Grasping the Concept of Annuity Factors

An annuity, in its simplest form, represents a series of equal payments made over a specified period. Think of it as a structured stream of income or expenses occurring at regular intervals. Now, to understand “how to find the annuity factor,” we must first grasp its purpose. An annuity factor is a crucial tool used to calculate the present value or future value of this series of payments. It essentially condenses the calculation process, making it more efficient than summing up each individual payment’s value.

There are two primary types of annuity factors: present value annuity factors and future value annuity factors. The present value annuity factor helps determine the current worth of a stream of payments that will be received in the future. This is vital when evaluating investments or loans. For example, if you are promised a certain amount of money each year for the next ten years, the present value annuity factor helps you understand what that entire stream of payments is worth today. Conversely, the future value annuity factor calculates the value of a series of payments at a specific point in the future, assuming a certain interest rate. This is useful for planning savings goals or projecting the growth of investments. Understanding the difference between these two factors is essential for “how to find the annuity factor” and use it correctly in financial calculations.

In essence, the annuity factor acts as a multiplier. It simplifies the process of determining the total present or future value of a series of equal payments. Knowing how to find the annuity factor and applying it appropriately empowers individuals to make informed financial decisions regarding investments, loans, and retirement planning. This knowledge provides a clear understanding of the time value of money and its impact on financial planning. The ability to accurately calculate the present or future value of an annuity is a cornerstone of financial literacy, enabling individuals to assess opportunities and manage their financial resources effectively, emphasizing the importance of understanding “how to find the annuity factor”.

Deciphering the Formula for Annuity Factor Calculation

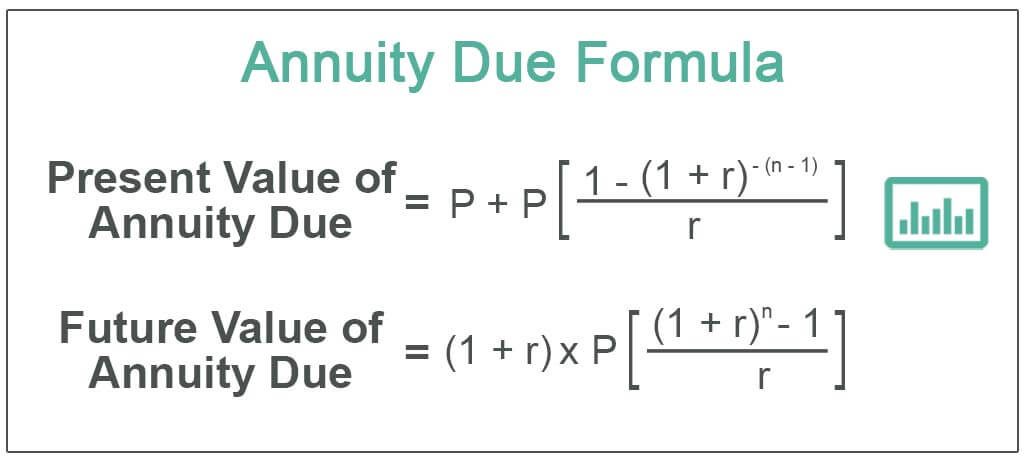

The journey to understanding how to find the annuity factor begins with the formulas. There are two primary formulas: one for the present value annuity factor and another for the future value annuity factor. The present value annuity factor helps determine the current worth of a series of future payments, while the future value annuity factor calculates the accumulated value of those payments at a specific point in the future.

The formula for the present value annuity factor is: [1 – (1 + r)^-n] / r. In this equation, ‘r’ represents the interest rate per period, expressed as a decimal. For instance, a 5% interest rate would be 0.05. The variable ‘n’ signifies the number of periods or payment installments. The interest rate and the number of periods are inversely proportional to the present value annuity factor. A higher interest rate results in a lower factor, and a longer time period leads to a higher factor, up to a certain limit. Understanding how to find the annuity factor hinges on grasping how these components interact within the formula.

Conversely, the future value annuity factor is calculated as: [(1 + r)^n – 1] / r. Again, ‘r’ denotes the interest rate per period, and ‘n’ represents the number of periods. In this case, the interest rate and the number of periods are directly proportional to the future value annuity factor. Higher interest rates and longer timeframes yield larger factor values. Both formulas rely on the concept of compounding, where interest earned also earns interest. To accurately apply these formulas and learn how to find the annuity factor, it’s crucial to pay attention to detail and ensure the correct values for ‘r’ and ‘n’ are used. Small differences in these values can significantly affect the outcome. For instance, if compounding occurs monthly but interest rates are expressed annually, an adjustment by dividing the annual rate by 12 will be needed to match the payment frequency with the compounding period.

Practical Steps for Finding the Annuity Factor

This section provides a step-by-step guide on how to find the annuity factor. The annuity factor is crucial for present value and future value annuity calculations. Understanding the process is essential for sound financial planning.

First, identify whether you need a present value annuity factor or a future value annuity factor. This depends on whether you are calculating the present worth of future payments or the future value of a series of payments. Next, determine the interest rate per period. This is typically an annual interest rate, but it may need to be adjusted if payments are made more frequently (e.g., monthly). Also, define the number of periods. This represents the total number of payment periods. For example, a 5-year annuity with annual payments has 5 periods.

