Decoding Prospective Returns: A Primer

Understanding the potential of investments requires grasping the concept of forward-looking expected return and risk. These are vital components in informed investment decision-making. To compute forward-looking expected return and risk effectively, it’s important to define them clearly. Expected return represents the anticipated profit or loss on an investment, expressed as a percentage, over a specific period in the future. Risk, conversely, signifies the uncertainty surrounding that return, reflecting the potential for actual returns to deviate from expectations.

It’s crucial to recognize that these forward-looking projections are not guarantees. Instead, they are educated estimations derived from current information, historical data, and various financial models. Investors need to compute forward-looking expected return and risk while acknowledging the inherent limitations of these projections. Market conditions can change, economic factors can shift, and unforeseen events can occur, all of which can impact actual investment outcomes. Therefore, these estimations should be viewed as benchmarks, subject to ongoing review and refinement.

The process to compute forward-looking expected return and risk involves assessing various factors. These factors range from company-specific data to broader economic indicators. While historical performance can offer insights, it’s not necessarily indicative of future results. A comprehensive analysis requires a forward-looking perspective, incorporating current market sentiment, analyst forecasts, and potential future scenarios. By carefully considering these elements, investors can develop a more nuanced understanding of the potential rewards and risks associated with different investment opportunities. Ultimately, the ability to compute forward-looking expected return and risk is essential for building a resilient and well-informed investment strategy.

How to Project Investment Performance: A Step-by-Step Approach

To effectively compute forward-looking expected return and risk, a structured approach is essential. This involves employing various models and carefully considering the necessary inputs. One widely used method is the discounted cash flow (DCF) model. This model projects future free cash flows and discounts them back to their present value using a discount rate, typically the weighted average cost of capital (WACC). To compute forward-looking expected return and risk using the DCF model requires projecting revenue growth, profit margins, capital expenditures, and working capital needs. Analyst estimates, company guidance, and industry trends are valuable sources for these projections.

Earnings-based models offer another avenue to compute forward-looking expected return and risk. These models often utilize metrics like the price-to-earnings (P/E) ratio or the earnings yield. To implement these models, one needs to forecast future earnings per share (EPS). Analyst consensus estimates, available from financial data providers such as Bloomberg, Reuters, or Yahoo Finance, are commonly used. The expected return can then be estimated by relating the projected earnings to the current market price. Factor-based models, such as the Fama-French three-factor model or more complex multi-factor models, consider factors like size, value, and momentum to explain asset returns. These models require historical data on factor returns and asset betas, which can be obtained from academic research and financial databases. When you compute forward-looking expected return and risk, ensure you understand the underlying assumptions of each model and their limitations.

Each of these methods requires careful consideration of the inputs and their potential impact on the final result. For instance, when using the DCF model, the discount rate plays a crucial role. A higher discount rate will result in a lower present value and thus a lower expected return. Sensitivity analysis, which will be discussed later, can help assess the impact of different assumptions on the expected return. To compute forward-looking expected return and risk accurately, remember that the quality of the inputs is paramount. Therefore, thorough research and due diligence are essential steps in the process. Sourcing reliable data and understanding the drivers of future performance are key to generating meaningful investment projections. The aim is not to predict the future with certainty, but to develop a reasonable range of potential outcomes based on the best available information.

Quantifying Uncertainty: Assessing and Managing Investment Risk

Assessing investment risk goes beyond simply observing historical volatility. To effectively compute forward-looking expected return and risk, investors must employ a range of analytical tools that illuminate potential downsides. Value at Risk (VaR) is one such tool. It estimates the potential loss in value of an investment or portfolio over a specific time period and confidence level. For example, a VaR of 5% over one month suggests there is a 5% chance of losing at least a certain percentage of the portfolio’s value during that month. Understanding VaR helps in setting appropriate risk limits and managing capital allocation.

Stress testing represents another crucial method. It involves simulating extreme market conditions, such as economic recessions or sudden interest rate hikes, to assess the impact on investment portfolios. By subjecting investments to these severe but plausible scenarios, investors can identify vulnerabilities and adjust their strategies accordingly. This proactive approach allows for better preparedness and mitigation of potential losses. Scenario analysis offers a more flexible approach, allowing investors to model a range of potential future outcomes, not just extreme ones. These scenarios can incorporate various factors, including economic growth, inflation, and geopolitical events. By analyzing the potential impact of each scenario on investment returns, investors gain a more comprehensive understanding of the range of possible outcomes. This ultimately aids in making more informed decisions and compute forward-looking expected return and risk with greater accuracy.

