Understanding Market Returns: Beyond the Basics

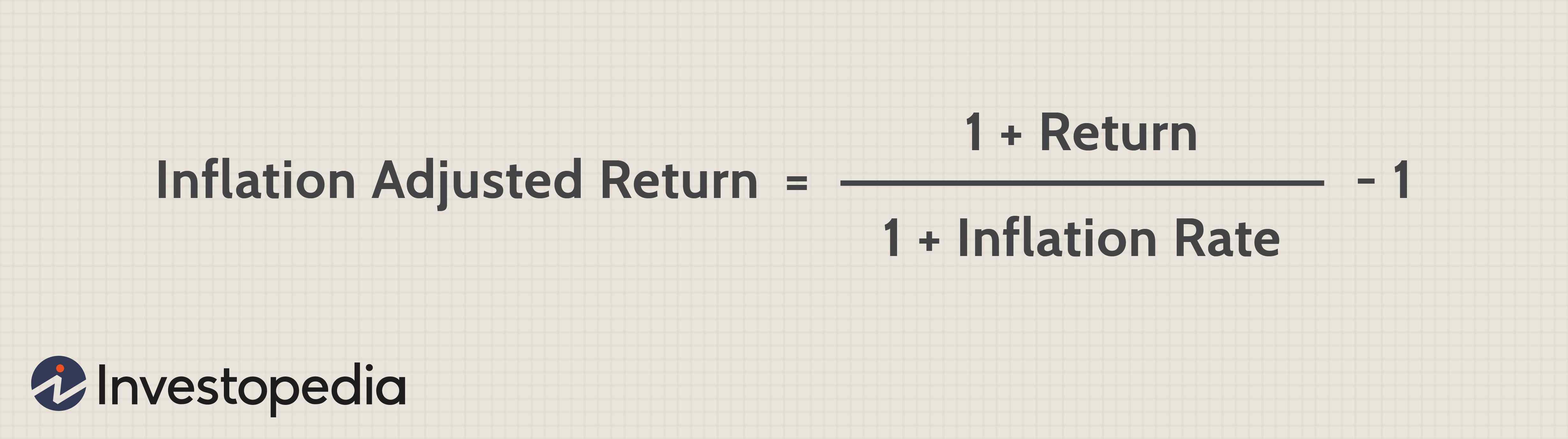

Market return, in its simplest form, represents the profit or loss made on an investment over a specific period. It’s the yardstick by which investment performance is measured. To truly understand market returns, one must differentiate between nominal and real returns. Nominal return is the percentage change in the price of an investment, not adjusted for inflation. Real return, on the other hand, factors in inflation, providing a more accurate picture of the investment’s actual purchasing power increase. Understanding both is crucial because while nominal returns might seem impressive, real returns reveal the true profitability after accounting for the erosion of value due to inflation. Knowing how to find return on market considering inflation protects your investment.

Market returns can come in various forms. Capital appreciation refers to the increase in the price of an asset, such as a stock or a property. Dividend income is the payment made by a company to its shareholders, typically from its profits. Interest income is earned from fixed-income investments like bonds. Each type contributes differently to the overall market return. For example, a growth stock may offer high capital appreciation but pay little to no dividends, while a bond provides a steady stream of interest income but with potentially lower capital appreciation. The long-term goal of consistent profits hinges on a solid understanding of these basics. Grasping these fundamentals will give an edge on how to find return on market.

Understanding these different components of market return is the foundation for achieving consistent profits. Without this knowledge, investors risk making uninformed decisions, chasing nominal gains without considering inflation, or overlooking opportunities for diversification. Therefore, before delving into investment strategies or analyzing market trends, it is essential to have a firm grasp of what market return is, its different types, and the crucial distinction between nominal and real returns. Learning how to find return on market with strategies and knowledge can set you for success. Moreover, by carefully selecting investment vehicles and understanding their risk-reward profiles, investors can build portfolios that are well-positioned to generate consistent returns over the long term.

