Understanding the Broad Money Supply (M2)

The broad money supply, commonly known as M2, represents the total amount of money circulating in an economy. It includes readily available cash, checking accounts, savings accounts, and other easily accessible funds. Understanding M2 is crucial because it acts as a key indicator of economic health and potential inflationary pressures. A close examination of the us m2 money supply chart reveals significant trends in economic activity. M2 differs from M1 (which only includes the most liquid forms of money) and M0 (the monetary base controlled by the central bank). Analyzing the us m2 money supply chart helps economists and investors assess the overall state of the economy. A growing M2 often suggests robust economic activity, but rapid growth can also signal potential inflation. Conversely, a shrinking M2 may indicate economic slowdown or even recession. The us m2 money supply chart provides a visual tool for tracking these vital economic shifts. Therefore, studying changes in the M2 money supply offers valuable insights into economic dynamics. Studying the us m2 money supply chart is an important aspect of economic analysis.

M2’s components include currency in circulation, demand deposits (checking accounts), savings deposits, money market deposit accounts, and small-denomination time deposits (less than $100,000). These components represent different levels of liquidity, meaning how easily they can be converted into cash. The us m2 money supply chart illustrates the interplay between these components and how they collectively shape the overall money supply. Changes in the composition of M2 can offer clues about shifts in consumer and business behavior. For example, a rise in savings deposits might suggest increased caution or uncertainty in the economy. Analyzing the us m2 money supply chart provides a comprehensive view of these dynamic relationships. The importance of monitoring the us m2 money supply chart cannot be overstated for its insights into economic conditions.

The us m2 money supply chart is essential for observing the economy’s overall health. The chart visually represents changes in M2 over time. It helps identify patterns and trends, allowing analysts to understand economic cycles. Line charts are best for showing trends over time. Bar charts are helpful for comparing M2 levels across specific periods. Both charts help economists, policymakers, and investors make informed decisions. The us m2 money supply chart is a fundamental tool for economic analysis. Understanding the us m2 money supply chart is critical for predicting future economic trends. The us m2 money supply chart offers a readily accessible and valuable indicator of economic health. The us m2 money supply chart is a visual representation of money supply changes.

Visualizing Changes in Aggregate Money

Understanding the complexities of the US M2 money supply requires effective visualization. Charts and graphs offer a clear, concise way to monitor trends and patterns in the money supply over time. A well-constructed US M2 money supply chart can instantly reveal significant changes, making it easier to identify periods of rapid growth or contraction. This visual representation is crucial for economists, investors, and policymakers seeking to grasp the overall economic health.

Different chart types serve distinct analytical purposes. Line charts, for example, excel at showcasing trends over extended periods. They effectively illustrate the gradual increase or decrease in the US M2 money supply across years or even decades. Bar charts, conversely, are more suitable for comparing the money supply across shorter timeframes, such as individual months or quarters. A combination of line and bar charts within a single US M2 money supply chart can offer a comprehensive overview, highlighting both long-term trends and short-term fluctuations. Interactive charts, which allow users to zoom in on specific periods and explore underlying data points, offer an even more nuanced understanding of the money supply. By utilizing these visualization techniques, one can readily interpret the dynamics of the US M2 money supply and its implications for the economy. The ability to quickly identify notable changes or deviations is key to understanding potential economic shifts.

The use of a US M2 money supply chart is not merely for aesthetic purposes; it’s an indispensable tool for insightful analysis. By presenting complex data in a readily digestible format, charts allow for efficient identification of significant shifts and patterns in the monetary landscape. This enhanced understanding aids in informed decision-making, offering a powerful resource for anyone seeking to understand the US M2 money supply and its implications. Analyzing a well-designed US M2 money supply chart becomes a critical step in interpreting economic indicators and forecasting future trends. The visual representation simplifies intricate data, highlighting trends and fluctuations that might be missed when only reviewing raw numerical data. Therefore, the strategic use of various charting methods is essential for effective monitoring of the US M2 money supply.

