Understanding the Merton Model’s Core Principles

The Merton model offers a powerful framework for assessing the probability of a firm’s default. This model rests on the fundamental assumption that a company’s equity can be viewed as a call option on its assets. This means equity holders have the right, but not the obligation, to purchase the company’s assets at maturity by paying off the debt. The Merton model probability of default calculation hinges on several key variables. These include the firm’s asset value (V), the face value of its debt (D), the volatility of the firm’s assets (σ), the risk-free interest rate (r), and the time to maturity of the debt (T). The relationship between these variables is crucial in determining the likelihood of default. A higher asset volatility increases the Merton model probability of default. Conversely, a higher asset value and longer time to maturity decreases this probability. The risk-free rate influences the present value of the debt, affecting the default probability.

To illustrate, imagine a company with assets worth $100 million and debt of $80 million maturing in one year. Assume an asset volatility of 20% and a risk-free rate of 5%. The Merton model would then use these inputs to calculate the probability that the company’s asset value at maturity will fall below the $80 million debt level. This probability represents the Merton model probability of default. This straightforward example highlights how the model uses option pricing theory to estimate credit risk. Understanding the interplay of these variables is fundamental to interpreting the Merton model’s output and appreciating its implications for credit risk assessment. The Merton model probability of default provides a valuable tool for investors and analysts.

The Merton model, while elegant, relies on several key assumptions. The model assumes that asset values follow a geometric Brownian motion, meaning asset returns are normally distributed. It also assumes a risk-free rate that is constant over the debt’s life and a constant debt level. These assumptions simplify the analysis but may not perfectly reflect real-world complexities. Despite these simplifications, the Merton model probability of default calculation provides valuable insights into credit risk. The Merton model provides a robust and widely used approach to estimating default probabilities. Accurate estimation of asset value and volatility is vital for reliable results. The Merton model probability of default serves as a cornerstone of modern credit risk management.

Applying Merton’s Model: A Step-by-Step Guide to Calculating Merton Model Probability of Default

The Merton model probability of default calculation begins with estimating the firm’s asset value (V). This is often challenging, as the asset value isn’t directly observable. Approaches include using market capitalization plus the book value of debt. Next, determine the face value of the firm’s debt (D), which represents the total amount owed to creditors at maturity. The standard deviation (σ) of the firm’s asset returns, representing asset volatility, is crucial. Historical data or implied volatility from equity options can estimate this parameter. The risk-free interest rate (r) reflects the return on a risk-free investment, typically a government bond yield. Finally, the time to maturity (T) indicates the time remaining until the debt obligation is due.

With these inputs, the Merton model probability of default calculation proceeds. First, calculate the distance to default (DD), a measure of how far the firm’s asset value is from its debt value. The formula is: DD = [ln(V/D) + (r + σ²/2)T] / (σ√T). This value represents the number of standard deviations the firm’s asset value is above its debt level. A higher DD indicates a lower probability of default. The Merton model probability of default is then computed using the cumulative standard normal distribution function, denoted as N(-DD). This function returns the probability that a standard normal random variable is less than -DD. Therefore, N(-DD) represents the probability that the firm’s asset value at maturity will fall below the debt value, leading to default. This probability directly reflects the Merton model probability of default.

Consider a hypothetical firm with V = $150 million, D = $100 million, σ = 0.3, r = 0.05, and T = 5 years. Applying the formula, the distance to default would be calculated. Then, using a standard normal distribution table or statistical software, the cumulative probability N(-DD) will provide the Merton model probability of default. This probability signifies the likelihood of the firm defaulting on its debt obligations within the five-year timeframe. The calculation, while seemingly straightforward, relies heavily on accurate estimations of input parameters, particularly asset volatility. This underlines the importance of robust data and sophisticated modeling techniques when applying the Merton model to assess the Merton model probability of default. Variations in these inputs can significantly impact the calculated Merton model probability of default, emphasizing the importance of sensitivity analysis.

