Grasping the Fundamentals of Volatility

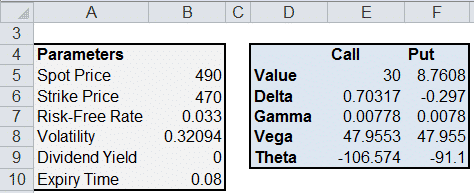

Volatility, in the world of finance, signifies the degree of fluctuation in a trading price series over a specific duration. It’s crucial for investors and traders to understand how to calculate volatility in excel because it provides insights into the risk associated with an asset. A volatile asset experiences large price swings, while a less volatile one remains relatively stable. Understanding volatility helps in making informed investment decisions, managing risk, and pricing options.

There are two main types of volatility: historical and implied. This guide focuses on historical volatility, which is calculated using past price data. Implied volatility, on the other hand, is derived from options prices and reflects market expectations of future price swings. How to calculate volatility in excel, by analyzing historical data, provides a tangible measure of past price behavior. This information is invaluable for assessing potential future risks.

Understanding how to calculate volatility in excel is essential. Investors can evaluate the potential upsides and downsides of investments. High volatility doesn’t always mean an asset is bad. It signifies potentially higher rewards, coupled with higher risks. Low volatility indicates lower risks and potentially lower returns. By mastering how to calculate volatility in excel, you gain a powerful tool for evaluating investment opportunities and managing your portfolio’s risk exposure effectively. This skill empowers you to make data-driven decisions in the financial markets, especially because knowing how to calculate volatility in excel, allows you to create custom analysis adjusted to your investing strategies.

Preparing Your Data for Accurate Volatility Calculations in Excel

To calculate volatility in Excel accurately, begin by obtaining reliable historical price data. Many reputable financial websites offer this data, often for free or a subscription fee. Yahoo Finance, Google Finance, and Alpha Vantage are popular choices. Download the data, ensuring it includes daily closing prices for the asset you’re analyzing. The data should cover a period relevant to your analysis; longer periods generally provide more robust volatility estimates. Import the data into an Excel spreadsheet. Each column should represent a specific data point (date, closing price, etc.). Check for any errors or inconsistencies. Accurate data is crucial for precise volatility calculations. Remember, learning how to calculate volatility in excel relies on clean, consistent data input.

Once imported, format the data correctly. The dates should be in a date format, and the prices should be numeric values without any extra characters (like currency symbols). Excel’s built-in formatting tools simplify this process. Ensure your data is properly aligned. Incorrect data formats can lead to errors in your calculations. Data cleaning is a critical preprocessing step. It reduces the risk of error and enhances the reliability of the results when you learn how to calculate volatility in excel. Double-check your data meticulously before proceeding to the calculation phase. This attention to detail is essential for achieving accurate and dependable volatility analysis.

After importing and formatting your data, carefully review it. Look for any obvious errors or inconsistencies. Are there any missing data points? Are there any entries that seem unusually high or low? Identify and correct any mistakes. If significant gaps exist in your data, consider using imputation methods or discarding the incomplete data set. Remember, the accuracy of your volatility calculations hinges upon the quality of your input data. Learning how to calculate volatility in excel requires diligent data preparation to ensure reliable outcomes.

Calculating Daily Price Changes: A Crucial Step in Learning How to Calculate Volatility in Excel

To calculate daily price changes, begin by organizing your historical price data in an Excel spreadsheet. Each row should represent a single day, and a column should contain the corresponding closing price. The formula to calculate the daily percentage change is straightforward. It involves subtracting the previous day’s closing price from the current day’s closing price, and then dividing the result by the previous day’s closing price. This calculation provides the percentage change in price from one day to the next. For instance, if cell B2 contains today’s closing price and cell B1 contains yesterday’s closing price, the formula in cell C2 would be `=(B2-B1)/B1`. This formula efficiently determines the daily percentage change. Replicate this formula down the column to calculate the daily percentage change for the entire dataset. Accurate data entry is crucial for reliable volatility calculations. Learning how to calculate volatility in excel accurately depends heavily on this initial step.

Understanding how to calculate volatility in excel requires attention to detail in this stage. Remember, the first day will not have a percentage change, as there is no previous day’s data to compare against. Leave the first cell in your percentage change column blank or indicate it with an appropriate label. The subsequent cells will display the daily percentage changes. These values represent the daily fluctuations in the asset’s price. These figures form the basis for all further volatility calculations. The accuracy of these calculations directly impacts the reliability of your final volatility measure. Always double-check your data and formulas for errors.

