Understanding the Essence of Borrowing Costs

The before-tax cost of debt represents the cost a company incurs for borrowing funds, expressed as a percentage before considering the impact of taxes. It is a crucial metric in financial decision-making, serving as a benchmark for evaluating the profitability of potential investments and projects. Companies need to understand how to calculate the before tax cost of debt because it directly influences their capital structure decisions. A lower cost of debt allows a company to take on more debt financing, potentially increasing returns to shareholders, but also increasing financial risk. Understanding how to calculate the before tax cost of debt is therefore vital.

The before-tax cost of debt plays a pivotal role in assessing a project’s Return on Investment (ROI). If a project’s expected return does not exceed the cost of debt, it may not be financially viable. Furthermore, this metric is essential for determining a company’s overall value. When evaluating how to calculate the before tax cost of debt, investors and analysts use it as an input in valuation models to discount future cash flows, ultimately impacting the perceived worth of the business. Knowing how to calculate the before tax cost of debt allows companies to make informed choices about raising capital and investing in growth opportunities.

In essence, understanding how to calculate the before tax cost of debt is not merely an academic exercise. It’s a fundamental aspect of sound financial management. It allows companies to strategically allocate capital, optimize their financial structure, and enhance shareholder value. Without a clear understanding of borrowing costs, businesses risk making suboptimal decisions that could negatively affect their long-term financial health. This metric provides a vital foundation for assessing financial performance and making strategic decisions that can significantly impact a company’s success. Therefore, accurately determining how to calculate the before tax cost of debt and applying it effectively are crucial for financial prosperity and strategic decision making.

The Nuances of Interest Rate and Yield to Maturity

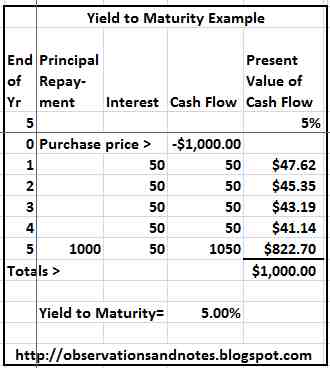

Understanding how to calculate the before tax cost of debt requires a clear distinction between the interest rate and the yield to maturity (YTM). The interest rate, often called the coupon rate for bonds, represents the periodic payment a borrower makes to the lender, expressed as a percentage of the face value of the debt. The yield to maturity, conversely, is a more comprehensive measure. It represents the total return an investor anticipates receiving if they hold the debt instrument until it matures. This calculation considers the current market price, par value, coupon interest rate, and time to maturity. These concepts are foundational for understanding how to calculate the before tax cost of debt.

The connection between these concepts and the before-tax cost of debt is direct. The interest rate directly influences the periodic cash outflows for the company. The yield to maturity is a market-driven indicator reflecting the cost of debt to the issuer, considering the prevailing market conditions and the debt’s risk profile. How to calculate the before tax cost of debt often involves analyzing the YTM as a more accurate representation of the actual borrowing cost, especially for bonds traded in the secondary market. A higher YTM suggests a higher cost of debt for the company.

Furthermore, the coupon rate significantly impacts a bond’s price in the market. When the coupon rate is higher than the prevailing market interest rates for similar bonds, the bond trades at a premium. This means its market price is higher than its face value. Conversely, if the coupon rate is lower than the market rate, the bond trades at a discount, with its market price below the face value. This inverse relationship is crucial when considering how to calculate the before tax cost of debt. The market price, reflecting these premium or discount scenarios, is a key input in determining the yield to maturity and, consequently, the true cost of borrowing for the company. Therefore, accurately assessing market dynamics is vital to understand how to calculate the before tax cost of debt. Companies should monitor these rates closely to make well-informed financial decisions. Understanding these factors is essential for anyone looking into how to calculate the before tax cost of debt.