How to Interpret Fluctuations in the Monetary Base?

Fluctuations in the monetary base, the foundation of the US M2 money supply chart, directly influence the broader money supply (M2). An increase in the monetary base, often driven by actions from the Federal Reserve, typically leads to a rise in M2. Conversely, a decrease in the monetary base tends to contract M2. Understanding this relationship is crucial for interpreting changes in the overall money supply. Analyzing the us m2 money supply chart reveals this dynamic interplay between the monetary base and M2. Factors such as the Federal Reserve’s open market operations—buying or selling government securities—significantly impact the monetary base and, consequently, M2. Changes in reserve requirements imposed on commercial banks also affect the money supply. When reserve requirements decrease, banks have more funds available to lend, increasing the money supply. The opposite is true when reserve requirements rise. Furthermore, changes in interest rates influence borrowing and lending, affecting the money supply. Lower interest rates encourage borrowing and spending, expanding M2, while higher rates have the opposite effect. Government spending and tax policies also play a role; increased government spending can inject more money into the system, boosting M2.

The us m2 money supply chart shows that various events can cause significant shifts in M2. For instance, during periods of economic expansion, increased borrowing and lending usually result in a higher M2. Conversely, economic downturns or recessions often lead to decreased borrowing and lending, causing M2 to decline. The impact of quantitative easing (QE) programs is also clearly visible on the us m2 money supply chart. QE, where central banks inject liquidity into the financial system by purchasing assets, substantially increases the monetary base and, subsequently, M2. Conversely, periods of deleveraging, where banks and other institutions reduce their borrowing, often lead to contractions in M2. Examining the us m2 money supply chart during periods of significant financial instability, such as the 2008 financial crisis, illustrates the dramatic impact such events can have on M2. This visual representation helps in understanding the dynamic nature of the money supply and its response to external shocks. The chart’s data provides context to interpret economic events and their consequences.

Interpreting fluctuations in M2 requires a comprehensive understanding of the interplay between the monetary base, interest rates, government policies, and overall economic conditions. The us m2 money supply chart provides a valuable visual tool for analyzing these complex interactions. By studying the historical trends displayed in the chart, one can better understand the factors driving money supply changes and their potential implications for the economy. For example, a consistently rising M2 coupled with high inflation might indicate a need for intervention by the central bank to stabilize the economy. Conversely, a sharply falling M2 could signal a weakening economy, possibly requiring expansionary monetary policies. Therefore, careful analysis of the us m2 money supply chart is essential for sound economic policymaking and forecasting.

Exploring the Historical Growth of Aggregate Money

Over the past few decades, the us m2 money supply chart reveals a fascinating narrative of growth and fluctuation. Periods of economic expansion typically witnessed a corresponding increase in the money supply. The expansion of credit and increased economic activity fueled this growth. Conversely, during times of recession or financial crisis, the rate of money supply growth slowed considerably. A visual representation, such as a us m2 money supply chart, would clearly depict this dynamic interplay between economic conditions and money supply. These fluctuations reflect the complex interplay of factors influencing the availability of money within the economy, including the actions of central banks and the behavior of financial institutions. Examining a us m2 money supply chart provides valuable insights into these patterns. The data illustrates how the monetary base can be impacted by major economic events and policy decisions.

Significant deviations from the overall trend are often observed during periods of major economic upheaval. A us m2 money supply chart would show how these events caused dramatic shifts in the money supply. These periods illustrate the inherent volatility of the us m2 money supply and its sensitivity to both internal and external economic shocks. Understanding these historical patterns is crucial for forecasting future trends and formulating effective monetary policy. A careful analysis of a us m2 money supply chart allows policymakers to better anticipate and mitigate potential risks to the financial system. The data emphasizes the need for a proactive and adaptable approach to managing the money supply, ensuring economic stability. Analyzing the us m2 money supply chart allows for a deeper understanding of the historical context shaping monetary policy.