This process of calculating daily price changes is fundamental to understanding how to calculate volatility in excel. It provides the raw data necessary for calculating variance and standard deviation, the key components in determining volatility. By accurately calculating these daily percentage changes, you lay a strong foundation for a comprehensive volatility analysis. These percentage changes will then be used in further Excel functions to determine the variance and subsequently, the standard deviation of the asset’s price.

Determining Variance: A Key Step in Calculating Volatility in Excel

Variance plays a crucial role in how to calculate volatility in Excel. It quantifies the dispersion of a dataset’s points around its mean. In the context of financial data, a higher variance of daily price changes indicates greater price fluctuation. To understand how to calculate volatility in excel, one must first grasp this fundamental concept. A larger variance suggests higher risk associated with the asset. Calculating variance helps determine the magnitude of price swings. This calculation is a precursor to determining standard deviation, the direct measure of volatility.

To calculate the variance of daily price changes in Excel, utilize the `VAR.S` function (or `VAR` for older Excel versions). This function takes a range of cells as input, representing the daily percentage changes computed in the previous step. The formula would look like this: `=VAR.S(range_of_daily_percentage_changes)`. Replace `range_of_daily_percentage_changes` with the actual cell range containing your calculated daily percentage changes. For example, if your daily percentage changes are in cells C1:C100, the formula becomes `=VAR.S(C1:C100)`. The result represents the variance of your price changes. Remember, variance is expressed in squared units, making it less intuitive to interpret than standard deviation.

Understanding how to calculate volatility in Excel involves comprehending variance. Variance provides a quantitative measure of price fluctuations. The `VAR.S` function offers a straightforward method to calculate this crucial statistic. By understanding the variance, you lay the groundwork for calculating standard deviation—a more readily interpretable measure of volatility. Remember that accurate data input is vital for obtaining reliable results when learning how to calculate volatility in Excel. The accuracy of variance and subsequent volatility calculations directly depends on the accuracy of the input data. Inaccurate data leads to misleading interpretations of market risk.

Computing Standard Deviation: Finding the Daily Volatility

Standard deviation represents the daily volatility of the asset. To calculate it in Excel, use the `STDEV.S` function (or `STDEV` for older versions). This function calculates the sample standard deviation, which is appropriate for analyzing a subset of the entire population of price data. The standard deviation is the square root of the variance, providing a more readily interpretable measure of price fluctuation. Understanding how to calculate volatility in Excel is crucial for effective risk management. The standard deviation quantifies the average distance of each daily price change from the mean daily price change. A higher standard deviation indicates greater price variability and, consequently, higher risk. This metric is a fundamental component of how to calculate volatility in Excel, providing a key insight into the asset’s price behavior. Learning how to calculate volatility in Excel accurately is essential for informed investment decisions.

The formula for calculating standard deviation is straightforward within Excel. Simply select a cell, type `=STDEV.S(range_of_daily_price_changes)`, replacing `range_of_daily_price_changes` with the actual cell range containing your calculated daily percentage changes. For example, if your daily price changes are in cells C1 through C252, the formula would be `=STDEV.S(C1:C252)`. This function performs the complex calculation efficiently, delivering the standard deviation as a single numerical value. This value represents the daily volatility. Therefore mastering how to calculate volatility in Excel allows for rapid and accurate assessments of risk. Excel’s built-in functions streamline the process, making even complex financial analysis accessible to a wide range of users. The result provides a quantifiable measure of the day-to-day price swings.

Remember, the standard deviation calculated using this method reflects the daily volatility. To understand how to calculate volatility in Excel for longer periods, you’ll need to annualize the daily standard deviation. This involves multiplying the daily standard deviation by the square root of the number of trading days in a year (usually 252). This annualized figure offers a more comprehensive understanding of the asset’s price behavior over a year. The annualized standard deviation, obtained through these calculations, is a far more useful measure than the daily volatility when making long-term investment decisions. Knowing how to calculate volatility in Excel, from the daily to the annualized measure, empowers informed financial analysis.

Annualizing Volatility: Scaling for Longer-Term Insights

To make informed investment decisions, it’s essential to understand how to calculate volatility in Excel, not just on a daily basis, but also annually. Daily volatility, while useful, needs to be scaled to reflect potential price swings over a longer investment horizon. Annualizing volatility provides a more meaningful metric for comparing different assets and assessing overall risk.

