Deciphering Situations Where Gross Profit is Absent

When “gross profit does not appear” on a financial statement, it can signify several scenarios. It’s not always an indication of poor performance but rather a signal to investigate further. Sometimes, the absence of a gross profit figure is a deliberate accounting choice, particularly in specific industries or reporting formats. Other times, it indicates that the cost of goods sold (COGS) equals or exceeds the revenue generated. This situation results in a zero or negative gross profit. Unusual circumstances, such as significant write-downs or accounting errors, can also cause gross profit does not appear as expected.

The fact that “gross profit does not appear” should prompt a thorough review of the financial data. It might point to underlying issues related to pricing strategies. Are products being sold at a price that adequately covers the cost of production and distribution? It can also reveal problems with cost management. Are there inefficiencies in the supply chain or production processes that are driving up COGS? Furthermore, it may uncover simple accounting errors, such as misclassification of expenses or incorrect inventory valuation. The absence of gross profit might manifest as a zero value or, more concerningly, as a negative value, often referred to as a gross loss.

To properly understand “gross profit does not appear”, it’s essential to examine different reporting formats and scenarios. Some companies might choose to present a simplified income statement that skips the gross profit line, focusing instead on operating income or net income. In other cases, certain business models, especially those involving subscriptions or long-term contracts, may defer revenue recognition, leading to a temporary absence of gross profit. Therefore, a missing gross profit figure isn’t inherently negative. However, it warrants careful scrutiny to determine the underlying cause and assess the potential implications for the business’s financial health. Understanding why “gross profit does not appear” is crucial for accurate financial analysis and decision-making.

How to Determine if Your Business Has a Gross Profit Anomaly

To ascertain whether the absence of gross profit does not appear as an anomaly in your business, a systematic approach is necessary. Begin by scrutinizing your income statement for the relevant reporting period. The income statement contains the financial performance summary for a specific period. Look for the key line items: Revenue and Cost of Goods Sold (COGS). Revenue represents the total income generated from sales. COGS reflects the direct costs associated with producing those goods or services. If the gross profit does not appear as expected, it signals the beginning of your investigation.

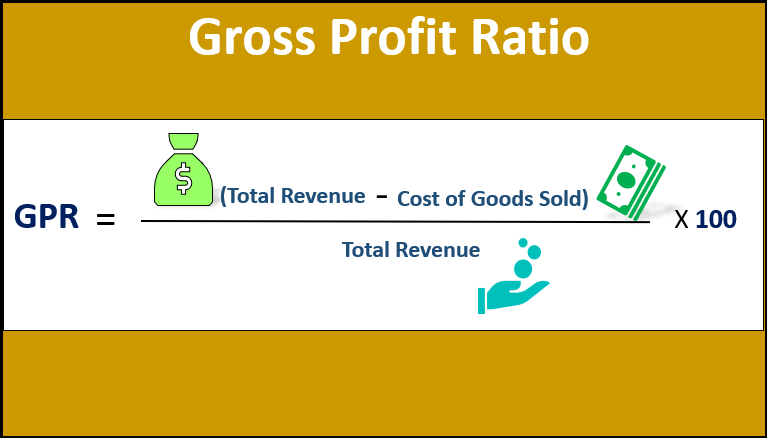

Accuracy is paramount. Verify the data entry for both Revenue and COGS. Small errors can significantly impact the calculated gross profit. Ensure that all sales transactions are correctly recorded. Confirm that COGS includes all direct costs, such as raw materials, direct labor, and manufacturing overhead. The formula for calculating gross profit is straightforward: Gross Profit = Revenue – COGS. For example, if your Revenue is $100,000 and your COGS is $70,000, your Gross Profit would be $30,000. If the gross profit does not appear, or the calculation results in zero or a negative value, further investigation is warranted.

