Understanding the YEARFRAC Function: What Does the YEARFRAC Function Do?

The YEARFRAC function calculates the fraction of a year between two dates. This seemingly simple function plays a crucial role in numerous financial calculations. Understanding what does the YEARFRAC function do is essential for anyone working with financial data. It’s used to determine the precise amount of time elapsed between two points in time, expressed as a fraction of a year. This is particularly important for accurately calculating accrued interest on loans, bonds, or other investments. What does the YEARFRAC function do? It provides the precise fractional year value needed for accurate financial modeling. The function’s output allows for precise calculations of time-weighted returns, ensuring accurate financial analysis. This eliminates the inaccuracies that could result from using simpler methods of calculating the time difference.

YEARFRAC’s core functionality centers around its ability to handle different day-count conventions. These conventions, which define the number of days in a year, impact the calculation’s outcome. Different financial instruments may require specific day-count conventions. Understanding what does the YEARFRAC function do, therefore, includes grasping the significance of these conventions. The choice of convention – such as actual/actual, 30/360, actual/360, or actual/365 – significantly alters the computed fraction. Actual/actual reflects the actual number of days in each year. 30/360 simplifies the calculation by assuming 30 days per month and 360 days per year. The precise method selected influences the accuracy and applicability of the result, aligning with regulatory and market standards. This directly answers the question: what does the YEARFRAC function do? It provides a flexible calculation method, adapting to various financial standards.

Financial professionals rely heavily on the YEARFRAC function for accurate calculations. What does the YEARFRAC function do in these complex scenarios? It provides the essential component for precise calculations of accrued interest, bond pricing, and the yield of various investments. The function’s accuracy is crucial for making informed financial decisions. Moreover, it simplifies otherwise cumbersome manual calculations, thus saving time and reducing the risk of human error. What does the YEARFRAC function do in essence? It bridges the gap between raw date information and the precise fractional year value required for accurate financial computations, making it an invaluable tool in financial modeling and analysis. The function contributes to a higher degree of precision and efficiency in financial calculations, enhancing the reliability and validity of financial projections and valuations.

How to Master YEARFRAC: A Step-by-Step Tutorial

This section offers a practical guide on how to use the YEARFRAC function effectively. Understanding what does the yearfrac function do is the first step to utilizing it in financial calculations. We’ll break down the process into manageable steps, ensuring clarity and ease of understanding.

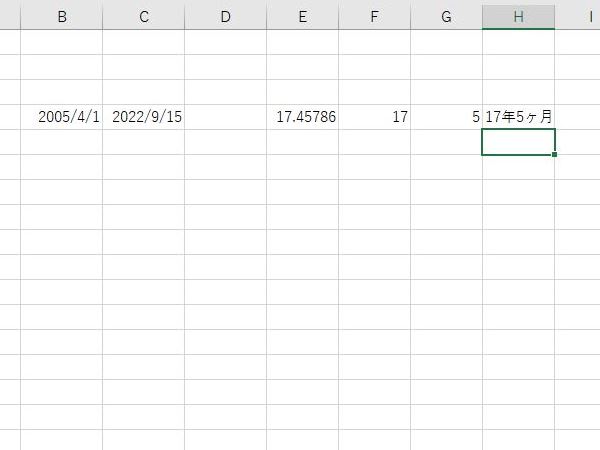

Let’s consider a scenario: You want to calculate the fraction of a year between January 1, 2023, and June 30, 2023, using Excel. Here’s how you would do it:

- Open Microsoft Excel.

- In cell A1, enter the start date: 2023-01-01.

- In cell A2, enter the end date: 2023-06-30.

- In cell A3, enter the YEARFRAC function: =YEARFRAC(A1, A2, 1).

- The result in cell A3 will display the fraction of the year between these two dates.

In this example, the third argument, “1,” specifies the basis for calculation. “1” represents the actual/actual day count convention. This means the function calculates the fraction based on the actual number of days between the dates divided by the actual number of days in the year. Excel also offers other basis options:

- 0 or omitted: US (NASD) 30/360.

