How to Determine Portfolio Risk Using Correlation

Understanding portfolio risk is paramount for investors seeking to achieve their financial goals. Diversification, a cornerstone of prudent investing, aims to mitigate risk by strategically allocating assets across various investments. However, simply holding a mix of assets doesn’t guarantee effective diversification. The relationships between these assets, particularly their correlation, significantly impact the overall portfolio risk. Correlation measures how the returns of different assets move in relation to each other. A key tool for quantifying and managing this risk is the portfolio variance formula with correlation. Investors often aim to minimize risk for a given level of expected return, or maximize return for a given level of risk. This is where understanding correlation and the portfolio variance formula with correlation becomes invaluable.

Effective diversification hinges on understanding how assets interact. If assets move in tandem (high positive correlation), the diversification benefit is limited. Conversely, assets that move in opposite directions (negative correlation) or have little relationship (low correlation) can significantly reduce portfolio volatility. The portfolio variance formula with correlation provides a framework for quantifying this effect. While the full formula will be detailed later, it’s important to grasp that it incorporates the individual risk (variance) of each asset, their weights in the portfolio, and the correlation between them. This formula allows investors to estimate the overall risk of their portfolio, taking into account the interplay between different asset classes. The portfolio variance formula with correlation, in essence, is a mathematical representation of diversification’s impact. The ultimate goal is to construct a portfolio that balances risk and return according to the investor’s specific objectives and risk tolerance.

Therefore, mastering the concept of correlation is essential for building a well-diversified portfolio. The portfolio variance formula with correlation serves as a powerful tool for investors, enabling them to assess and manage risk effectively. By understanding the relationships between assets and utilizing the portfolio variance formula with correlation, investors can make more informed decisions, constructing portfolios that are better positioned to weather market fluctuations and achieve long-term financial success. The beauty of the portfolio variance formula with correlation lies in its ability to translate complex relationships into a single, quantifiable metric for portfolio risk.

The Building Blocks: Variance and Standard Deviation Explained

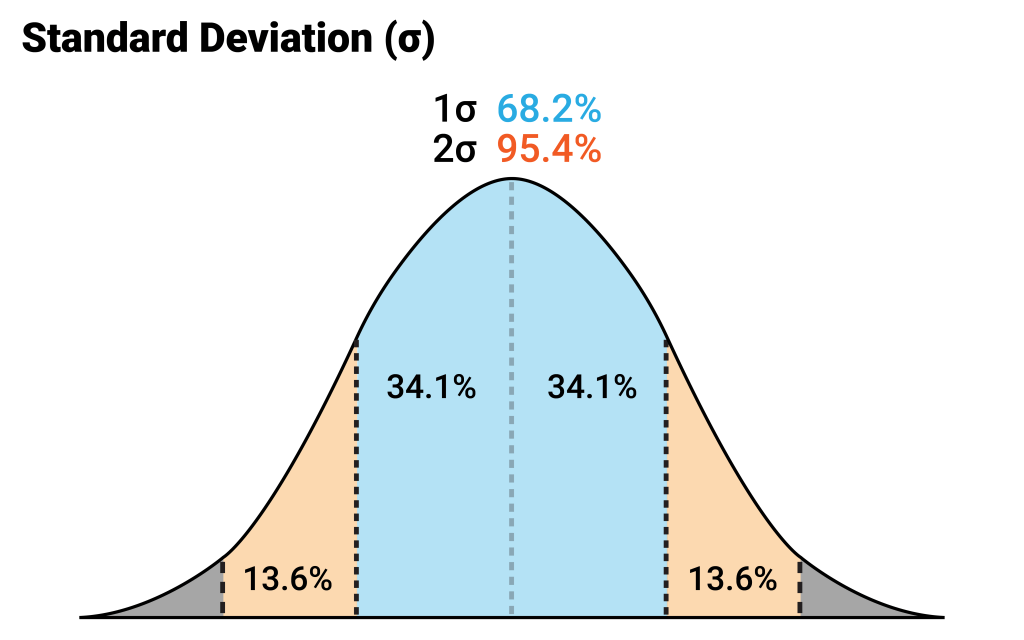

Variance and standard deviation are fundamental measures of risk associated with individual assets. Understanding these concepts is essential before delving into the complexities of the portfolio variance formula with correlation. Variance quantifies the dispersion of an asset’s returns around its average return. A higher variance indicates greater volatility, suggesting a wider range of potential outcomes, both positive and negative. Standard deviation, simply the square root of variance, provides a more intuitive measure of volatility, expressed in the same units as the asset’s returns.

