Understanding Zero-Coupon Bonds: A Simple Explanation

Imagine buying a savings certificate. You pay less than its eventual worth, and you get the full amount back later. Zero-coupon bonds work similarly. They are essentially IOUs. Instead of receiving regular interest payments (coupons), you purchase the bond at a discounted price. At maturity, the investor receives the bond’s face value. This difference between the purchase price and the face value represents your return. Think of them as a simple loan to a government or corporation. Treasury Bills and some municipal bonds are common examples of zero-coupon bonds. Understanding the ytm of zero coupon bond is critical for evaluating these investments. These bonds offer a straightforward way to earn a return, and calculating the ytm of zero coupon bond helps determine the true profitability.

The beauty of zero-coupon bonds lies in their simplicity. Investors know exactly how much they’ll receive at maturity. This predictability makes them attractive to investors with specific financial goals, like saving for a down payment or college tuition. Different factors influence the price, impacting how much you eventually earn. Calculating the ytm of zero coupon bond is essential for comparing returns against other investment options. The ytm of zero coupon bond acts as a critical benchmark when considering such investments.

Many investors use zero-coupon bonds for long-term financial planning. They provide a guaranteed return at a future date, offering a degree of certainty in an uncertain market. However, the value of these bonds before maturity fluctuates based on market interest rates. The ytm of zero coupon bond reflects this fluctuation and the overall return over the bond’s life. Therefore, accurately calculating the ytm of zero coupon bond is paramount for informed decision-making in your investment strategy. The ytm of zero coupon bond allows for apples-to-apples comparisons, enabling better assessment of investment potential.

Yield to Maturity (YTM): The Core Concept

Yield to maturity (YTM) is a crucial metric for investors in zero-coupon bonds. It represents the total return an investor can expect if they hold the bond until its maturity date. This return considers the discounted price paid for the bond and the face value received at maturity. Understanding the YTM of zero-coupon bond is essential for making informed investment decisions. The YTM calculation accounts for the time value of money, reflecting the return earned over the bond’s life. Investors use YTM to compare the potential returns of different zero-coupon bonds and other investment opportunities. A higher YTM generally suggests a greater potential return, although it also typically implies a higher level of risk.

Calculating the YTM of a zero-coupon bond involves solving for the interest rate that equates the present value of the bond’s face value to its current market price. This calculation considers the time until maturity. The YTM doesn’t directly consider factors like reinvestment risk. It assumes that any interest earned can be reinvested at the same rate. The accuracy of the YTM as a predictor of future returns depends on several factors, including the stability of interest rates and the issuer’s creditworthiness. The YTM of a zero-coupon bond is a key indicator of its attractiveness relative to other investment options. Investors use the YTM to assess the potential profitability of a zero-coupon bond investment, helping them to build a diversified and effective portfolio. Accurate YTM calculations are critical for effective portfolio management.

The YTM of a zero-coupon bond provides a standardized measure of return, facilitating comparisons across different bonds. This allows investors to make more informed decisions about which bonds offer the best risk-adjusted return. Analyzing the YTM is crucial when assessing the potential returns of a zero-coupon bond. Investors should also consider other factors alongside the YTM, such as the creditworthiness of the issuer and the overall market conditions. The YTM of zero-coupon bond is a vital tool for investors seeking to maximize returns while managing risk effectively. Understanding the YTM calculation and its implications is a cornerstone of successful zero-coupon bond investing.

Factors Affecting the YTM of Zero-Coupon Bonds

Several key factors influence the ytm of zero coupon bond. The current market price plays a crucial role. A lower market price results in a higher YTM, as the investor’s return is calculated relative to the purchase price. Conversely, a higher market price leads to a lower YTM. The bond’s face value, the amount the investor receives at maturity, is the other pivotal component in determining the ytm of zero coupon bond. A larger face value, all else equal, will increase the YTM. The time to maturity significantly impacts the ytm of zero coupon bond. Longer maturities generally lead to higher YTMs to compensate investors for the increased time their money is tied up. This reflects the time value of money; money received sooner is worth more than money received later.