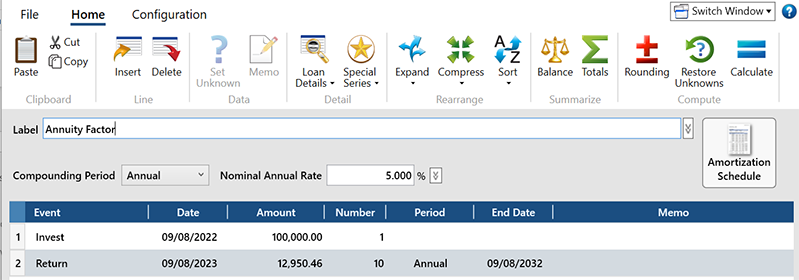

To illustrate how to find the annuity factor, let’s look at the formula for the present value annuity factor: PVIFA = [1 – (1 + r)^-n] / r, where ‘r’ is the interest rate per period and ‘n’ is the number of periods. Suppose you want to find the present value annuity factor for an annuity with an interest rate of 5% per year and a term of 10 years. In this case, r = 0.05 and n = 10. Plugging these values into the formula: PVIFA = [1 – (1 + 0.05)^-10] / 0.05. Calculate (1 + 0.05)^-10, which is approximately 0.6139. Then, subtract this from 1: 1 – 0.6139 = 0.3861. Finally, divide by the interest rate: 0.3861 / 0.05 = 7.7217. Thus, the present value annuity factor is approximately 7.7217. This means that at a 5% discount rate, you would pay 7.7217 times the annuity payment to achieve the present value of the investment. This calculation is a demonstration of how to find the annuity factor.

The formula for the future value annuity factor is: FVIFA = [(1 + r)^n – 1] / r. Let’s use the same interest rate of 5% and a term of 10 years to find the future value annuity factor. FVIFA = [(1 + 0.05)^10 – 1] / 0.05. Calculate (1 + 0.05)^10, which is approximately 1.6289. Then, subtract 1: 1.6289 – 1 = 0.6289. Finally, divide by the interest rate: 0.6289 / 0.05 = 12.5779. Thus, the future value annuity factor is approximately 12.5779. Double-checking your calculations is a good way on how to find the annuity factor correctly. Always ensure accuracy and that you are using the correct values for the interest rate and number of periods. Small errors can lead to significant discrepancies in your financial analysis. Remember that the formulas are the core component to understanding how to find the annuity factor.

Utilizing Annuity Factor Tables for Quick Reference

Annuity factor tables offer a convenient way to quickly determine annuity factors without performing manual calculations. These tables present pre-calculated factors based on different interest rates and time periods. Understanding how to find the annuity factor using these tables can save time and effort. The tables are structured with interest rates typically listed across the top as column headers and the number of periods (n) listed down the side as row labels. To find the annuity factor, one must locate the intersection of the appropriate interest rate column and the corresponding number of periods row. The value at this intersection is the annuity factor.

To effectively use annuity factor tables, begin by identifying the relevant interest rate and the number of periods for the annuity in question. Next, locate the interest rate column and the number of periods row on the appropriate table (either present value annuity table or future value annuity table). Trace along the row and column until they intersect. The value found at this intersection is the annuity factor. For example, if you need to know how to find the annuity factor for an annuity with an interest rate of 5% and a term of 10 years using a present value annuity table, you would find the intersection of the 5% column and the 10-year row. Be meticulous in ensuring that you are using the correct row and column to avoid errors. This is a quick how to find the annuity factor method, though keep in mind its limitations.

While annuity factor tables are useful, they have limitations. Tables typically provide factors for a limited range of interest rates and time periods. If the exact interest rate or time period needed is not listed in the table, interpolation may be necessary, or one might need to use a formula or an online calculator. It’s crucial to recognize the difference between present value annuity tables and future value annuity tables. Present value annuity tables are used to calculate the present value of a stream of future payments, while future value annuity tables are used to calculate the future value of a series of payments made over time. Using the wrong table will result in an incorrect calculation. Understanding these nuances is key to accurately how to find the annuity factor and applying it effectively in financial analyses.

Exploring Online Annuity Factor Calculators

The digital age offers convenient tools for financial calculations, and annuity factor calculators are readily available online. These calculators simplify the process of determining annuity factors, offering a quick and efficient alternative to manual calculations or using tables. Several reputable online calculators can be found with a simple search. When selecting an online calculator, it’s wise to consider those from trusted financial institutions or websites known for their accuracy and reliability. Before using any online calculator, it is prudent to review its terms of service and privacy policy.

Using an online annuity factor calculator is straightforward. Typically, the user needs to input the interest rate per period and the number of periods. Some calculators may also ask whether it is a present value or future value annuity factor that needs to be calculated. Ensure you understand what the calculator is asking for and input the correct information. The calculator will then automatically compute the annuity factor. It is always a good idea to verify the results obtained from any online calculator with another source, such as a different calculator or a manual calculation, especially for critical financial decisions. Understanding how to find the annuity factor is crucial, even when using a calculator, as it allows verification of the results.

