Decoding a 9% Coupon on a Decade-Long Corporate Bond

Corporate bonds represent a crucial component of the investment landscape, serving as debt instruments issued by corporations to raise capital. Understanding the fundamentals of these bonds is essential for both beginner and seasoned investors. Key terms associated with corporate bonds include the “coupon,” which represents the annual interest rate paid on the bond’s face value; the “yield,” reflecting the return an investor receives, taking into account the bond’s market price; the “maturity date,” indicating when the principal is repaid; and the “par value,” also known as face value, which is the amount the issuer pays back at maturity, typically $1,000. When a 10-year corporate bond has an annual coupon of 9%, it signifies that the bondholder will receive $90 annually for every $1,000 par value bond they own. This payment is typically split into two semi-annual installments of $45 each.

A 9% annual coupon on a 10-year corporate bond has an annual coupon of 9 provides a predictable income stream for investors. This fixed income can be particularly attractive in periods of economic uncertainty or low interest rates. However, it’s important to remember that the actual return an investor receives may differ from the coupon rate, depending on the price they pay for the bond in the secondary market. If an investor purchases the bond at par value ($1,000), their return will match the 9% coupon rate. If they purchase it at a premium (above $1,000), their return will be lower than 9%, and conversely, if they buy it at a discount (below $1,000), their return will be higher. Investing in a 10-year corporate bond has an annual coupon of 9 can be part of a broader diversification strategy.

The predictability of the coupon payments makes investing in a 10-year corporate bond has an annual coupon of 9 an appealing option for investors seeking a steady income stream. Before investing in a 10-year corporate bond has an annual coupon of 9 it’s very important to understand the concept. The coupon payments are usually fixed for the life of the bond, offering a degree of financial certainty that can be particularly valuable in retirement planning or other long-term investment strategies. However, investors must also consider the risks associated with corporate bonds, such as the issuer’s creditworthiness and the potential impact of rising interest rates on the bond’s market value. Thorough due diligence is always recommended before making any investment decisions.

How to Calculate the Current Yield of a 10-Year Corporate Bond

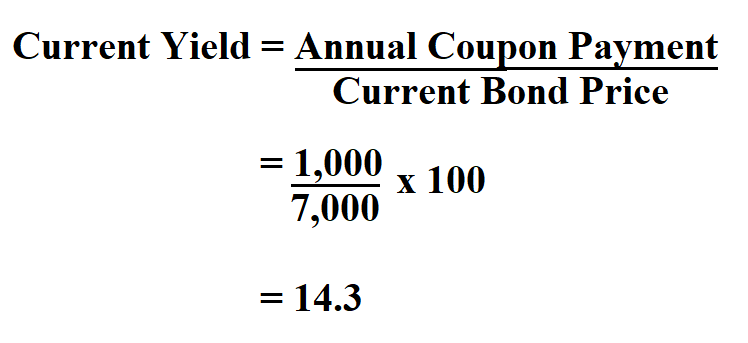

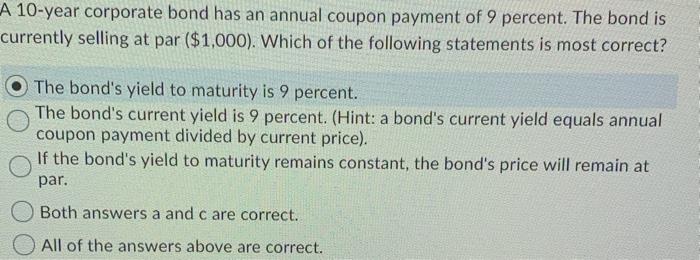

The current yield is a crucial metric for bond investors. It estimates the annual return on a bond based on its current market price. Unlike the coupon rate, which is fixed, the current yield fluctuates with the bond’s price. Understanding this difference is vital for making informed investment decisions regarding a 10-year corporate bond that has an annual coupon of 9. A 10-year corporate bond has an annual coupon of 9 offers fixed payments. However, its attractiveness varies with market conditions.

