Understanding the CAPM and its Alpha

The Capital Asset Pricing Model (CAPM) is a financial model that calculates the expected rate of return for an asset or investment. It considers the asset’s sensitivity to systematic risk (beta), the risk-free rate, and the expected market return. To understand how to calculate capm alpha in excel, it is important to define these core components. The risk-free rate represents the return on a risk-free investment, such as a government bond. The market return reflects the expected return of the overall market. Beta measures the volatility of an asset relative to the market.

Alpha, in the context of the CAPM, represents the excess return of an investment. This return is above and beyond what the CAPM predicts based on the investment’s risk profile. In other words, it is the difference between the actual return and the expected return. A positive alpha suggests the investment has outperformed its expected return, while a negative alpha indicates underperformance. Understanding how to calculate capm alpha in excel allows investors to assess investment performance.

The significance of alpha in portfolio management and investment analysis is paramount. It provides a measure of an investment manager’s skill in generating returns. Investors use alpha to evaluate the performance of their portfolios and to make informed decisions about asset allocation. Knowing how to calculate capm alpha in excel helps in identifying investments that have the potential to generate superior returns relative to their risk. This understanding is essential for optimizing portfolio performance and achieving investment goals. Alpha, therefore, is a critical metric for both individual investors and institutional portfolio managers.

Gathering Necessary Data for Your Calculation

To effectively demonstrate how to calculate CAPM alpha in Excel, acquiring the right data is paramount. The calculation relies on three key data sets: the historical returns of the investment asset being analyzed, the historical returns of a relevant market benchmark, and the risk-free rate of return over the same period. Each of these elements plays a critical role in determining the investment’s alpha, and their accuracy directly impacts the reliability of the results. This section will guide you through the process of identifying, sourcing, and preparing this essential data for use in your Excel calculations, enabling you to accurately assess investment performance.

First, historical returns for the investment asset are needed. This could be a stock, a mutual fund, an ETF, or any other investment vehicle. Data providers like Yahoo Finance, Google Finance, and Bloomberg offer historical price data, which can be downloaded directly into Excel. Remember to select a suitable time frame that aligns with your investment horizon, typically spanning several years to capture sufficient market cycles. The frequency of the data (daily, weekly, monthly, or annual) should also be consistent across all data sets to ensure accurate comparisons. For the market benchmark, the S&P 500 is frequently used to represent the overall market. Similar to the investment asset, historical data for the S&P 500 can be obtained from the same financial data providers. When gathering market data, ensure that the period matches that of the investment asset to maintain consistency for how to calculate CAPM alpha in Excel.

Finally, the risk-free rate is a crucial component. This is often represented by the yield on a government bond with a maturity date that aligns with the investment horizon. For example, the yield on a 10-year U.S. Treasury bond is commonly used. The Federal Reserve website provides historical data on Treasury yields. As with the other data sets, ensure the frequency matches. Once all data is gathered, organize it in separate columns in your Excel spreadsheet, clearly labeled for asset returns, market returns, and risk-free rate. Consistency in data frequency and accuracy in data entry are crucial for the correct determination of how to calculate CAPM alpha in Excel and will pave the way for precise and meaningful analysis.

Calculating Beta in Excel: A Step-by-Step Approach

Beta is a measure of a stock’s volatility in relation to the market. Before learning how to calculate CAPM alpha in Excel, beta calculation is a must. This section provides a detailed guide on calculating beta using Excel’s built-in functions. The SLOPE function is the key to this calculation. First, gather the historical returns for both the investment asset and the market benchmark (e.g., S&P 500). These returns should cover the same time period and frequency (e.g., monthly data for the past five years). Input these returns into two separate columns in your Excel spreadsheet.

Next, use the SLOPE function to determine beta. The syntax is =SLOPE(known_ys, known_xs). The “known_ys” are the historical returns of the investment asset. The “known_xs” are the historical returns of the market benchmark. For example, if your asset returns are in column A (A2:A61) and the market returns are in column B (B2:B61), the formula would be =SLOPE(A2:A61, B2:B61). Enter this formula into an empty cell in your Excel sheet. The result will be the calculated beta value. Excel provides a straightforward method on how to calculate CAPM alpha in Excel, with this beta calculation as the base.