Interpreting the Default Probability: What Does it Really Mean?

The merton model probability of default, calculated using the Merton model, provides a quantitative estimate of the likelihood that a company will be unable to meet its debt obligations within a specified timeframe. It is crucial to understand that this is a probability, not a guarantee. A calculated probability of default of 5%, for instance, does not mean that the company will assuredly default. It suggests that, based on the model’s assumptions and inputs, there is a 5% chance of default occurring. The merton model probability of default serves as a valuable tool for investors and credit analysts, aiding in risk assessment and investment decisions.

However, the merton model probability of default is subject to limitations. The model relies on several assumptions, such as efficient markets and normally distributed asset returns, which may not always hold true in the real world. Furthermore, the accuracy of the model is highly dependent on the quality and reliability of the input data. Estimating asset volatility, in particular, can be challenging and may require the use of historical data or implied volatility from option prices. External factors, such as unexpected economic downturns or industry-specific shocks, can also significantly impact a company’s financial health and its ability to repay its debts, potentially rendering the model’s prediction less accurate. The merton model probability of default should therefore be interpreted with caution, recognizing its inherent limitations.

Despite these limitations, the merton model probability of default remains a useful metric when used in conjunction with other credit risk assessment tools and qualitative analysis. Investors can use the merton model probability of default to compare the creditworthiness of different companies and to assess the potential risk associated with investing in their debt securities. Credit analysts can incorporate the merton model probability of default into their overall credit ratings and lending decisions. By understanding the assumptions, limitations, and practical implications of the merton model probability of default, users can make more informed decisions about credit risk management and investment allocation. The merton model probability of default provides a valuable, albeit imperfect, lens through which to view a company’s financial stability and its ability to meet its obligations.

Beyond the Basics: Incorporating Additional Factors into the Merton Model

The basic Merton model offers a foundational understanding of default probability, its assumptions can be limiting in real-world scenarios. To enhance its accuracy and applicability, several extensions and refinements have been developed. These modifications address some of the core model’s constraints, leading to more realistic assessments of credit risk and merton model probability of default.

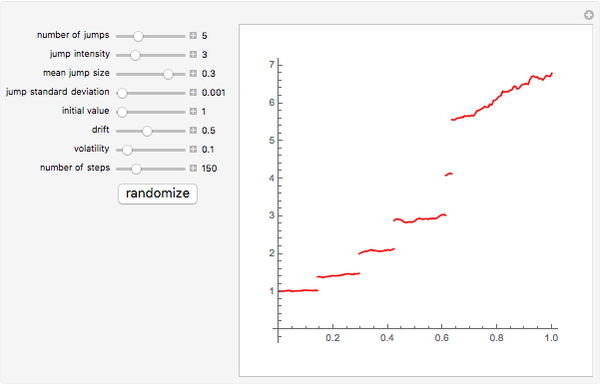

One significant extension involves incorporating stochastic interest rates. The original Merton model assumes a constant, risk-free interest rate. However, interest rates fluctuate, impacting a company’s debt obligations and asset values. Models incorporating stochastic interest rate processes, such as the Vasicek or Cox-Ingersoll-Ross models, provide a more dynamic view of default probability. Another refinement addresses the assumption of continuous asset value movements. In reality, companies may experience sudden jumps in asset values due to unexpected events like mergers, acquisitions, or regulatory changes. Jump-diffusion models, which combine continuous diffusion processes with discrete jump processes, can capture these abrupt shifts and their effects on the merton model probability of default. Furthermore, the original Merton model typically assumes a simple debt structure. However, companies often have complex debt structures with varying maturities, seniority, and covenants. Incorporating these complexities into the model allows for a more precise assessment of default risk associated with specific debt tranches. This can be achieved by modeling each debt obligation separately or by using more sophisticated structural models that account for the interactions between different debt classes. These enhancements provide a more accurate calculation of merton model probability of default.