Irregularities in gross profit calculation may indicate underlying issues. A missing gross profit does not appear out of nowhere, and it usually stems from inaccurate or incomplete data. Compare the current period’s gross profit to previous periods. Look for any significant deviations or trends. Investigate any unusual patterns. If the gross profit does not appear on the income statement when it should, or if it’s significantly lower than expected, it’s time to dig deeper. This deeper dive will help uncover the root causes contributing to the absence or reduction in gross profit. Understanding the reasons will then facilitate corrective actions to improve future financial performance. The fact that the gross profit does not appear should raise a flag for investigation.

Exploring Reasons Behind a Zero or Negative Gross Margin

When “gross profit does not appear” on a financial statement, it signifies that the cost of goods sold (COGS) equals or exceeds revenue. This situation can arise from a multitude of factors, demanding a thorough investigation to pinpoint the root cause. One common reason is aggressive price reductions, such as sales and discounts, implemented to boost sales volume or clear out excess inventory. While these tactics might attract customers, they can significantly shrink the gross margin, potentially leading to a situation where “gross profit does not appear” if the discounts are too deep or not strategically managed. For instance, a retailer offering a 50% discount on a product with a standard 30% gross margin would inevitably experience a loss on each sale. A scenario where “gross profit does not appear” can also occur if raw material costs sharply increase, particularly if these increases cannot be passed on to consumers through higher prices due to market competition.

Another contributing factor when “gross profit does not appear” could be inefficiencies in the production process. Suboptimal manufacturing processes, excessive waste, or equipment malfunctions can inflate COGS, thereby eroding the gross profit margin. For example, a manufacturing plant with outdated machinery might experience higher labor costs and material waste, directly impacting the cost of goods sold. Errors in inventory valuation can also lead to an inaccurate gross profit calculation, and consequently, “gross profit does not appear”. Improperly valued or obsolete inventory could lead to write-downs that increase COGS and reduce gross profit. Furthermore, discrepancies in inventory tracking, such as theft or spoilage that are not properly accounted for, can create a scenario where reported gross profit does not reflect the actual profitability.

In some unfortunate cases, “gross profit does not appear” due to fraudulent activities. Manipulating sales figures or inflating inventory values are examples of accounting fraud that can temporarily mask the true financial performance of a company. Such activities are illegal and can have severe consequences for all involved. Therefore, any instance where “gross profit does not appear” should trigger a comprehensive audit to rule out any potential misconduct. Each of these elements directly impacts either revenue or COGS, highlighting the importance of careful monitoring and control to ensure a healthy gross profit margin. Addressing the underlying issues causing a zero or negative gross profit is essential for the long-term financial stability and success of any business.

The Impact of No Gross Profit on Financial Statements

The absence of gross profit profoundly impacts a company’s financial statements, signaling potential issues to investors, lenders, and management alike. When gross profit does not appear, it directly affects key financial metrics and the overall perception of the business’s financial health. This situation casts a shadow on the reliability and usefulness of the financial statements for informed decision-making. A missing gross profit figure distorts the true picture of a company’s operational efficiency and profitability.

Specifically, when gross profit does not appear, the net income is immediately and negatively impacted. Gross profit serves as the foundation for calculating net income; without it, the remaining operating expenses and other deductions are subtracted from a figure that is already zero or negative, resulting in a significantly reduced or negative net income. Profit margins, such as the gross profit margin and net profit margin, become either zero or negative, rendering them useless for comparative analysis. These skewed metrics can deter potential investors and lenders, as they indicate potential operational inefficiencies, unsustainable pricing strategies, or cost management problems. A company consistently showing that gross profit does not appear may struggle to secure funding or attract investment, hindering its growth prospects. The absence of a healthy gross profit also raises concerns about the company’s ability to cover its operating expenses and service its debt obligations.