- 1: Actual/actual.

- 2: Actual/360.

- 3: Actual/365.

- 4: European 30/360.

To explore different calculation methods, simply change the third argument in the YEARFRAC function. For instance, using “=YEARFRAC(A1, A2, 3)” calculates the year fraction based on the actual number of days between the dates divided by 365. Each method impacts the result. Understanding what does the yearfrac function do under various calculation methods is essential for accurate financial modeling.

Using Python, specifically with the `numpy_financial` library, you can achieve the same result. First, ensure you have the library installed (`pip install numpy-financial`). Then, use the following code:

import numpy_financial as npf

import numpy as np

start_date = np.datetime64('2023-01-01')

end_date = np.datetime64('2023-06-30')

year_fraction = npf.yearfrac(start_date, end_date, daycount=1)

print(year_fraction)

This Python code snippet mirrors the Excel example. The `daycount` argument corresponds to the basis in Excel. The result will be a decimal representing the fraction of the year. Mastering these steps allows for using what does the yearfrac function do across different software platforms.

Exploring Different YEARFRAC Calculation Methods

The YEARFRAC function offers several calculation methods, each impacting the result. Understanding these differences is key to accurate financial calculations. A crucial question many users have is: what does the YEARFRAC function do with different methods? The function calculates the fraction of a year between two dates, but the “day count basis” significantly alters the outcome. The common methods are ‘actual/actual,’ ‘actual/360,’ ‘actual/365,’ and ’30/360′.

The ‘actual/actual’ method calculates the fraction based on the actual number of days between the start and end dates, divided by the actual number of days in the year. This is often considered the most accurate method. The ‘actual/360’ method calculates the fraction using the actual number of days between the dates, but it always assumes a 360-day year. This method is sometimes used in older financial calculations. The ‘actual/365′ method uses the actual number of days between the dates and divides it by 365, regardless of whether the year is a leap year. Then what does the YEARFRAC function do when a year is not 365 days? It will not take the leap year into account. The ’30/360’ method assumes each month has 30 days and the year has 360 days. This method simplifies calculations but can be less precise.

The choice of method depends on the specific financial context. For instance, bond calculations often specify a particular day-count convention. Using the wrong method can lead to significant errors in financial models, particularly when dealing with large sums of money or long time periods. Consider a scenario where you need to calculate the accrued interest on a bond. Using the ’30/360′ method when the bond indenture specifies ‘actual/actual’ will result in an inaccurate interest calculation. Similarly, what does the YEARFRAC function do when calculating short term interest? Understanding and correctly applying the appropriate YEARFRAC method is critical for precise financial analysis. The best approach is understanding what does the YEARFRAC function do and selecting the method that corresponds to the terms and conditions for each financial instrument.

YEARFRAC in Financial Modeling: Real-World Applications

The YEARFRAC function is a powerful tool in financial modeling, offering practical solutions across various contexts. Its primary function, determining the fraction of a year between two dates, proves invaluable in calculations related to investments, loans, and other financial instruments. Understanding what does the yearfrac function do in these scenarios is crucial for accurate financial analysis. This section explores some key real-world applications where YEARFRAC significantly enhances financial modeling capabilities. What does the yearfrac function do? It precisely calculates time elapsed.

One common application lies in bond valuation. Accurately calculating the accrued interest on a bond requires knowing the exact fraction of the coupon period that has passed since the last payment. YEARFRAC provides this fraction, enabling precise determination of the accrued interest amount. For instance, if a bond pays semi-annual coupons and 100 days have passed since the last payment, YEARFRAC calculates the fraction representing 100 days out of the coupon period. This allows investors and analysts to value the bond accurately, considering the accrued interest component. Loan calculations also heavily rely on YEARFRAC. When calculating interest on a loan, particularly for periods that don’t align perfectly with standard monthly or annual schedules, YEARFRAC helps determine the exact fraction of the year for which interest should be charged. This ensures fairness and accuracy in interest calculations, especially for short-term loans or loans with irregular payment schedules. What does the yearfrac function do? It impacts loan interest calculations significantly.

