Gauging Profitability: What is Return on Invested Capital?

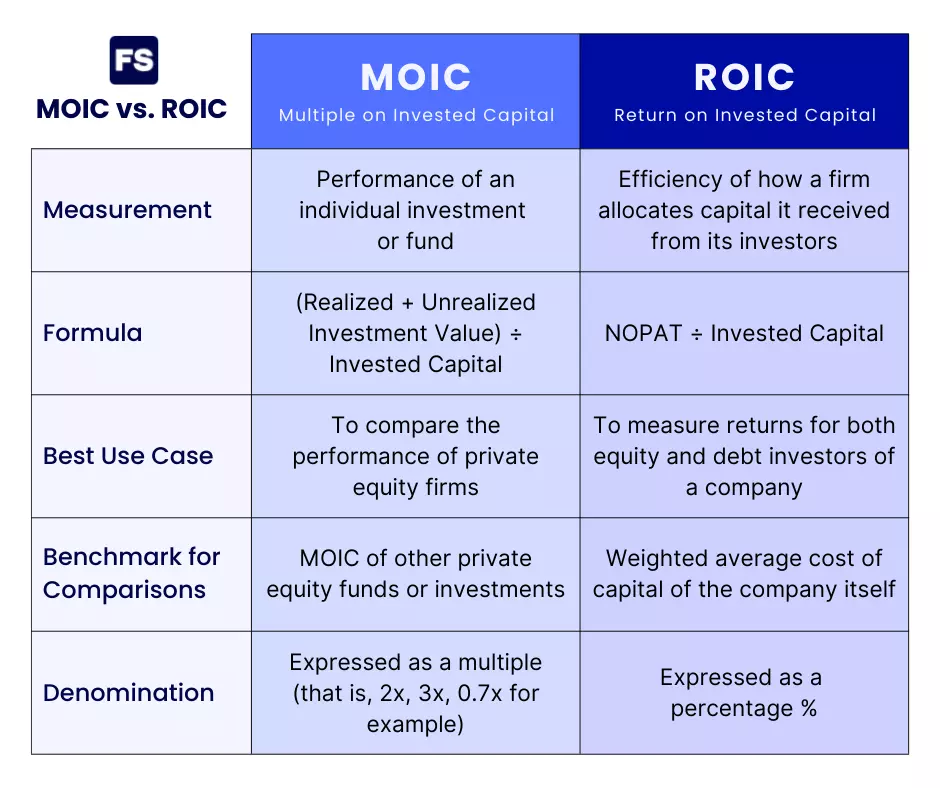

Return on Invested Capital (ROIC) is a crucial financial metric that reveals how efficiently a company utilizes its capital to generate profits. Understanding how to calculate return on invested capital is essential for investors seeking to evaluate a company’s performance. ROIC offers insights into a company’s ability to create value and sustain profitability. It serves as a key indicator of management’s effectiveness in allocating resources. Unlike other profitability ratios, such as Return on Equity (ROE) and Return on Assets (ROA), ROIC provides a more comprehensive view by focusing specifically on the capital invested in the business. While ROE measures the return to shareholders’ equity and ROA assesses profitability relative to total assets, ROIC hones in on the actual capital employed to generate profits. This distinction makes ROIC a powerful tool for comparing companies with different capital structures. Learning how to calculate return on invested capital can significantly improve investment decisions by identifying companies that are not only profitable but also efficient in their capital allocation.

The importance of ROIC lies in its ability to reflect the true economic performance of a company. By considering both the profits generated and the capital invested, ROIC offers a more nuanced understanding of a company’s efficiency. A high ROIC indicates that a company is generating substantial profits relative to its invested capital. This suggests effective management and a strong competitive advantage. Conversely, a low ROIC may signal inefficiencies or poor capital allocation decisions. For investors, understanding how to calculate return on invested capital and interpreting its results is paramount. It allows for a more informed assessment of a company’s financial health and its potential for future growth. ROIC helps investors identify companies that are not only profitable but also capable of sustaining their profitability over the long term. This makes it a valuable tool in making sound investment choices.

To fully appreciate the value of ROIC, it’s important to differentiate it from other commonly used financial ratios. While ROE focuses on the return to equity holders and ROA examines the return on total assets, ROIC provides a more granular view by considering the specific capital invested in operations. This distinction is particularly important when comparing companies with varying levels of debt or different asset compositions. Knowing how to calculate return on invested capital allows investors to compare “apples to apples” when evaluating different investment opportunities. By focusing on the efficiency with which a company generates profits from its invested capital, ROIC offers a unique perspective that complements other financial metrics. Ultimately, mastering how to calculate return on invested capital empowers investors to make more informed and strategic investment decisions, leading to potentially higher returns and reduced risk.

