Grasping the Essence of Annual Net Cash Flow

To understand what is annual cash flow, one must first visualize money moving in and out of a business or personal account throughout the year. It is essentially the total sum of all cash inflows minus the total sum of all cash outflows during a specific 12-month period. Therefore, the annual net cash flow represents the actual amount of money a business has readily available, unlike profit which may not be immediately accessible as cash. It’s the real-time measure of how much liquid capital a company possesses, showing the real health of its financial position. The annual cash flow provides a clear picture of the money circulating through the organization, a perspective that is often overlooked when focusing solely on accounting profits. For individuals, it could be tracking the cash available after all yearly bills are paid and income is received. This basic understanding of cash flow focuses on the actual movement of money rather than hypothetical or promised earnings.

The concept of what is annual cash flow might seem simple, but its importance in financial planning cannot be overstated. Think of it as the heartbeat of your business or personal finances, reflecting the circulation of money that keeps everything running smoothly. Understanding what is annual cash flow starts with differentiating it from profit, which may include future receivables. Unlike profit, annual cash flow represents the physical money you have at hand, offering a clearer picture of your operational capacity. A positive cash flow means there is more cash coming in than going out, allowing for operational expenses, loan payments, and future growth opportunities. Conversely, a negative annual cash flow signals that money is being depleted more rapidly than it is being generated, which can lead to debt, delayed payments, and reduced investment potential. Thus, understanding what is annual cash flow is a key component in financial awareness, providing valuable insight into the actual financial health and stability of an organization or an individual’s finances.

Why Tracking Your Yearly Cash Movement is Crucial

Monitoring annual cash flow is fundamental to the health and sustainability of any business. Understanding what is annual cash flow and its implications is not just an accounting exercise; it’s a critical component of strategic decision-making. A business’s ability to invest in growth opportunities, manage debts, and respond to unforeseen challenges hinges directly on its cash flow position. Positive annual cash flow provides the financial flexibility needed to expand operations, develop new products, or acquire assets, all essential for long-term success. For instance, a business with consistent positive cash flow may decide to invest in new equipment to increase production capacity or venture into new markets. Conversely, a pattern of negative annual cash flow, where more money is going out than coming in, often signals an underlying issue that requires immediate attention. This could indicate inefficiencies in operations, poor sales performance, or an imbalance between income and expenses. Businesses experiencing such a situation may struggle to meet their obligations, pay suppliers, or take advantage of growth prospects, underscoring the importance of proactive cash flow management.

The annual cash flow statement also serves as a crucial tool when seeking financing or investment. Lenders and investors closely examine a company’s annual cash flow history and projections to assess its creditworthiness and viability. A history of robust positive cash flow demonstrates financial stability and the capacity to repay loans or provide returns on investment. In contrast, negative cash flow may raise concerns about a business’s ability to honor its financial commitments, potentially leading to loan rejections or unfavorable investment terms. Furthermore, understanding what is annual cash flow, and tracking it diligently, allows management to make informed decisions on budgeting, pricing, and cost control. For example, a clear understanding of past cash flow patterns can help a business optimize its inventory levels and reduce holding costs. By regularly monitoring annual cash flow and understanding the trends, businesses can make informed decisions, plan for the future, and address potential problems before they escalate, ultimately supporting long-term stability and success. The ability to use annual cash flow data effectively for strategic planning is vital in achieving sustainable growth and financial health.

Components of Yearly Cash Flow Explained

Understanding what is annual cash flow requires a breakdown of its core elements, which essentially fall into two categories: cash inflows and cash outflows. Cash inflows represent all the money coming into the business throughout the year. These can include revenue from sales of products or services, interest earned on investments, and any other income that generates cash for the company. For instance, a retail store’s cash inflow comes primarily from sales, while an investment firm might see inflows from dividends and interest. It’s crucial to recognize that not all revenues translate directly into cash inflows; for example, credit sales only become cash once the payment is received. It is important to note that, understanding what is annual cash flow involves tracking both streams meticulously, ensuring each source is correctly identified and quantified. This detailed approach creates the foundation for a comprehensive cash flow analysis.

Conversely, cash outflows represent all the money leaving the business within a year. These expenses include a broad spectrum of costs, such as operating expenses like salaries, rent, and utilities, purchasing inventory, repaying loans, and covering tax payments. It is not only operating expenses but also significant investments made by the business such as capital expenditures, should be considered. When examining cash outflows for what is annual cash flow, it is essential to differentiate between cash expenses and non-cash expenses, such as depreciation, that are included in a profit and loss statement but do not represent an actual movement of cash. The core concept of what is annual cash flow focuses solely on the real money going in and out of the company, emphasizing the liquidity of the business rather than its overall profitability as accounted for in more accounting-centric measures. For example, paying a supplier in cash reduces the cash balance, which is an outflow but a depreciation expense is not.

