Understanding the Federal Funds Rate and its Influence

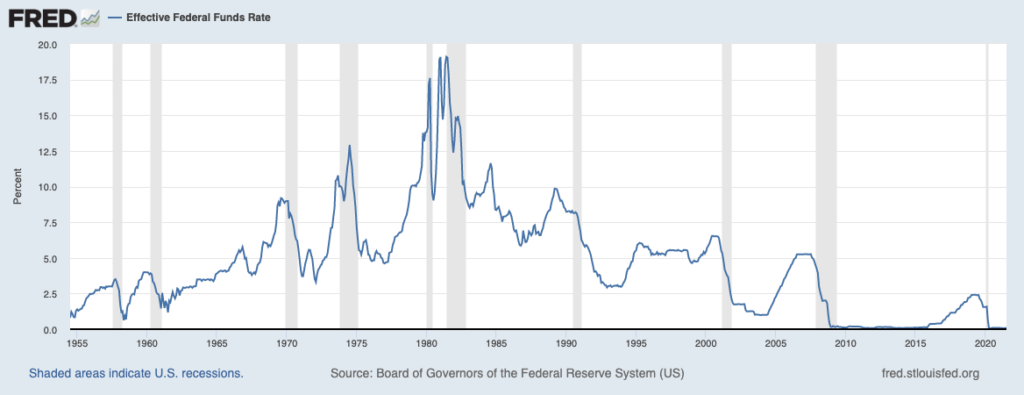

The federal funds rate serves as a cornerstone of the US monetary system. It represents the target rate that the Federal Reserve (also known as the Fed or Federal Open Market Committee, or FOMC) wants banks to charge one another for overnight loans. The FOMC, through meticulous analysis of economic indicators, sets this rate. This crucial rate significantly impacts borrowing costs across the entire economy. Lowering the federal funds rate generally makes borrowing cheaper, stimulating economic activity through increased investment and consumer spending. Conversely, raising the rate increases borrowing costs, potentially slowing down inflation. This intricate relationship between the Fed’s monetary policy decisions, the federal funds rate, and the overall health of the economy underscores the importance of understanding and potentially trading instruments tied to this key rate, such as CME Group Fed Funds futures.

Changes in the federal funds rate ripple through various financial markets. Interest rates on mortgages, auto loans, and credit cards often reflect adjustments to the federal funds rate, albeit with some lag. The yield curve, a graphical representation of interest rates across different maturities of government bonds, is particularly sensitive to changes in the federal funds rate. A steepening yield curve often suggests expectations of future rate hikes, while a flattening curve may signal a pause or potential rate cuts. Monitoring the federal funds rate and its influence on these indicators is vital for anyone involved in financial markets. Understanding how market participants interpret these signals is crucial for informed decision-making, particularly when considering trading strategies using CME Group Fed Funds futures.

The impact of the federal funds rate extends beyond traditional lending. It influences exchange rates, impacting the value of the US dollar against other currencies. Furthermore, it affects investor sentiment and asset prices across various asset classes, including stocks and bonds. Because of the broad and significant influence of the federal funds rate on the financial markets, sophisticated investors frequently utilize tools like CME Group Fed Funds futures to manage their exposure to interest rate risk and capitalize on opportunities presented by anticipated rate changes. The CME Group Fed Funds futures market offers a transparent and efficient platform for participants to execute their strategies.

Introducing CME Group Fed Funds Futures Contracts

The CME Group is the leading global marketplace for trading Fed Funds futures contracts. These contracts offer a highly liquid and efficient way to trade interest rate risk. CME Group Fed Funds futures provide a benchmark for short-term interest rates in the United States. The contracts are designed to reflect market expectations of the federal funds rate, allowing traders to speculate on, or hedge against, future rate movements. Each contract represents a $5 million notional principal value. Trading occurs electronically on the CME Globex platform, providing 24-hour access. Settlement is in cash, based on the actual federal funds rate observed at the end of the contract period.

CME Group Fed Funds futures contracts have a rich history. Their evolution reflects the growing sophistication of the financial markets and the increasing need for effective tools to manage interest rate risk. The standardization and liquidity provided by these contracts have helped make them indispensable for market participants. The contracts are designed with specific delivery dates, allowing traders to pinpoint their exposure to specific periods. This precision facilitates precise hedging and speculation strategies. CME Group actively monitors and manages the trading of these crucial contracts, ensuring market integrity and fairness.

