Understanding Treasury Bill Maturity

Treasury Bills, commonly known as T-bills, represent short-term debt obligations backed by the full faith and credit of the U.S. government. These instruments are popular among investors seeking a safe and liquid way to preserve capital and earn a modest return over a short period. T-bills are sold at a discount to their face value, and the investor receives the face value at maturity. A crucial aspect of T-bills is their maturity date. This is the date on which the principal amount of the T-bill is repaid to the investor. Knowing how to check t-bill maturity date is very important.

The maturity date signifies the end of the investment term and the point at which you regain access to your invested funds. For effective investment planning, tracking the maturity date is essential. It allows you to anticipate when your funds will become available. It also enables you to make informed decisions about reinvesting the proceeds or allocating them to other financial goals. Understanding how to check t-bill maturity date ensures you’re always aware of your investment timeline.

Failing to monitor the maturity date can lead to missed opportunities or unexpected surprises. For example, you might need the funds for a specific purpose and be unaware that the T-bill has already matured. Similarly, you might want to reinvest the proceeds promptly to maintain your investment strategy. Knowing how to check t-bill maturity date prevents these oversights. It empowers you to proactively manage your T-bill investments. This is a key component of successful financial planning. Investors should always be aware of how to check t-bill maturity date.

Accessing Your TreasuryDirect Account

To effectively manage your Treasury Bills (T-bills) and understand how to check t-bill maturity date, the initial step involves accessing your TreasuryDirect account. This secure online portal, maintained by the U.S. Department of the Treasury, provides a direct interface for managing your T-bill investments. Begin by navigating to the official TreasuryDirect.gov website. Ensure that the connection is secure, indicated by “https” in the address bar and a padlock icon, to protect your sensitive financial information. This is a crucial security measure when dealing with government financial platforms.

Upon reaching the TreasuryDirect website, locate the login section. You will be prompted to enter your designated username or email address, along with your password. It’s important to use a strong, unique password for your TreasuryDirect account to safeguard against unauthorized access. Consider utilizing a password manager to generate and store complex passwords securely. After entering your credentials, you may encounter a two-factor authentication (2FA) step. This security measure adds an extra layer of protection by requiring a verification code from your registered device, such as a smartphone or email address. Follow the on-screen instructions to complete the 2FA process. This might involve entering a code sent via SMS, email, or generated by an authenticator app. Successfully completing this step grants you access to your TreasuryDirect account, where you can proceed to find how to check t-bill maturity date.

Once logged in, familiarize yourself with the TreasuryDirect dashboard. This central hub provides an overview of your holdings and account activity. From here, you can navigate to sections that display your purchased T-bills and their respective details. Regularly accessing and reviewing your account not only allows you to track your investments but also ensures you stay informed about upcoming maturity dates. Knowing how to check t-bill maturity date allows you to proactively plan for reinvestment or other financial strategies. The TreasuryDirect platform is designed to provide investors with the necessary tools to manage their T-bill investments effectively and securely, providing a clear path on how to check t-bill maturity date.

How to Check T-Bill Maturity Date Within TreasuryDirect

To effectively manage your investments, knowing how to check t-bill maturity date is essential. If you purchased your Treasury Bills (T-bills) directly through TreasuryDirect, the process for finding the maturity date is straightforward. First, ensure you are logged into your TreasuryDirect account. This involves navigating to the TreasuryDirect.gov website and entering your registered username or email address and password. You may also need to complete a two-factor authentication process for added security.

Once logged in, you’ll need to locate the section of the website that displays your holdings. This is commonly labeled as “My Securities” or “Holdings.” Click on this section to view a list of all the securities you currently own through TreasuryDirect. The list will include each T-bill you’ve purchased. To find how to check t-bill maturity date for a specific T-bill, simply locate that T-bill within the list. Information about each T-bill is displayed alongside it, including the issue date, interest rate (if applicable), and, most importantly, the maturity date. The maturity date is typically displayed clearly, often in a format like MM/DD/YYYY.