Distinguishing between what is annual cash flow and profit is key, as profit is an accounting metric that includes non-cash items like depreciation and considers revenues and expenses based on their recognition rather than when cash actually changes hands. While profit is certainly important, it can sometimes be misleading because a business could be profitable on paper but lack the actual cash to cover its immediate operating costs, highlighting the significance of what is annual cash flow for ensuring financial stability and solvency of the business. Thus, a complete understanding of these components – cash inflows and cash outflows – is essential for effective financial planning and management.

How to Calculate Your Organization’s Annual Cash Flow

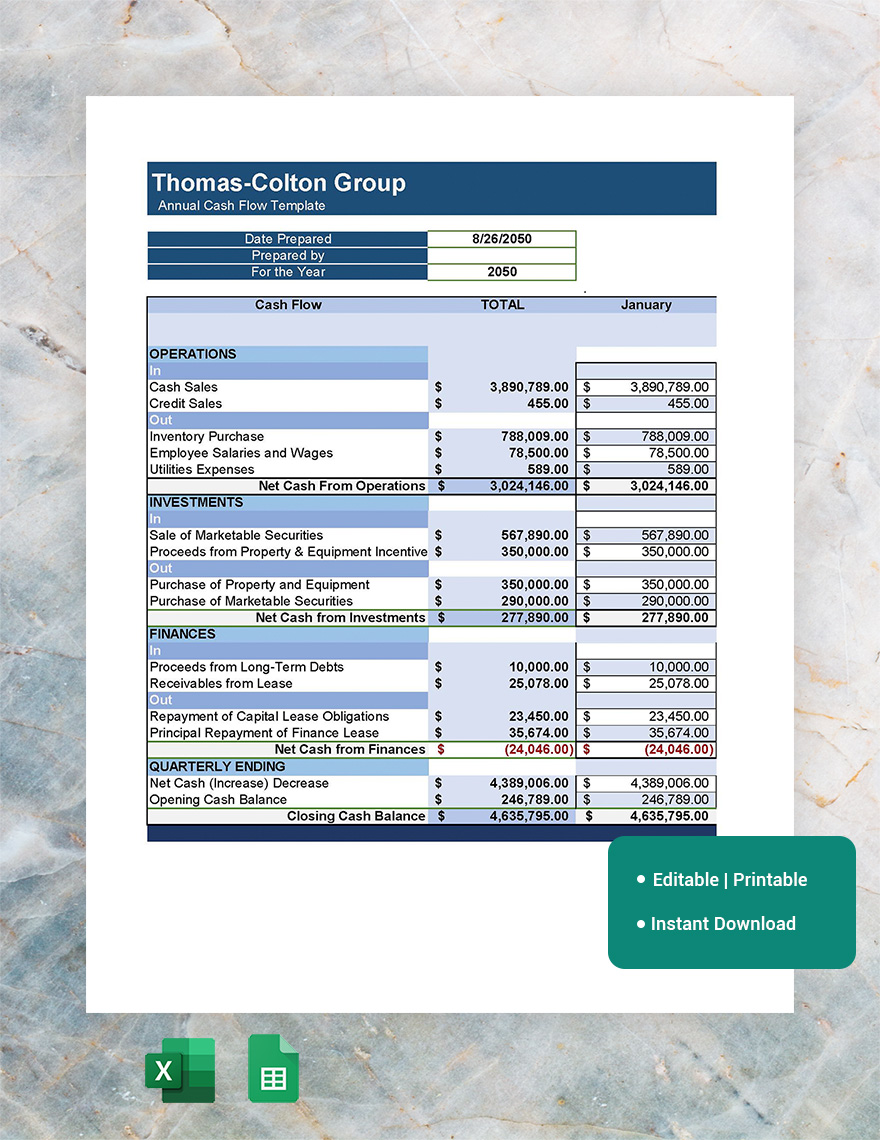

Understanding what is annual cash flow is crucial for business health. Calculating annual cash flow involves a straightforward process that focuses on the actual movement of money into and out of your business. The fundamental formula is: Total Cash Inflows – Total Cash Outflows = Net Cash Flow. Begin by meticulously recording all cash inflows, which represent money received by your business. This includes revenue from sales, payments from clients, investment returns, loan proceeds, and any other sources of cash influx. Similarly, meticulously list all cash outflows, representing money spent by the business. These include operating expenses such as rent, salaries, utilities, and materials; debt payments; capital expenditures; and tax payments. What is annual cash flow, in essence, is the difference between these two figures.