To calculate the current yield, divide the bond’s annual coupon payments by its current market price. The formula is: Current Yield = (Annual Coupon Payment / Current Market Price) x 100. Let’s consider our example of a 10-year corporate bond has an annual coupon of 9. Assume its par value is $1,000, and its current market price is $900. The annual coupon payment is 9% of $1,000, which equals $90. Therefore, the current yield is ($90 / $900) x 100 = 10%. This means that even though the bond’s coupon rate is 9%, an investor buying it at $900 would receive a current yield of 10%. Conversely, if the market price were $1,100, the current yield would be ($90 / $1,100) x 100 = 8.18%. This simple calculation helps investors quickly assess the immediate return they can expect from a bond at its current price. A 10-year corporate bond has an annual coupon of 9 provides a steady income stream. Its current yield reflects market valuations.

The current yield provides a snapshot of a bond’s return at a specific point in time. It’s essential to remember that the current yield doesn’t account for the bond’s face value or the number of years until maturity. It is a straightforward measure for comparing different bonds. Especially when assessing a 10-year corporate bond has an annual coupon of 9. For a more complete picture of a bond’s potential return, investors should also consider the Yield to Maturity (YTM). The YTM considers the total return an investor will receive if they hold the bond until maturity. The current yield is a practical tool for evaluating bonds. But it should be used in conjunction with other metrics for comprehensive analysis. Understanding current yield empowers investors to make better decisions.

The Relationship Between Bond Prices and Yields

A fundamental principle in the bond market dictates an inverse relationship between bond prices and yields. When interest rates rise, newly issued bonds offer higher yields. Consequently, existing bonds with lower coupon rates, such as a 10-year corporate bond has an annual coupon of 9%, become less attractive. Investors demand a lower price for these older bonds to achieve a competitive yield. This decrease in price increases the yield for the new buyer. Conversely, when interest rates fall, the yields on newly issued bonds decrease. Existing bonds with higher coupon rates, like a 10-year corporate bond has an annual coupon of 9%, become more appealing, driving up their prices and lowering their yield. This dynamic illustrates how prevailing interest rates significantly impact bond values and returns. A 10-year corporate bond has an annual coupon of 9%, but its market price fluctuates directly with interest rate changes.

Supply and demand also play a crucial role in determining bond prices and yields. High demand for a particular bond, perhaps due to its perceived safety or strong credit rating of the issuer, will push its price up and consequently lower its yield. Conversely, if a bond’s creditworthiness is questioned or market conditions shift investor sentiment, supply increases and demand falls causing a reduction in price and a rise in yield. The interplay of these economic forces dictates the market value of bonds, even those with fixed coupon payments like a 10-year corporate bond has an annual coupon of 9%. Therefore, understanding these factors helps investors navigate the complexities of the bond market. Changes in interest rates often impact the price of a bond more than changes in creditworthiness.

Consider a scenario where a 10-year corporate bond has an annual coupon of 9% and is initially issued at par value. If interest rates increase, newly issued bonds will offer higher yields. The demand for the 9% bond decreases, pushing its price down. This lower price raises the current yield for new investors, making it competitive with newer higher-yield bonds. Conversely, if interest rates decrease, the 9% bond becomes more attractive, its price rises, and its yield falls. The price movements demonstrate the inverse relationship between bond prices and yields. Understanding this dynamic is crucial for managing the risk associated with holding a 10-year corporate bond has an annual coupon of 9%, or any bond for that matter. A 10-year corporate bond has an annual coupon of 9%, highlighting the importance of monitoring interest rate movements.

Factors Influencing Corporate Bond Yields

Several factors significantly influence the yield of a 10-year corporate bond, including the creditworthiness of the issuer. Credit rating agencies like Moody’s and S&P assess the likelihood of a company defaulting on its debt obligations. A higher credit rating generally translates to a lower yield, reflecting the reduced risk. Conversely, a lower credit rating indicates higher risk, resulting in a higher yield to compensate investors. A 10-year corporate bond has an annual coupon of 9%, but this coupon alone doesn’t dictate the market yield. The market yield fluctuates with overall economic conditions and investor sentiment.

The prevailing economic environment plays a crucial role. During periods of economic expansion, investors are generally more willing to take on risk, leading to lower yields on corporate bonds. Conversely, during economic downturns or recessions, investors demand higher yields to compensate for the increased risk of default. Inflation also impacts bond yields. Rising inflation erodes the purchasing power of future coupon payments, prompting investors to demand higher yields to offset this erosion. The risk-free rate, typically represented by the yield on U.S. Treasury bonds, serves as a benchmark. Corporate bond yields usually exceed the risk-free rate to reflect the additional credit risk associated with corporate debt. A 10-year corporate bond has an annual coupon of 9%, but its yield will always be relative to the risk-free rate.

