Decoding Triple Leveraged Inverse Small-Cap ETFs

An inverse Russell 2000 ETF 3x, also known as a triple leveraged bear ETF, is a type of exchange-traded fund designed to deliver *three times* the *opposite* of the daily performance of a small-cap index, most commonly the Russell 2000. So, if the Russell 2000 decreases by 1% on a given day, the inverse Russell 2000 ETF 3x should aim to increase by 3%. Conversely, if the Russell 2000 increases by 1%, the ETF is designed to decrease by 3%. Some examples include ETFs that aim to achieve this.

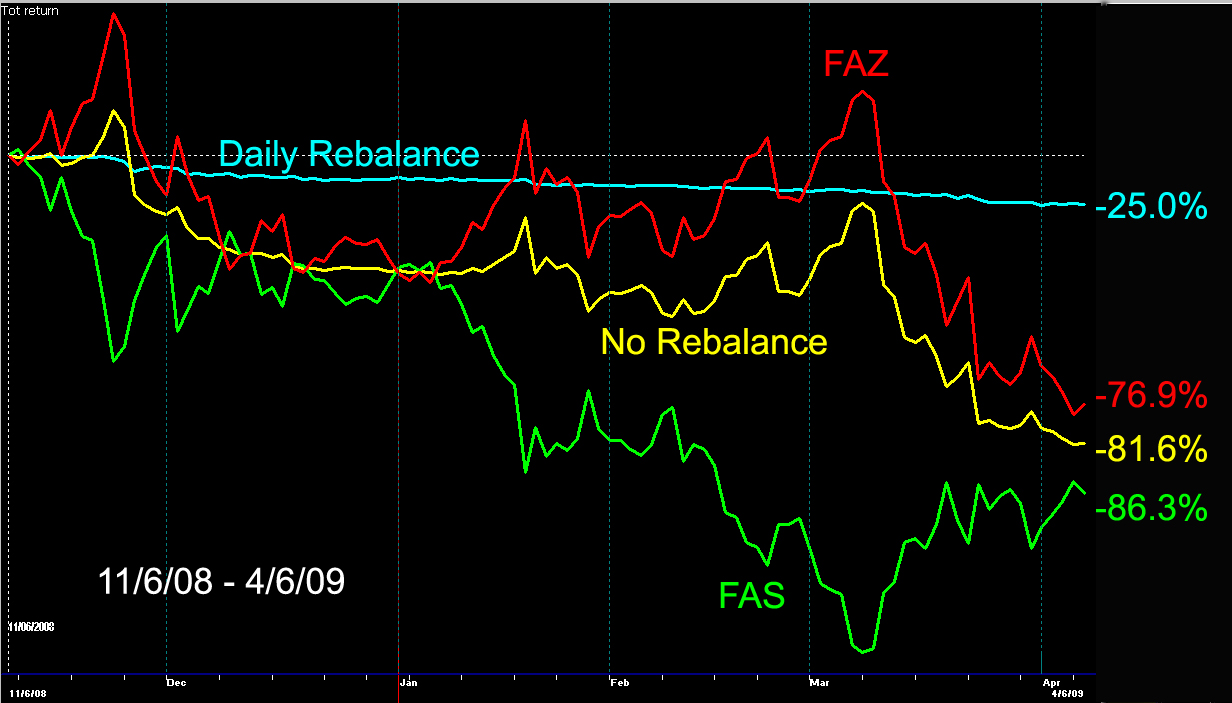

The key term here is “daily.” These ETFs are engineered to achieve their 3x inverse target on a *daily* basis. This daily reset mechanism has significant implications for investors holding these ETFs for longer than a single day. The effects of compounding, especially in volatile markets, can erode returns and lead to outcomes that differ significantly from the anticipated 3x inverse performance over an extended period. These funds are not intended as buy-and-hold investments. The inverse Russell 2000 ETF 3x is a specialized tool.

Investors should fully understand the risks before considering an inverse Russell 2000 ETF 3x. These ETFs use financial instruments and strategies to amplify returns (or losses). This leverage increases both the potential rewards and the potential risks. Due to the compounding effect and volatility decay, an inverse Russell 2000 ETF 3x may not accurately reflect three times the inverse performance of the Russell 2000 over longer periods. The daily reset can lead to unexpected results, especially in choppy or sideways-moving markets. Therefore, the inverse Russell 2000 ETF 3x should be approached with caution. It requires active monitoring and a clear understanding of its mechanics.