Furthermore, the absence of gross profit distorts other financial indicators, making it challenging to assess the true value and performance of the company. For instance, traditional valuation methods that rely on profitability, such as price-to-earnings ratios or discounted cash flow analysis, become unreliable. Without a positive gross profit, these models produce skewed or meaningless results, making it difficult for investors to accurately assess the company’s intrinsic value. Imagine a scenario where a company reports significant revenue but shows that gross profit does not appear; this immediately raises red flags. The financial statement loses its utility in evaluating the potential value of the company. It signals a fundamental problem that needs to be addressed before any meaningful financial analysis can be conducted. Careful examination of underlying cost structures and pricing strategies is crucial to determining the root cause of the missing gross profit and implementing corrective measures.

Strategies for Improving Gross Profit When It’s Lacking

When the gross profit does not appear healthy, businesses must take decisive action. Enhancing profitability requires a multi-faceted approach. Strategies should address both revenue generation and cost control. This section provides actionable steps to improve gross profit.

One primary solution involves strategic price adjustments. While raising prices can increase revenue, it requires careful consideration of market dynamics. Analyze competitor pricing. Understand customer price sensitivity. Implement value-added strategies to justify higher prices. Bundling products or services can enhance perceived value. Offering premium versions caters to customers willing to pay more. Negotiating better deals with suppliers is critical to lowering Cost of Goods Sold (COGS). Explore alternative suppliers. Consolidate orders to leverage volume discounts. Implementing efficient inventory management is crucial. Minimize waste and spoilage through accurate forecasting. Employ just-in-time inventory systems to reduce holding costs. Optimizing the production process to reduce waste and errors will lower costs and improve gross profit. Investing in technology and automation can streamline operations. Training employees to improve efficiency is another important step. Regularly review pricing strategies to identify areas for improvement, when gross profit does not appear as expected. Evaluate product profitability. Eliminate or re-price underperforming items. Consider promotional pricing for slow-moving inventory. Always balance profitability with affordability to maintain competitiveness in the target market.

Another approach to consider when the gross profit does not appear is improving operational efficiency. Identify bottlenecks in the production process. Implement lean manufacturing principles to eliminate waste. Invest in employee training to improve skills and productivity. Automate tasks to reduce labor costs and improve accuracy. Reducing operational costs directly impacts COGS, thereby enhancing the gross profit. Furthermore, consider reviewing pricing strategies, focusing on products that are profitable, and adjusting prices accordingly. Discontinue underperforming products and focus on top-selling items. Improve your marketing efforts to drive more sales of your most profitable products. These strategic adjustments will improve the gross profit, even if the gross profit does not appear right away.

Alternative Metrics When Gross Profit is Unclear

When gross profit does not appear on financial statements, or its accuracy is questionable, alternative metrics offer valuable insights into a business’s financial health. One such metric is the contribution margin. This metric calculates the revenue remaining after deducting variable costs. It’s particularly useful for businesses with high variable costs, such as those in manufacturing or retail. The contribution margin reveals how much revenue contributes towards covering fixed costs and generating profit. For example, a company selling handmade goods can track the contribution margin per unit to understand the profitability of each product, even if overall gross profit is unclear due to fluctuating material costs.

Focusing on operating income provides another perspective. Operating income considers all revenues and expenses related to a company’s core operations. It excludes non-operating items like interest income or losses. Analyzing operating income helps assess the profitability of day-to-day operations, irrespective of how gross profit is calculated or presented. In situations where gross profit does not appear, because of unique accounting practices, operating income still provides a useful measure of a company’s performance. Businesses in the service sector, which often have lower direct costs associated with goods sold, may find operating income a more relevant indicator than gross profit.

Analyzing sales growth and customer acquisition costs offers further insight into a company’s performance. Tracking sales growth shows the overall expansion of the business. Understanding customer acquisition costs helps determine the efficiency of marketing and sales efforts. These metrics are valuable even when gross profit calculations are ambiguous. For instance, a subscription-based software company might prioritize subscriber growth and customer lifetime value, even if the initial gross profit margin is low or negative due to high upfront development costs. These metrics can better reflect long-term profitability. In situations where gross profit does not appear consistently, these alternative metrics paint a more comprehensive picture of business performance.