Understanding the specifics of CME Group fed funds futures is crucial for anyone involved in interest rate trading or hedging. Traders need to be aware of the contract specifications, including the contract size, trading hours, and settlement procedures to successfully participate in the market. The CME Group provides comprehensive documentation and educational resources to support traders. Active monitoring of market conditions and understanding of the underlying economic factors is essential for successful trading of CME Group fed funds futures. These contracts are a significant component of the global financial landscape. CME Group’s ongoing commitment to innovation and market development further enhances the value of these instruments for market participants worldwide. The depth and liquidity of the CME Group fed funds futures market make it an attractive option for a wide range of investors and traders.

How to Analyze Fed Funds Futures Prices

Interpreting cme group fed funds futures prices is fundamental to understanding market expectations regarding future Federal Reserve interest rate decisions. The price of a cme group fed funds futures contract reflects the market’s consensus view of the effective federal funds rate during the contract’s delivery month. A higher contract price suggests an expectation of a lower average federal funds rate, while a lower price indicates an anticipated increase. Analyzing these prices allows traders to gauge the likelihood of future rate hikes or cuts.

One crucial tool for analysis is the implied probability calculation. By converting the futures price into an implied interest rate, traders can estimate the probability of the Federal Open Market Committee (FOMC) raising, lowering, or maintaining the current federal funds rate target at upcoming meetings. For example, if the December cme group fed funds futures contract is trading at 95.00, this implies an interest rate of 5.00% (100 – 95.00). Comparing this implied rate to the current federal funds rate provides insights into the market’s expected policy path. Yield curves, constructed from cme group fed funds futures contracts with varying expiration dates, visually represent the market’s expectations for interest rates over time. An upward-sloping curve suggests anticipated rate increases, while an inverted curve may signal expectations of future rate cuts. Traders also monitor key economic indicators, such as inflation data, employment figures, and GDP growth, to assess their potential impact on Fed policy and, consequently, on cme group fed funds futures prices.

Consider a hypothetical scenario: Suppose the FOMC has signaled a commitment to fighting inflation, and economic data releases consistently show higher-than-expected inflation figures. In this environment, traders might expect the Fed to continue raising interest rates. This expectation would likely lead to lower prices for cme group fed funds futures contracts, reflecting the anticipated increase in the effective federal funds rate. Conversely, if economic growth slows and inflation begins to moderate, traders might anticipate a potential pause or even a reversal in the Fed’s tightening cycle. This scenario could drive cme group fed funds futures prices higher, as the market prices in the possibility of lower future interest rates. By carefully analyzing cme group fed funds futures prices in conjunction with economic data and Fed communications, traders can develop informed trading strategies and manage their interest rate risk effectively.

Strategies for Trading Fed Funds Futures

Various trading strategies can be employed utilizing CME Group Fed Funds futures. These strategies cater to different risk appetites and market views. Hedging interest rate risk is a common application, as is speculating on future rate changes. Understanding these strategies is crucial for navigating the Fed Funds futures market. Traders can establish long positions, betting on rising rates, or short positions, anticipating rate declines. Spread trading, another popular approach, involves simultaneously buying and selling different Fed Funds futures contracts. This aims to profit from changes in the relationship between their prices.

Speculation is a primary driver in the cme group fed funds futures market. Traders analyze economic data and Federal Reserve communications to forecast future interest rate decisions. If a trader anticipates a rate hike, they might buy Fed Funds futures contracts. Conversely, if they expect a rate cut, they might sell these contracts. The potential profit or loss depends on the accuracy of their prediction and the magnitude of the rate change. Spread trading strategies using cme group fed funds futures often involve calendar spreads. This means taking offsetting positions in contracts with different expiration dates. For example, a trader might buy a contract expiring in one month and sell a contract expiring in the following month. The goal is to profit from changes in the yield curve.

Effective risk management is paramount when trading cme group fed funds futures. Stop-loss orders are essential for limiting potential losses. These orders automatically close a position if the price reaches a predetermined level. Position sizing is another crucial aspect of risk management. Traders should only risk a small percentage of their capital on any single trade. Diversification can also help mitigate risk. By spreading investments across different asset classes, traders can reduce their overall portfolio volatility. Understanding the leverage involved in futures trading is also essential. While leverage can amplify profits, it can also magnify losses. Therefore, traders must carefully consider their risk tolerance and financial resources before trading cme group fed funds futures. Comprehensive risk management practices are critical for success in the Fed Funds futures market.