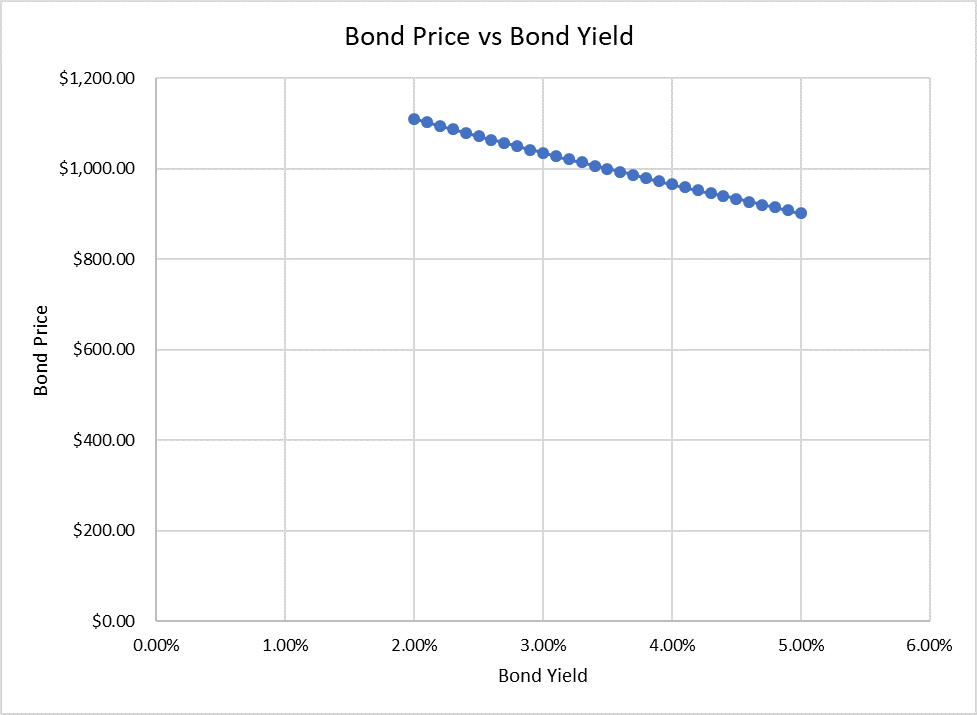

Prevailing interest rates in the market are a major external factor influencing the ytm of zero coupon bond. When interest rates rise, newly issued bonds offer higher yields, making existing zero-coupon bonds less attractive. This causes their market prices to fall, consequently increasing their YTM. Conversely, falling interest rates increase the demand for existing zero-coupon bonds, raising their prices and lowering their YTM. Imagine two scenarios: a bond with a face value of $1,000 maturing in five years is trading at $800 when interest rates are 5%. Its YTM would be higher compared to a similar bond trading at $900 when interest rates fall to 3%. The ytm of zero coupon bond reflects this dynamic interplay between market conditions and bond characteristics.

Understanding the relationship between these factors is vital for investors. For example, an investor comparing two zero-coupon bonds with the same maturity date but different market prices can use the YTM calculation to determine which bond offers a better return. The bond with the higher YTM, all other factors being equal, provides a more attractive investment opportunity. The ytm of zero coupon bond serves as a powerful tool to gauge relative value and potential returns in the bond market. Changes in any of these factors – market price, face value, time to maturity, or prevailing interest rates – will directly affect the calculated YTM and an investor’s potential return. Therefore, continuous monitoring of these factors is essential for informed investment decisions.

How to Calculate the YTM of a Zero-Coupon Bond: A Step-by-Step Guide

Calculating the YTM of a zero-coupon bond involves determining the interest rate that equates the present value of the bond’s face value with its current market price. The formula used is a variation of the present value formula. The most common method involves solving for the YTM iteratively. This means making educated guesses and refining them until the present value of the bond’s face value matches the market price. While there is no direct algebraic solution, iterative approximation methods, such as the Newton-Raphson method or using financial calculators or software, provide accurate results for the ytm of zero coupon bond.