These tools—VaR, stress testing, and scenario analysis—complement traditional risk measures like standard deviation. They provide a more nuanced view of potential downside risks and enable investors to develop more robust risk management strategies. Successfully implementing these methods will allow the investor to compute forward-looking expected return and risk in a detailed manner. Understanding the potential downside scenarios is crucial for any investor seeking to achieve long-term investment success. Risk management, when properly implemented, protects capital and enhances the likelihood of achieving investment goals in a volatile world where the ability to compute forward-looking expected return and risk accurately is highly prized.

The Role of Economic and Market Forecasting

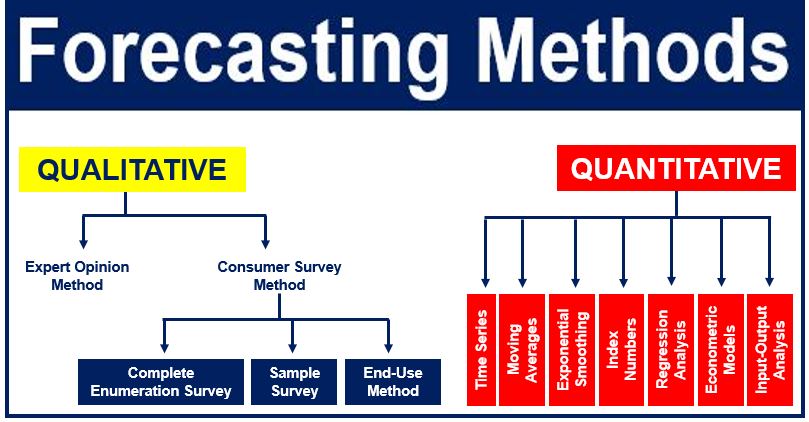

Economic and market forecasts play a crucial role when investors compute forward-looking expected return and risk. These forecasts provide a broader context for understanding potential investment outcomes. Macroeconomic factors, such as interest rates, inflation, and gross domestic product (GDP) growth, can significantly influence company earnings, valuation multiples, and overall market sentiment, all of which are essential to compute forward-looking expected return and risk.

Interest rates, for example, affect borrowing costs for companies and consumers, influencing investment decisions and economic activity. Rising inflation can erode purchasing power, impacting consumer spending and corporate profitability. GDP growth reflects the overall health of the economy, influencing corporate revenue growth and investor confidence. These factors need to be carefully considered to compute forward-looking expected return and risk.

It is important to acknowledge the inherent uncertainties associated with economic and market forecasting. Economic models are simplifications of complex systems, and unforeseen events can significantly alter the course of the economy. Different forecasting models may yield varying projections. Investors should consider a range of potential scenarios when assessing investment opportunities and compute forward-looking expected return and risk. Sensitivity analysis, as discussed later, can help investors understand how changes in macroeconomic assumptions affect investment outcomes. Integrating macroeconomic forecasts with company-specific analysis is vital to compute forward-looking expected return and risk effectively.

Incorporating Qualitative Factors: Beyond the Numbers

Investment analysis often leans heavily on quantitative data, but successful forecasting requires considering qualitative factors. While numbers provide a snapshot of past and present performance, qualitative elements offer insights into a company’s future potential and its ability to navigate challenges. These aspects are inherently more subjective but can significantly influence expected returns and risk profiles. To effectively compute forward-looking expected return and risk, investors must look beyond the spreadsheets and delve into the nuances of a business.

Assessing management quality is paramount. A skilled and ethical leadership team can steer a company through turbulent times and capitalize on opportunities. Consider their track record, communication style, and strategic vision. Look for evidence of integrity and a commitment to long-term value creation. Evaluating a company’s competitive advantages is equally crucial. Does the company possess a unique selling proposition, strong brand recognition, or proprietary technology? These advantages, often referred to as a “moat,” can protect market share and profitability. Understanding industry trends is also vital to compute forward-looking expected return and risk. Is the industry growing, shrinking, or undergoing disruption? Identify the key drivers of change and assess how well-positioned the company is to adapt. Consider regulatory changes, technological advancements, and evolving consumer preferences.

These qualitative factors are harder to quantify than financial metrics, but they should not be ignored. Gathering information from various sources is key. Read company reports, listen to earnings calls, and follow industry news. Seek out independent research and analysis. Engage with management teams when possible. Remember that qualitative analysis is an ongoing process. As circumstances change, reassess your assumptions and adjust your expectations accordingly. While it’s challenging to assign precise numerical values to qualitative factors, consider incorporating them into your investment decision-making process through scenario planning or weighting different factors based on their perceived importance. By combining quantitative and qualitative analysis, investors can develop a more comprehensive and nuanced understanding of potential investments and better compute forward-looking expected return and risk.

