Navigating the World of Overnight Funding Costs

Short-term interest rates are vital to the financial market’s function. They influence everything from the cost of borrowing to the profitability of investments. One key development has been the shift away from the London Interbank Offered Rate (LIBOR). Now, the Secured Overnight Financing Rate (SOFR) is becoming the standard benchmark. This transition marks a significant change in how financial institutions manage risk and determine interest rate pricing. Overnight funding rates, like SOFR, reflect the cost of borrowing money for very short periods, often just overnight. These rates are sensitive to market conditions and play a crucial role in the broader economy. Understanding these rates is key to grasping the dynamics of the modern financial system. Tracking the “1 month term sofr rate today” is a common practice for many financial professionals.

The move to SOFR is driven by the need for a more reliable and transparent benchmark. LIBOR was based on estimations submitted by banks. SOFR, however, is based on actual transactions in the overnight repurchase agreement (repo) market. This makes SOFR more resilient to manipulation and a more accurate reflection of market conditions. The 1 month term sofr rate today is influenced by factors such as the supply and demand for overnight funding. Central bank policies also influence these rates through tools like reserve requirements and open market operations. Overnight funding rates are essential for banks to manage their liquidity. They allow institutions to borrow funds to meet their short-term obligations and regulatory requirements. Knowing the “1 month term sofr rate today” helps institutions make informed decisions.

The transition to SOFR has implications for various financial products, including loans, derivatives, and mortgages. As SOFR becomes more widely adopted, it will affect the pricing and risk management of these products. Participants in the financial market are increasingly focused on the “1 month term sofr rate today”. This increased attention highlights the importance of understanding how SOFR works and how it impacts financial transactions. Monitoring overnight funding rates provides insights into the overall health and stability of the financial system. Changes in these rates can signal shifts in investor sentiment, economic conditions, and monetary policy. The “1 month term sofr rate today” serves as a barometer of the market’s short-term outlook.

Decoding the Daily SOFR Rate: A Practical Guide

The Secured Overnight Financing Rate (SOFR) is a benchmark interest rate. It serves as a replacement for LIBOR. SOFR reflects the cost of borrowing cash overnight. These borrowings are secured by U.S. Treasury securities. The SOFR rate is crucial for various financial transactions.

SOFR’s origin lies in the overnight repurchase (repo) market. This market involves short-term borrowing. Borrowers sell U.S. Treasury securities. They agree to repurchase them the next day. The SOFR rate represents the median rate of these transactions. This makes it a robust measure of overnight funding costs. Understanding the SOFR rate is vital. It impacts everything from loans to derivatives.

Finding and interpreting the daily SOFR rate is straightforward. The rate is published daily by the Federal Reserve Bank of New York. You can typically find it on the New York Fed’s website. Financial news outlets also report the daily SOFR rate. Bloomberg and Reuters are common sources. When you see the “1 month term sofr rate today,” it reflects the average of the daily SOFR rate over the past month, providing a more stable benchmark for longer-term contracts. To interpret the rate, consider it a percentage. This percentage represents the annual cost of borrowing funds overnight, secured by Treasury bonds. A higher SOFR rate indicates increased borrowing costs. The 1 month term sofr rate today is essential knowledge for understanding the overall market and making informed financial decisions. Monitoring the 1 month term sofr rate today helps in grasping broader financial trends. Because the 1 month term sofr rate today is widely used, understanding it is advantageous.