A company’s ability to consistently pay its coupon payments and repay principal at maturity depends on various factors. Its financial health, including profitability, cash flow, and leverage, directly affects its creditworthiness. A company’s industry and competitive landscape also play a significant role. Strong and stable industries generally offer less risk compared to volatile sectors. Furthermore, macroeconomic factors such as interest rate changes, economic growth, and geopolitical events can impact a company’s ability to meet its debt obligations. A 10-year corporate bond has an annual coupon of 9%, but its viability rests on the financial soundness of the issuing company and the stability of the broader economic environment. Investors should carefully consider these factors before investing in corporate bonds.

Assessing the Risk of a 9% Corporate Bond

Investing in a 10-year corporate bond has an annual coupon of 9% carries inherent risks. Credit risk, or the risk of default, is paramount. A company’s failure to make timely coupon payments or repay the principal at maturity represents a significant loss for bondholders. Credit rating agencies like Moody’s and S&P assess the creditworthiness of corporations issuing bonds. Higher ratings signify lower default risk, while lower ratings suggest a greater likelihood of default. A 10-year corporate bond has an annual coupon of 9% from a lower-rated issuer carries substantially more risk than one from a higher-rated company. Investors should carefully examine the credit rating before investing. Understanding the credit spread, the difference between the yield of a corporate bond and a similar-maturity government bond, helps assess the additional risk premium demanded by investors for bearing the credit risk of a corporate bond like a 10-year corporate bond that has an annual coupon of 9%. A wider spread indicates a higher perceived risk.

Interest rate risk is another critical factor to consider when evaluating a 10-year corporate bond that has an annual coupon of 9%. Rising interest rates generally cause bond prices to fall. If interest rates increase after purchasing the bond, the market value of the bond will decline. This is because newly issued bonds will offer higher yields, making existing bonds with lower coupons less attractive. The longer the maturity of the bond, the greater the interest rate risk. A 10-year bond is more susceptible to interest rate fluctuations than a shorter-term bond. A 10-year corporate bond has an annual coupon of 9% purchased when interest rates are low will experience a greater price decline if interest rates rise significantly compared to a bond with a shorter maturity or a lower coupon rate. Careful consideration of interest rate forecasts is crucial for informed investment decisions.

Investors should also be aware of reinvestment risk. This risk relates to the uncertainty of reinvesting coupon payments at the same or similar rate as the initial yield. If interest rates decline during the life of the bond, reinvestment of the coupon payments will produce lower returns. For a 10-year corporate bond that has an annual coupon of 9%, this means the overall return may be lower than anticipated if interest rates fall significantly. Diversification across different bond issuers and maturities can help mitigate both credit risk and interest rate risk. Thorough due diligence, including reviewing the issuer’s financial statements and industry outlook, is essential before investing in any corporate bond, especially one like a 10-year corporate bond that has an annual coupon of 9% that carries a higher level of risk compared to other investment options.

Comparing a 10-Year Corporate Bond with a 9% Coupon to Other Investments

Investing in a 10-year corporate bond with an annual coupon of 9% presents a unique risk-reward profile compared to other investment options. Government bonds, generally considered less risky, typically offer lower yields. The lower yield reflects the reduced risk of default associated with government issuers. A 10-year corporate bond has an annual coupon of 9%, offering a potentially higher return, but this comes with increased credit risk. The potential for higher returns attracts investors seeking better yields than those offered by government bonds. However, careful consideration of the issuer’s creditworthiness is crucial, as defaults can lead to significant losses. Understanding the credit rating is essential when assessing the risk involved in a 10-year corporate bond.

Stocks present a different investment landscape. They offer the potential for significantly higher returns than bonds, but also expose investors to greater volatility and risk. A 10-year corporate bond has an annual coupon of 9%, providing a more stable income stream compared to the fluctuating returns of stocks. The choice between stocks and bonds depends on individual risk tolerance and investment goals. Conservative investors might prefer the relative stability of a 10-year corporate bond, while those with higher risk tolerance might find stocks more appealing, despite the uncertainty. Money market accounts provide liquidity and safety, but typically offer significantly lower returns than a 10-year corporate bond with a 9% coupon. They are suitable for short-term needs but fall short in terms of long-term growth potential.