How to Utilize a Triple Leveraged Bear Russell 2000 ETF

The intended use case for a triple leveraged bear Russell 2000 ETF, also known as an inverse russell 2000 etf 3x, centers around short-term hedging. Investors anticipating a decline in small-cap stock values, as represented by the Russell 2000 index, might employ this instrument to offset potential losses in their broader portfolio. The goal is to profit from the index’s downward movement, thereby cushioning the impact on overall investment holdings. For example, if an investor predicts an imminent market correction impacting small-cap stocks, they could allocate a small portion of their capital to a triple leveraged inverse russell 2000 etf 3x.

This strategy aims to provide a short-term counterweight to losses incurred elsewhere. If the Russell 2000 declines, the inverse russell 2000 etf 3x should increase in value, partially mitigating the negative impact. However, a strong word of caution is necessary: these ETFs are explicitly *not* designed for long-term investment. The daily reset of the leverage, combined with market volatility, leads to what’s known as volatility decay. This effect erodes the ETF’s value over time, even if the underlying index moves in the anticipated direction over an extended period.

Consider a scenario where an investor expects the Russell 2000 to decline over a single week due to upcoming economic data. They purchase shares of a triple leveraged inverse russell 2000 etf 3x. If their prediction is correct and the index falls during that week, they may realize a profit. Once the week concludes, they would typically exit the position. Holding it longer introduces substantial and unnecessary risks. These risks are driven by the inherent nature of leveraged ETFs and compounding, where daily gains and losses affect the base value each day. For instance, constant ups and downs will erode value, even if the index ends up at roughly the same place.

The Risks of Investing in Leveraged Inverse ETFs

Investing in a triple leveraged inverse ETF, such as an inverse Russell 2000 ETF 3x, carries substantial risks. Understanding these risks is crucial before considering such an investment. One major risk is volatility decay. This refers to the fact that daily rebalancing, necessary to maintain the 3x inverse leverage, can significantly erode returns over time, even if the underlying Russell 2000 index moves as anticipated. For example, if the index declines 10% one day and then rises 10% the next, the 3x inverse ETF will not return to its starting value. The compounding of daily returns means that losses tend to be magnified more than gains, resulting in a net loss for the investor despite a return to the original index level. This is a key characteristic of inverse russell 2000 etf 3x products. Therefore, it’s essential to understand this decay factor and its effects on the inverse russell 2000 etf 3x performance.

The impact of compounding on daily returns is another critical risk. Daily fluctuations in the underlying index are amplified three times for the leveraged ETF. This means that even small, seemingly insignificant daily changes can accumulate to substantial losses over a period of time. Consider a scenario where the index experiences several small daily declines that add up to a moderate overall drop. A 3x inverse ETF will experience a more significant decline than the index itself. Conversely, if the index experiences a sustained period of upward movement, even with some temporary setbacks, the inverse ETF might still incur significant losses if those upward movements are not as large as anticipated. Investors should carefully consider how a 3x inverse ETF magnifies both positive and negative market moves. This is especially true with the inverse russell 2000 etf 3x, which focuses on a volatile sector of the market.

These effects can lead to substantial losses, even if the market moves in the direction initially predicted. It’s vital to remember that an inverse Russell 2000 ETF 3x is designed for short-term trading, not long-term investing. Long-term performance will be influenced heavily by the compounding of daily returns and the effect of volatility decay. Using illustrative examples, a series of small daily declines can result in significant losses within a short span even if the underlying Russell 2000 index ultimately recovers. Conversely, even a small upward movement in the market might produce substantial short-term losses for an investor using an inverse russell 2000 etf 3x strategy. Understanding these dynamics is fundamental to making informed investment choices.

Evaluating the Performance of Inverse Russell 2000 ETFs

Evaluating the performance of an inverse Russell 2000 ETF 3x requires a nuanced approach. It’s crucial to remember that past performance is not a reliable predictor of future results. A high return in one period doesn’t guarantee similar performance later. Investors should avoid making investment decisions based solely on historical data. Instead, focus on several key metrics and resources to gain a comprehensive understanding of the ETF’s behavior and potential risks. One important aspect is evaluating the tracking error, which measures how closely the ETF mirrors the inverse performance of the Russell 2000 index. A larger tracking error indicates a greater deviation from the intended benchmark, potentially leading to unexpected outcomes. Furthermore, it is vital to consider the expense ratio. This represents the annual cost of owning the ETF, expressed as a percentage of the assets. A higher expense ratio can eat into returns, especially over longer periods. Analyzing these factors provides a clearer picture of the ETF’s efficiency and cost-effectiveness.