While the overall trend might appear to be one of consistent growth over the long term, a us m2 money supply chart would reveal nuances within that growth. There have been periods of accelerated expansion, followed by periods of slower growth or even contraction. These fluctuations reflect the influence of various factors, ranging from changes in interest rates and government spending to shifts in consumer and business confidence. A well-constructed us m2 money supply chart not only illustrates the magnitude of these changes but also highlights the timing and duration of each phase. By examining the historical data presented in a us m2 money supply chart, economists can gain valuable insights into the complex dynamics driving the growth of the money supply and its effects on the broader economy. This knowledge is essential for informed decision-making and effective economic management.

Factors Affecting the Availability of Liquid Assets

The us m2 money supply chart is influenced by several factors that affect the availability of liquid assets in the economy. Quantitative easing (QE), reserve requirements, and lending practices play significant roles in determining the size of the M2 money supply. Understanding these factors is crucial for interpreting changes observed in the us m2 money supply chart.

Quantitative easing involves a central bank injecting liquidity into money markets by purchasing assets. This increases the money supply directly, as banks receive new reserves. These reserves can then be used to create new loans, further expanding the money supply. Lower reserve requirements allow commercial banks to lend out a larger proportion of their deposits, thus increasing the money multiplier effect. This means that each dollar of reserves can support a larger increase in the money supply. Lending practices also affect the us m2 money supply chart. When banks are willing to lend more freely, the money supply tends to increase. Conversely, when banks become more risk-averse and tighten their lending standards, the money supply may grow at a slower rate or even contract. These actions by commercial banks are essential for the fluctuations watched in the us m2 money supply chart.

The role of commercial banks is critical in expanding or contracting the money supply. Banks create money through fractional reserve banking, which is why the us m2 money supply chart is always changing. When a bank makes a loan, it creates a new deposit in the borrower’s account, effectively increasing the money supply. The extent to which banks can expand the money supply is limited by reserve requirements and their willingness to lend. Changes in these factors can lead to significant shifts in the M2 money supply, as reflected in the us m2 money supply chart. Therefore, close monitoring of these factors is essential for understanding the dynamics of the money supply and its potential impact on the economy. The interplay between quantitative easing, reserve requirements, lending practices, and the actions of commercial banks creates the landscape shown in the us m2 money supply chart.

Analyzing the Relationship with Economic Indicators

The correlation between the us m2 money supply chart and key economic indicators offers valuable insights into the overall health and trajectory of the economy. The us m2 money supply chart serves as a barometer, reflecting the amount of liquid assets available within the economy. Understanding its relationship with indicators like GDP growth, inflation, and interest rates is crucial for informed economic analysis. Central bank policies significantly influence these relationships, acting as a lever to steer the economy towards desired outcomes.

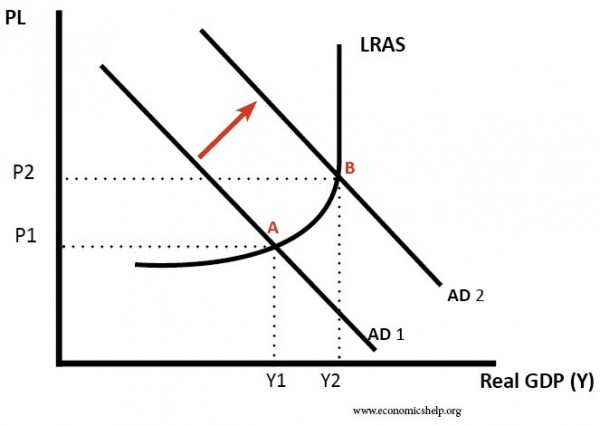

An increase in the us m2 money supply chart can potentially lead to inflation if not managed prudently. When the money supply grows faster than the economy’s output, there’s more money chasing the same amount of goods and services, driving prices up. This inflationary pressure can erode purchasing power and destabilize the economy. However, the relationship isn’t always direct or immediate. Other factors, such as supply chain disruptions or changes in consumer demand, can also contribute to inflation. Conversely, a contraction in the us m2 money supply chart can signal a slowing economy or even deflation, where prices fall. While deflation might seem beneficial initially, it can discourage spending and investment, leading to a downward economic spiral.