A Step-by-Step Approach: Calculating the Pre-Tax Debt Cost

Calculating the before-tax cost of debt is a critical step in financial analysis. It allows companies to understand the true cost of borrowing funds. This understanding is vital for capital structure decisions and project evaluation. To effectively illustrate how to calculate the before tax cost of debt, a systematic approach is necessary. This approach involves gathering key data points and applying the appropriate formulas. The following steps outline this process in detail.

First, identify the necessary data. This includes the interest payments, which are the periodic payments made to debt holders. The face value, or par value, of the debt is also required. This is the amount the borrower will repay at maturity. The current market price of the debt is another essential piece of information. This is the price at which the debt is currently trading in the market. Different types of corporate debt exist, ranging from bonds to loans. Bonds are typically issued to the public and have a standardized structure. Loans, on the other hand, are usually obtained from banks or other financial institutions and can be customized to meet the borrower’s needs. Understanding the specific characteristics of the debt instrument is crucial for accurately calculating the before tax cost of debt. For bonds, the yield to maturity (YTM) is often used as an estimate of the before-tax cost of debt. YTM represents the total return an investor can expect to receive if they hold the bond until it matures. It considers the bond’s current market price, face value, coupon interest rate, and time to maturity. Several methods can be employed to determine YTM, including using financial calculators or spreadsheet software. For loans, the interest rate specified in the loan agreement typically represents the before-tax cost of debt. However, it’s important to consider any fees or other costs associated with the loan, as these can impact the effective cost of borrowing.

Once the necessary data is collected, calculate the before tax cost of debt. For bonds, this often involves determining the Yield to Maturity (YTM). The YTM can be approximated using the following formula: YTM = (Annual Interest Payment + (Face Value – Current Market Price) / Years to Maturity) / ((Face Value + Current Market Price) / 2). This formula provides an estimated before-tax cost of debt. Financial calculators or spreadsheet functions like Excel’s RATE function offer more precise calculations. For loans, the stated interest rate provides the initial before-tax cost of debt. However, consider any additional fees or charges associated with the loan. These costs should be added to the interest payments to determine the total cost of borrowing. Divide the total cost by the loan amount to arrive at the effective before-tax cost of debt. Understanding how to calculate the before tax cost of debt is essential for making informed financial decisions. By following these steps, companies can accurately assess their borrowing costs and make strategic choices about their capital structure and investment opportunities.

Illustrative Examples: Bringing the Calculation to Life

To effectively illustrate how to calculate the before tax cost of debt, let’s consider a few practical examples. These scenarios will demonstrate the calculation process under varying conditions, such as different interest rates, coupon payment frequencies, and current market prices. These examples will clarify how to calculate the before tax cost of debt in different situations.

Example 1: Bond with Annual Coupon Payments Imagine “TechForward Inc.” has a bond outstanding with a face value of $1,000. It has an annual coupon rate of 6%, meaning it pays $60 in interest each year. The bond is currently trading in the market for $950. To calculate the before tax cost of debt, we can approximate it using the current yield. The current yield is calculated as annual interest payment divided by the current market price: $60 / $950 = 0.0632, or 6.32%. This provides a quick estimate of how to calculate the before tax cost of debt. A more precise calculation would involve finding the yield to maturity (YTM), which considers the time value of money and the difference between the purchase price and the face value at maturity. The YTM can be found using financial calculators or spreadsheet software. Using a financial calculator, the YTM is approximately 6.85% which is more accurate to calculate the before tax cost of debt.

Example 2: Loan with Quarterly Interest Payments Now, let’s consider a different scenario. “Global Innovations Ltd.” secures a bank loan of $500,000 at a stated annual interest rate of 8%, with interest payments made quarterly. The effective quarterly interest rate is 8%/4 = 2%. The quarterly interest payment is $500,000 * 0.02 = $10,000. Since this is a loan, there isn’t a market price to consider as with a bond. The before tax cost of debt is simply the annual interest rate of 8%. It is vital to consider how interest payment frequencies impact the overall cost. If Global Innovations Ltd. also incurred $5,000 in loan origination fees (flotation costs), these costs can be amortized over the life of the loan, increasing the effective cost of borrowing. To accurately calculate the before tax cost of debt including the flotation costs, you would need to factor those costs into the effective interest rate calculation, slightly increasing the 8% rate. These examples highlight the practical steps involved in how to calculate the before tax cost of debt under diverse financial scenarios.