Carefully review the displayed maturity date to ensure accurate record-keeping. Consider adding this date to your personal calendar or setting a reminder to track when the T-bill will mature. Knowing how to check t-bill maturity date and taking proactive steps will help you manage your finances effectively. The TreasuryDirect website provides a user-friendly interface for accessing this crucial information. By regularly checking your holdings and noting the maturity dates, you can ensure a smooth process when your funds become available, allowing you to reinvest or utilize the funds as needed. This proactive approach to managing your T-bill investments contributes to sound financial planning. Remember to securely store your login credentials to protect your account and facilitate easy access to your T-bill maturity date information whenever required.

Checking Your T-Bill Details Through Brokerage Statements

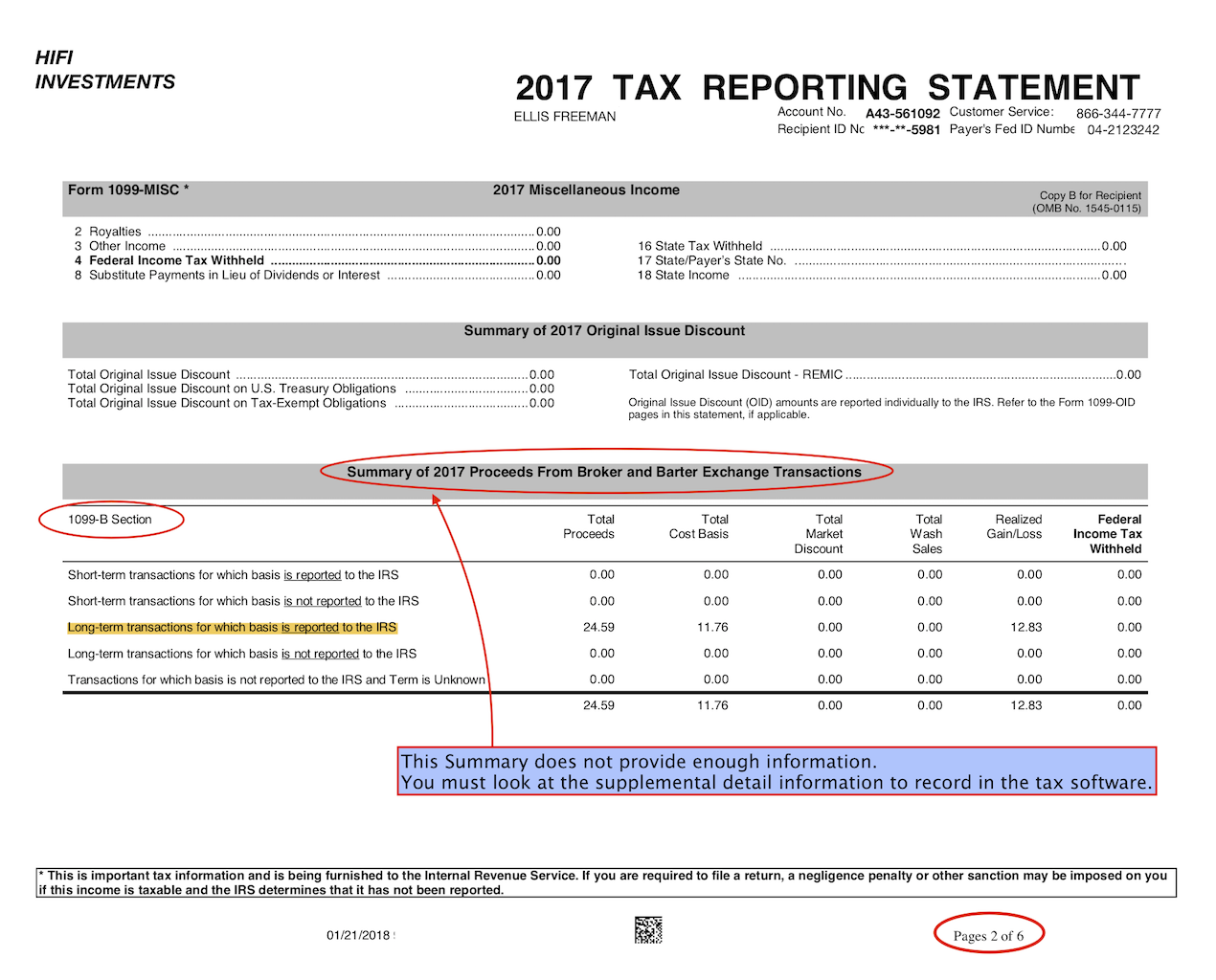

For those investors wondering how to check t-bill maturity date and who purchased Treasury Bills through a brokerage account, such as Fidelity or Schwab, locating the maturity date is generally straightforward. Brokerage firms provide account statements that summarize your holdings and transactions. These statements are typically available online, offering a convenient way to monitor your investments. The process to find the maturity date will slightly vary depending on the specific brokerage firm you use, but the general principle remains consistent.

To check t-bill maturity date, navigate to the section of your brokerage account statement that lists your fixed income or bond holdings. Brokerage statements often categorize investments by type, making it easier to find your T-bills. Once you have located the fixed income section, look for your Treasury Bill holdings. The description of each T-bill should include key information, such as the purchase date, the CUSIP number (a unique identifier for the security), the face value, and, most importantly, the maturity date. The maturity date indicates the day on which the T-bill will mature, and the principal amount will be returned to you. Reviewing your brokerage statements regularly is a vital part of managing your investments. It allows you to track performance, identify any discrepancies, and stay informed about upcoming maturity dates. This proactive approach ensures you are prepared to reinvest the proceeds or utilize the funds as needed.

The location of the maturity date on a brokerage statement can vary in formatting and presentation. Some brokerages clearly label the maturity date with a specific heading, while others might include it within a more detailed description of the T-bill. If you are having trouble locating the information, most brokerage firms offer search functionality within their online platforms. Try searching for terms like “maturity date,” “T-bill,” or the CUSIP number of your Treasury Bill. Furthermore, brokerage firms typically provide customer support