Factors Influencing Fluctuations in the Secured Overnight Financing Rate

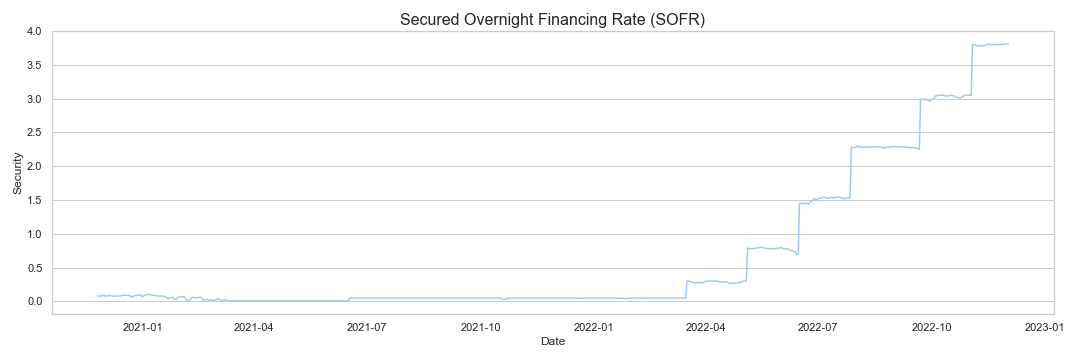

Several key factors influence the daily SOFR rate. Monetary policy decisions by the Federal Reserve significantly impact short-term interest rates. For example, increasing the federal funds rate target generally leads to a higher SOFR. The 1 month term sofr rate today often reflects these policy changes. Economic indicators, such as inflation data and employment figures, also play a crucial role. Strong economic growth can push SOFR upward, while signs of economic weakness may cause it to fall. Market liquidity, or the ease with which financial institutions can borrow and lend, is another important factor. Reduced liquidity can lead to increased borrowing costs and a higher SOFR. Understanding these influences helps in interpreting the daily fluctuations observed in the SOFR.

The supply and demand for overnight loans directly affect the SOFR. A higher demand for short-term funding tends to increase the SOFR, while increased supply lowers it. This dynamic is influenced by various factors, including the overall health of the financial system and the amount of reserve balances held by banks. The 1 month term sofr rate today can also be impacted by events that increase uncertainty in financial markets. Periods of heightened uncertainty often lead to investors seeking safer assets, potentially reducing liquidity and driving up SOFR. Global economic conditions and geopolitical events can also indirectly affect the SOFR by influencing investor sentiment and market liquidity. These factors interact to create the daily SOFR rate, making it a crucial indicator of overall financial market conditions.

Analyzing the SOFR requires considering the interplay of these forces. The 1 month term sofr rate today, for instance, might be higher due to a combination of tighter monetary policy and increased demand for funds. Conversely, a lower SOFR might reflect abundant liquidity and weaker economic indicators. It’s crucial to remember that these factors are interconnected and their influence on SOFR can vary over time. Therefore, understanding the individual and combined effects of monetary policy, economic data, and market dynamics is essential for accurate interpretation of the SOFR and its implications. Understanding how these factors affect the SOFR rate provides valuable insight into the overall financial health of the market. The 1 month term sofr rate today, and its fluctuations, offer a window into these important dynamics.

Comparing SOFR with Other Short-Term Interest Rate Benchmarks

SOFR, the Secured Overnight Financing Rate, serves as a crucial benchmark for short-term interest rates. However, it’s not the only game in town. Understanding its relationship to other benchmarks, such as the Effective Federal Funds Rate (EFFR), is vital for a comprehensive grasp of the interest rate landscape. The EFFR reflects the average of overnight federal funds transactions. It’s a key indicator of monetary policy. While both SOFR and EFFR influence short-term borrowing costs, they differ in their underlying mechanisms and the markets they represent. SOFR is derived from actual transactions in the repurchase agreement market, providing a more robust reflection of borrowing costs for financial institutions. The EFFR, conversely, focuses specifically on overnight federal funds lending between banks. This difference highlights the nuances within the financial system. Knowing this distinction helps navigate the complexities of short-term interest rates. Understanding the differences between these benchmarks is critical for anyone involved in financial markets, from corporations managing their cash flows to individual investors assessing their investment options. One key consideration is the availability of data for these rates. SOFR data is readily available through various financial data providers. Finding the 1 month term SOFR rate today, for instance, is straightforward. This easy access underscores the increasing reliance on SOFR as a primary benchmark. The prevalence of SOFR in financial contracts further strengthens its significance.