The Formula Unveiled: How to Calculate Return on Invested Capital

To calculate return on invested capital (ROIC), understanding the formula is essential. The basic ROIC formula is: ROIC = Net Operating Profit After Tax (NOPAT) / Invested Capital. This ratio reveals how effectively a company uses its capital to generate profit. The higher the ROIC, the better a company is at converting investments into profits.

NOPAT represents a company’s earnings after accounting for taxes and operating expenses. To calculate NOPAT, start with the operating income, often found on the income statement. Then, adjust for taxes. Specifically, NOPAT = Operating Income * (1 – Tax Rate). This adjustment accounts for the tax shield provided by interest expense. Finding invested capital requires examining the balance sheet. Invested capital can be calculated in a few ways. One common method is to sum up a company’s debt and equity. Another approach involves taking total assets and subtracting current liabilities. Both methods should arrive at a similar figure. Accurately determining NOPAT and invested capital are crucial steps to correctly calculate return on invested capital.

Alternative formulas can offer simplified approaches to calculate return on invested capital. For instance, a simplified version might involve using earnings before interest and taxes (EBIT) instead of meticulously calculating NOPAT. However, these shortcuts can sacrifice accuracy. Using the standard ROIC formula ensures a more precise evaluation of a company’s financial performance. When you calculate return on invested capital, consistency in the chosen method is important for meaningful comparisons across different periods or companies. Remember that to calculate return on invested capital requires careful attention to detail and a solid understanding of financial statements.

Deciphering the Numbers: Calculating NOPAT Accurately

Calculating Net Operating Profit After Tax (NOPAT) is a critical step when you calculate return on invested capital. NOPAT represents a company’s true operating profitability, excluding the effects of financing and accounting decisions. It often requires adjustments to the accounting profit reported on the income statement. The starting point is typically earnings before interest and taxes (EBIT). However, you should not calculate return on invested capital until you have made the needed adjustments.

One crucial adjustment involves interest expense and associated tax shields. Interest expense is tax-deductible, which reduces a company’s tax liability. To accurately reflect operating profitability, the tax savings from interest expense must be added back to EBIT. This is done by multiplying the interest expense by the company’s tax rate and adding the result back to EBIT. For example, if a company has an EBIT of $1 million, interest expense of $100,000, and a tax rate of 30%, the tax shield is $100,000 * 0.30 = $30,000. Therefore, the NOPAT would be calculated as ($1,000,000 – $100,000) * (1-0.30) + $30,000 = $660,000. Other potential adjustments may include adding back non-recurring items or adjusting for accounting distortions. These adjustments ensure that NOPAT accurately reflects the company’s sustainable operating profit, vital to calculate return on invested capital.

Consider a scenario where a company has a significant one-time restructuring charge. This charge would reduce the reported accounting profit but may not reflect the company’s ongoing operating performance. To arrive at a more accurate NOPAT, this restructuring charge should be added back. Similarly, if a company has significant gains or losses from the sale of assets, these should also be excluded when you calculate return on invested capital, as they are not part of the core operating activities. Accurate NOPAT calculation is essential for investors. It allows for a more precise assessment of a company’s ability to generate profits from its operations. This, in turn, allows for a more informed investment decision. Always scrutinize the income statement and related disclosures to identify items that may require adjustment when you calculate return on invested capital and determine NOPAT accurately.

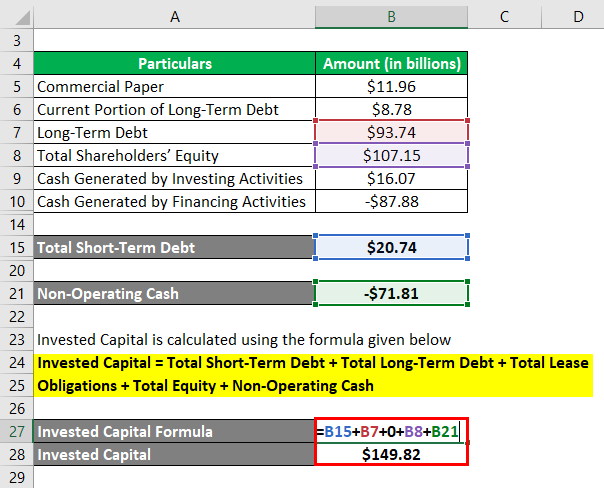

Pinpointing Investment: Determining Invested Capital

Calculating Invested Capital is a critical step in the ROIC calculation. It represents the total amount of capital a company has deployed to generate profits. There are several approaches to determine Invested Capital, and consistency is key when comparing companies or tracking performance over time. One common method involves subtracting current liabilities from total assets. This approach reflects the idea that current liabilities are typically funded by operating activities, not by investors. Another approach is to sum debt and equity, representing the capital provided by creditors and shareholders. Understanding how to calculate return on invested capital starts with a clear grasp of invested capital itself.