Imagine two stocks, Stock A and Stock B. Stock A has demonstrated annual returns consistently close to 8%, while Stock B’s annual returns have fluctuated significantly, ranging from -5% to +20%. Stock B clearly exhibits a higher degree of volatility. To quantify this, we calculate the variance and standard deviation for each stock. A higher variance and standard deviation for Stock B would confirm its greater risk profile compared to Stock A. The portfolio variance formula with correlation uses these measures to estimate overall portfolio risk.

To illustrate further, consider a simple example: Suppose Stock C has an average return of 10% with a standard deviation of 5%, while Stock D has an average return of 12% with a standard deviation of 15%. Although Stock D offers a higher average return, its significantly larger standard deviation indicates a much higher level of risk. Investors must consider their risk tolerance and investment goals when evaluating assets based on their variance and standard deviation. These metrics are crucial inputs when applying the portfolio variance formula with correlation to determine the overall risk of a diversified portfolio. By understanding these building blocks, investors can better grasp the intricacies of portfolio risk management and make more informed decisions.

The Power of Relationships: A Deep Dive Into Correlation

The correlation coefficient is a statistical measure that quantifies the extent to which two assets move in relation to each other. It ranges from -1 to +1, providing valuable insights for constructing diversified portfolios. Understanding correlation is essential for effectively applying the portfolio variance formula with correlation and managing overall portfolio risk. A crucial aspect of the portfolio variance formula with correlation is the way it considers how assets interact.

A positive correlation (between 0 and +1) indicates that the assets tend to move in the same direction. For example, stocks within the same industry sector often exhibit a positive correlation. If one stock in the sector performs well, others tend to follow suit. While these assets may individually seem sound, a portfolio excessively weighted towards positively correlated assets is vulnerable since similar factors will impact them all in similar ways. The portfolio variance formula with correlation accounts for these relationships. A negative correlation (between -1 and 0), on the other hand, signifies that the assets tend to move in opposite directions. This is where the benefits of diversification truly shine. Stocks and bonds often demonstrate a low or negative correlation. When the stock market declines, bonds may hold their value or even increase in value, offsetting some of the losses in the stock portion of the portfolio. The more negative the correlation, the greater the diversification benefit when using the portfolio variance formula with correlation. A correlation of zero implies that there is no linear relationship between the movements of the two assets. Including assets with low or zero correlation can further reduce portfolio risk.

Consider these examples to illustrate different levels of correlation. Stocks and bonds, as previously mentioned, often have a low or negative correlation, making them a classic pairing for diversification. Stocks in the technology sector and stocks in the energy sector may exhibit a lower correlation than two stocks within the same technology sub-sector. Stocks of companies that sell complementary products might have a positive correlation. For instance, a video game console maker and a popular video game publisher might see their stocks move somewhat in tandem. Understanding these relationships and incorporating them into the portfolio variance formula with correlation allows investors to construct more resilient and risk-aware portfolios. Using the portfolio variance formula with correlation is key to building a portfolio that can endure various market conditions, by diversifying across different types of assets.

Unveiling the Formula: Portfolio Variance Calculation

The portfolio variance formula with correlation is a cornerstone of modern portfolio theory, allowing investors to quantify the overall risk of a diversified portfolio. This formula considers not only the individual riskiness of each asset, measured by its variance, but also the relationships between assets, captured by their correlations. Understanding this formula is crucial for building well-diversified portfolios that balance risk and return. It provides a framework for estimating how much the portfolio’s value might fluctuate over time.

The portfolio variance formula with correlation might look intimidating at first, but it’s built from understandable components. For a two-asset portfolio, the formula is as follows: Portfolio Variance = (Weight of Asset 1)^2 * (Variance of Asset 1) + (Weight of Asset 2)^2 * (Variance of Asset 2) + 2 * (Weight of Asset 1) * (Weight of Asset 2) * (Correlation between Asset 1 and Asset 2) * (Standard Deviation of Asset 1) * (Standard Deviation of Asset 2). Let’s break down each part: ‘Weight of Asset’ refers to the proportion of the portfolio invested in that asset, expressed as a decimal (e.g., 50% = 0.50). ‘Variance of Asset’ quantifies the volatility of the asset’s returns; a higher variance indicates greater volatility. ‘Correlation between Assets’ measures how the returns of the two assets move in relation to each other, ranging from -1 to +1. ‘Standard Deviation of Asset’ is the square root of the variance, representing the typical deviation of returns from the average.