To illustrate, let’s consider a simplified example. Suppose a business had total cash inflows of $500,000 during the year (from sales and investments) and total cash outflows of $400,000 (operating costs, debt payments, etc.). Using the formula, the net cash flow would be $100,000 ($500,000 – $400,000). This positive net cash flow indicates the business generated more cash than it spent during the year. It’s important to note that while depreciation is a non-cash expense (it doesn’t involve an actual outflow of cash), it’s often included in cash flow statements as an adjustment to net income. Similarly, other non-cash items like changes in working capital (accounts receivable, accounts payable, inventory) should be considered to arrive at a truly accurate picture of what is annual cash flow. For instance, a significant increase in accounts receivable (money owed to the business) might not be reflected immediately as cash inflow, affecting the net annual cash flow figure.

Accurate calculation requires diligent record-keeping. Utilizing accounting software or spreadsheets can significantly simplify this process. Regularly monitoring your cash flow, ideally monthly, will allow for proactive adjustments to your business strategy. Understanding what is annual cash flow—and how to effectively calculate and interpret it—empowers businesses to make informed decisions about resource allocation, investment opportunities, and overall financial stability. Remember that consistent monitoring and accurate calculations are critical for effective cash flow management.

Interpreting the Results: What Positive and Negative Cash Flow Means

Understanding what is annual cash flow requires interpreting the results of its calculation. Positive annual cash flow signifies that a business has more money coming in than going out over the course of a year. This is a strong indicator of financial health and stability. With more cash entering than leaving, the business has resources to cover its operating expenses, make necessary investments, and explore growth opportunities. A healthy positive cash flow is crucial for a business to be sustainable in the long term, enabling it to weather unexpected downturns or seize new market opportunities. It means the business can comfortably meet its short-term liabilities, such as paying suppliers and employees on time, and it can also fund larger projects, like equipment upgrades or expansion into new markets. This financial flexibility is the key to long-term success. The ability to generate and maintain a positive what is annual cash flow position provides the basis for strategic investments and allows the business to confidently navigate its future growth.

Conversely, negative annual cash flow means that a business is spending more money than it is earning. While this might not always indicate an immediate crisis, persistent negative cash flow can severely affect a business’s sustainability and viability. Such a situation can hinder the business’s ability to meet its immediate obligations, potentially forcing it to rely on borrowing, selling assets, or seeking outside investment just to stay afloat. A negative what is annual cash flow situation often signals underlying issues within the business model, such as insufficient sales, excessively high operating costs, or poor payment collection processes. In the short term, businesses with negative cash flow may struggle to pay employees, settle accounts with suppliers, or service debts. This can lead to operational disruptions and, if unaddressed, can spiral into serious problems. It’s critical for such businesses to quickly understand the root causes of their negative what is annual cash flow and take decisive steps to rectify the situation. This can involve cost-cutting measures, strategies to increase sales, and sometimes restructuring.

The implications of both positive and negative annual cash flow are far-reaching for a business. Positive cash flow supports growth, allows for debt reduction, and provides a safety net against economic fluctuations. It also increases investor confidence. Negative cash flow, on the other hand, signals a need for urgent action. Businesses in this state must evaluate their operational practices, revenue generation, and spending patterns. Ultimately, monitoring and managing what is annual cash flow effectively is essential to the longevity and prosperity of any business. Understanding the difference between positive and negative cash flow provides a clear perspective on the financial health and future potential of a company.

Annual Cash Flow vs. Profit: Recognizing the Key Differences

While both annual cash flow and profit are crucial financial metrics, they represent distinct aspects of a business’s financial health. Profit, often referred to as net income, reflects a company’s earnings after deducting all expenses from its revenue over a specific period. It’s an accounting measure that includes non-cash items like depreciation and amortization. Essentially, profit demonstrates the theoretical profitability of a business based on accounting principles. However, this doesn’t necessarily mean the business has that exact amount of cash available. In contrast, what is annual cash flow focuses specifically on the actual movement of cash into and out of a business within a year. It’s a real-time measure of liquidity, indicating how much cash a company has on hand to meet its immediate obligations. A company can report a healthy profit on its income statement but still struggle with cash flow issues, demonstrating that profitability doesn’t always translate to having sufficient cash readily available. Understanding this difference is fundamental for effective financial management, as it impacts the ability to cover operational expenses, invest in growth, and navigate unexpected financial challenges. Businesses should not rely on profit alone when making important financial decisions, as it does not provide the whole picture of what is annual cash flow.