While SOFR provides a broad picture of short-term borrowing costs, the EFFR offers a narrower perspective, focusing solely on federal funds transactions. This focus makes it a crucial gauge of the Federal Reserve’s monetary policy impact. Understanding the relationship between these two benchmarks is especially important for entities directly involved in the federal funds market. However, the broader adoption of SOFR across various financial instruments underscores its growing prominence in the short-term interest rate landscape. Financial institutions and corporations are increasingly using SOFR for a wide range of transactions. This shift away from other benchmarks highlights SOFR’s increasing importance in understanding the general direction of short-term borrowing costs. This widespread adoption has made SOFR the dominant benchmark for many financial products and contracts. Accessing data like the 1 month term SOFR rate today provides a clear picture of the current market conditions.

The increasing reliance on SOFR stems from its robustness and transparency. Its calculation method, based on actual transactions, offers a more reliable reflection of borrowing costs compared to some of its predecessors. This accuracy has led to its widespread acceptance as a primary benchmark for various financial instruments. Understanding this shift, including how to find data points like the 1 month term SOFR rate today, is crucial for anyone seeking to navigate the complexities of the financial markets. The transition from LIBOR to SOFR has emphasized the importance of staying informed about these benchmarks and how they relate to each other. For example, understanding the difference between the SOFR rate and the EFFR allows for a more nuanced understanding of monetary policy’s influence on short-term borrowing costs. It helps one interpret the forces shaping interest rates and their impact on lending and borrowing decisions. This contextual knowledge enhances informed decision-making within various financial settings.

How Changes in Short-Term Rates Impact Lending and Borrowing

Fluctuations in the Secured Overnight Financing Rate (SOFR), and similar short-term interest rate benchmarks, directly influence borrowing costs. These costs affect various financial products, from everyday loans to large-scale corporate debt. A rising SOFR generally leads to higher interest rates on new loans. Conversely, a falling SOFR may result in lower rates. Understanding this relationship is crucial for both consumers and businesses. For example, changes in SOFR can impact the interest rates on adjustable-rate mortgages (ARMs), where the rate adjusts periodically based on benchmark rates. Businesses also experience the effects, as their borrowing costs for short-term corporate debt are often tied to these benchmarks. The 1 month term SOFR rate today plays a significant role in determining the cost of these short-term financial instruments. This rate serves as a key indicator for lenders when setting interest rates for businesses and individuals.

The impact extends beyond just the direct cost of borrowing. Changes in SOFR can affect investment decisions. When interest rates rise, borrowing becomes more expensive, potentially reducing investment in new projects. This can have a broader effect on economic growth. Conversely, lower rates can stimulate borrowing and investment, leading to increased economic activity. Businesses, anticipating future changes in the 1 month term SOFR rate today, adjust their borrowing and investment strategies accordingly. They might choose to lock in rates through longer-term financing if they anticipate rates increasing, or they might take advantage of lower rates to finance expansion plans. This active management of interest rate risk is a key aspect of financial planning for businesses of all sizes. The ripple effect of SOFR changes is far-reaching, impacting individual financial planning and broader macroeconomic conditions.

Consider the impact on consumers. Changes in SOFR influence the interest rates on various consumer loans, including credit cards and personal loans. These changes can impact household budgets and spending patterns. Furthermore, the effects are felt in the secondary market as well. Investors holding bonds or other debt instruments tied to SOFR will see the value of their investments fluctuate as the benchmark rate moves. Understanding the dynamics of short-term interest rates, including the 1 month term SOFR rate today, is therefore essential for informed financial decision-making at all levels. Monitoring these trends helps individuals and businesses make better financial decisions and navigate the complexities of the financial market.

The Role of SOFR in the Broader Economy

The Secured Overnight Financing Rate (SOFR) plays a crucial role in shaping the broader economic landscape. Its influence extends beyond the realm of financial transactions, impacting investment strategies and overall financial stability. Understanding the 1 month term sofr rate today and its fluctuations is key to grasping the economic forces at work. Changes in the SOFR rate can ripple through various sectors, influencing the cost of borrowing for consumers and businesses alike. Consequently, the rate significantly affects interest rates for mortgages, personal loans, and corporate debt.

SOFR’s impact extends to investment decisions. Investors carefully consider the SOFR rate when making decisions about bonds, securities, and other investments. This rate acts as a benchmark, informing the return potential and risk associated with various investment opportunities. The influence of the 1 month term sofr rate today on the overall economy is multifaceted, affecting lending practices, investor sentiment, and ultimately, the pace of economic activity. Changes in this rate can create instability in financial markets if not monitored correctly.