Several factors can significantly influence the performance of an inverse Russell 2000 ETF 3x. Market volatility plays a crucial role. Higher volatility can lead to larger daily swings in both directions, which can amplify the effects of compounding and volatility decay. The management strategies employed by the ETF’s issuer also matter. Active management decisions, such as adjustments to the portfolio composition or the use of different hedging techniques, can impact performance. Additionally, the cost of leverage is a significant consideration. The ETF uses financial leverage to achieve its 3x inverse exposure, and the interest expense associated with this leverage can affect returns. To find this data, investors can refer to official fund pages, typically available on the issuer’s website. These pages provide detailed information on the ETF’s holdings, performance, expense ratio, and other relevant metrics. Financial news websites and investment research platforms also offer tools and analysis to help investors evaluate the performance of inverse Russell 2000 ETF 3x.

In summary, a thorough evaluation of an inverse Russell 2000 ETF 3x involves more than just looking at past returns. Investors need to assess the ETF’s tracking error, expense ratio, and the various factors that can influence its performance. This includes understanding the role of market volatility, management strategies, and the cost of leverage. By utilizing resources such as official fund pages and financial news websites, investors can make more informed decisions. Remember, the intended use is for short term hedging against a predicted downturn in small-cap stocks, this type of financial instrument isn’t designed for long-term investment strategies. Before investing in an inverse Russell 2000 ETF 3x, it is essential to fully understand the risks involved and whether it aligns with your investment goals and risk tolerance. An informed approach is paramount when navigating the complexities of leveraged inverse ETFs.

Factors That Influence the Russell 2000 Index

The Russell 2000 index serves as a benchmark for the performance of small-cap companies in the United States. Understanding its composition and the factors that influence it is crucial when considering investments tied to it, such as an inverse russell 2000 etf 3x. The index includes approximately 2,000 of the smallest companies in the Russell 3000 index, representing about 8% of the total Russell 3000 market capitalization. This focus on smaller companies makes it distinct from indices like the S&P 500, which tracks large-cap stocks.

The construction of the Russell 2000 involves a market-capitalization weighting methodology. This means that larger companies within the index have a greater influence on its overall performance. Sector allocation within the Russell 2000 can shift over time, reflecting changes in the economy and market trends. Typically, sectors like financials, healthcare, and consumer discretionary have significant weightings. The performance of these sectors can significantly impact the index’s overall movement. Understanding these sector weightings provides insights into the potential drivers of an inverse russell 2000 etf 3x. The inverse russell 2000 etf 3x is designed to perform the opposite of this index, so knowing the index’s composition is key.

The Russell 2000 is not isolated from broader market trends. It exhibits correlation with the overall stock market, but its sensitivity to specific factors can differ. Small-cap stocks are often more volatile than their large-cap counterparts. They can be more susceptible to economic fluctuations, changes in interest rates, and shifts in investor sentiment. These factors can amplify the potential gains or losses in an inverse russell 2000 etf 3x. The inverse russell 2000 etf 3x will react to market shifts, attempting to provide a return based on the inverse of the index. Monitoring macroeconomic indicators and overall market conditions is important when evaluating an inverse russell 2000 etf 3x investment.

Alternatives to Triple Leveraged Bear ETFs

For investors seeking to hedge against potential declines in small-cap stocks without the complexities and risks associated with a triple leveraged inverse Russell 2000 ETF 3x, several alternative strategies exist. These alternatives offer varying degrees of risk and reward and may be more suitable for investors with different risk tolerances and investment horizons. Understanding these options is crucial before incorporating any bearish strategy into a portfolio.

One common alternative is traditional short selling. This involves borrowing shares of a Russell 2000 ETF or individual small-cap stocks and selling them, with the expectation of buying them back at a lower price in the future. Short selling can provide a direct hedge against losses in a portfolio of small-cap stocks. However, it carries unlimited risk, as the potential losses are theoretically unlimited if the stock price rises. Unlike a triple leveraged inverse Russell 2000 ETF 3x where the loss is limited to the initial investment, short selling requires a margin account and the potential for margin calls if the stock price moves against the investor. Another alternative is purchasing put options on the Russell 2000 index or related ETFs. A put option gives the buyer the right, but not the obligation, to sell the underlying asset at a specified price (the strike price) on or before a certain date. If the index declines below the strike price, the put option will increase in value, offsetting potential losses in a portfolio. The risk is limited to the premium paid for the put option. While options strategies can be complex, they offer more control over the level of risk and potential reward compared to a triple leveraged inverse Russell 2000 ETF 3x.