Several challenges can arise when identifying which assets and liabilities to include in Invested Capital. For example, the treatment of goodwill can be complex. Some analysts argue that goodwill should be included because it represents a portion of the purchase price of acquired companies and reflects an investment made to generate future profits. Others may exclude it, particularly if they believe it is not generating adequate returns. Similarly, deferred taxes can be a source of debate. Deferred tax assets arise from temporary differences between accounting and tax treatment of certain items, while deferred tax liabilities arise when taxable income is higher than accounting profit. The decision to include or exclude these items depends on the analyst’s judgment and the specific circumstances of the company. To accurately calculate return on invested capital, it’s important to examine these elements.

Regardless of the approach used, transparency and consistency are paramount. Companies should clearly disclose how they calculate Invested Capital in their financial reports. When comparing companies, it’s essential to ensure that they are using similar methodologies. If not, adjustments may be necessary to ensure a fair comparison. Analyzing the components of Invested Capital can also provide valuable insights into a company’s capital structure and its financing decisions. Paying close attention to these details will result in a more reliable analysis of how to calculate return on invested capital and its implications for investment decisions. By carefully pinpointing investments made, analysts gain a clearer picture of a company’s true profitability and capital efficiency.

Beyond the Formula: Interpreting ROIC for Investment Decisions

Interpreting the Return on Invested Capital (ROIC) ratio is crucial for sound investment decisions. While calculating ROIC provides a numerical value, understanding what that value signifies in the context of a specific company and industry is essential. A solitary ROIC figure, without context, offers limited insight. To effectively use ROIC, investors must consider benchmarks, industry averages, and the company’s cost of capital.

What constitutes a “good” ROIC varies considerably across different sectors. Capital-intensive industries, such as manufacturing or energy, may naturally exhibit lower ROICs compared to technology or service-based businesses. Therefore, comparing a company’s ROIC to its direct competitors within the same industry is vital. Industry averages can serve as valuable benchmarks, providing a sense of what is typical performance. However, simply exceeding the industry average doesn’t automatically qualify a company as a stellar investment. To effectively calculate return on invested capital is a powerful way to compare companies. Furthermore, a consistently high ROIC over several years signals a company’s ability to generate sustainable profits from its investments. This long-term perspective is particularly important for investors seeking stable, growing businesses.

A key consideration is comparing the ROIC to the company’s cost of capital. The cost of capital represents the minimum return a company must earn on its investments to satisfy its investors (both debt and equity holders). If a company’s ROIC is consistently higher than its cost of capital, it indicates that the company is creating value for its shareholders. Conversely, if the ROIC is lower than the cost of capital, the company is essentially destroying value. To calculate return on invested capital effectively requires a deep understanding of the business and its financial dynamics. A high ROIC combined with a low cost of capital suggests a company is efficiently allocating resources and generating attractive returns for its investors. This comparison is arguably more meaningful than simply looking at the absolute ROIC value or comparing it to arbitrary benchmarks. By factoring in the cost of capital, investors gain a clearer picture of whether a company’s investments are truly profitable and value-creating.

Elevating Insight: Using ROIC to Compare Companies

Return on Invested Capital (ROIC) serves as a powerful tool for comparing the performance of companies, particularly those within the same industry. It offers a standardized measure of profitability relative to the capital invested, allowing investors and analysts to assess which companies are most efficiently utilizing their resources to generate returns. Unlike metrics such as earnings per share (EPS), which can be influenced by factors like share buybacks or accounting practices, ROIC provides a more fundamental view of a company’s underlying operational efficiency. To effectively calculate return on invested capital is crucial for accurate comparison.

One of the key advantages of using ROIC for comparison lies in its ability to normalize for differences in capital structure. Companies with varying levels of debt, for example, may exhibit different levels of profitability based on metrics like Return on Equity (ROE). ROIC, by focusing on the return generated from total invested capital (both debt and equity), provides a more level playing field for comparing companies with different financing strategies. Furthermore, ROIC can help identify companies with a sustainable competitive advantage. Companies that consistently generate higher ROIC than their peers are likely to possess some form of competitive edge, such as a strong brand, proprietary technology, or efficient operations. Investors can use these insights to make informed decisions about which companies are best positioned for long-term success. Learning how to accurately calculate return on invested capital will improve comparison analysis.