How to Calculate Your Investment Returns

Understanding how to find return on market is essential for gauging investment performance. It allows investors to track progress and make informed decisions. This section provides clear, step-by-step instructions for calculating investment returns, using real-world examples to illustrate the process.

There are two primary methods for calculating returns: simple return and compound return. Simple return provides a basic overview of performance over a specific period. The formula for simple return is: [(Ending Value – Beginning Value) / Beginning Value] x 100. For example, if an investment starts at $1,000 and ends at $1,200, the simple return is [($1,200 – $1,000) / $1,000] x 100 = 20%. This calculation is straightforward and useful for understanding returns over short periods. However, it does not account for the effects of compounding, where earnings generate further earnings.

Compound return, on the other hand, considers the impact of reinvesting earnings over time. It provides a more accurate reflection of long-term investment growth. The formula for compound annual growth rate (CAGR), a common measure of compound return, is: [(Ending Value / Beginning Value)^(1 / Number of Years)] – 1. To illustrate, consider an investment that grows from $1,000 to $1,500 over 5 years. The CAGR is [($1,500 / $1,000)^(1 / 5)] – 1 = 0.0845, or 8.45%. This means the investment grew at an average annual rate of 8.45%, taking into account the compounding effect. The difference between simple and compound return becomes more significant over longer time horizons. Understanding how to find return on market using both methods allows investors to appreciate the power of compounding and make more informed decisions about their investments. Analyzing how to find return on market enables precise tracking and optimization. This knowledge empowers investors to refine their strategies and work toward consistent profitability. Regular calculation of investment returns, using both simple and compound methods, is crucial for assessing performance and adapting to market conditions. This ensures a proactive approach to investment management.

Identifying Reliable Investment Vehicles

Navigating the investment landscape requires careful consideration of various options. Stocks, representing ownership in a company, offer the potential for high growth but also carry significant risk. Bonds, essentially loans to a government or corporation, generally provide more stable, but lower, returns. Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets, offering instant diversification but also incurring management fees. ETFs (Exchange Traded Funds) are similar to mutual funds but trade on exchanges like stocks, often with lower expense ratios. Real estate can provide rental income and potential appreciation, but it’s also relatively illiquid and requires significant capital. Understanding the nuances of each investment vehicle is critical to how to find return on market.

Each investment avenue presents a unique risk-reward profile. Stocks, particularly those of smaller companies, can experience substantial price swings. Bonds are generally considered less risky, especially government bonds, but their returns may not keep pace with inflation. Mutual funds and ETFs aim to balance risk and return through diversification, but their performance depends on the underlying assets and the fund manager’s skill. Real estate values can fluctuate based on market conditions and local factors. Successful investing depends on how to find return on market while acknowledging your ability to tolerate loss. Assess your own comfort level with risk and select investments accordingly. Consider how your time horizon affects the suitability of different investment types. Diversification is key to mitigating risk and enhancing the potential for consistent profits.

Diversification involves spreading investments across different asset classes, industries, and geographic regions. This strategy reduces the impact of any single investment on the overall portfolio. For example, a portfolio might include a mix of stocks, bonds, and real estate, with further diversification within each asset class. Diversifying across different sectors, such as technology, healthcare, and energy, can further reduce risk. International diversification can also provide exposure to different economic cycles and growth opportunities. By diversifying, investors can smooth out returns and increase the likelihood of achieving consistent, long-term profit goals. Consistent profits in the market depend on how to find return on market through comprehensive research, combined with strategic asset allocation and ongoing portfolio management.

Analyzing Market Trends and Indicators

Understanding market trends and indicators is essential to learn how to find return on market. Several key economic indicators can significantly influence market performance. Gross Domestic Product (GDP) growth reflects the overall health of the economy. A rising GDP typically signals economic expansion, often leading to higher corporate profits and increased stock prices. Inflation, measured by the Consumer Price Index (CPI), indicates the rate at which prices for goods and services are rising. High inflation can erode purchasing power and may prompt central banks to raise interest rates, potentially dampening economic growth and market returns. Conversely, low inflation can stimulate spending and investment.