services to assist you with any questions about your account statements or holdings. Do not hesitate to contact your brokerage firm directly if you require assistance in finding the maturity date of your T-bills. Knowing how to check t-bill maturity date enables you to make informed decisions about your investment strategy and financial planning. Regularly checking your statements will help avoid surprises and ensure a smooth process when your T-bills mature.

Decoding Confirmation Documents: A Crucial Step in Knowing How to Check T-Bill Maturity Date

The purchase confirmation document serves as a critical record for understanding your Treasury bill investment. This document, received immediately after purchasing a T-bill, whether directly through TreasuryDirect or via a brokerage, contains essential information. It provides a detailed summary of the transaction. You will find the purchase date clearly listed. The document also displays the unique identifier for your specific T-bill, known as the CUSIP number. This number is vital for tracking your investment and ensuring you know how to check t-bill maturity date across different platforms. The confirmation also specifies the quantity of T-bills purchased and, importantly, the maturity date itself. Keeping these documents organized is essential for efficient financial management.

Understanding the information within the confirmation document is key to successful T-bill investing. The purchase date helps you track the duration of your investment. The CUSIP number helps identify the T-bill uniquely. This number can be used to check the maturity date across multiple financial platforms. Knowing the quantity of T-bills you own ensures accurate accounting. The maturity date, perhaps the most critical information, dictates when your investment will mature and your funds become available. You can easily see how to check t-bill maturity date using this document. This date should be prominently featured and easy to find within your confirmation. Therefore, properly storing your confirmation document ensures easy access to all relevant information regarding your T-bill investment, simplifying the process of knowing how to check t-bill maturity date and managing your finances effectively.

Remember, retaining these confirmation documents is crucial for accurate record-keeping. This allows for easy reference when you need to find information about your T-bills. Having access to this documentation simplifies the process of how to check t-bill maturity date, and reduces the potential for any confusion or delays. The information provided on these documents is invaluable, offering a comprehensive overview of your investment details. It significantly improves your understanding of how to check t-bill maturity date and allows for smooth and timely management of your financial portfolio. By keeping this document readily available, investors are well-equipped to manage their treasury bills efficiently and effectively plan for their maturity.