Analyzing Industries Where Absent Gross Profit is More Common

In certain industries and business models, it is more common for the gross profit does not appear or to be minimal. This doesn’t automatically indicate financial distress. Rather, it reflects unique economic realities. Understanding these contexts is vital for accurate financial interpretation. Industries with substantial upfront investments often exhibit this pattern. Infrastructure projects, such as building highways or constructing large-scale energy plants, require significant initial expenditures. Revenue generation may be delayed for years. During the initial phases, cost of goods sold (COGS) which includes construction costs, can exceed revenue, leading to a situation where gross profit does not appear. Similarly, research and development-intensive sectors, like biotechnology or pharmaceuticals, invest heavily before generating sales. A gross profit does not appear until a product reaches the market. The initial years may show significant losses due to R&D expenses. The assessment of such companies requires focusing on their intellectual property and long-term market potential.

Heavily subsidized industries may also experience situations where gross profit does not appear as expected. Agriculture, for example, receives subsidies that artificially lower costs or inflate revenue. This distorts the traditional gross profit calculation. A clearer picture emerges when considering the impact of subsidies on the financial statements. Some businesses intentionally adopt a “loss leader” strategy to attract customers. This involves selling a product or service below cost to drive traffic or gain market share. Many tech companies employ this tactic. They offer free services or heavily discounted products to build a user base. A gross profit does not appear on these initial offerings. The goal is to monetize the user base later through advertising, premium subscriptions, or other revenue streams. Therefore, a short-term absence of gross profit is a calculated risk.

It’s crucial to evaluate the broader business strategy and long-term profitability potential in these industries. Focusing solely on the absence of gross profit does not appear can be misleading. Financial planning and strategic considerations are equally important. Analyze alternative metrics like customer acquisition cost, churn rate, and lifetime value. These offer a more complete understanding of the company’s performance. Investors and analysts should recognize that traditional financial ratios may not accurately reflect the business’s true health. Industries where a gross profit does not appear demand a nuanced and forward-looking analysis. This ensures an accurate evaluation of their viability and long-term success. Understanding the specific industry dynamics and strategic choices is key to interpreting financial data correctly.

Preventing Gross Profit Discrepancies: Best Practices

Preventing discrepancies that lead to a missing or inaccurate gross profit figure requires a proactive approach. Implementing robust accounting systems is a foundational step. These systems should be capable of accurately tracking revenue and cost of goods sold (COGS). Maintaining meticulous inventory records is equally crucial. This ensures accurate COGS calculations. Regular audits, both internal and external, can help identify and correct errors promptly. These audits should scrutinize financial transactions and inventory valuations. Staff training on proper accounting procedures is also essential. Well-trained staff are less likely to make mistakes. When the gross profit does not appear as expected, these practices become even more vital.

Segregation of duties is another key best practice. This helps to prevent fraud and errors. No single person should have complete control over all financial processes. Continuous monitoring of financial performance is vital. This allows for the early detection of discrepancies. Regular reporting is also important. This reporting should be detailed and timely. It enables management to identify and correct errors quickly. When the gross profit does not appear, immediate investigation is necessary. This involves reviewing all relevant financial data and processes. Addressing the root cause of the discrepancy is paramount.

Data integrity is paramount in preventing gross profit inaccuracies. Careful attention to these details ensures accurate financials. Robust systems, diligent record-keeping, and regular audits are fundamental. Staff training and segregation of duties contribute to a strong control environment. Continuous monitoring and regular reporting allow for timely detection and correction of errors. Businesses must prioritize these best practices to safeguard their financial reporting. When the gross profit does not appear, these measures offer a safety net. They highlight potential issues and ensure accurate financial representation. Ultimately, these efforts contribute to sound financial decision-making and maintain stakeholder confidence. The absence of a typical gross profit can be a red flag, so vigilance in these areas is crucial for businesses of all sizes.