While online annuity factor calculators are convenient, it’s important to recognize their limitations. The accuracy of the output depends on the accuracy of the input. Always double-check the entered values to avoid errors. Furthermore, some calculators may have limitations on the range of interest rates or time periods they can handle. It’s also important to understand the underlying formulas being used by the calculator. This knowledge will help you interpret the results and ensure they are appropriate for your specific situation. Understanding how to find the annuity factor, even with the use of online tools, remains a valuable skill for informed financial decision-making, especially in evaluating investment opportunities or understanding loan terms. Remember that the goal is to understand how to find the annuity factor to improve financial literacy.

Applying Annuity Factors in Real-World Scenarios

Annuity factors are not just theoretical concepts; they are essential tools in various financial applications. Understanding how to find the annuity factor unlocks a deeper understanding of financial planning and investment analysis. One common application is calculating loan payments. When you take out a loan, the lender uses an annuity factor to determine the periodic payment required to repay the principal and interest over the loan term. By understanding how to find the annuity factor, you can verify the accuracy of these calculations and compare different loan offers.

Another crucial area where annuity factors come into play is in retirement planning. Many retirement income streams, such as pensions or annuities, involve a series of regular payments. The present value of these future payments can be determined using the present value annuity factor. This calculation helps individuals assess the true value of their retirement income and make informed decisions about their retirement savings and spending. For example, consider two investment options: one that guarantees a stream of payments over a set period and another that offers a lump sum payout. By calculating the present value of the annuity stream using the appropriate annuity factor, you can directly compare it to the lump sum and determine which option is financially more advantageous. Knowing how to find the annuity factor becomes key to comparing those different retirement plans.

Furthermore, annuity factors are valuable in evaluating investment opportunities. For instance, if you are considering investing in a bond that pays regular interest payments, you can use the present value annuity factor to determine the present value of those payments. This allows you to compare the bond’s price to its present value and assess whether it is a worthwhile investment. Understanding how to find the annuity factor in these and other scenarios provides a powerful framework for making informed financial decisions. By comparing investments with varying factors and values, you can identify opportunities that align with your financial goals and risk tolerance, helping you to compare different investments with varying values. Learning how to find the annuity factor empowers individuals to take control of their financial futures and make sound investment choices.

Common Pitfalls to Avoid When Calculating Annuity Factors

Several mistakes can occur when learning how to find the annuity factor. Avoiding these pitfalls is crucial for accurate financial planning. One common error is using the wrong formula. It is important to differentiate between present value and future value annuity factor formulas. Ensure the correct formula is selected for the specific calculation needed. Another frequent mistake involves inputting incorrect data. Double-check the interest rate and the number of periods. Even small errors in these values can significantly impact the annuity factor.

Misunderstanding the concept of compounding is another potential problem. The time value of money is central to annuity factor calculations. This means that money available today is worth more than the same amount in the future. It is because of its potential earning capacity. Ensure a solid grasp of this principle. A more subtle issue arises when payment frequencies differ from the interest rate’s compounding period. For instance, if payments are made monthly, but the interest rate is annual, an adjustment is needed. Divide the annual interest rate by the number of compounding periods per year. Also, multiply the number of years by the number of compounding periods per year. This converts both the interest rate and the number of periods to match the payment frequency.

Carelessness can undermine even a correct methodology. Always double-check the calculations. Especially when performing them manually. Online calculators can help, but still verify the inputs are accurate. Understanding how to find the annuity factor is a valuable skill. However, it requires diligence and a keen eye for detail. By avoiding these common pitfalls, one can improve accuracy. The result will be more reliable financial forecasts.

Mastering Annuity Factor Calculation for Financial Success

Understanding annuity factors is a cornerstone of informed financial decision-making. This knowledge empowers individuals to assess the true value of investments and financial obligations. Knowing how to find the annuity factor and applying it correctly allows for accurate comparisons between different financial products. Individuals can then make choices aligned with their long-term financial goals. With practice, anyone can become proficient in calculating annuity factors. This skill becomes a powerful tool for navigating the complexities of personal finance.

Financial literacy is essential for achieving long-term financial security. Mastering concepts like how to find the annuity factor contributes significantly to this literacy. It allows for a deeper understanding of the time value of money. This includes how it impacts various financial instruments. Understanding annuity factors enhances the ability to plan for retirement. Individuals can confidently evaluate loan options and make sound investment decisions. Seek professional advice when facing complex financial scenarios. However, mastering the basics empowers individuals to take control of their financial future. The ability to confidently determine how to find the annuity factor is invaluable.

Accurate calculations are crucial when determining how to find the annuity factor. Common errors include using the wrong formula or inputting incorrect data. A solid understanding of compounding is also essential. It is important to ensure consistency between payment frequencies and the interest rate’s compounding period. Adjustments may be necessary to align these periods. By avoiding these pitfalls and practicing regularly, one can improve their proficiency. This ensures that they can accurately calculate annuity factors. This skill then becomes an asset in achieving financial goals. Ultimately, understanding how to find the annuity factor puts the power of financial planning firmly in your hands.