The key distinction between what is annual cash flow and profit lies in their treatment of non-cash expenses and timing of revenue and expenses. Profit calculation includes expenses like depreciation, which reduces taxable income, but they don’t represent an actual cash outflow. Conversely, cash flow tracks when cash is received (inflows) and when it’s spent (outflows). A scenario illustrates this perfectly: a company might record a large sale on credit, which appears in its profit calculation as revenue but might not result in immediate cash inflow. The cash from that sale might only be received in the future, creating a gap between reported profit and available cash. A business with a robust profit on paper might be facing a cash crunch if there is a delay in customers paying their invoices or if it invests heavily in inventory. Therefore, while profit is an important metric for understanding a company’s long-term financial performance, annual cash flow is an immediate reflection of its financial stability and ability to pay its bills. Effective management of both profit and what is annual cash flow is vital for a business’s sustainability and growth, but they do require separate attention and strategy for healthy financial practices.

Improving Your Company’s Yearly Cash Flow Management: Practical Tips

Improving annual cash flow requires a dual approach: boosting inflows and carefully managing outflows. To increase inflows, consider strategies like expanding sales efforts through targeted marketing campaigns, exploring new customer segments, or offering promotions and discounts to incentivize purchases. Diversifying your product or service offerings can also attract a wider range of clients, while implementing upselling and cross-selling techniques with your existing customer base could further enhance revenue. Furthermore, shortening the payment cycle by implementing faster billing practices and offering incentives for early payments can accelerate cash inflow. Also, strategic partnerships and collaborations with other businesses can create new revenue streams and introduce your offerings to a wider audience. Understanding what is annual cash flow and consistently aiming to improve it are paramount for sustainable growth.

On the outflow side, careful monitoring and strategic management of expenses are key. Begin by thoroughly examining all expenditures, identifying areas where costs can be reduced without compromising quality or essential functions. Negotiating better payment terms with suppliers can significantly extend the time you have before needing to pay bills, easing the immediate pressure on cash flow. Consider switching to more cost-effective vendors or exploring alternatives to reduce costs where applicable. Implementing energy-saving measures and using technology to automate processes can further contribute to lower operational costs. When faced with short-term negative cash flow, exploring short-term loan options, securing a line of credit, or considering invoice factoring can offer immediate relief. For medium-term challenges, a robust analysis of operational inefficiencies is crucial, combined with the development of a detailed budget and forecasting plan.

Effective management also includes building a cash reserve to cushion against potential financial downturns, or unexpected expenses, to help navigate periods of lower cash flow. When addressing negative cash flow, a comprehensive turnaround strategy that encompasses both cost reductions and revenue enhancements will prove essential. Prioritizing payments to vital suppliers and focusing on revenue generating activities, while considering temporary reductions in non-essential expenses will help preserve cash during difficult times. By implementing these measures, businesses can enhance what is annual cash flow and set the foundation for long-term financial health and stability.

Applying Annual Cash Flow Data to Strategic Decision Making

Understanding what is annual cash flow is not just about tracking past performance; it’s a powerful tool for shaping future strategies. Annual cash flow data provides critical insights for budgeting, allowing businesses to allocate resources effectively based on the anticipated inflow and outflow of cash. This data enables informed decisions regarding investments, be it in new equipment, expansion projects, or research and development, as the financial health and liquidity of these ventures are directly linked to the net cash flow generated. Businesses can also strategically assess the optimal timing for such investments, ensuring funds are available when needed. Furthermore, annual cash flow analysis is crucial when seeking external funding, as lenders and investors meticulously examine the cash flow history and projections to determine the financial viability of the business and its capacity to repay loans or provide returns. Projecting future cash flows is equally as important as analyzing historical data. By creating realistic forecasts, businesses can anticipate potential cash crunches and proactively implement corrective measures, such as delaying expenditures, initiating cost-cutting strategies, or exploring new revenue streams. This forward-thinking approach transforms annual cash flow from a mere reporting metric into a predictive instrument for sustained financial stability and growth. Therefore, the strategic use of what is annual cash flow, enables businesses to not only survive but thrive.

The strategic significance of what is annual cash flow further extends to informing key managerial decisions. For instance, a business might utilize cash flow data to determine the optimal timing for large purchases, such as raw materials or equipment, aiming to align these expenditures with periods of strong cash inflow to avoid liquidity challenges. By analyzing annual cash flow patterns, a business can also better negotiate payment terms with suppliers or implement favorable payment collection policies with customers, thus optimizing the timing of cash inflows and outflows. Moreover, these insights can drive discussions around pricing strategies, with the goal of maximizing revenue while maintaining a competitive edge. When it comes to managing debt, a clear grasp of annual cash flow allows for planning strategic repayments that align with a business’s financial capabilities, minimizing interest expenses and the potential for default. The ability to use cash flow as a predictive tool for strategic planning, underscores the importance of maintaining accurate and current data. It helps identify potential risks and opportunities, allowing for a proactive management approach rather than a reactive one. Ultimately, a business that prioritizes the strategic use of annual cash flow is better prepared to navigate the complexities of the market and maintain long-term financial sustainability.