Understanding Cash Flow Analysis and its Importance

Cash flow analysis is a crucial aspect of financial decision-making, providing insights into the movement of money into and out of a business or investment. It involves evaluating inflows (cash coming in) and outflows (cash going out) over a specific period. Understanding how to use cash flow on a financial calculator is essential because it streamlines the complex calculations often involved. This analysis is invaluable for various purposes, including investment appraisal, where it helps determine the profitability of projects, and loan amortization, which illustrates how loan payments are structured to repay principal and interest. Efficiently performing cash flow analysis, particularly when dealing with numerous transactions or complex scenarios, is greatly simplified through the use of a financial calculator. Learning how to use cash flow on a financial calculator empowers individuals and businesses to make more informed financial choices. The use of this tool allows for quick calculations that provide a foundation for sound financial decisions.

Cash flow analysis provides a clear picture of an entity’s financial health. Positive cash flows indicate a healthy financial position, while negative cash flows might signal potential problems. Different types of cash flows exist, including operating cash flows (from the core business), investing cash flows (related to buying or selling assets), and financing cash flows (related to debt and equity). These flows are frequently examined to gauge the overall health of a business or project. The process of correctly interpreting and utilizing cash flow data is greatly facilitated with a financial calculator. Mastering how to use cash flow on a financial calculator enhances the accuracy and speed of analysis, leading to improved financial planning and strategic decision-making. The ability to readily calculate key metrics allows for deeper exploration of financial opportunities and risks.

Many real-world scenarios benefit from effective cash flow analysis. For instance, businesses use it to forecast future needs, manage working capital, and secure funding. Investors rely on it to assess the potential return of an investment, making it a fundamental aspect of investment appraisal. Understanding the principles behind cash flow analysis and knowing how to use cash flow on a financial calculator allows for a more thorough understanding of financial situations and empowers users to approach investments and financial planning more strategically. The ability to efficiently calculate and analyze cash flows facilitates insightful and well-supported decision making across a multitude of financial contexts. It’s a critical skill for informed financial management in personal and professional life.

Step-by-Step Instructions: Inputting Cash Flows on a Calculator

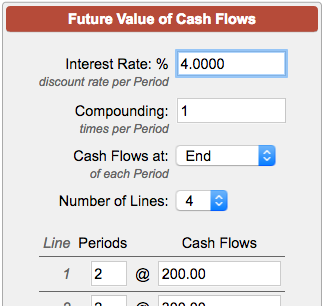

To effectively perform cash flow analysis, understanding how to use cash flow on financial calculator is crucial, and it begins with correctly inputting your data. Most financial calculators utilize specific keys for cash flow entry, typically labeled as CF, CF0, and CFj. The CF0 key represents the initial cash flow, which occurs at time zero—usually today—and often corresponds to the initial investment in a project. It is vital to remember that this initial outflow is commonly entered as a negative value, reflecting the money spent to start the investment. For instance, if you invest $10,000 at the start, you would input -10000 into CF0. Subsequent cash flows, denoted by CFj, represent cash flows occurring at various intervals (period 1, 2, 3, and so on). Here you will have to press the CF key, and then your calculator should show the label CF1, you would input your cash flow for the first period, it could be for example, 2000, representing an inflow of $2,000, which will be registered as a positive number. Then if you have for example, $1,000 as a second period cash flow, you would input CF2 as 1000. It’s important to pay close attention to the sign of your cash flow, positive for inflows and negative for outflows, to ensure accurate results. When inputting data, carefully distinguish between CF0 and subsequent CFj values, as using the incorrect key will lead to errors. If you make a mistake, many calculators have a clear or delete function allowing you to correct your entries. Consistent practice and careful attention are essential for mastering how to use cash flow on financial calculator.