Navigating the Impact of Flotation Costs

Flotation costs represent the expenses incurred when issuing new debt. These costs reduce the net amount a company receives from borrowing. Understanding how to incorporate these costs into the calculation of the before-tax cost of debt is crucial for obtaining a true reflection of borrowing expenses. Key flotation costs include underwriting fees paid to investment banks, legal expenses, and accounting fees. These costs directly impact the effective interest rate, increasing the overall cost of borrowing. To accurately calculate the before-tax cost of debt considering flotation costs, one must adjust the net proceeds received. This involves subtracting the total flotation costs from the gross proceeds of the debt issuance. The adjusted net proceeds then form the basis for calculating the yield to maturity, reflecting the true cost of borrowing and providing a more realistic representation of the debt’s cost.

For example, if a company issues a bond with a face value of $1,000,000 and incurs flotation costs of $20,000, the net proceeds received are $980,000. This reduced amount is used when calculating the yield to maturity, thereby incorporating the impact of the flotation costs. The formula for calculating the before-tax cost of debt, when considering flotation costs, remains largely similar but uses the net proceeds in place of the face value or market price. This adjustment ensures a more precise calculation of how to calculate the before tax cost of debt, crucial for accurate financial planning and decision-making. Ignoring these costs can lead to underestimating the true cost of capital, affecting investment appraisal and potentially leading to flawed business decisions.

Different types of debt incur varying flotation costs. Bonds typically have higher flotation costs than bank loans due to the complexities of public offerings and regulatory requirements. The specific flotation costs will depend on factors such as the company’s credit rating, the size of the debt issuance, and prevailing market conditions. How to calculate the before tax cost of debt accurately therefore requires diligent estimation and inclusion of all relevant flotation costs. This ensures a comprehensive understanding of the true financial burden associated with debt financing, enabling better informed strategic decisions. A thorough analysis of flotation costs is essential for a precise calculation of the before-tax cost of debt, a critical element in financial modeling and resource allocation within a company. The process of determining these costs involves examining previous issuance details or consulting with investment bankers for estimates based on the current market environment.

How to Determine the Interest Rate on a Loan

Determining the interest rate on a loan is a crucial step in understanding how to calculate the before-tax cost of debt. Several factors influence this rate. Lenders typically use a base rate, often the prime rate, and add a margin. This margin reflects the borrower’s creditworthiness. A borrower with a higher credit rating, indicating lower risk, will typically secure a smaller margin, resulting in a lower overall interest rate. Conversely, a borrower with a lower credit rating will face a larger margin and a higher interest rate. This is because lenders perceive a greater risk of default. Understanding these dynamics is vital when calculating the before-tax cost of debt for any financial planning.

The choice between fixed and variable interest rates significantly impacts the cost of borrowing. Fixed-rate loans offer predictability. The interest rate remains constant throughout the loan term. This stability simplifies financial planning, especially important when calculating how to calculate the before-tax cost of debt, as it eliminates uncertainty around future interest payments. Variable-rate loans, on the other hand, adjust periodically based on market benchmarks like the prime rate or LIBOR. This flexibility offers potential advantages in low-interest-rate environments but introduces uncertainty into the long-term cost of borrowing. The choice between fixed and variable rates significantly affects the overall cost calculation and its predictability.

Credit rating agencies like Moody’s and S&P play a critical role in determining a borrower’s creditworthiness. These agencies assess the borrower’s financial health and assign a credit rating. This rating directly influences the interest rate a lender offers. A higher credit rating signals lower risk, leading to more favorable interest rates. Conversely, a lower credit rating indicates higher risk, resulting in higher interest rates. Market conditions also play a crucial role. During periods of economic uncertainty, interest rates generally rise as lenders demand higher returns to compensate for increased risk. Understanding these market forces is essential when learning how to calculate the before-tax cost of debt, allowing for more accurate cost projections and financial planning. Therefore, a comprehensive understanding of these factors allows for more precise calculations of the before-tax cost of debt.