Interest rates, set by central banks, play a crucial role in shaping market sentiment. Higher interest rates can increase borrowing costs for businesses and consumers, potentially slowing economic activity and reducing corporate earnings. Lower interest rates tend to encourage borrowing and investment, boosting economic growth and stock market returns. Employment figures, such as the unemployment rate and job creation numbers, provide insights into the labor market’s strength. Strong employment data typically supports consumer spending and economic growth. Analyzing these indicators involves monitoring their trends and comparing them to historical data and forecasts. Economic calendars provide scheduled release dates for these indicators, allowing investors to stay informed. Learning how to find return on market involves staying ahead.

Interpreting these indicators requires considering their context and potential impact on different sectors and asset classes. For example, a rise in interest rates may negatively impact interest-sensitive sectors like real estate and utilities, while benefiting financial institutions. Investors can use this information to adjust their portfolios and manage risk. Technical analysis, which involves studying price charts and trading volumes, can also provide insights into market trends and potential turning points. Common technical indicators include moving averages, relative strength index (RSI), and MACD. Combining fundamental analysis (economic indicators) with technical analysis can provide a more comprehensive view of market conditions. Regularly monitoring and analyzing these indicators is crucial for making informed investment decisions and maximizing the potential for consistent profits. Successful investors continually seek ways how to find return on market through diligent research and analysis.

Developing a Diversified Investment Strategy

Crafting a personalized investment portfolio is a crucial step toward achieving consistent, long-term market returns. The foundation of this portfolio lies in understanding individual risk tolerance and financial aspirations. Risk tolerance refers to an investor’s capacity to withstand potential losses in exchange for potentially higher returns. Financial goals might include retirement savings, purchasing a home, or funding education. Aligning these factors is paramount when deciding how to find return on market opportunities that suit specific needs.

Asset allocation, the distribution of investments across different asset classes, is a cornerstone of a diversified strategy. Common asset classes include stocks, bonds, and cash. Stocks generally offer higher potential returns but also carry greater risk. Bonds provide more stability and income, while cash offers liquidity and security. The optimal asset allocation depends on an investor’s risk tolerance and time horizon. For example, a younger investor with a longer time horizon might allocate a larger portion of their portfolio to stocks, while an older investor nearing retirement might favor bonds. It’s very important how to find return on market depending on your age.

Regular portfolio rebalancing is essential to maintain the desired asset allocation. Over time, the value of different asset classes will fluctuate, causing the portfolio’s original allocation to drift. Rebalancing involves selling assets that have outperformed and buying assets that have underperformed to restore the original balance. This process helps to control risk and can potentially enhance returns. A well-diversified portfolio, coupled with regular rebalancing, contributes to steady growth and increases the likelihood of achieving consistent market returns over the long term. One needs to understand how to find return on market and how often the portfolio needs rebalancing. Furthermore, consider exploring alternative investments like real estate or commodities to further diversify and potentially enhance the overall portfolio performance.

Managing Risk and Volatility

Navigating the financial markets requires a keen understanding of risk management. Market volatility, characterized by rapid and unpredictable price swings, can significantly impact investment portfolios. Implementing proactive strategies is crucial to protect investments and maintain a steady course toward long-term financial goals. A key strategy is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This method reduces the risk of investing a large sum at a market peak. When prices are low, more shares are purchased, and when prices are high, fewer shares are bought. Over time, this can lead to a lower average cost per share. To understand how to find return on market while using dollar cost averaging, it’s important to track your investments to measure the overall impact over time.

