Calculating the Number of Payment Periods in Excel

Excel is a powerful tool for financial calculations, offering a range of functions that can greatly assist with budgeting and planning. Understanding these functions is crucial for making informed financial decisions. One particularly valuable function is NPER, which stands for “Number of Periods.” Knowing what does nper mean in excel is essential for anyone dealing with loans or investments.

The NPER function allows you to determine the length of a loan or investment, expressed in terms of payment periods. This is incredibly useful when you want to figure out how long it will take to pay off a loan, or how many periods are required for an investment to reach a specific target. Using NPER effectively requires understanding its purpose and application within Excel.

What does nper mean in excel practically? It means you can easily calculate the duration needed for financial obligations or goals. The function is a cornerstone for anyone seeking clarity in their financial projections. By mastering NPER, users can gain valuable insights into their financial timelines, enabling more effective planning and management of resources. This capability makes Excel an indispensable tool for both personal and professional finance management.

NPER Function Explained: Syntax and Arguments

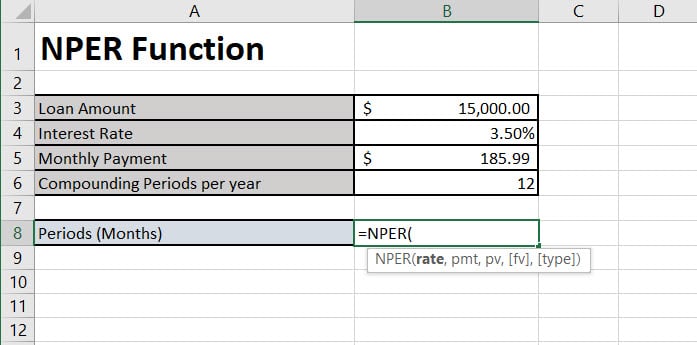

The NPER function in Excel is designed to calculate the number of payment periods required to repay a loan or reach an investment goal. Understanding its syntax is crucial for accurate financial modeling. The NPER function employs the following syntax: NPER(rate, pmt, pv, [fv], [type]). Each argument plays a specific role in the calculation.

The ‘rate’ argument represents the interest rate per period. It is essential to express the interest rate consistently with the payment period. For example, if you make monthly payments on a loan with an annual interest rate, you should divide the annual rate by 12 to get the monthly rate. The ‘pmt’ argument signifies the payment made each period. This payment remains constant throughout the loan or investment term. The ‘pv’ argument stands for the present value, which is the initial loan amount or investment value. The optional ‘[fv]’ argument indicates the future value, which is the desired value after the last payment is made. If omitted, it is assumed to be 0. The optional ‘[type]’ argument specifies when payments are made. Use 0 for payments made at the end of the period and 1 for payments made at the beginning of the period. What does nper mean in excel? It means determining the required number of periods for a loan or investment.

Consider a simple example. Suppose you want to calculate the number of months it will take to pay off a $5,000 loan with a monthly interest rate of 1% and monthly payments of $200. In this case, the formula in Excel would be: NPER(0.01, -200, 5000). Note the negative sign on the payment, indicating a cash outflow. Excel returns the number of periods (months) required to repay the loan. The correct usage of these arguments ensures the accuracy of the NPER function, providing valuable insights into loan and investment timelines. What does nper mean in excel? It means an important tool for budgeting.

How to Use NPER to Calculate Loan Duration

This section offers a step-by-step example of using the NPER function to calculate the number of payment periods for a loan. Consider a realistic loan scenario: a car loan. Suppose you want to purchase a car and need to finance $20,000. The interest rate is 6% per year, and you can afford monthly payments of $400. The goal is to determine how many months it will take to pay off the loan. You will use the NPER function in Excel to find this.

First, open a new Excel spreadsheet. In cell A1, enter “Loan Amount”. In cell B1, enter “$20,000”. Next, in cell A2, enter “Annual Interest Rate”. In cell B2, enter “6%” (or 0.06). Because payments are monthly, divide the annual interest rate by 12 to get the monthly interest rate. In cell A3, enter “Monthly Interest Rate”. In cell B3, enter “=B2/12”. This calculates the monthly interest rate. In cell A4, enter “Monthly Payment”. In cell B4, enter “-$400”. Note the negative sign. This represents a cash outflow. Finally, in cell A5, enter “Number of Payments (NPER)”. In cell B5, enter the NPER function: “=NPER(B3,B4,B1)”. This formula calculates the number of payment periods. The arguments are the monthly interest rate (B3), the monthly payment (B4), and the loan amount (B1). Excel will return the number of months it will take to repay the loan, approximately 57.7 months.