Furthermore, YEARFRAC finds applications in determining the yield on investments. When calculating the yield on an investment held for a portion of a year, YEARFRAC allows for annualizing the return accurately. By determining the fraction of the year the investment was held, the return can be scaled to reflect an equivalent annual yield, facilitating comparisons between investments with different holding periods. Consider an investment held for 150 days that generated a certain return. YEARFRAC calculates the fraction 150/365 (or using a different day-count convention), which is then used to annualize the return and provide a standardized yield measure. Therefore, what does the yearfrac function do? It helps in standardizing investment yields. The ability to accurately measure time fractions is vital in these applications, illustrating what does the yearfrac function do for real-world financial modeling.>

Troubleshooting Common YEARFRAC Errors

Encountering errors while using the YEARFRAC function is a common experience, but most issues are easily resolved. One frequent problem arises from inconsistencies in date formatting. Ensure that both the start and end dates are recognized as valid dates by the software being used. What does the YEARFRAC function do when it encounters text instead of a date? It typically returns an error, or an unexpected result, so double-check the cell formatting or the source of the date values. Dates should generally be in a standard format (e.g., YYYY-MM-DD or MM/DD/YYYY), and the software’s regional settings should be configured correctly to interpret them.

Another potential pitfall is entering invalid date values. For instance, attempting to calculate the YEARFRAC for February 30th will result in an error, as that date does not exist. Similarly, ensure that the start date precedes the end date. Reversing the order of dates will lead to inaccurate, often negative, results. To prevent these errors, use date validation features available in most spreadsheet programs. These features can restrict the input to valid dates within a specified range, ensuring data integrity and accurate calculations when considering what does the YEARFRAC function do. Furthermore, when importing data from external sources, carefully inspect the date formats and perform any necessary conversions before using them in YEARFRAC calculations.

When discrepancies arise between expected and actual results, the chosen calculation method might be the culprit. The YEARFRAC function offers various day count conventions (‘actual/actual,’ ‘actual/360,’ ‘actual/365,’ ’30/360′), each yielding slightly different results. Understanding what does the YEARFRAC function do under each convention is key. The ’30/360′ method, for instance, assumes each month has 30 days and each year has 360 days, which can deviate from the actual number of days. Always verify that the selected method aligns with the requirements of the financial calculation being performed. Consulting the software’s documentation or financial guidelines can help determine the appropriate method. Also, be aware of blank cells or cells containing non-numeric values, as these can disrupt the calculation. Treat blank cells as zero or replace them with appropriate default values to avoid errors and get a better understanding of what does the YEARFRAC function do.

Comparing YEARFRAC to Other Date Functions

The YEARFRAC function stands as a valuable tool for calculating the fraction of a year between two dates, yet it’s important to understand its relationship to other date functions available in software like Excel. One common alternative is the DATEDIF function. While both functions deal with date differences, they approach the task from different angles. DATEDIF, short for “Date Difference,” offers more flexibility in specifying the units of the difference, such as days, months, or years. It allows users to find the number of complete months between two dates, something YEARFRAC doesn’t directly provide. So, what does the yearfrac function do that DATEDIF can’t? YEARFRAC excels in providing a precise fractional representation of the year, crucial for financial calculations where accuracy is paramount.

The key difference lies in the output and intended use. DATEDIF returns an integer representing the whole number of specified units between two dates, whereas YEARFRAC returns a decimal representing the fraction of a year. This distinction makes YEARFRAC particularly suitable for calculating accrued interest, bond yields, and other financial metrics that require precise time weighting. For instance, if you need to know how many full months have passed between two dates for reporting purposes, DATEDIF is a strong choice. However, if you need to determine the proportion of a year that a loan has been outstanding to calculate interest, YEARFRAC is the more appropriate function. Understanding what does the yearfrac function do best will ensure accurate application.