Central bank policies play a critical role in mediating the relationship between the us m2 money supply chart and economic indicators. By adjusting interest rates, reserve requirements, and engaging in open market operations, central banks can influence the availability of credit and the overall level of economic activity. For example, lowering interest rates can encourage borrowing and investment, leading to an increase in the us m2 money supply chart and potentially stimulating economic growth. However, this also carries the risk of inflation if not carefully managed. Conversely, raising interest rates can curb inflation by making borrowing more expensive and reducing the money supply. The complex interplay between the us m2 money supply chart, economic indicators, and central bank policies requires constant monitoring and analysis to maintain economic stability and promote sustainable growth.

The Role of the Federal Reserve in Money Management

The Federal Reserve (the Fed) plays a crucial role in regulating the us m2 money supply chart and maintaining economic stability. It acts as the central bank of the United States, and one of its primary responsibilities is to manage the money supply to promote maximum employment and stable prices. The Fed employs several tools to influence the availability of money and credit in the economy. These tools directly impact the us m2 money supply chart.

Open market operations are a key instrument used by the Fed. This involves buying and selling U.S. government securities in the open market. When the Fed buys securities, it injects money into the banking system, increasing the monetary base and potentially expanding the us m2 money supply chart. Conversely, when the Fed sells securities, it withdraws money from the banking system, reducing the monetary base and contracting the us m2 money supply chart. The discount rate, which is the interest rate at which commercial banks can borrow money directly from the Fed, is another important tool. Lowering the discount rate encourages banks to borrow more from the Fed, increasing the money supply. Conversely, raising the discount rate discourages borrowing and reduces the money supply. Reserve requirements, which are the fraction of a bank’s deposits that they are required to keep in their account at the Fed or as vault cash, also play a significant role. Decreasing reserve requirements allows banks to lend out more of their deposits, expanding the money supply. Increasing reserve requirements forces banks to hold more reserves, reducing the amount of money available for lending and impacting the us m2 money supply chart.

The Fed’s actions have a direct influence on interest rates and lending activity. By manipulating the money supply, the Fed can influence the federal funds rate, which is the target rate that commercial banks charge one another for the overnight lending of reserves. Changes in the federal funds rate then ripple through the economy, affecting other interest rates, such as mortgage rates and corporate bond yields. Lower interest rates encourage borrowing and investment, leading to increased economic activity. Higher interest rates discourage borrowing and investment, helping to cool down the economy and control inflation. The Fed’s ability to manage the us m2 money supply chart is essential for maintaining a stable and healthy economy. The us m2 money supply chart is an important indicator to track, as it provides insights into the effectiveness of the Fed’s monetary policy.

Considering the Implications of Inflationary Pressure

The consequences of changes in the us m2 money supply chart, particularly regarding inflation and deflation, are significant for economic stability. An excessive increase in M2 can potentially lead to inflation. This happens when there is more money chasing the same amount of goods and services. As a result, prices rise, reducing the purchasing power of each dollar.

Conversely, a sharp decrease in the us m2 money supply chart can lead to deflation. Deflation occurs when prices fall, which might sound positive, but can lead to decreased economic activity. Consumers may delay purchases, expecting prices to fall further. Businesses may reduce production and investment. Deflation can increase the real burden of debt. This makes it harder for individuals and businesses to repay loans.

The impact of inflation and deflation affects consumers, businesses, and the entire economy. Inflation erodes the value of savings and fixed incomes. It also creates uncertainty for businesses regarding costs and pricing. Deflation can lead to decreased wages, job losses, and a slowdown in economic growth. Managing the us m2 money supply chart is crucial for maintaining price stability. Central banks closely monitor M2 to implement policies that promote sustainable economic growth and mitigate the risks of both inflation and deflation, thus ensuring a stable financial environment for all economic participants.