The calculated beta value represents the asset’s systematic risk. A beta of 1 indicates that the asset’s price will move with the market. A beta greater than 1 suggests the asset is more volatile than the market. A beta less than 1 indicates lower volatility than the market. Understanding beta is crucial because it is a direct input into the CAPM formula. The CAPM formula will be used to determine the expected return of the investment. This expected return will then be used to calculate alpha. Therefore, a correct beta calculation is essential for a correct alpha calculation. This step is a vital part of understanding how to calculate CAPM alpha in Excel.

Determining the Expected Return using CAPM

This section details how to determine the expected return of an investment using the Capital Asset Pricing Model (CAPM) formula within Excel. The expected return is a critical component in understanding how to calculate CAPM alpha in Excel. It represents the return an investor should anticipate, given the investment’s beta, the market’s expected return, and the prevailing risk-free rate. Accurately calculating this expected return is paramount for a reliable alpha calculation.

The CAPM formula is: Expected Return = Risk-Free Rate + Beta * (Market Return – Risk-Free Rate). To implement this in Excel, first, identify the cells containing each of these values. For example, assume the risk-free rate is in cell B1, the calculated beta (from the previous step) is in cell B2, and the market return is in cell B3. Then, in a separate cell (e.g., B4), enter the following formula: =B1 + B2*(B3-B1). This formula directly translates the CAPM equation into an Excel calculation. Be sure that the returns are expressed in the same frequency (e.g. monthly or annually). This is a crucial step in how to calculate CAPM alpha in Excel.

Ensuring accuracy in this step is crucial. Double-check the cell references in your formula and verify that the input values (risk-free rate, beta, and market return) are correct and consistent with the time period you’re analyzing. A small error in these inputs can significantly impact the expected return and, consequently, the calculated alpha. After entering the formula, the cell will display the expected return. This value will then be used in the subsequent step to calculate alpha, providing an indicator of the investment’s performance relative to what the CAPM predicts. Understanding how to calculate CAPM alpha in Excel hinges on a correctly derived expected return.

Calculating Alpha: The Final Step

The culmination of the previous calculations leads to determining alpha, a measure of an investment’s performance relative to a benchmark. This step details how to compute alpha in Excel, offering a clear and concise method for investment analysis. To calculate alpha, subtract the expected return (derived from the CAPM formula in the prior step) from the actual average return of the investment. The formula in Excel is straightforward: `=Actual Return – Expected Return`. For example, if an investment had an actual average return of 12% and the CAPM-predicted expected return was 8%, the alpha would be 4%. This indicates the investment outperformed its expected return by 4%.

A positive alpha signifies that the investment has outperformed its benchmark, generating returns above what the CAPM model predicted based on its beta and the market’s performance. Conversely, a negative alpha indicates underperformance, meaning the investment’s returns were lower than expected. A zero alpha suggests the investment performed exactly as predicted by the CAPM. Understanding these interpretations is critical for investment decision-making. The actual return of the investment asset is a key input when considering how to calculate capm alpha in excel. For example, consider a stock with an actual return of 15%. If the expected return, based on its beta, the market return, and the risk-free rate, is 10%, then the alpha is 5% (15% – 10% = 5%). This positive alpha suggests the stock has performed well, exceeding expectations. Using Excel, this calculation is easily performed, providing a quantitative measure of investment performance.

Consider another scenario: a mutual fund with an actual return of 7%. If the expected return, calculated using the CAPM, is 9%, then the alpha is -2% (7% – 9% = -2%). This negative alpha indicates the mutual fund underperformed relative to what was expected, given its risk profile and market conditions. Investors use alpha to evaluate investment managers and to make decisions about asset allocation. A high positive alpha is generally desirable, while a negative alpha may prompt a review of the investment strategy or a reallocation of assets. Excel’s capability to quickly calculate and analyze alpha makes it a valuable tool for portfolio management and investment analysis. Knowing how to calculate capm alpha in excel empowers investors to make informed decisions. Also understanding how to calculate capm alpha in excel provides critical insight into investment success and asset performance. This ability to easily know how to calculate capm alpha in excel contributes significantly to effective financial management.