Tax implications play a crucial role in evaluating the true return of a 10-year corporate bond. Interest income from corporate bonds is generally taxable. Tax rates vary depending on individual circumstances. Investors should consider the after-tax return when comparing a 10-year corporate bond to other investments. Inflation also erodes the purchasing power of returns over time. It’s essential to consider the inflation-adjusted return of a 10-year corporate bond with an annual coupon of 9%, to get a clearer picture of its real return. Calculating the real return accounts for the impact of inflation and provides a more accurate assessment of the investment’s performance. A 10-year corporate bond has an annual coupon of 9%, but its real return is influenced by the prevailing inflation rate.

Understanding Yield to Maturity (YTM) for a Corporate Bond

Yield to Maturity (YTM) is a crucial concept for investors considering corporate bonds. It represents the total return anticipated on a bond if it is held until it matures. YTM differs from the current yield, offering a more complete picture of a bond’s potential profitability. For example, a 10-year corporate bond has an annual coupon of 9%, its YTM will also consider the difference between the purchase price of the bond and its face value, as well as reinvesting the coupon payments. The current yield only considers the coupon payment relative to the purchase price.

YTM calculations take into account several factors. These include the bond’s current market price, its par value (the amount the issuer will pay back at maturity), the coupon interest rate, and the time remaining until maturity. The YTM is the discount rate that equates the present value of the bond’s future cash flows (coupon payments and par value) to its current market price. Because a 10-year corporate bond has an annual coupon of 9, the YTM calculation becomes intricate. If an investor purchases a bond below its par value (at a discount), the YTM will be higher than the current yield. Conversely, if the bond is purchased above its par value (at a premium), the YTM will be lower than the current yield.

While the precise calculation of YTM can be complex and often requires financial calculators or specialized software, understanding its underlying principle is essential for bond investors. For instance, consider a scenario where a 10-year corporate bond has an annual coupon of 9 but is trading at a discount due to prevailing interest rates. The YTM would factor in both the steady income from the 9% coupon payments and the capital gain realized when the bond matures and the investor receives the full face value. In essence, YTM provides a single, comprehensive measure of the expected return, assuming the bond is held until maturity and all coupon payments are reinvested at the same rate. Investors should recognize that the actual yield realized may differ slightly from the YTM due to fluctuating interest rates and the reinvestment of coupon payments at different rates.

Should You Invest in a Corporate Bond with a 9% Coupon?

Deciding whether to invest in a 10-year corporate bond that has an annual coupon of 9% requires careful consideration. It’s not a one-size-fits-all answer, as the suitability depends heavily on individual circumstances, financial goals, and risk tolerance. A 10-year corporate bond that has an annual coupon of 9% can seem attractive due to the potential for a relatively high income stream compared to other fixed-income investments.

One must carefully weigh the risks and rewards associated with such an investment. The higher coupon rate often reflects a higher level of risk compared to government bonds or highly-rated corporate bonds. Credit risk, or the risk that the issuer may default on its payments, is a primary concern. Before investing, it’s crucial to assess the creditworthiness of the issuing corporation by reviewing its credit ratings from agencies like Moody’s or S&P. A lower credit rating suggests a higher risk of default. Interest rate risk is another important consideration. If interest rates rise, the market value of a 10-year corporate bond that has an annual coupon of 9% may decline, potentially leading to losses if the bond is sold before maturity. Inflation also erodes the actual return.

Before making any investment decisions, it’s essential to conduct thorough due diligence and seek personalized advice from a qualified financial advisor. Understand your investment objectives, risk capacity, and time horizon. Evaluate how a 10-year corporate bond that has an annual coupon of 9% aligns with your overall investment strategy. Diversification is also crucial. Consider diversifying your portfolio across different asset classes and industries to mitigate risk. A 10-year corporate bond that has an annual coupon of 9%, while potentially lucrative, should be part of a well-thought-out investment plan that aligns with your specific needs and circumstances. Thorough research and professional guidance are paramount to making informed investment decisions.