Moreover, the SOFR rate’s transparency and objectivity contribute to a more stable financial system. By using SOFR as a reference point, financial institutions can more effectively manage risk and avoid reliance on less transparent measures. The consistent and reliable nature of the SOFR rate enhances market efficiency and confidence. Understanding how the 1 month term sofr rate today factors into the wider picture is essential for participants in the economy. From consumers to investors, understanding its role provides a better grasp of economic trends.

Strategies for Managing Interest Rate Risk in Short-Term Markets

Managing interest rate risk, particularly in the volatile world of short-term rates like the 1 month term SOFR rate today, requires a proactive approach. Diversification across various asset classes is a fundamental strategy. This reduces the impact of fluctuations in any single market segment. For example, holding a mix of short-term government bonds and highly-rated corporate debt can mitigate the overall risk exposure. Understanding the correlation between different assets is crucial for effective diversification.

Hedging instruments offer another valuable tool for managing interest rate risk. These instruments, such as interest rate swaps or futures contracts, allow investors to offset potential losses from adverse interest rate movements. By using these tools strategically, businesses and investors can protect themselves against unfavorable shifts in the 1 month term SOFR rate today and similar benchmarks. However, it is crucial to remember that hedging strategies require careful planning and expertise. Improper use of hedging instruments can lead to unexpected losses.

Regular monitoring of market trends and economic indicators is essential for effective risk management. Staying informed about potential changes in monetary policy and overall economic conditions allows businesses and investors to adjust their strategies accordingly. While forecasting future interest rates is inherently uncertain, understanding the factors influencing rates—such as inflation, economic growth, and central bank actions—provides a valuable basis for informed decision-making. This includes paying close attention to how the 1 month term SOFR rate today aligns with these broader economic trends. A comprehensive risk management plan should incorporate multiple strategies, adapting to changing market conditions to minimize potential losses. The goal is to maintain a robust portfolio, regardless of shifts in short-term interest rates.

Looking Ahead: Forecasting Future Trends in Overnight Rates

Forecasting short-term interest rate movements, including the 1 month term sofr rate today and future trends, is a complex undertaking. Experts rely on a multifaceted approach, considering numerous economic indicators and market forces. Monetary policy decisions by central banks hold significant sway. Announcements regarding interest rate targets or quantitative easing programs directly impact overnight rates. The Federal Reserve’s actions, for instance, heavily influence the Effective Federal Funds Rate (EFFR), which in turn correlates with SOFR. Economic data releases, such as inflation reports (CPI and PCE) and employment figures (non-farm payrolls), offer crucial insights into the overall economic health. Strong economic growth might signal future rate hikes, while signs of slowing growth or recession could lead to rate cuts. Market liquidity also plays a critical role. Periods of increased market stress or uncertainty can lead to higher overnight funding costs as financial institutions demand more compensation for risk.

Analyzing the yield curve, comparing short-term and long-term interest rates, provides additional clues. A steepening yield curve, where long-term rates exceed short-term rates, can suggest expectations of future rate increases. Conversely, a flattening or inverted yield curve might signal concerns about economic slowdown or potential rate cuts. Global economic events also exert influence. International monetary policies, trade tensions, and geopolitical factors all have the potential to affect global capital flows and, consequently, short-term interest rates. Understanding these global dynamics is essential for accurately assessing the future trajectory of rates. The 1 month term sofr rate today, and its future behavior, will also be affected by supply and demand within the repo market, the primary market for overnight lending.

It’s crucial to remember that forecasting interest rates remains inherently uncertain. Unexpected economic events or shifts in market sentiment can quickly alter the outlook. While experts employ sophisticated models and analytical techniques, precise prediction is impossible. The information available to predict the 1 month term sofr rate today and future rates is never perfect. Instead of aiming for pinpoint accuracy, focusing on understanding the key drivers and acknowledging the inherent uncertainty provides a more realistic approach to navigating the short-term rate landscape. Understanding these factors allows investors and businesses to better position themselves for potential rate changes, minimizing the potential for adverse impacts.