Interpreting Your Alpha Results: What They Mean

The calculated alpha value provides crucial insights into an investment’s performance relative to its expected return, as predicted by the Capital Asset Pricing Model (CAPM). Understanding how to calculate CAPM alpha in Excel is essential for interpreting these results effectively. A positive alpha indicates that the investment has outperformed its expected return, suggesting skillful management or favorable market conditions. Investors often seek positive alpha as it signals above-average returns relative to the risk taken. This information is critical for portfolio optimization and selecting investments that align with specific risk-return profiles. Remember that consistent positive alpha is rare and often suggests strong manager skill or a period of sustained market advantage.

Conversely, a negative alpha signifies underperformance. The investment has yielded less than what the CAPM predicted, indicating either poor investment choices or unfavorable market circumstances. Knowing how to calculate CAPM alpha in Excel empowers investors to identify and potentially mitigate underperforming assets. A negative alpha might prompt a reassessment of the investment strategy or portfolio allocation. Careful analysis is required, however, as a single negative alpha value does not automatically signal future underperformance; it simply indicates past underperformance relative to the model’s expectation.

A zero alpha suggests that the investment’s return precisely matched the expected return based on its risk as measured by beta. While a zero alpha might seem neutral, it’s important to consider the context. Did the investment generate returns in line with its risk profile? If so, a zero alpha may be acceptable. However, if the investment was expected to outperform but only achieved market-rate returns, this could suggest a missed opportunity. Ultimately, the interpretation of alpha requires a thorough understanding of how to calculate CAPM alpha in Excel, the investment’s risk profile, and the overall market conditions. Using this information, investors can make informed decisions, adjust portfolio strategies, and enhance overall investment success.

Advanced Techniques and Considerations for Calculating CAPM Alpha in Excel

While the basic CAPM alpha calculation provides a valuable initial assessment, several advanced techniques can refine the process. One key consideration involves the choice of risk-free rate. Using a longer-term government bond yield might offer a more stable measure compared to shorter-term rates, impacting the expected return and consequently the calculated alpha. Understanding how to choose the most appropriate risk-free rate for a given investment horizon is crucial when learning how to calculate CAPM alpha in Excel. Different regression methods beyond simple linear regression, such as robust regression, can provide more accurate beta estimates, especially when dealing with outliers in the data. Robust regression is less sensitive to data points that might skew the results of a standard linear regression. This is particularly important when exploring how to calculate CAPM alpha in Excel accurately.

Data quality significantly influences the reliability of CAPM alpha. Inconsistent data frequencies, missing values, or errors in the historical return data can lead to inaccurate calculations. Careful data cleaning and validation are essential steps before commencing the calculations. Moreover, the CAPM itself has limitations. It assumes a linear relationship between risk and return, which may not always hold in the real world. It also simplifies market behavior and doesn’t account for factors like market sentiment or investor psychology. Understanding these limitations helps in interpreting the alpha values responsibly. Remember that even the most meticulously performed calculation, when learning how to calculate CAPM alpha in Excel, is only as good as the underlying data and the model’s assumptions.

Furthermore, the standard CAPM model often omits potential biases. Survivorship bias, for instance, can occur when only successful investments are included in the dataset. This upwardly biases the alpha. Similarly, data-snooping bias might arise if numerous investment strategies are tested before selecting one to evaluate, inflating the perceived performance. Acknowledging these potential biases and employing techniques to mitigate them are crucial aspects of accurately determining how to calculate CAPM alpha in Excel. Consider these advanced techniques and limitations when interpreting the results of your alpha calculation. A thorough understanding of these nuances will improve the accuracy and reliability of your analysis and lead to more insightful investment decisions. Remember, understanding how to calculate CAPM alpha in Excel is just one step in a comprehensive investment analysis process.