The process of annualizing volatility involves multiplying the daily volatility by the square root of the number of trading days in a year. A standard assumption is that there are approximately 252 trading days in a year, accounting for weekends and holidays. Therefore, the Excel formula to annualize volatility is `=SQRT(252)*[Daily Volatility Cell]`. Replace `[Daily Volatility Cell]` with the actual cell reference in your spreadsheet that contains the calculated daily volatility. This calculation effectively scales the daily fluctuations to an annual equivalent, giving investors a clearer picture of potential price ranges over the course of a year. Understanding how to calculate volatility in Excel and annualize it provides crucial insights for risk management.

For example, if the daily volatility calculated using the standard deviation is 0.01 (or 1%), the annualized volatility would be `=SQRT(252)*0.01`, which equals approximately 0.1587 (or 15.87%). This indicates that the asset’s price is expected to fluctuate by around 15.87% annually, based on its historical daily price movements. Knowing how to calculate volatility in Excel and annualize it allows for a better comparison between assets with different trading frequencies or historical periods. Remember that this annualized figure is still an estimate based on past performance and does not guarantee future volatility. However, it is a valuable tool for assessing risk and making investment decisions when considered alongside other factors. This annualized volatility measure offers a more comprehensive view for long-term financial planning and risk assessment, especially when considering how to calculate volatility in Excel effectively.

Interpreting Your Volatility Results

Understanding the results of your volatility calculations is crucial for informed decision-making. Volatility, in essence, is a measure of price fluctuation. Higher volatility signifies that the price of an asset can swing dramatically over a short period. Conversely, lower volatility suggests more stable price movements. When interpreting your results after you learn how to calculate volatility in excel, consider the following:

A high annualized volatility, perhaps above 20% or 30% (depending on the asset class), typically implies a higher degree of risk. This means that while the potential for gains might be significant, the potential for losses is also amplified. Assets with lower annualized volatility, such as certain blue-chip stocks or government bonds, generally offer more stability but may also provide lower returns. It is vital to remember that volatility is not inherently “good” or “bad.” Its desirability depends entirely on your individual risk tolerance and investment strategy. A risk-averse investor might prefer lower volatility investments, while a risk-seeking trader might be drawn to assets with higher volatility for the chance of larger profits.

It’s essential to avoid viewing volatility in isolation. Volatility is just one piece of the puzzle. Investors should always consider it alongside other factors like the asset’s fundamentals, market conditions, and their investment goals. Knowing how to calculate volatility in excel is a great tool, but should be complemented with other analysis tools. For example, while a stock might exhibit high volatility, it could still be a worthwhile investment if the underlying company has strong growth prospects. Conversely, a low-volatility asset might not be suitable if it doesn’t offer sufficient returns to meet your financial objectives. Therefore, integrate volatility analysis with other financial metrics and qualitative assessments for a well-rounded investment approach. Do not rely on a single indicator to make financial decisions.

Enhancing Your Analysis with Moving Averages

To further refine your understanding of market dynamics, consider incorporating moving averages into your volatility analysis. This technique allows you to observe how volatility evolves over specific timeframes, offering a more nuanced perspective than a single, static calculation. Essentially, you’ll be calculating volatility within a rolling window. This involves selecting a period, such as 30 days, and calculating the volatility for that specific window. Then, you shift the window forward by one day and repeat the calculation. By iterating this process across your entire dataset, you create a series of volatility values that reflect changes over time. This is a dynamic way on how to calculate volatility in excel.

The implementation in Excel requires careful use of formulas. You will be using the same formulas as before (`VAR.S` and `STDEV.S`), but with adjusted cell references to define the rolling window. For example, to calculate the 30-day volatility starting from day 30, your `VAR.S` and `STDEV.S` functions would reference the range of daily price changes from day 1 to day 30. As you move down a row, the range would shift to day 2 to day 31, and so on. Mastering how to calculate volatility in excel with a rolling window provides valuable insights.

Visualizing these rolling volatility values can be extremely beneficial. Excel’s charting capabilities can be used to create a line graph that plots the volatility over time. This visual representation can reveal trends, patterns, and potential turning points in market volatility. It can also help you identify periods of increased or decreased risk, which can inform your investment decisions. Learning how to calculate volatility in excel and visualize the results significantly enhances your analytical capabilities and provides a more comprehensive understanding of market behavior.