Using Fed Funds Futures for Hedging

Hedging with cme group fed funds futures is a crucial application, enabling diverse market participants to mitigate interest rate risk. Banks, corporations, and other financial institutions frequently utilize these contracts to protect their portfolios against unfavorable interest rate movements. Because interest rate volatility can significantly impact profitability and asset values, effective hedging strategies are essential for stability. cme group fed funds futures contracts provide a mechanism for locking in future interest rates, regardless of market fluctuations. This section explores how different entities employ these futures to safeguard their financial positions.

Consider a bank anticipating a future loan disbursement. To hedge against a potential rise in interest rates before the disbursement, the bank can purchase cme group fed funds futures contracts. If interest rates indeed increase, the gains from the futures contracts can offset the higher cost of funding the loan. Conversely, a corporation planning to issue debt can use cme group fed funds futures to hedge against a decrease in interest rates. By selling futures contracts, the corporation can lock in a specific interest rate for their future debt issuance. Any losses incurred on the futures position due to rising rates would be compensated by the lower borrowing costs achieved at issuance. This approach provides certainty and protects against adverse market movements.

Real-world examples highlight the effectiveness of these hedging strategies. For instance, a regional bank might use cme group fed funds futures to manage the interest rate risk associated with its variable-rate mortgage portfolio. By strategically using futures contracts, the bank can reduce its exposure to interest rate fluctuations, ensuring more predictable earnings. Similarly, a large manufacturer might employ cme group fed funds futures to protect against changes in the cost of borrowing for capital expenditures. These hedging strategies are not without risk. Understanding basis risk, the difference between the price movements of the futures contract and the underlying asset being hedged, is critical. Careful analysis and monitoring are crucial for successful hedging with cme group fed funds futures. Proper risk management, including position sizing and the use of stop-loss orders, are essential components of any hedging program utilizing cme group fed funds futures.

The Role of Fed Funds Futures in Forecasting

CME Group Fed Funds futures serve as a valuable tool for gauging market expectations regarding future adjustments to the federal funds rate. The price of a cme group fed funds futures contract reflects the market’s consensus view of what the effective federal funds rate will be at the time of the contract’s expiration. By analyzing these prices, one can derive implied probabilities of future rate hikes, cuts, or no change in policy.

The implied probability is calculated by subtracting the futures price from 100 and annualizing the result. For example, if a cme group fed funds futures contract expiring in three months is priced at 99.50, the market is anticipating an average effective federal funds rate of 0.50% (100 – 99.50) over that period. This information can then be used to estimate the likelihood of the Federal Reserve raising or lowering rates at upcoming Federal Open Market Committee (FOMC) meetings. Traders and analysts closely monitor these implied probabilities to anticipate potential shifts in monetary policy and adjust their investment strategies accordingly. Yield curves, constructed from cme group fed funds futures contracts with varying expiration dates, offer a visual representation of the market’s expectations for the path of interest rates over time. An upward-sloping yield curve suggests expectations of rising rates, while a downward-sloping or inverted yield curve may signal an anticipated economic slowdown and potential rate cuts.

While cme group fed funds futures provide valuable insights into market sentiment, it’s crucial to recognize their limitations as a forecasting tool. Futures prices reflect the collective expectations of market participants, which can be influenced by a variety of factors, including economic data releases, geopolitical events, and even speculation. These expectations may not always align with the actual decisions of the Federal Reserve. Therefore, it’s essential to consider cme group fed funds futures data in conjunction with other economic indicators, such as inflation figures, employment reports, and GDP growth, to form a more comprehensive assessment of the economic outlook and potential future interest rate changes. Relying solely on futures prices for forecasting can lead to inaccurate predictions and poor investment decisions. A holistic approach that integrates various sources of information is crucial for effective decision-making in the financial markets, especially when trading cme group fed funds futures.