The Role of the Before-Tax Cost of Debt in Capital Budgeting

The before-tax cost of debt plays a vital role in capital budgeting decisions. Understanding how to calculate the before-tax cost of debt is crucial for accurately assessing the true cost of borrowing. This metric forms a key component in calculating the Weighted Average Cost of Capital (WACC), a crucial element in evaluating potential projects. The WACC represents the average rate a company expects to pay to finance its assets. It combines the cost of equity and the cost of debt, weighted by the proportion of each in the company’s capital structure. A lower WACC indicates a lower cost of capital, making it easier for a company to fund projects and enhance its overall value. To determine whether a project is financially viable, its expected return should exceed the WACC. Therefore, accurately calculating the before-tax cost of debt, a major component of the WACC, is essential for sound financial decision-making. Companies that understand how to calculate the before-tax cost of debt gain a significant competitive advantage.

While the WACC ultimately utilizes the after-tax cost of debt (because interest expenses are tax-deductible), the before-tax cost provides a crucial foundation. It represents the pure cost of borrowing before any tax benefits are considered. This pre-tax cost is fundamental in determining the true cost of capital for the firm. Analyzing the before-tax cost, alongside the after-tax cost, offers a complete picture of the financial implications of debt financing. This allows for a more informed evaluation of various financing options and ensures decisions align with the company’s overall financial goals. Knowing how to calculate the before-tax cost of debt is therefore instrumental in minimizing financial risks and maximizing returns.

The before-tax cost of debt’s influence extends beyond individual project appraisals. It significantly impacts a company’s overall valuation. Investors use the WACC, which incorporates the before-tax cost of debt, to discount future cash flows and arrive at a company’s present value. An accurate calculation of the before-tax cost of debt, therefore, directly influences the market’s perception of a company’s financial health and its attractiveness to investors. This underlines the importance of mastering the calculation of the before-tax cost of debt for both financial planning and strategic decision-making. Understanding how to calculate the before-tax cost of debt empowers companies to make data-driven choices that enhance their financial performance and long-term sustainability.

Beyond the Numbers: Considerations and Limitations

Calculating and interpreting the before-tax cost of debt involves several considerations and limitations. Market volatility significantly impacts the cost of debt. Fluctuations in interest rates and economic conditions can quickly alter borrowing costs. Understanding these dynamics is crucial for accurate financial planning. Restrictive covenants in debt agreements can also influence the effective cost. These covenants may limit a company’s operational flexibility, adding an indirect cost. Therefore, a comprehensive assessment should account for these qualitative factors alongside quantitative calculations. It’s important to understand how to calculate the before tax cost of debt and it’s relation to the wider economy.

Credit ratings play a vital role. A downgrade in a company’s credit rating typically leads to higher borrowing costs. This reflects the increased risk perceived by lenders. Conversely, an upgrade can lower the cost of debt. When considering how to calculate the before tax cost of debt, it is important to understand the macroeconomic impacts on the business. The model used to calculate the before-tax cost of debt is only as good as the data inputted. Inaccurate or outdated information will yield misleading results. Therefore, regular reviews and updates are essential. Furthermore, different types of debt instruments (e.g., bonds, loans, commercial paper) may have varying risk profiles and associated costs. This requires careful analysis and comparison.

The before-tax cost of debt is a crucial metric, but it should not be viewed in isolation. It’s essential to consider other factors. These factors include the company’s overall financial health, industry trends, and strategic objectives. Relying solely on the before-tax cost of debt without considering these elements may lead to suboptimal decisions. Moreover, understanding how to calculate the before tax cost of debt requires considering the limitations of financial models. These models are simplifications of reality and may not capture all relevant complexities. Therefore, expert judgment and qualitative analysis should complement quantitative calculations. Accurately assessing all factors is the key on how to calculate the before tax cost of debt.