus minimizing the portfolio’s sensitivity to small price changes in the underlying asset. This meticulous balancing act showcases a practical application of the definition of delta in finance.

For example, consider a trader who owns 10 call options contracts on a stock. Each contract represents 100 shares, so the trader effectively controls 1000 shares. If the call options have a combined delta of 0.60, it means the portfolio’s value is expected to increase by $0.60 for every $1 increase in the stock price, per share. To delta hedge, the trader would need to sell 600 shares (0.60 x 1000) of the underlying stock. This sale creates a negative delta that offsets the positive delta of the options, resulting in a delta-neutral portfolio. However, it’s important to remember that delta is not constant. As the stock price moves, the delta of the options will change, requiring the trader to rebalance the hedge by buying or selling more shares to maintain a delta-neutral position. This continuous adjustment highlights the dynamic nature of risk management and the ongoing relevance of the definition of delta in finance. The effectiveness of delta hedging relies heavily on accurate delta calculations and frequent adjustments to maintain the desired level of risk neutrality.

Delta vs. Other Greeks: Understanding the Relationships

Delta is a crucial measure, but it’s not the only factor in options trading. Several other “Greeks” provide a more complete picture of an option’s risk profile. Understanding these relationships is essential for effective risk management. The definition of delta in finance centers on price sensitivity, but other Greeks consider different aspects of risk.

Gamma measures the rate of change of delta. It indicates how much the delta of an option is expected to change for every $1 move in the underlying asset. A high gamma means the delta is very sensitive to price changes. Vega measures the sensitivity of an option’s price to changes in implied volatility. Options with high vega will experience larger price swings when volatility increases or decreases. Theta measures the rate of time decay. It indicates how much an option’s value will decrease each day as it approaches its expiration date. Rho measures the sensitivity of an option’s price to changes in interest rates. Rho is generally less significant than the other Greeks, especially for short-term options. The definition of delta in finance serves as a foundation for understanding these more complex measures.

Delta provides a snapshot of an option’s price sensitivity at a specific point in time. However, it’s important to remember that delta is not static. It changes as the underlying asset’s price moves, time passes, and volatility fluctuates. The other Greeks help traders anticipate and manage these changes. For instance, a trader using delta hedging might also monitor gamma to adjust their hedge as the underlying asset’s price moves. Similarly, a trader might consider vega when trading options on assets with high volatility, the definition of delta in finance helps traders to predict the approximate price changes. By understanding the relationships between delta and the other Greeks, traders can make more informed decisions and manage their risk more effectively. Ignoring these relationships can lead to unexpected losses.

Delta’s Limitations: When Does It Break Down?

The definition of delta in finance is a dynamic measure; it is not a static, foolproof indicator. Its accuracy diminishes under certain market conditions. A key limitation lies in its assumption of a linear relationship between the option price and the underlying asset price. This assumption holds reasonably well for small price movements and short timeframes, but it becomes less reliable as the price change becomes more significant.

One crucial factor impacting the reliability of the definition of delta in finance is the concept of Gamma. Gamma represents the rate of change of delta with respect to changes in the underlying asset’s price. A high Gamma indicates that the delta value is highly sensitive and can change rapidly. This means that a delta hedge, designed to neutralize risk, may quickly become ineffective, requiring frequent adjustments to maintain a neutral position. Furthermore, extreme market volatility can cause significant and rapid shifts in delta values, making hedging strategies more challenging to implement effectively. The definition of delta in finance is most accurate within a narrow range around the current asset price.

Time decay (Theta) and changes in implied volatility (Vega) also affect delta. As an option approaches its expiration date, its delta can become increasingly sensitive to price movements, especially for options that are near the money. Similarly, significant changes in implied volatility can shift the delta, even if the underlying asset price remains constant. Therefore, traders should be aware of these factors and continuously monitor their positions. The definition of delta in finance, while a valuable tool, should be used in conjunction with other risk measures and a thorough understanding of market dynamics. While the definition of delta in finance offers a valuable snapshot of price sensitivity, traders must remember that it is only a piece of the puzzle.

Delta in Different Option Strategies: Practical Applications

Delta plays a crucial role in understanding and managing risk within various option trading strategies. One common strategy is the covered call. In a covered call, an investor owns shares of a stock and sells a call option on those shares. The delta of the short call option will be negative. This is because the call option’s value moves inversely to the investor’s stock position. Understanding the definition of delta in finance helps the investor gauge the extent to which the option will offset gains or losses in the stock holding. The overall delta of the position reflects the combined sensitivity to price changes.

Another strategy is the protective put, where an investor buys a put option to protect against declines in a stock they own. The put option has a negative delta. This negative delta acts as insurance, offsetting potential losses in the stock. The definition of delta in finance is key to setting up this strategy. Traders use delta to determine how much of the stock position is hedged by the put. For example, a put option with a delta of -0.5 will offset approximately 50% of any downward movement in the underlying stock. This allows investors to customize their level of protection based on their risk tolerance.

Straddles and strangles are strategies that involve buying or selling both call and put options with the same (straddle) or different (strangle) strike prices and expiration dates. In a long straddle or strangle (buying both a call and a put), the trader profits if the underlying asset makes a significant move in either direction. The combined delta of the call and put options determines the overall sensitivity of the position to small price changes. Understanding the definition of delta in finance helps the trader manage this combined sensitivity. As the underlying asset price moves, the deltas of the individual options will change, impacting the overall position delta. Experienced traders continuously monitor and adjust their positions based on these delta shifts. Ultimately, grasping the definition of delta in finance is essential for successfully implementing and managing a wide range of options trading strategies, allowing traders to make informed decisions and effectively control risk.

Real-World Delta Example: Analyzing a Stock Option

Consider a call option on Apple (AAPL) stock. Assume AAPL is trading at $175, and there’s a call option with a strike price of $180 expiring in one month. The definition of delta in finance is crucial here. Let’s say this call option has a delta of 0.40. This means that for every $1 increase in AAPL’s stock price, the option price is expected to increase by $0.40. Conversely, if AAPL’s stock price decreases by $1, the option price should decrease by approximately $0.40. The definition of delta in finance provides a valuable metric for gauging potential profit or loss.

This 0.40 delta also suggests there’s roughly a 40% probability that the option will expire in the money. It’s important to remember that this is just an estimate. If AAPL’s price jumps to $176, the option price might increase from, say, $2.00 to $2.40. However, this is a simplified view. Other factors, such as changes in implied volatility and time decay, also influence the option’s price. This example highlights the practical application of the definition of delta in finance. It allows traders to quickly assess the potential impact of stock price movements on their option positions. A higher delta indicates a greater sensitivity to price changes in the underlying asset.

The definition of delta in finance isn’t static. As AAPL’s stock price fluctuates, the delta of the option will also change. If AAPL’s price rises significantly, moving closer to or above the $180 strike price, the delta will increase, potentially approaching 1. This indicates the option is becoming increasingly sensitive to further price increases. Conversely, if AAPL’s price falls considerably, the delta will decrease, moving closer to 0, signifying a reduced sensitivity. Understanding how delta changes in response to these factors is critical for effective risk management. Traders use the definition of delta in finance as a crucial tool in their trading strategies, alongside other Greeks, to make informed decisions.