Refining Your Investment Outlook: The Value of Sensitivity Analysis

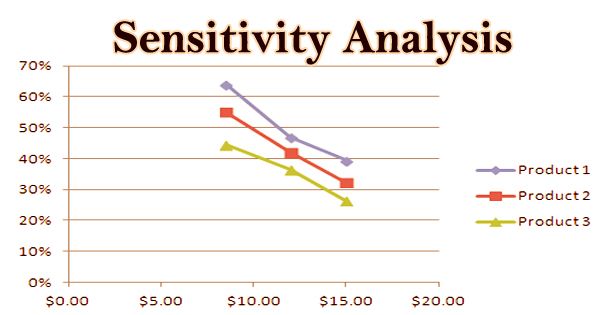

Sensitivity analysis plays a crucial role in refining investment outlooks and understanding the potential range of outcomes. It involves systematically changing key assumptions within your financial model to observe how these changes impact the computed forward-looking expected return and risk. This process helps investors identify the variables that have the most significant influence on their investment projections. By understanding this sensitivity, investors can better prepare for unforeseen events and manage their portfolios more effectively. Sensitivity analysis is not about predicting the future with certainty, but rather about understanding the potential variability of investment outcomes under different scenarios. To compute forward-looking expected return and risk effectively, you need to consider how various factors can influence the results. A well-executed sensitivity analysis helps to stress-test your assumptions and build a more robust investment strategy.

Consider a simple example: Imagine you are evaluating a stock using a discounted cash flow (DCF) model. The model projects future cash flows and discounts them back to their present value. Key assumptions in this model include the growth rate of future cash flows and the discount rate used to calculate the present value. To conduct a sensitivity analysis, you would systematically vary these assumptions, one at a time, and observe the impact on the stock’s estimated intrinsic value. For instance, you might analyze the computed forward-looking expected return and risk, lowering the growth rate by 1% or 2% increments to see how the intrinsic value declines. Similarly, you could increase the discount rate to reflect higher risk. This will give you a range of possible intrinsic values, highlighting the sensitivity of your valuation to these key assumptions.

This type of analysis allows you to compute forward-looking expected return and risk under different conditions, offering a more complete picture of the investment’s potential. Furthermore, it allows for a more nuanced understanding of risk, moving beyond simple volatility metrics. By understanding which assumptions have the biggest impact, you can focus your research efforts on those areas and make more informed investment decisions. Sensitivity analysis is an essential tool for investors seeking to refine their investment outlooks and build more resilient portfolios. It allows one to compute forward-looking expected return and risk more strategically. In practice, software tools can help streamline the sensitivity analysis process, but the underlying principle remains the same: explore how changing your assumptions impacts your investment projections.