Understanding the CUSIP Number and Its Role

The CUSIP number, short for Committee on Uniform Securities Identification Procedures number, serves as a unique identifier for each Treasury Bill (T-bill). This alphanumeric code distinguishes one T-bill from another, much like a serial number. Understanding the CUSIP number is crucial when learning how to check T-bill maturity date information.

Each T-bill issuance has its own distinct CUSIP. This allows investors and financial institutions to easily track and manage their holdings. When you purchase a T-bill, the confirmation document will always display the CUSIP number. This number is essential for finding specific details about your investment. These details include, most importantly, the maturity date. Investors seeking to learn how to check T-bill maturity date efficiently often rely on the CUSIP.

You can leverage the CUSIP number to find information about your T-bill using various financial tools. These tools are typically available through your brokerage account. Most brokerage platforms have search functions where you can input the CUSIP. Upon entering the CUSIP, the system will display key details about the T-bill. These details includes the issuer (U.S. Treasury), the interest rate (if any, though T-bills are typically sold at a discount), and, crucially, the maturity date. Knowing how to check T-bill maturity date is simplified by using the CUSIP. Investors can also use financial websites and data providers. These platforms often allow you to search for fixed-income securities using the CUSIP. Regular monitoring and knowing how to check T-bill maturity date ensures that you are always aware of when your funds will become available. This helps integrate the maturity date into overall financial planning.

What Happens on the Maturity Date

Understanding what transpires on the maturity date of your Treasury Bills (T-bills) is crucial for effective financial planning. When the T-bill reaches its maturity date, the investor receives the face value of the bill. This process differs slightly depending on whether the T-bill was purchased through TreasuryDirect or a brokerage account. Knowing how to check t-bill maturity date will also help you understand this process.

For T-bills held within a TreasuryDirect account, the principal amount is typically deposited directly into the bank account linked to your TreasuryDirect profile. This process is generally seamless and occurs automatically on the maturity date. It’s advisable to ensure your bank account information on TreasuryDirect is current to avoid any delays or complications in receiving your funds. Understanding how to check t-bill maturity date helps in anticipating this deposit and planning accordingly.

If you acquired your T-bills through a brokerage account, the funds are credited to your account’s cash balance on the maturity date. From there, you have several options. You can reinvest the proceeds into new T-bills, explore other investment opportunities available through your brokerage, or simply withdraw the funds. Many investors use maturing T-bill funds to ladder into new short-term investments, ensuring a continuous stream of returns. Knowing how to check t-bill maturity date empowers you to make informed decisions about reinvesting or utilizing these funds. You can reinvest the funds into another T-bill or explore other financial opportunities. It’s essential to consider your investment goals and risk tolerance when deciding how to allocate these funds.

Planning for T-Bill Maturity: Avoiding Surprises

Tracking your Treasury Bill (T-bill) maturity dates is crucial for effective financial planning. Knowing how to check t-bill maturity date proactively prevents unexpected events and ensures a seamless transition for your funds. Incorporating T-bill maturities into your broader financial strategy allows for informed decision-making and optimized investment management. Setting reminders or calendar alerts before the maturity date is a practical step. This helps you review your investment options and adjust your plan as needed.

Ignoring the maturity date can lead to missed opportunities. For example, you might want to reinvest the proceeds into new T-bills or explore other investment avenues. By actively monitoring your T-bill maturities, you gain greater control over your assets. You also ensure that your investment strategy aligns with your financial goals. Regular reviews also allow you to assess whether your current investment mix still suits your risk tolerance and time horizon. Learning how to check t-bill maturity date is an investment in your overall financial well-being.

Consider the benefits of integrating T-bill maturity dates into your financial calendar. This simple practice can significantly enhance your financial awareness and decision-making. When you know how to check t-bill maturity date, you are empowered to make timely adjustments. You can take advantage of market conditions or changes in your personal circumstances. Tracking maturity dates is not just about knowing when your funds become available. It’s about actively managing your investments to achieve your long-term financial objectives. This proactive approach minimizes surprises. It also maximizes the potential benefits of your T-bill investments. By actively knowing how to check t-bill maturity date, you are taking control of your financial future.