Another risk management technique involves using stop-loss orders. A stop-loss order instructs a broker to sell a security when it reaches a specific price. This helps limit potential losses if the price declines sharply. Determining the appropriate stop-loss level depends on the investor’s risk tolerance and the volatility of the asset. Employing this technique could assist on how to find return on market based on strategies. However, it’s important to note that stop-loss orders are not foolproof and may not always execute at the desired price, particularly during periods of extreme volatility.

Emotional discipline is paramount when managing risk and volatility. Market fluctuations can trigger fear and greed, leading to impulsive decisions. It is vital to maintain a long-term perspective and avoid making rash choices based on short-term market movements. Sticking to a well-defined investment plan, even during turbulent times, is essential for achieving consistent returns. Remember that market downturns can present opportunities to buy quality assets at discounted prices. Consider how to find return on market after a downturn by rebalancing your portfolio, selling assets that have increased in value and buying those that have decreased, is a strategy for maintaining your desired asset allocation and potentially enhancing returns over the long term.

The Importance of Patience and Long-Term Vision

Investing successfully requires a long-term perspective. Understanding how to find return on market involves recognizing that market fluctuations are inevitable. Short-term market movements can create anxiety. However, focusing on long-term growth minimizes the impact of these temporary dips. Consistent, disciplined investing over many years typically yields better results than trying to time the market for quick profits. This approach reduces the influence of emotional decision-making, a common pitfall for less experienced investors. Successful long-term investing depends on staying the course, even when short-term results seem disappointing. How to find return on market also means understanding this fundamental truth.

Patience is a crucial element in building wealth through market returns. Investors who consistently contribute to their portfolios, regardless of market conditions, often see significantly higher returns than those who react emotionally to market volatility. Regular contributions through dollar-cost averaging, a strategy many find effective, help mitigate risk and take advantage of market dips. The temptation to react to every market fluctuation is understandable but detrimental in the long run. A well-defined investment strategy, adjusted periodically, provides a roadmap for long-term success. How to find return on market involves developing a strategy based on your financial goals and risk tolerance.

Emotional discipline is paramount. Fear and greed can cloud judgment, leading to impulsive decisions that often hurt investment performance. Sticking to a well-researched investment plan, regardless of market sentiment, shows discipline. Avoiding impulsive reactions is key to reaching long-term financial objectives. Remember, building wealth through the market takes time and consistent effort. How to find return on market also hinges on controlling your emotions and maintaining a long-term focus on your investment goals. Understanding the process and developing a sound strategy are the foundations for achieving consistent market returns. Avoid trying to get rich quickly. Instead, focus on steady, sustainable growth through disciplined investing.

Continuously Monitoring and Adapting Your Strategy

Successfully navigating the market requires ongoing vigilance. Regularly review your investment portfolio, analyzing its performance against your initial goals. This process helps identify areas needing adjustment. Understanding how to find return on market requires consistent monitoring. Track key performance indicators, comparing actual returns to projected returns. This allows for timely adjustments to your strategy based on evolving market conditions. Market trends are dynamic, and a static approach risks underperformance. Proactive adjustments based on data-driven analysis ensure your strategy remains relevant and effective.

Staying informed about market changes is crucial. Read reputable financial news sources. Attend industry conferences or webinars to keep your knowledge current. Consider subscribing to market analysis services or newsletters. These resources help you interpret economic data and anticipate potential shifts. Understanding how to find return on market involves staying informed. Access to valuable information allows you to predict shifts, avoiding potentially costly errors. The information gathered helps in making well-informed decisions, thereby improving the probability of success.

Seeking professional financial advice can significantly enhance your investment journey. A qualified advisor provides personalized guidance based on your specific circumstances and risk tolerance. They offer valuable insights into complex market dynamics. A professional can help you refine your investment strategy and navigate challenging market situations. They provide another set of eyes reviewing performance. They can also help you understand how to find return on market more efficiently. Remember, professional guidance adds a layer of expertise to your investment process, potentially enhancing your long-term success.