Examples of sophisticated variations include models that incorporate macroeconomic factors, such as GDP growth, inflation, and unemployment rates. These factors can significantly impact a company’s financial performance and its ability to meet its debt obligations. Other variations focus on incorporating industry-specific factors, such as commodity prices, regulatory changes, or technological disruptions. These models provide a more tailored assessment of default risk for companies operating in specific sectors. By incorporating these additional factors, the Merton model becomes a more powerful tool for credit risk analysis, providing a more realistic and nuanced assessment of merton model probability of default. These advanced models are increasingly used by financial institutions and investors to make more informed lending and investment decisions.

How to Use Merton Model Outputs in Real-World Credit Analysis

Credit analysts and investors leverage the Merton model in diverse ways to inform their decisions. The merton model probability of default serves as a crucial input in assessing the creditworthiness of companies and the risk associated with lending to them. For instance, when evaluating corporate bonds, analysts will calculate the merton model probability of default to determine if the yield adequately compensates for the risk of default. A higher probability of default generally warrants a higher yield to attract investors. This quantitative assessment complements traditional qualitative analysis, such as evaluating management quality and industry trends.

The merton model probability of default output is often integrated with other credit risk assessment tools. Credit scoring models, which rely on historical data and statistical analysis, can be enhanced by incorporating the Merton model’s forward-looking perspective. Banks use the merton model probability of default to estimate potential losses from their loan portfolios, allowing them to set aside appropriate capital reserves. Portfolio managers employ the model to construct portfolios with specific risk-return profiles, managing their overall exposure to credit risk. The merton model probability of default also helps in pricing credit derivatives, such as credit default swaps (CDS), where the price reflects the perceived risk of default of the underlying entity. Stress testing scenarios in financial institutions frequently incorporate the Merton model to assess the impact of adverse economic conditions on the creditworthiness of their borrowers.

Real-world applications demonstrate the Merton model’s utility. During economic downturns, the model can provide early warnings of potential credit deterioration, allowing investors to adjust their positions accordingly. For example, during the 2008 financial crisis, some analysts used the Merton model to identify companies with rapidly increasing default probabilities, signaling potential problems before they were fully reflected in credit ratings. Similarly, in the energy sector, the merton model probability of default can be used to assess the credit risk of companies heavily reliant on volatile commodity prices. By providing a quantitative framework for assessing default risk, the Merton model enhances the rigor and objectivity of credit analysis, aiding in better-informed investment and lending decisions. The accurate calculation of the merton model probability of default is, therefore, of paramount importance for financial institutions and investors.

Comparing Merton Model to Alternative Default Prediction Methods

The merton model probability of default stands as a cornerstone in credit risk assessment, but it’s essential to understand its position relative to other models. A prominent alternative is the KMV model, which, while sharing roots with the Merton model, leverages market data more extensively. The KMV model, developed by Moody’s Analytics, incorporates real-time stock prices to derive the Expected Default Frequency (EDF), offering a market-driven perspective on default risk. Unlike the Merton model, which relies heavily on accounting data and estimations of asset value and volatility, the KMV model is more reactive to market sentiment. However, both models are structural models, meaning they model the firm’s asset value and debt structure to determine default probability. The merton model probability of default is based on options pricing theory and is mostly used when market data is scarce.

Another class of models to consider are reduced-form models. These models, in contrast to structural models, do not explicitly model the firm’s assets and liabilities. Instead, they focus on statistically modeling the default event itself. Examples include models that use hazard rates or logistic regression to predict default based on macroeconomic variables and firm-specific financial ratios. Reduced-form models are often easier to implement and can incorporate a broader range of factors that might influence default, such as industry trends or management quality. However, they lack the intuitive link between a firm’s financial health and its default risk that is inherent in the merton model probability of default framework and other structural models.