For portfolios with more than two assets, the portfolio variance formula with correlation expands to include terms for every pair of assets in the portfolio. This involves creating a covariance matrix, which displays the covariance between each pair of assets. While the calculation becomes more complex, the underlying principle remains the same: portfolio variance is a weighted sum of the variances of individual assets and their covariances. The beauty of the portfolio variance formula with correlation lies in its ability to capture the risk-reducing effects of diversification. By combining assets with low or negative correlations, investors can construct portfolios with lower overall risk than investing in any single asset alone. The power of the portfolio variance formula with correlation helps to quantify and manage risk effectively. In subsequent sections, we will illustrate the application of the portfolio variance formula with correlation through practical examples, making it even more accessible and understandable.

Step-by-Step Guide: Applying the Formula to a Two-Asset Portfolio

Understanding the portfolio variance formula with correlation becomes significantly easier with a practical example. This section provides a step-by-step guide to calculating portfolio variance for a simple two-asset portfolio. By working through a hypothetical scenario, the abstract concepts transform into concrete actions, revealing the power of diversification. The portfolio variance formula with correlation helps investors understand the potential risk reduction achieved by combining different assets.

Consider a portfolio consisting of two assets: Asset A and Asset B. Asset A has a weighting of 60% (0.6) within the portfolio, while Asset B accounts for the remaining 40% (0.4). Assume that Asset A has an expected return variance of 0.01 (or 1%), and Asset B has a variance of 0.0225 (or 2.25%). Furthermore, the correlation coefficient between Asset A and Asset B is 0.5. To calculate the portfolio variance, the following formula is employed: Portfolio Variance = (Weight of A)2 * (Variance of A) + (Weight of B)2 * (Variance of B) + 2 * (Weight of A) * (Weight of B) * (Correlation of A, B) * (Standard Deviation of A) * (Standard Deviation of B). First, calculate the standard deviations by taking the square root of the variances. The standard deviation of Asset A is √0.01 = 0.1, and the standard deviation of Asset B is √0.0225 = 0.15. Now, plug the values into the formula: Portfolio Variance = (0.6)2 * (0.01) + (0.4)2 * (0.0225) + 2 * (0.6) * (0.4) * (0.5) * (0.1) * (0.15). Portfolio Variance = (0.36 * 0.01) + (0.16 * 0.0225) + (0.12 * 0.015). Portfolio Variance = 0.0036 + 0.0036 + 0.0018. Portfolio Variance = 0.009. This result indicates that the portfolio variance is 0.009 or 0.9%.

The example clearly illustrates how to implement the portfolio variance formula with correlation. The portfolio variance formula with correlation allows an investor to assess the overall risk of their portfolio by considering not only the risk of individual assets, but also how these assets move in relation to one another. It is important to note that this example simplifies the calculation for illustrative purposes. Real-world portfolios often contain numerous assets, necessitating the use of spreadsheets or specialized software to efficiently perform these calculations. Analyzing the effect of different correlation values will enhance the understanding of how the portfolio variance formula with correlation impacts investment decisions. The lower the correlation, the greater the diversification benefit and the lower the overall portfolio risk will be.

Beyond the Basics: Expanding to Multi-Asset Portfolios

Extending the portfolio variance formula with correlation to portfolios holding more than two assets introduces significant complexity. While the fundamental principles remain the same, the calculations become substantially more intricate. Instead of dealing with individual covariances, a correlation matrix becomes necessary. This matrix displays the correlation between every pair of assets in the portfolio. For a portfolio of ‘n’ assets, the matrix will contain n x n entries. Each entry represents the correlation coefficient between a specific pair of assets. The portfolio variance formula with correlation still applies, but its application requires matrix algebra for efficient computation.

Calculating the portfolio variance for a multi-asset portfolio directly using the expanded formula can be computationally demanding. The formula’s complexity grows rapidly with the number of assets. Therefore, spreadsheets like Microsoft Excel or Google Sheets, or specialized financial software packages, are typically employed to manage these calculations. These tools often include functions designed specifically to handle matrix operations, making the computation of portfolio variance significantly more manageable. These applications simplify the input of asset weights, variances, and the correlation matrix, automating the otherwise complex calculations of the portfolio variance formula with correlation.