A simplified formula, useful for approximate calculations or when using financial tools, is: YTM ≈ (Face Value / Current Market Price)^(1 / Years to Maturity) – 1. This formula provides a reasonable estimate, particularly for bonds with shorter maturities. However, for longer maturities or for a high degree of accuracy, iterative methods are preferred for calculating the ytm of zero coupon bond. Remember that this simplified formula is an approximation and might not yield perfectly precise results. The accuracy increases as the years to maturity decreases. To illustrate, consider a zero-coupon bond with a face value of $1,000, a current market price of $826, and a maturity of 5 years. Using the simplified formula: YTM ≈ ($1000 / $826)^(1/5) – 1 ≈ 0.04 or 4%. This represents an approximate annual yield. More sophisticated methods, available in spreadsheet software or financial calculators, provide a more precise calculation for ytm of zero coupon bond. These tools often incorporate more complex formulas and iterative procedures to achieve higher accuracy in calculating the yield.

Let’s consider a worked example using a financial calculator or spreadsheet software. Assume a zero-coupon bond with a face value of $1,000, a current market price of $750, and a maturity of 10 years. Using a financial calculator or spreadsheet function (like RATE in Excel or Google Sheets), input the following: N (number of periods) = 10, PV (present value) = -750 (negative because it’s an outflow), FV (future value) = 1000 (inflow at maturity), and PMT (payment) = 0 (zero-coupon bond). The calculator or function will then solve for the interest rate (I/Y or RATE), which represents the precise YTM of this zero-coupon bond. This result will be more accurate than the simplified formula, providing a more reliable value for the ytm of zero coupon bond in investment decision-making. The calculated YTM helps investors understand the total return on investment, considering both the initial discounted price and the future face value upon maturity. Understanding the calculation of ytm of zero coupon bond allows investors to make well-informed comparisons between different investment opportunities and to better manage their financial portfolios.

Interpreting the YTM: What Does it Mean for Investors?

The calculated Yield to Maturity (YTM) of a zero coupon bond offers investors a valuable tool for comparison and decision-making. Understanding the YTM of zero coupon bond is critical when evaluating different investment opportunities. It allows for a direct comparison of the potential return on investment across various zero-coupon bonds, even if they have different maturities or face values. A higher YTM generally indicates a more attractive investment, assuming all other factors are equal. However, investors must delve deeper than simply seeking the highest YTM.

The YTM should be viewed in conjunction with the bond’s risk profile. A higher YTM often signals a higher degree of risk. This risk can stem from various sources, including the creditworthiness of the issuer (the likelihood they will repay the face value at maturity) or the time remaining until maturity (longer maturities typically carry more interest rate risk). For example, a zero coupon bond issued by a corporation with a lower credit rating will likely offer a higher YTM than a similar bond issued by a government entity, reflecting the increased risk of default. Therefore, investors should carefully assess the underlying risks before making any investment decisions based solely on the YTM of zero coupon bond.

Furthermore, the YTM can be used to compare zero coupon bonds to other types of investments, such as stocks or mutual funds. While the YTM represents the annualized return of the bond if held to maturity, it’s crucial to consider the potential returns and risks associated with alternative investments. Stocks, for instance, may offer the potential for higher returns but also carry significantly greater risk than zero-coupon bonds. By comparing the YTM of zero coupon bond to the expected returns of other investments, investors can make informed decisions that align with their individual risk tolerance and investment goals. Understanding the YTM of zero coupon bond empowers investors to navigate the bond market with greater confidence and make strategic choices that contribute to a well-diversified and balanced investment portfolio.

Zero-Coupon Bond YTM vs. Other Bond Yield Measures

The Yield to Maturity (YTM) of a zero-coupon bond stands apart from other yield measures commonly used for bonds that distribute periodic interest payments, known as coupon bonds. A primary distinction lies in the fact that zero-coupon bonds do not provide any interim cash flows to the investor. Their return is entirely derived from the difference between the purchase price and the face value received at maturity. This contrasts sharply with coupon bonds, where investors receive regular interest payments throughout the bond’s lifespan, in addition to the face value at maturity.

For coupon-paying bonds, measures such as the current yield are often used. The current yield is calculated by dividing the annual coupon payment by the bond’s current market price. While simple to calculate, current yield only reflects the income an investor receives in a given year and doesn’t account for the total return if the bond is held until maturity. Other metrics for coupon bonds, like YTM, consider the present value of all future coupon payments and the face value, providing a more comprehensive view of the potential return. However, YTM for coupon bonds requires an iterative calculation, while the ytm of zero coupon bond calculation is more straightforward because there are no coupon payments to discount.

