What is the Landscape of Smaller Company Stocks?

The Russell 2000 index serves as a primary benchmark for small-cap U.S. stocks. This index offers a glimpse into a segment of the market often characterized by growth potential and higher volatility. Small-cap stocks generally represent companies with relatively smaller market capitalizations compared to their large-cap counterparts. These companies typically possess a market cap ranging from approximately $300 million to $2 billion, although this range can fluctuate with market conditions. Investors are often drawn to small-cap stocks due to their potential for significant growth. Smaller companies may have more room to expand and innovate compared to established large-cap corporations. This growth potential can translate into higher returns for investors. The russell 2000 index companies list is a very valuable list for investors.

However, this potential for higher returns comes with increased risk. Small-cap stocks tend to be more volatile than large-cap stocks. Their prices can fluctuate more dramatically in response to market news, economic conditions, and company-specific events. This volatility stems from several factors. Smaller companies often have less financial stability and fewer resources than larger companies. They may be more susceptible to economic downturns and industry-specific challenges. The trading volume for small-cap stocks is typically lower than that of large-cap stocks. This lower liquidity can exacerbate price swings and make it more difficult to buy or sell shares quickly at desired prices. The russell 2000 index companies list, although containing promising companies, requires careful analysis.

Despite the risks, the potential rewards of small-cap investing can be substantial. Many successful companies that are now large-cap corporations started as small-cap stocks. Investing in small-cap stocks can provide diversification benefits to a portfolio. Small-cap stocks often have low correlations with large-cap stocks. This means they may perform differently in various market conditions. The russell 2000 index companies list provides a starting point for exploring the diverse world of small-cap investing. Understanding the characteristics, risks, and opportunities associated with small-cap stocks is crucial for making informed investment decisions and potentially capturing significant growth over the long term. The russell 2000 index companies list remains a key resource for investors seeking exposure to this dynamic market segment. A list of russell 2000 index companies list is a tool for investment.

How to Find a List of Companies in the Russell 2000

Accessing a current russell 2000 index companies list requires utilizing specific resources. FTSE Russell, the index provider, is the definitive official source. They offer data subscriptions and tools that provide the most accurate and up-to-date information. However, these services typically involve costs. Investors interested in tracking the russell 2000 index companies list need to consider the budget.

Several financial data providers also offer access to the russell 2000 index companies list. Bloomberg, Refinitiv, and FactSet are examples of such providers. These platforms deliver comprehensive financial data. This data includes company profiles, financials, and index constituents. Access to these services generally comes with a subscription fee. Many brokerage platforms provide access to index information. Clients can often view the russell 2000 index companies list directly through their brokerage accounts. The availability and depth of information vary depending on the platform. Investors should evaluate what tools their broker offers. Some reputable financial news websites may publish lists of russell 2000 index companies list. However, these lists might not be updated as frequently as those from official sources or data providers. Investors should verify the source’s update frequency.

When choosing a method for accessing the russell 2000 index companies list, consider both cost and frequency of updates. Official sources and major data providers offer the most reliable and timely data, but come at a price. Brokerage platforms can be a cost-effective alternative. Ensure the data is sufficiently current for your investment needs. Always verify the information with a reputable source. Accessing the russell 2000 index companies list is the initial step. Conduct thorough research on individual companies before making any investment decisions.

Understanding the Criteria for Inclusion in the Index

The methodology for determining which companies are included in the Russell 2000 index companies list primarily hinges on market capitalization. The Russell 2000 index companies list is a subset of the broader Russell 3000 index, which represents the 3,000 largest publicly traded companies in the United States. Companies are ranked by their market capitalization, from largest to smallest.

The bottom 2,000 companies in this ranking then form the Russell 2000 index companies list, representing the small-cap segment of the U.S. equity market. Market capitalization is calculated based on a company’s share price multiplied by the number of shares outstanding. Therefore, fluctuations in share price directly impact a company’s market capitalization and its eligibility for inclusion in the Russell 2000 index companies list. The Russell 2000 index companies list serves as a key benchmark for investors looking at small cap stocks.

It’s important to note that the Russell 2000 undergoes reconstitution and rebalancing. Reconstitution is the annual process where the entire index is reviewed and updated to accurately reflect the current market landscape. This involves adding newly eligible companies and removing those that no longer meet the criteria. Rebalancing, on the other hand, is the process of adjusting the weightings of each company within the index to reflect changes in their market capitalization. Both reconstitution and rebalancing typically occur annually, ensuring the Russell 2000 index companies list remains a relevant and representative benchmark for the small-cap market. These periodic adjustments impact the Russell 2000 index companies list, reflecting market dynamics.