It’s crucial to input the correct values for accurate results. What does nper mean in excel if not correctly inputted? The answer would be a miscalculation. If the payment is entered as a positive number, the result will be incorrect. Ensure the interest rate and payment period align. If payments are monthly, use the monthly interest rate. If payments are annual, use the annual interest rate. Small errors in input can lead to significant discrepancies in the calculated loan duration. Therefore, double-check all values before entering them into the NPER function. Understanding what does nper mean in excel is key to properly calculating loan terms. The function can assist in budgeting and financial planning when correctly applied. Always verify that the rate and the period, or NPER, are on the same time interval. Failing to convert an annual interest rate to a monthly rate when calculating monthly payments is a common mistake. Properly using NPER ensures that you get an accurate estimate of your loan repayment timeline.

Real-World Scenarios: Applying NPER to Different Financial Situations

The NPER function in Excel is a versatile tool applicable to numerous financial situations. Understanding what does nper mean in excel, allows for informed decision-making across various scenarios. Consider a common situation: paying off a credit card balance. By knowing the monthly payment amount, the annual interest rate (divided by 12 to get the monthly rate), and the current balance, NPER can calculate the number of months required to eliminate the debt. This provides a clear timeline and allows for adjustments to payment amounts to accelerate debt repayment.

Another practical application lies in investment planning. Suppose an individual aims to accumulate a specific amount of money through regular investments. Knowing the periodic investment amount, the expected rate of return, and the target future value, NPER can determine the number of periods needed to reach the goal. This is invaluable for retirement planning or saving for long-term objectives such as a down payment on a house. The formula helps to understand how different savings rates impact the investment timeline. Knowing what does nper mean in excel empowers users to project the future. Furthermore, NPER facilitates comparisons of different interest rates on loan repayment periods. For example, when considering a mortgage, NPER can illustrate how a slightly lower interest rate can significantly shorten the loan term and reduce the total interest paid over the life of the loan. This ability to quantify the impact of interest rates is crucial for making financially sound choices.

NPER is also applicable to mortgage interest calculation. When assessing different mortgage options, knowing what does nper mean in excel is invaluable. By inputting the loan amount, interest rate, and monthly payment, NPER calculates the total number of payments (months) required to pay off the mortgage. This allows potential homeowners to compare loan terms and assess the long-term financial implications of each option. It allows for making an informed decision and selecting the mortgage that best aligns with their financial goals. Understanding what does nper mean in excel helps users to navigate complex financial decisions with greater confidence.

Troubleshooting Common NPER Errors

Encountering errors while using the NPER function in Excel is a common experience, but most issues can be easily resolved by understanding potential pitfalls and adhering to best practices. One frequent mistake involves incorrect sign conventions for cash flows. Remember that present value (PV) and future value (FV) should have opposite signs if they represent money moving in opposite directions. For example, a loan received (PV) is a positive cash flow to you, while loan payments (PMT) are negative cash flows. An incorrect sign can lead to a #NUM! error or a nonsensical result.

Another common error stems from improper formatting of input values. Ensure that the interest rate is entered as a decimal (e.g., 0.05 for 5%) and that all numerical values are formatted correctly as numbers. A frequent oversight is not aligning the interest rate with the payment period. If you are making monthly payments on a loan with an annual interest rate, you must divide the annual rate by 12 to obtain the monthly interest rate. Similarly, when calculating “what does nper mean in excel”, the time interval should be consistent (monthly, quarterly, annually). Failing to do so will yield an inaccurate number of periods.

Furthermore, it’s important to verify the inputs for the NPER function carefully. Double-check the loan amount, payment amount, and interest rate to ensure they are accurate. When dealing with complex financial scenarios, consider using cell references instead of hardcoding values directly into the formula. This makes it easier to update the inputs and recalculate the NPER value if any of the underlying assumptions change. Pay close attention to the ‘type’ argument, which specifies whether payments are made at the beginning (1) or end (0) of each period. Incorrectly setting this argument can affect the calculated number of periods. Always cross-validate the results with a loan amortization schedule or an online calculator to confirm the accuracy of the NPER calculation, ensuring a clear understanding of “what does nper mean in excel” in practical terms. If the rate is zero, the formula simplifies, and a different approach might be needed to derive a meaningful result.

Beyond Basic Calculations: Advanced NPER Applications

Excel’s NPER function becomes exceptionally powerful when combined with other financial functions. This allows for comprehensive financial analyses that extend beyond simple loan term calculations. Understanding what does nper mean in excel is only the starting point. By integrating NPER with functions like PMT (payment), PV (present value), and RATE (interest rate), users can gain deeper insights into the interplay of various financial elements.