The YTM is particularly relevant and crucial for zero-coupon bonds because it encapsulates the entirety of the expected return. Since there are no coupon payments, the YTM of zero coupon bond explicitly represents the annualized return an investor will realize if they hold the bond until it matures. In the context of bonds that pay coupons, YTM represents the effective rate of return, considering compounding interest. For zero-coupon bonds, the ytm of zero coupon bond is even more significant as it is the only return an investor receives. Understanding the ytm of zero coupon bond is therefore vital for assessing its attractiveness relative to other investment options. The ytm of zero coupon bond offers a clear benchmark for evaluating the potential profitability of investing in these unique financial instruments, and is very straightforward to calculate providing a transparent view of potential returns.

Practical Applications of YTM in Zero-Coupon Bond Investing

Understanding the yield to maturity (YTM) of zero coupon bond is paramount in several real-world investment scenarios. Consider a portfolio diversification strategy. An investor aiming for a balanced portfolio might include zero-coupon bonds alongside stocks and coupon-paying bonds. Calculating the ytm of zero coupon bond allows them to accurately assess the potential return from the zero-coupon bond component, facilitating informed decisions about asset allocation.

Retirement planning is another area where the ytm of zero coupon bond plays a crucial role. Imagine an individual wants to ensure a specific sum of money is available upon retirement. They can purchase zero-coupon bonds that mature around their retirement date. By calculating the ytm of zero coupon bond, they can determine the initial investment needed to reach their financial goal, taking into account the time to maturity and the desired future value. This provides a predictable path toward meeting retirement savings targets.

Furthermore, the ytm of zero coupon bond assists in managing risk. Suppose an investor is risk-averse and seeks investments with a guaranteed return if held to maturity. Zero-coupon bonds offer this predictability, and calculating the ytm of zero coupon bond allows for comparison with other low-risk investments, such as certificates of deposit (CDs) or treasury bills. By comparing yields, the investor can choose the option that provides the most favorable return for their risk tolerance. Also by understanding the ytm of zero coupon bond, investment decisions become more strategic and aligned with financial objectives, whether for diversification, retirement, or risk management.

Risks Associated with Zero-Coupon Bond Investments and YTM

Investing in zero-coupon bonds carries inherent risks that investors must understand. Interest rate risk is a primary concern. When prevailing interest rates rise, the market value of zero-coupon bonds typically declines. This is because new bonds are issued with higher yields, making existing lower-yielding bonds less attractive. The longer the time to maturity, the greater the price sensitivity to interest rate changes. Therefore, long-term zero-coupon bonds are more susceptible to interest rate risk than short-term ones. The calculation of the ytm of zero coupon bond is crucial, but doesn’t eliminate market risks.

Inflation risk is another factor to consider. Inflation erodes the purchasing power of future cash flows. If inflation rises unexpectedly, the real return on a zero-coupon bond (the return after accounting for inflation) may be lower than anticipated. While the ytm of zero coupon bond provides a nominal rate of return, it doesn’t guarantee a real return. Investors should assess inflation expectations when evaluating the attractiveness of zero-coupon bonds. Credit risk, although generally lower for government-issued zero-coupon bonds, also exists. This refers to the risk that the issuer may default on its obligation to pay the face value at maturity. Assessing the creditworthiness of the issuer is essential. The accurate calculation of the ytm of zero coupon bond depends on the issuer’s capacity to fulfill their commitment.

The calculated ytm of zero coupon bond is a valuable tool, but it’s essential to recognize its limitations. It represents the expected return only if the bond is held until maturity and the issuer doesn’t default. Market fluctuations and changes in interest rates can impact the actual return realized if the bond is sold before maturity. Investors should conduct thorough research and consider their individual risk tolerance and investment objectives before investing in zero-coupon bonds. Understanding the factors influencing the ytm of zero coupon bond and associated risks are paramount for informed decision-making. Further independent exploration of these concepts is highly recommended to gain a more comprehensive understanding. Always remember that the higher the ytm of zero coupon bond does not always mean a better investment.