Another consideration involves the calculation methods. YEARFRAC allows users to specify different day-count conventions (e.g., actual/actual, 30/360), impacting the resulting fraction. DATEDIF does not offer this level of control over the underlying calculation. Furthermore, some software may have other date functions that calculate durations or extract specific date components. For example, functions that extract the day, month, or year from a date can be combined with other formulas to achieve similar results to YEARFRAC or DATEDIF, albeit with more complexity. Ultimately, the best function depends on the specific requirements of the task. If precision in calculating the fraction of a year is needed, especially in financial contexts, YEARFRAC is often the superior choice. Therefore, know what does the yearfrac function do, and consider other options.

Advanced Techniques and Optimizations with YEARFRAC

The YEARFRAC function is a powerful tool, and its capabilities extend far beyond basic date difference calculations. Efficiently handling large datasets and integrating YEARFRAC into complex formulas can significantly improve financial modeling workflows. Understanding these advanced techniques is crucial for professionals seeking to optimize their analytical processes. What does the YEARFRAC function do in these more demanding scenarios? It continues to provide the fractional year calculation, but its application becomes more sophisticated.

One advanced technique involves using YEARFRAC within array formulas. For example, when calculating the time-weighted return of a portfolio with numerous transactions, an array formula incorporating YEARFRAC can efficiently compute the fractional year for each holding period. This avoids the need for repetitive calculations and streamlines the entire process. Another optimization strategy is pre-calculating common YEARFRAC values. If a specific date range is frequently used within a model, computing the YEARFRAC value once and storing it in a dedicated cell can reduce computational overhead. This is especially beneficial when working with large datasets. What does the YEARFRAC function do in this optimization context? It’s used strategically to minimize redundant calculations.

Furthermore, consider nesting YEARFRAC within other functions like IF or CHOOSE to create dynamic calculations. For instance, you might use an IF statement to select a specific day-count convention based on the type of financial instrument being analyzed. Alternatively, consider using the choose function to select from a predefined set of yearfrac calculations based on a given parameter, like a country code or regulation. This level of flexibility allows for highly customized and accurate financial models. Understanding the nuances of different day-count conventions and their impact on financial metrics is essential for professionals working in this field. What does the YEARFRAC function do when nested in this way? It becomes a component of a larger, more complex calculation that is more adaptable. Moreover, always ensure consistent date formatting across your entire model to prevent errors. A seemingly minor discrepancy in date formats can lead to incorrect YEARFRAC results, potentially skewing critical financial analyses. Proper validation and error handling are paramount when working with date-related functions.

Future-Proofing Your YEARFRAC Skills

YEARFRAC remains a crucial function in financial modeling. Its ability to accurately calculate the fraction of a year between two dates ensures precise calculations for accrued interest and time-weighted returns. Understanding what does the yearfrac function do is paramount for financial professionals. As financial instruments and markets evolve, the need for accurate date calculations persists, making YEARFRAC a consistently relevant tool. The function’s adaptability ensures its continued usefulness across various software and platforms. What does the yearfrac function do? It provides a foundation for building more sophisticated financial models. Continuous learning and practice will enhance proficiency and allow for the effective application of YEARFRAC in complex financial scenarios.

Proficiency in YEARFRAC extends beyond simple calculations. Mastering its various calculation methods (actual/actual, actual/360, actual/365, 30/360) is essential for choosing the most appropriate method for different financial instruments. This understanding enables users to avoid common errors and ensure accurate results. What does the yearfrac function do in these complex scenarios? It provides the necessary precision for informed financial decision-making. The ability to integrate YEARFRAC within larger, more complex formulas and models demonstrates a higher level of competency. This expertise is highly valuable in today’s dynamic financial world.

To future-proof your skills, stay updated on software updates and enhancements related to the YEARFRAC function. Explore advanced techniques for handling large datasets and optimizing calculations for improved efficiency. This proactive approach ensures your skills remain current and relevant. By actively seeking out opportunities to apply YEARFRAC in new and challenging situations, you will continuously refine your understanding of what does the yearfrac function do and its potential applications. Continued learning in this area will not only improve your technical skills, but will also increase your value as a financial professional.