The use of software is not merely a convenience; it’s crucial for accurate and efficient computation when dealing with large and complex portfolios. The portfolio variance formula with correlation, when applied to a multitude of assets, quickly becomes unwieldy without the aid of such tools. Furthermore, these programs often offer additional functionalities beyond basic variance calculation, such as portfolio optimization tools that help investors find the optimal asset allocation strategy to minimize risk for a given level of return. This highlights the importance of utilizing advanced software in practical portfolio management, especially when considering the complexities introduced by the portfolio variance formula with correlation in multi-asset scenarios.

Advantages of Low Correlation: Reducing Portfolio Risk

Including assets with low or negative correlation in a portfolio offers significant benefits. A key advantage is the reduction of overall portfolio risk. This risk reduction stems from the ability of these assets to offset losses in other parts of the portfolio. When one asset experiences a downturn, another asset with a low or negative correlation may experience gains or remain stable. This diversification effect lessens the impact of negative market fluctuations on the portfolio’s overall value. Understanding this principle is crucial for effectively applying the portfolio variance formula with correlation. Investors can use this formula to quantify the impact of correlation on overall portfolio risk. The lower the correlation between assets, the lower the overall portfolio variance, indicating a less volatile portfolio. This is a key aspect of effective risk management. Properly applying the portfolio variance formula with correlation allows investors to make more informed decisions.

Examples of asset classes that often exhibit low correlation with traditional stocks include real estate and commodities. Real estate prices typically react differently to market swings than stocks. Similarly, commodity prices, influenced by factors like supply and demand, frequently move independently of stock market trends. By incorporating these assets into a portfolio, investors can potentially reduce their overall risk exposure. The portfolio variance formula with correlation allows a precise quantification of this risk reduction. It highlights the impact of adding assets with varying degrees of correlation, illustrating how diversification strategies can minimize volatility. This information helps investors strategically allocate their funds and build more resilient portfolios.

The portfolio variance formula with correlation is not just a theoretical concept; it’s a practical tool for informed investment decision-making. By carefully selecting assets with low correlation and using the formula to calculate portfolio variance, investors can create portfolios tailored to their risk tolerance. This allows for a more strategic approach to portfolio construction, moving beyond simple diversification and towards optimized risk management. The formula allows for a quantitative assessment of the risk reduction achieved through diversification, enabling investors to make data-driven decisions. Furthermore, understanding the influence of correlation on portfolio variance through the formula enhances an investor’s comprehension of risk management within their investment strategy.

Practical Applications: Using Portfolio Variance for Investment Decisions

The portfolio variance formula with correlation is a powerful tool for making informed investment decisions. Investors can use it to optimize asset allocation, minimizing overall portfolio risk while maximizing potential returns. By calculating the portfolio variance, investors gain a quantitative understanding of their portfolio’s volatility. This allows for a more data-driven approach to risk management, enabling investors to adjust their asset mix to better align with their risk tolerance. Understanding the interplay between individual asset variances and their correlations provides valuable insights into portfolio behavior under different market conditions.

Effective asset allocation relies heavily on the portfolio variance formula with correlation. Investors can use this formula to compare the risk profiles of different portfolios. This allows them to choose a portfolio that balances risk and return in a way that aligns with their investment goals. For example, an investor with a higher risk tolerance might opt for a portfolio with higher variance, while a more conservative investor might prefer a portfolio with lower variance. The formula helps quantify these differences, providing a clear basis for comparison. Sophisticated portfolio optimization techniques often leverage the portfolio variance formula with correlation as a core component, seeking the optimal asset weights to minimize risk for a given level of expected return.

Many tools and platforms are available to assist investors in analyzing portfolios and calculating the portfolio variance formula with correlation. Spreadsheet software, dedicated portfolio management programs, and even online investment calculators can handle these calculations, especially for portfolios with many assets. These tools frequently incorporate advanced features like scenario analysis and Monte Carlo simulations to further refine risk assessments. By utilizing these resources, investors can streamline their portfolio analysis and leverage the insights provided by the portfolio variance formula with correlation for better investment outcomes. The portfolio variance formula with correlation is not just a theoretical concept; it’s a practical tool for navigating the complexities of modern investment management.