Key Sectors and Industries Represented

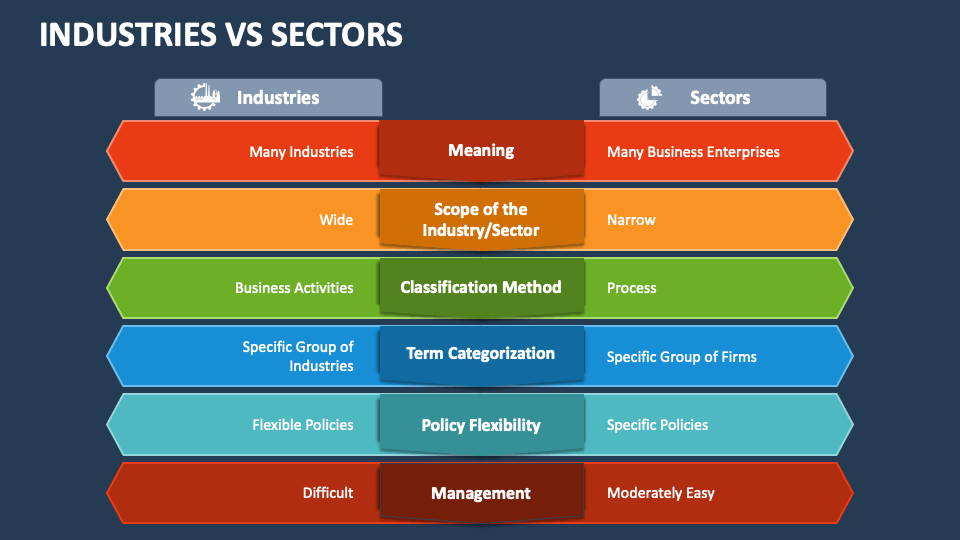

The Russell 2000 index companies list offers a diversified snapshot of the U.S. small-cap market, reflecting the dynamic nature of the economy. An analysis of the sector breakdown reveals the relative importance of different industries within this segment. Sector weightings can shift over time due to market conditions and company performance. These shifts impact the overall index performance, as stronger or weaker performance in heavily weighted sectors will have a more pronounced effect. Prominent sectors often include healthcare, financials, consumer discretionary, and information technology. Each sector contains a variety of russell 2000 index companies list, contributing to the diverse nature of the index.

The healthcare sector within the russell 2000 index companies list typically includes biotechnology firms, pharmaceutical companies, and healthcare providers. These companies are often characterized by innovation and growth potential but can also be subject to regulatory changes and clinical trial outcomes. Financials encompass banks, insurance companies, and investment firms. Their performance is closely tied to interest rates, economic growth, and regulatory environments. The consumer discretionary sector includes retailers, media companies, and consumer services firms. Spending habits and consumer confidence influence this sector’s performance. Technology companies in the russell 2000 index companies list range from software developers to IT service providers. Their success depends on innovation, adoption rates, and overall technological advancements.

To illustrate, within the healthcare sector, one might find companies specializing in novel drug therapies. The financials sector may include regional banks focused on serving local communities. The consumer discretionary sector could feature emerging retail brands with unique product offerings. The technology sector might showcase software companies developing niche applications. Examining the sector composition of the Russell 2000 index companies list provides valuable insights into the drivers of small-cap performance and helps investors understand the risks and opportunities associated with this market segment. Changes to the russell 2000 index companies list sector allocations are carefully monitored by investors.

Using the Index as a Benchmark and Investment Tool

The Russell 2000 serves as a crucial benchmark for investors evaluating the performance of their small-cap investments. Investors can easily compare the returns of their individual stock picks or actively managed small-cap funds against the Russell 2000 index companies list. This comparison helps determine if their investments are outperforming, underperforming, or simply mirroring the overall small-cap market. A key metric in this evaluation is tracking error, which measures the divergence between the performance of a fund or portfolio and the index it is benchmarked against. A lower tracking error indicates a closer alignment with the Russell 2000 index companies list, while a higher tracking error suggests greater deviation.

Exchange-Traded Funds (ETFs) and mutual funds that track the Russell 2000 provide investors with a convenient way to gain broad exposure to the small-cap market. These passively managed funds aim to replicate the performance of the Russell 2000 index companies list by holding the same stocks in similar proportions. Investing in these funds offers several benefits, including diversification, low cost, and ease of trading. Instead of selecting individual stocks, investors can purchase shares of a Russell 2000 ETF or mutual fund, instantly gaining exposure to hundreds of small-cap companies. The russell 2000 index companies list, and the related ETF’s offer immediate diversification. This approach helps mitigate risk and allows investors to participate in the potential growth of the small-cap market without the need for extensive stock picking.

Furthermore, passively managed Russell 2000 index companies list tracking funds typically have lower expense ratios compared to actively managed funds, making them a cost-effective investment option. The transparency of these funds is another advantage, as investors can easily see the list of holdings and understand the fund’s investment strategy. The russell 2000 index companies list, and the funds that track it, are rebalanced periodically to reflect changes in the index composition, ensuring that the fund continues to accurately represent the small-cap market. For investors seeking broad exposure to the russell 2000 index companies list, ETFs and mutual funds that track the index are valuable tools.

Factors Influencing the Performance of the Small-Cap Index

The Russell 2000 index companies list performance is subject to a range of macroeconomic and market-specific factors. Economic growth is a primary driver. A growing economy often translates to increased revenue and earnings for smaller companies, boosting their stock prices. Interest rates also play a significant role. Lower interest rates can stimulate borrowing and investment, benefiting small-cap companies that rely on financing for growth. Conversely, rising interest rates can increase borrowing costs and dampen economic activity, negatively impacting small-caps.