Utilizing Investment Analysis Software: A Look at Tools and Resources

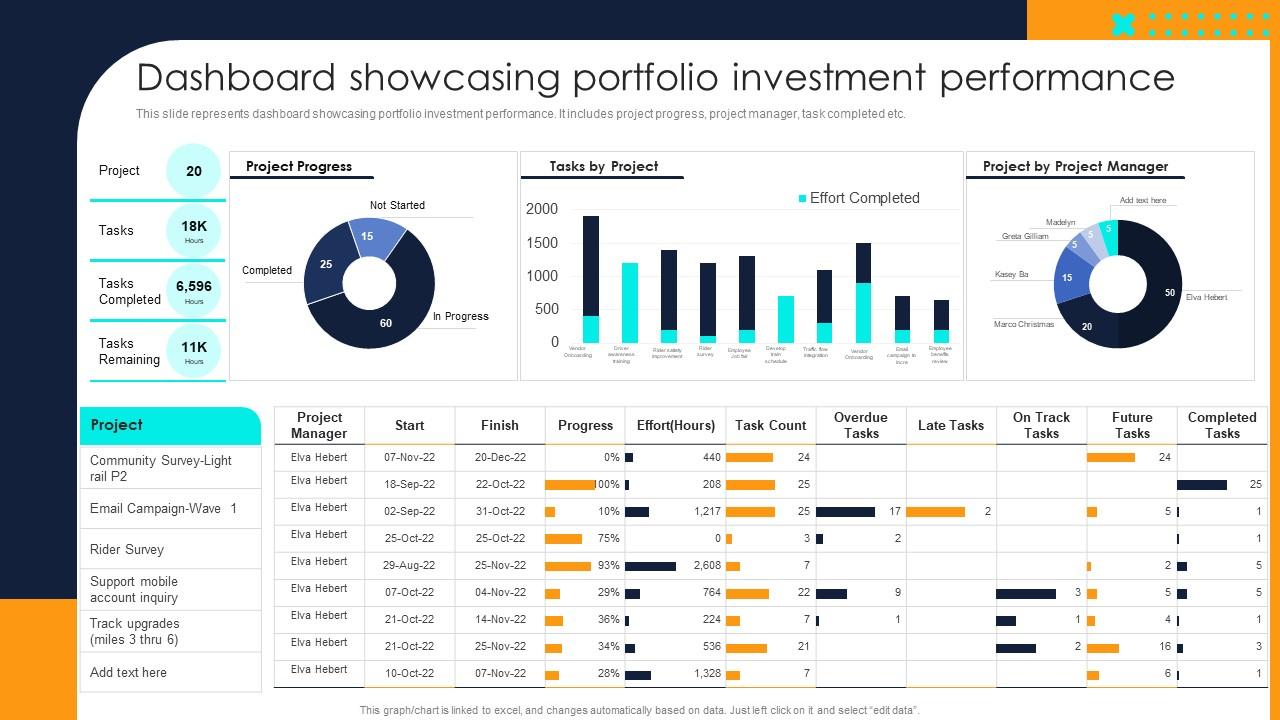

The process to compute forward-looking expected return and risk can be significantly streamlined with the assistance of specialized investment analysis software. While specific endorsements are avoided to maintain timeless relevance, it’s important to acknowledge the general capabilities offered by various platforms. These tools empower investors to more efficiently compute forward-looking expected return and risk. Consider exploring the features of portfolio management systems that offer comprehensive functionalities.

These platforms often excel in data management, allowing users to consolidate and organize vast amounts of financial information. This includes historical price data, company financials, and macroeconomic indicators. Robust data management is crucial for accurate modeling. Financial modeling platforms provide the framework for constructing sophisticated models used to compute forward-looking expected return and risk. These models can incorporate various methodologies. Users can implement discounted cash flow (DCF) analysis, earnings-based valuation, and factor-based models within these platforms. Many also offer pre-built templates and customizable features to adapt to specific investment strategies.

Furthermore, modern investment analysis software frequently incorporates risk analysis tools. These tools extend beyond simple volatility measures, encompassing techniques like Value at Risk (VaR) calculations, stress testing capabilities, and scenario analysis frameworks. These features enable investors to quantify potential downside risks. They also assess the impact of various market conditions on portfolio performance. When selecting software, consider its data integration capabilities, the flexibility of its modeling tools, and the comprehensiveness of its risk analysis features. These platforms can significantly enhance the ability to compute forward-looking expected return and risk, leading to more informed investment decisions and improved portfolio management strategies. The goal is to effectively compute forward-looking expected return and risk. Remember to critically evaluate the outputs and understand the underlying assumptions of any model.

Navigating Market Volatility: Adapting to Changing Conditions

Financial markets are inherently dynamic, demanding constant vigilance and adaptability. It is crucial to regularly review and update investment projections to effectively compute forward-looking expected return and risk. This ongoing assessment ensures investment strategies remain aligned with prevailing market conditions and new information. The initial effort to compute forward-looking expected return and risk serves as a starting point, not a definitive endpoint. Market volatility, influenced by a multitude of factors, necessitates a flexible approach. Investors should embrace the understanding that projections are subject to change as new data emerges and market dynamics evolve. Employing a reactive yet informed approach is paramount for sustained success.

Maintaining flexibility in investment strategies is essential to navigate the unpredictable nature of financial markets. Economic indicators, geopolitical events, and shifts in investor sentiment can all significantly impact asset valuations and expected returns. Proactive monitoring of these influences allows for timely adjustments to portfolio allocations, mitigating potential losses and capitalizing on emerging opportunities. The ability to compute forward-looking expected return and risk in real-time or near real-time becomes invaluable in this environment. It enables investors to quickly reassess the potential impact of market fluctuations on their investments and make informed decisions. Sticking rigidly to outdated projections can prove detrimental, emphasizing the need for continuous refinement.

Forward-looking analysis should be viewed as a continuous process, not a one-time event. As market conditions shift, the assumptions underpinning the initial projections may no longer hold true. Regular re-evaluation allows investors to incorporate new information, refine their models, and adapt their strategies accordingly. This iterative approach enhances the accuracy of expected return and risk assessments and improves the overall effectiveness of investment decision-making. Successfully navigating market volatility requires a commitment to ongoing learning and a willingness to adjust to the ever-changing investment landscape. By actively engaging in the process to compute forward-looking expected return and risk, investors can position themselves to achieve their financial goals, even amidst uncertainty. The continuous cycle of analysis, adaptation, and refinement is crucial for long-term investment success.