Despite its many benefits, it’s important to acknowledge the limitations of ROIC when making comparisons. ROIC is a backward-looking metric, reflecting past performance rather than future potential. It can also be influenced by accounting policies and one-time events, which can distort the true picture of a company’s profitability. To mitigate these limitations, it’s essential to consider ROIC in conjunction with other financial metrics and qualitative factors, such as management quality, industry trends, and competitive landscape. It’s also important to consider that accurately calculate return on invested capital depends on precise and reliable financial data. Industry-specific nuances should be taken into account as well, since what constitutes a “good” ROIC can vary significantly across different sectors.

Strategic Application: How ROIC Drives Value Creation

Return on Invested Capital (ROIC) serves as a powerful tool for companies striving to improve operational efficiency and generate shareholder value. A higher ROIC indicates a company is effectively deploying capital to generate profits, leading to increased investor confidence and a higher valuation. Strategies aimed at boosting ROIC often involve a multifaceted approach, addressing both profitability and capital efficiency. To effectively calculate return on invested capital, companies must first accurately determine both their Net Operating Profit After Tax (NOPAT) and Invested Capital.

One key strategy for increasing ROIC is improving profit margins. This can be achieved through various initiatives, such as streamlining operations, reducing costs, and implementing effective pricing strategies. Companies may focus on optimizing their supply chains, negotiating better deals with suppliers, and improving production processes to minimize waste and maximize output. Investing in research and development to create innovative products or services with higher profit margins can also significantly impact ROIC. Furthermore, reducing capital expenditures can substantially improve ROIC. Companies can carefully evaluate new investment opportunities, prioritize projects with the highest potential returns, and explore alternative financing options to minimize the amount of capital required. Efficiently managing existing assets and optimizing their utilization is also crucial. Companies might consider leasing assets instead of purchasing them outright or divesting underperforming assets to free up capital for more productive uses. It’s important to consistently calculate return on invested capital to monitor the effects of these capital expenditures.

Optimizing working capital management is another critical area for enhancing ROIC. Efficiently managing inventory, accounts receivable, and accounts payable can free up significant amounts of capital that can be reinvested in the business or returned to shareholders. For example, implementing just-in-time inventory management systems can reduce the amount of capital tied up in inventory. Similarly, improving collection processes and offering incentives for early payment can reduce the amount of capital tied up in accounts receivable. Extending payment terms with suppliers can also free up capital in the short term. Many companies calculate return on invested capital frequently to track the performance. Consider a retailer that improved its inventory management system, reducing its inventory holding period by 20%. This freed up a significant amount of capital, which was then used to invest in new store openings, leading to increased revenue and higher ROIC. By focusing on these key areas, companies can strategically improve their ROIC and create lasting value for shareholders.

Real World Scenarios: ROIC Calculation in Practice

To illustrate how to calculate return on invested capital, consider Company A, a manufacturing firm. Its income statement reveals a net income of $50 million, interest expense of $10 million, and a tax rate of 25%. The balance sheet shows total assets of $200 million and current liabilities of $50 million. To calculate return on invested capital, we first need to determine NOPAT. We start with net income and add back interest expense, adjusted for the tax shield. The interest tax shield is calculated as interest expense multiplied by the tax rate ($10 million * 25% = $2.5 million). NOPAT is therefore $50 million + $10 million – $2.5 million = $57.5 million.

Next, we determine invested capital. Using the formula of total assets minus current liabilities, invested capital is $200 million – $50 million = $150 million. Now, we calculate return on invested capital by dividing NOPAT by invested capital: $57.5 million / $150 million = 0.383 or 38.3%. This indicates that for every dollar of invested capital, Company A generates 38.3 cents in profit. Consider Company B, a technology company. Its net income is $75 million, with no interest expense, and a tax rate of 20%. Total assets are $300 million, and current liabilities are $100 million. Since there’s no interest expense, NOPAT is simply net income adjusted for taxes. NOPAT equals $75 million. Invested capital is $300 million – $100 million = $200 million. The return on invested capital calculation is $75 million / $200 million = 0.375 or 37.5%. Even though Company B has a higher net income, its return on invested capital is slightly lower than Company A’s due to its higher invested capital base.

Finally, let’s examine Company C, a retail chain. Its net income is $30 million, interest expense is $5 million, and the tax rate is 30%. Total assets are $150 million, and current liabilities are $40 million. The interest tax shield is $5 million * 30% = $1.5 million. NOPAT is $30 million + $5 million – $1.5 million = $33.5 million. Invested capital is $150 million – $40 million = $110 million. The return on invested capital calculation is $33.5 million / $110 million = 0.305 or 30.5%. These examples demonstrate how to calculate return on invested capital across different industries, considering factors like interest expense, tax rates, and varying levels of assets and liabilities. Accurately calculate return on invested capital requires careful attention to the details in the financial statements and understanding how different components impact the final ratio. By learning how to calculate return on invested capital, investors may compare companies to see which one can most efficiently turn investment into profits.