For investors seeking a less aggressive approach, less leveraged inverse ETFs are available. These ETFs aim to provide the inverse (1x) or double inverse (2x) of the daily performance of the Russell 2000 index. While they still carry the risks associated with leveraged and inverse products, the lower leverage factor reduces the impact of volatility decay and compounding, making them potentially more suitable for short-term tactical positions. A 1x inverse Russell 2000 ETF, for example, will generally move in the opposite direction of the index on a 1:1 basis, while a 2x inverse ETF will aim for twice the inverse movement. These options may provide a more balanced risk/reward profile for investors who want to express a bearish view on small-cap stocks without the amplified risks of a triple leveraged inverse Russell 2000 ETF 3x. It’s important to carefully consider the expense ratios and tracking error of any inverse ETF, regardless of the leverage factor. Remember, each of these alternatives should be carefully evaluated in light of an investor’s individual circumstances and risk tolerance before implementation.

Incorporating Bearish Small-Cap Strategies Into a Portfolio

The decision to incorporate bearish small-cap strategies, such as utilizing an inverse russell 2000 etf 3x, into an investment portfolio warrants careful consideration. This approach is not universally suitable and should be evaluated against an individual’s specific financial circumstances, risk appetite, and investment objectives. Investors must align such strategies with their tolerance for volatility and potential losses. Remember that these instruments are designed for sophisticated investors who understand and can manage the inherent risks.

Before implementing any bearish strategy involving an inverse russell 2000 etf 3x, a comprehensive assessment of the portfolio’s existing composition is essential. Determine how this strategy interacts with other holdings and its potential impact on overall portfolio performance. Understand the correlation between small-cap stocks and other asset classes within the portfolio. This understanding helps to gauge how the inverse russell 2000 etf 3x might behave under different market conditions. A well-defined exit strategy is crucial. Predetermine the conditions under which the position will be closed to limit potential losses and protect profits. The complexity and risks associated with an inverse russell 2000 etf 3x mean this strategy is best suited for investors with a deep understanding of financial markets and leveraged instruments.

Consider the time horizon for the investment. An inverse russell 2000 etf 3x is generally intended for short-term tactical positioning rather than long-term strategic allocation. The effects of compounding and volatility decay can significantly erode returns over extended periods. Therefore, frequent monitoring and active management are necessary. This strategy should only represent a small portion of the overall portfolio, reflecting its speculative nature and potential for significant losses. Ensure sufficient liquid assets are available to cover potential margin calls or losses associated with the inverse russell 2000 etf 3x. The use of a 3x leveraged inverse russell 2000 etf demands diligence, expertise, and a clear understanding of its limitations. It is essential to reiterate that this strategy is not for everyone, and certainly not for the long term.

The Future of Small-Cap Investing and Inverse Strategies

The landscape of small-cap investing and the utilization of 3x leveraged inverse russell 2000 etf 3x strategies are subject to potential shifts influenced by a multitude of economic and regulatory factors. As economic conditions evolve, particularly concerning interest rate fluctuations and overall market sentiment, the appetite for both small-cap investments and hedging instruments like the inverse russell 2000 etf 3x is likely to fluctuate.

Increased market volatility often drives demand for inverse russell 2000 etf 3x, as investors seek to protect their portfolios from potential downturns. Conversely, periods of sustained economic growth and low volatility may diminish the appeal of these bearish strategies. Furthermore, regulatory changes impacting leveraged ETFs could significantly alter their availability and attractiveness to investors. Scrutiny regarding the risks associated with these products may lead to stricter regulations, potentially limiting their leverage or imposing additional disclosure requirements.

Technological advancements and the increasing sophistication of trading platforms may also play a role in shaping the future of inverse russell 2000 etf 3x strategies. The ease with which investors can access and trade these instruments could lead to increased participation, but it also underscores the importance of investor education and a thorough understanding of the inherent risks. Considering the complexities and potential pitfalls of 3x leveraged inverse russell 2000 etf 3x, it is vital for investors to remain vigilant, stay abreast of market developments, and seek guidance from qualified financial advisors before making any investment decisions. Prudent portfolio management necessitates a comprehensive understanding of risk tolerance, investment objectives, and the potential impact of economic and regulatory shifts on investment strategies. Diversification and a long-term perspective remain essential principles for navigating the ever-changing investment landscape, especially when considering leveraged and inverse products.