Practical Example: Calculating Alpha for a Real-World Investment

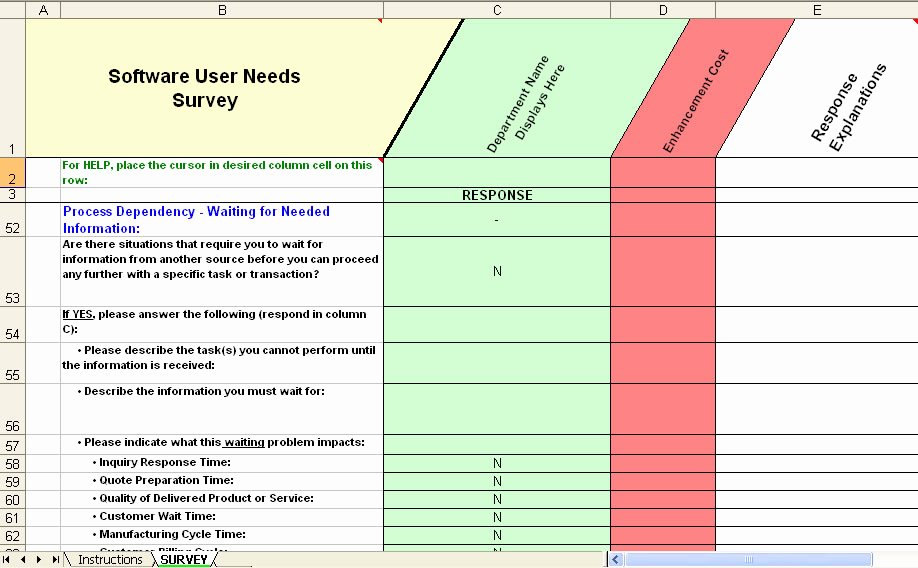

This section demonstrates how to calculate CAPM alpha in Excel using real-world data. We’ll use hypothetical monthly returns for a technology stock (Investment) and the S&P 500 (Market) as our benchmark. The risk-free rate will be approximated using a 1-year US Treasury bond yield. The data is presented below, illustrating a practical application of learning how to calculate CAPM alpha in excel. Understanding how to calculate CAPM alpha in excel is critical for investment analysis.

Imagine the following data: Investment returns are 2%, 5%, -1%, 3%, 7%, and market returns are 1%, 4%, 0%, 2%, 6%. The average risk-free rate is consistently 0.5% for the period. First, calculate the average investment return and the average market return in Excel. Use Excel’s SLOPE function to calculate beta: `=SLOPE(Investment Returns, Market Returns)`. This gives you the beta of the investment relative to the market. Next, apply the CAPM formula: Expected Return = Risk-Free Rate + Beta * (Market Return – Risk-Free Rate). This will give the expected return based on the CAPM. Finally, subtract the expected return from the average investment return to get alpha. A positive alpha signifies the investment outperformed the market, while a negative alpha indicates underperformance. Remember, learning how to calculate CAPM alpha in excel empowers informed investment decisions. This process clarifies how to calculate CAPM alpha in excel efficiently and accurately.

To visualize the process, an Excel spreadsheet would show the data input, the intermediate calculations of beta and expected return, and the final alpha calculation. The formulas should be clearly displayed for easy replication. The resulting alpha value provides a measure of the investment’s performance relative to the market, considering its risk. Mastering how to calculate CAPM alpha in excel facilitates deeper investment understanding and more effective portfolio management. Consistent application of this methodology, as demonstrated here in how to calculate CAPM alpha in excel, significantly enhances investment decision-making. The accurate calculation of alpha, using the steps illustrated in how to calculate CAPM alpha in excel, is key for informed investment analysis. Thorough understanding of how to calculate CAPM alpha in excel provides investors with a powerful tool for evaluating investment performance.