Comparing Fed Funds Futures to Other Interest Rate Instruments

Understanding the nuances between various interest rate derivatives is crucial for making informed trading decisions. While CME Group Fed Funds futures provide a direct way to speculate on or hedge against changes in the Federal Reserve’s target rate, other instruments offer different exposures and functionalities. Eurodollar futures, for example, are based on the London Interbank Offered Rate (LIBOR), which represents the average rate at which major global banks lend to one another. Although LIBOR is being phased out, contracts referencing the Secured Overnight Financing Rate (SOFR) are increasingly common. SOFR is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. While both CME Group Fed Funds futures and Eurodollar/SOFR futures reflect expectations of future interest rates, they are influenced by different market factors and reflect slightly different risk premiums. Eurodollar/SOFR futures can be affected by global banking conditions, while Fed Funds futures are more directly tied to the Federal Reserve’s policy decisions.

Treasury bill (T-bill) futures, on the other hand, are based on the prices of short-term U.S. government debt. While T-bill yields are influenced by the Fed Funds rate, they also reflect investor sentiment towards government creditworthiness and broader macroeconomic conditions. Trading T-bill futures allows market participants to express views on the overall health of the U.S. economy and the demand for safe-haven assets. Municipal bond futures provide exposure to the municipal bond market, offering a way to hedge or speculate on changes in tax-exempt interest rates. These rates are influenced by factors such as state and local government finances, tax policy changes, and the overall economic environment. Each of these instruments has its own risk and reward profile, and the suitability of each depends on the specific investment goals and risk tolerance of the trader. The cme group fed funds futures offers a unique instrument for those following the feds moves.

One key advantage of CME Group Fed Funds futures is their direct link to the Federal Reserve’s policy rate. This makes them a particularly useful tool for those seeking to express views on the future path of monetary policy. Furthermore, the transparency and liquidity of the CME Group Fed Funds futures market make it relatively easy to execute trades and manage risk. However, it’s important to consider the limitations of each instrument. For example, while Fed Funds futures can provide insights into market expectations for future rate hikes or cuts, they do not perfectly predict the future. Market sentiment can change quickly, and unexpected economic events can lead to significant price swings. By understanding the differences between these various interest rate instruments, traders can better diversify their portfolios and manage their overall risk exposure. Hedging interest rate risk becomes much more efficient with the use of cme group fed funds futures.

The Importance of Risk Management in Fed Funds Futures Trading

Effective risk management is paramount when trading cme group fed funds futures. The leverage inherent in futures contracts can amplify both profits and losses, making it crucial to implement robust risk control measures. Position sizing is a fundamental aspect of risk management. Traders should carefully determine the appropriate number of contracts to trade based on their risk tolerance and available capital. Avoid over-leveraging, which can lead to significant losses if the market moves against your position. Stop-loss orders are essential tools for limiting potential losses. By placing a stop-loss order, traders can automatically exit a position if the price reaches a predetermined level. This helps to protect capital and prevent emotional decision-making. Diversification is another important risk management technique. Spreading investments across different asset classes or strategies can help to reduce overall portfolio risk. However, diversification within cme group fed funds futures trading might involve different contract months or spread strategies rather than other asset classes.

Assessing and managing the risks associated with different trading strategies is vital. For example, a strategy that involves speculating on future rate changes may carry higher risk than a hedging strategy designed to protect against interest rate fluctuations. Thoroughly understand the potential risks and rewards of each strategy before implementation. Consider factors such as market volatility, economic data releases, and central bank announcements, all of which can impact cme group fed funds futures prices. Monitoring these factors closely and adjusting your risk management accordingly can help to mitigate potential losses. Active monitoring of positions is also crucial. Regularly review open positions and adjust stop-loss orders as needed. Stay informed about market developments and be prepared to react quickly to unexpected events.

Cme group fed funds futures offer valuable tools for managing interest rate risk and speculating on future rate movements. However, it is important to recognize the potential drawbacks. The complexity of futures contracts can be challenging for novice traders. Thorough education and understanding are essential before engaging in trading. Unexpected market events or economic data releases can lead to rapid price swings, potentially triggering stop-loss orders or resulting in losses. It is crucial to have a well-defined trading plan and stick to it, even during periods of market volatility. Successful cme group fed funds futures trading requires a combination of market knowledge, analytical skills, and disciplined risk management. By carefully assessing the potential benefits and drawbacks and implementing appropriate risk control measures, traders can increase their chances of success in this dynamic market. Remember, consistent profitability comes from managing risk effectively, not from chasing every potential profit opportunity in the cme group fed funds futures market.