For instance, consider a scenario where you want to determine the feasibility of purchasing a property. You might first use the PMT function to calculate the monthly mortgage payment based on the loan amount, interest rate, and desired loan term. If the calculated payment is higher than you can comfortably afford, you can then use the NPER function to determine how much longer it would take to pay off the loan if you made smaller payments. This can also work to shorten payment terms. To do so, first, you calculate a higher payment, and then calculate NPER to see how the loan term decreases. This advanced application of NPER provides a clear picture of the trade-offs between payment amount and loan duration. The answer to what does nper mean in excel, therefore, goes beyond finding a static value; it’s about using NPER dynamically.

Another advanced use of NPER is in creating amortization schedules. While Excel doesn’t have a built-in function to generate these schedules automatically, NPER can be integrated into formulas that calculate the principal and interest portions of each payment over the life of a loan. This level of detail is invaluable for understanding the true cost of borrowing and for tracking the progress of loan repayment. Furthermore, NPER can be employed to evaluate the profitability of different investment options. By estimating future cash flows and using NPER in conjunction with other financial functions, investors can compare the time required to reach specific financial goals under varying investment strategies. Let’s say you want to buy a house in 5 years. You know how much money you need to have saved for a down payment. You can figure out how much money needs to be invested monthly at a certain interest rate (using the PMT function). From there, using NPER you can tweak different values to determine the best course of action for you. For example, if you are willing to invest a higher monthly payment, then NPER will show you how quickly you’ll reach your goal. This showcases that what does nper mean in excel is more than just knowing the function. It’s about manipulating the function and using it in conjunction with other functions.

Alternatives to NPER: Exploring Other Methods for Finding Loan Term

While Excel’s NPER function offers a precise way to calculate loan duration, alternative methods exist. These alternatives can range from simple online calculators to more involved manual calculations. Understanding the pros and cons of each approach helps in choosing the best method for a given situation. The question of “what does nper mean in excel” can also be answered by comparing it to these other methods.

Online loan calculators are readily accessible and user-friendly. They typically require inputting the loan amount, interest rate, and monthly payment to determine the loan term. These calculators are convenient for quick estimations, but they might lack the customization and precision of the NPER function. Moreover, many online calculators do not offer detailed amortization schedules. Manual calculations, on the other hand, involve using mathematical formulas to solve for the number of periods. This approach offers a deeper understanding of the underlying calculations, but it can be time-consuming and prone to errors if not executed carefully. These alternative methods can help provide context for “what does nper mean in excel”, in terms of its value proposition.

Compared to these alternatives, the NPER function in Excel provides a balance of accuracy, flexibility, and control. It allows for incorporating various financial scenarios, including adjustments for future value and payment types. The NPER function also integrates seamlessly with other Excel functions, enabling comprehensive financial analyses. While online calculators offer simplicity and manual calculations provide insight, NPER offers a robust and reliable solution when used correctly. For users asking “what does nper mean in excel”, it’s important to know that web-based calculators can be useful for quick estimates, but NPER provides a more powerful and customizable tool. Furthermore, NPER’s ability to integrate with other Excel features makes it a preferred choice for in-depth financial planning. NPER’s ability to handle complex scenarios and integrate seamlessly with other Excel tools explains what does nper mean in excel, in the context of robust financial analysis.

Mastering Financial Formulas: Final Thoughts on Excel and NPER

This article has explored the power of Excel’s NPER function for financial planning. Understanding how to calculate the number of payment periods is crucial for anyone managing loans or investments. The NPER function provides a precise and efficient way to determine the duration of a financial commitment, playing a vital role in effective budgeting and financial decision-making. Knowing what does nper mean in excel can significantly enhance your ability to analyze financial scenarios.

The correct application of NPER requires careful attention to detail. This includes the accurate input of interest rates, payment amounts, and present values. Furthermore, understanding the sign conventions and ensuring consistency in time periods are critical for avoiding errors. Excel offers a wide range of other financial functions that, when combined with NPER, can enable complex financial analyses. Mastering these functions will allow for a deeper understanding of financial concepts and improve your overall financial literacy. What does nper mean in excel in terms of empowering your financial forecasting? It means greater precision and control.

As you continue to explore Excel’s financial capabilities, remember the importance of verifying your work. Double-check your inputs, validate your formulas, and consider seeking professional advice when dealing with complex financial situations. While tools like NPER are incredibly helpful, they are only as good as the data you provide. By combining a solid understanding of financial principles with the power of Excel, you can make informed decisions and achieve your financial goals. What does nper mean in excel for long-term financial health? It’s a tool for informed planning and proactive management of your resources. Continue to practice, explore different scenarios, and refine your spreadsheet analysis skills to maximize the benefits of Excel in your financial journey. Further enhance your skills with online courses that teach what does nper mean in excel with practical applications.