Inflation can also impact the Russell 2000 index companies list. High inflation can erode profit margins as input costs rise, while low inflation can signal weak demand. Investor sentiment is another key factor. Market optimism and risk appetite tend to favor small-cap stocks, while risk aversion often leads investors to flock to larger, more established companies. The Russell 2000 index companies list, being composed of smaller firms, can experience greater volatility due to shifts in investor sentiment. Small-caps tend to outperform large-caps during economic expansions and underperform during recessions. This phenomenon is often referred to as the ‘small-cap premium’. However, this premium is not always consistent and can vary depending on market conditions and the specific economic cycle.

Small-cap stocks, like those included in the Russell 2000 index companies list, often react differently to economic news compared to large-cap stocks. For example, small-caps are often more sensitive to changes in domestic economic conditions, as they tend to have less international exposure than large-caps. Furthermore, regulatory changes and government policies can disproportionately affect smaller companies. Understanding these factors is crucial for investors seeking to navigate the small-cap market effectively. A careful analysis of these elements can aid in predicting the potential trajectory of the Russell 2000 index companies list and making informed investment decisions. Keep abreast of current economic data and market trends to better grasp the forces influencing small-cap performance.

Risks and Opportunities Associated with Small-Cap Investing

Investing in small-cap stocks, particularly those found in a russell 2000 index companies list, presents both unique risks and compelling opportunities. The potential for high growth is a major draw. Small companies often possess the agility to adapt to market changes. They can also capitalize on emerging trends more quickly than their larger counterparts. This agility can translate into substantial returns for investors. However, this potential comes with increased risk. Smaller companies are often more vulnerable to economic downturns. Their financial resources may be limited, and they may lack the established market presence of larger corporations. This makes them more susceptible to failure during challenging economic times.

One significant risk is higher volatility. Small-cap stock prices can fluctuate dramatically in response to market news or company-specific events. This volatility can be unnerving for some investors. It can also lead to losses if not managed carefully. Liquidity can also be a concern. Trading volumes for small-cap stocks are generally lower than those for large-cap stocks. This can make it more difficult to buy or sell shares quickly without affecting the price. Despite these risks, the diversification benefits of including small-cap stocks in a portfolio are noteworthy. Small-caps often have a low correlation with large-cap stocks. This means they can perform differently in various market conditions. Adding small-caps can help to reduce overall portfolio risk and enhance returns over the long term. Analyzing a russell 2000 index companies list requires careful assessment.

Due diligence is paramount when investing in small-cap stocks, particularly from a russell 2000 index companies list. Investors should thoroughly research the company’s financials. Also, they should understand its business model, and assess its competitive landscape. Evaluating the management team and their track record is also essential. Consider factors like debt levels, cash flow, and profitability. Pay close attention to industry trends. Understand the company’s position within its industry. Be aware that information on small-cap companies may be less readily available. Analyst coverage may be limited compared to large-cap stocks. Investors must be prepared to conduct their own independent research. Investing in a russell 2000 index companies list through ETFs or mutual funds can mitigate some risks. These funds offer diversification across a basket of small-cap stocks. This approach reduces the impact of any single company’s performance on the overall investment. However, it’s crucial to understand the fund’s investment strategy and fees before investing.

Beyond the List: Conducting Deeper Research on Individual Stocks

Once you have a russell 2000 index companies list, the next crucial step involves in-depth research. Relying solely on the list is insufficient for making sound investment decisions. Comprehensive due diligence is paramount to understanding the true potential and risks associated with each company. This process requires delving into various information sources to form a well-rounded perspective.

Start by examining the company’s financial statements. These include the balance sheet, income statement, and cash flow statement. These documents provide insights into the company’s assets, liabilities, revenues, expenses, and profitability. Key metrics, like revenue growth, profit margins, debt levels, and return on equity, should be closely analyzed. Investors can also find valuable information in the Management Discussion and Analysis (MD&A) section of the annual report. It offers management’s perspective on the company’s performance and future outlook. News articles and press releases can provide timely updates on company developments. These resources often highlight new product launches, partnerships, acquisitions, or regulatory changes. Analyst reports, available through brokerage platforms or financial data providers, offer expert opinions on a company’s prospects. They typically include ratings, price targets, and detailed analyses of the business model and competitive landscape. Understanding the industry in which the company operates is also critical. Analyzing industry trends, market size, competitive dynamics, and regulatory environment can help assess the company’s potential for growth and profitability. Utilize resources for fundamental analysis, which focuses on evaluating a company’s intrinsic value by examining its financial health and future earnings potential. The russell 2000 index companies list is only the starting point.

Remember that the russell 2000 index companies list represents a diverse range of businesses. Each company possesses unique characteristics and operates within its own specific context. Therefore, a standardized approach to research may not always be appropriate. Tailor your analysis to the specific industry and business model of each company. Consider factors such as the company’s competitive advantages, management team, and corporate governance practices. By conducting thorough research and gathering information from multiple sources, investors can make more informed decisions. This deeper dive beyond the russell 2000 index companies list is essential for successful small-cap investing.