The choice between the merton model probability of default, the KMV model, and reduced-form models depends on the specific application and data availability. The Merton model provides a theoretically sound framework for understanding default risk, particularly when detailed market data is limited. The KMV model offers a market-sensitive alternative, while reduced-form models provide flexibility in incorporating a wide range of factors. Each approach has its strengths and weaknesses, and practitioners often use a combination of models to gain a comprehensive view of credit risk. Understanding the nuances of each model and its underlying assumptions is crucial for making informed decisions about credit risk management. When estimating the merton model probability of default it’s important to keep in mind its limitations and the assumption of perfect market conditions, which don’t exist in real life.

Addressing Limitations and Potential Biases in Merton’s Model

The Merton model, while a valuable tool for assessing credit risk and calculating the merton model probability of default, is not without its limitations. A critical evaluation reveals several potential biases and sources of error that users must acknowledge. One key challenge lies in the estimation of the model’s input parameters. Accurately determining asset volatility and, more crucially, the current asset value of a firm is often difficult. Asset value, unlike equity value, is not directly observable in the market, requiring indirect estimation methods that can introduce inaccuracies. This reliance on estimations can significantly impact the calculated merton model probability of default.

Another significant limitation stems from the model’s underlying assumptions, particularly the assumption of perfect market conditions. The Merton model assumes that markets are efficient, information is readily available, and there are no transaction costs. In reality, these assumptions rarely hold true. Market imperfections, such as information asymmetry and liquidity constraints, can distort asset prices and affect the accuracy of the merton model probability of default. Furthermore, the model typically assumes a constant interest rate and a simple debt structure. Variations in interest rates and more complex debt arrangements can necessitate adjustments or extensions to the basic Merton model framework. The merton model probability of default is very sensitive to these assumptions.

Moreover, the Merton model’s reliance on a continuous-time framework may not fully capture the impact of sudden, unexpected events on a firm’s asset value. The model may underestimate the likelihood of default in situations where a company experiences a rapid deterioration in its financial condition due to unforeseen circumstances. Despite these limitations, the Merton model remains a useful benchmark for credit risk assessment. By understanding its potential biases and sources of error, analysts can use the model more effectively and complement its findings with other credit risk assessment tools to arrive at a more informed judgment regarding a company’s creditworthiness and refine the merton model probability of default estimates.

Advanced Applications and Future Trends in Merton Model Research

The Merton model continues to evolve, finding applications in increasingly sophisticated areas of finance. Current research explores its utility in assessing the credit risk of complex financial instruments, such as collateralized debt obligations (CDOs) and other structured products. These applications often require incorporating advanced mathematical techniques and computational methods to handle the intricacies of these assets. One emerging trend involves integrating macroeconomic factors into the Merton model to better capture systemic risk and the impact of economic cycles on corporate default probabilities. This allows for a more holistic view of credit risk, acknowledging the interconnectedness of firms and the broader economic environment. The merton model probability of default, therefore, is not seen in isolation but as part of a larger system.

Another area of active research focuses on refining the model’s assumptions about asset value dynamics. Traditional Merton models often assume that asset values follow a log-normal distribution, which may not accurately reflect real-world market behavior. Researchers are exploring alternative distributions and models that allow for jumps, volatility clustering, and other non-normal characteristics. These enhancements aim to improve the model’s accuracy in predicting extreme events and capturing the fat tails often observed in asset returns. Furthermore, the merton model probability of default calculations are being adapted to incorporate machine learning techniques, using historical data to improve parameter estimation and model calibration. This includes using machine learning to predict asset volatility, a crucial input for the model.

The merton model probability of default framework is also being extended to assess the creditworthiness of non-corporate entities, such as sovereign nations and municipalities. This involves adapting the model to account for the unique characteristics of these entities, such as their tax revenue streams and political risk factors. Future research will likely focus on developing more robust and flexible versions of the Merton model that can be applied to a wider range of assets and entities. The goal is to create a more comprehensive and accurate framework for assessing credit risk in an increasingly complex and interconnected global financial system. Ongoing advancements in computational power and data availability will undoubtedly contribute to further refinements and innovations in merton model probability of default research, solidifying its place as a cornerstone of credit risk management.