When entering the cash flows, take note that some calculators display CF1, CF2, etc. automatically as you input. If your calculator uses a different structure it is useful to check your calculator manual for specific instructions. In case you have more than one period with the same cash flow amount, you may be able to use the ‘Frequency’ key (often labeled as ‘F’ or ‘Nj’). For example, if you have $500 in cash flow occurring over three consecutive periods, input the cash flow of 500, press ‘F’ or ‘Nj’, and then input ‘3’. This saves considerable time when dealing with repeating cash flows. Remember, the accuracy of your calculations depends on the meticulous input of the data. It is very common to have users confuse outflow and inflows and enter them with the wrong sign, always double check your work. Common errors also include skipping cash flows, or misplacing decimal points, all of them easy to spot if you focus on checking, one by one, your entries on the calculator screen. Learning how to use cash flow on financial calculator includes learning how to double check your entries.

Navigating the data entry is a critical step to use cash flow on financial calculator effectively, so it’s helpful to practice with varied examples of both positive and negative cash flows. Start with simple examples, such as a single investment with a few cash flows, and gradually work towards more complex scenarios. Be mindful of the calculator’s display and ensure you fully understand each step as you progress. The goal is to become proficient at inputting cash flows with both speed and accuracy, and understanding how to use cash flow on financial calculator functions is a skill built with consistent and careful practice. With practice, users will be able to manage more complex cash flow streams and will be more efficient on their analysis of investment opportunities, loan amortization and general financial planning.

Calculating Net Present Value (NPV) Using Cash Flows

Net Present Value (NPV) is a cornerstone of financial analysis, representing the present value of all future cash flows, both inflows and outflows, associated with an investment, discounted back to the present using a specified rate of return. It is a critical metric for assessing the profitability of an investment or project. A positive NPV suggests that the investment is expected to add value to the firm, while a negative NPV indicates that the investment is likely to result in a loss. Understanding how to use cash flow on financial calculator to compute NPV is essential for informed financial decisions. To calculate NPV using your financial calculator, first ensure that all cash flow data has been entered as described in the previous section. Once the cash flows are inputted, the next step is to specify the discount rate or hurdle rate, often denoted as ‘I/YR’ or something similar on the calculator. This rate represents the minimum return required for the investment to be considered acceptable, often based on the company’s cost of capital. After entering the discount rate, typically, you would press the ‘NPV’ key, followed by the ‘compute’ key to obtain the Net Present Value. The resulting NPV is the sum of the discounted cash flows, providing a clear indication of the investment’s projected profitability.

The process of computing NPV using the calculator is straightforward, provided the user understands how to use cash flow on financial calculator correctly, and the meaning of the data entered. For instance, an initial cash outflow (representing an investment) is always entered as a negative value, while subsequent inflows are entered as positive values. The calculator will discount each of these values based on the specified discount rate, sum them, and display the resulting NPV. A crucial element here is the correct interpretation of the calculator’s output. If the calculator displays a positive NPV, it implies that the investment is projected to yield a return greater than the discount rate, making it potentially a good investment choice. Conversely, a negative NPV implies that the investment’s expected return is lower than the hurdle rate, potentially making the investment undesirable unless other strategic factors outweigh the loss. Therefore, the NPV calculation is not just about getting a number; it is about interpreting this number correctly within the context of an investment decision. Knowing how to use cash flow on financial calculator accurately allows for a more strategic evaluation of investment opportunities based on projected future cash flows.

The accuracy of the NPV calculation, and ultimately, the reliability of the investment decision, relies heavily on the accuracy of the cash flow inputs and the appropriateness of the discount rate. Before using the calculator to compute NPV, users should verify the data and the chosen discount rate. The NPV results allow investors to compare investments with different timelines and expected returns in a standardized, present-day value format. This process emphasizes the importance of both data input and understanding the underlying financial principles of present value calculation. By mastering how to use cash flow on financial calculator for NPV calculations, one will be better equipped to make sound financial judgments, selecting investments that contribute to the growth and profitability of the firm.

Determining Internal Rate of Return (IRR) with Your Calculator

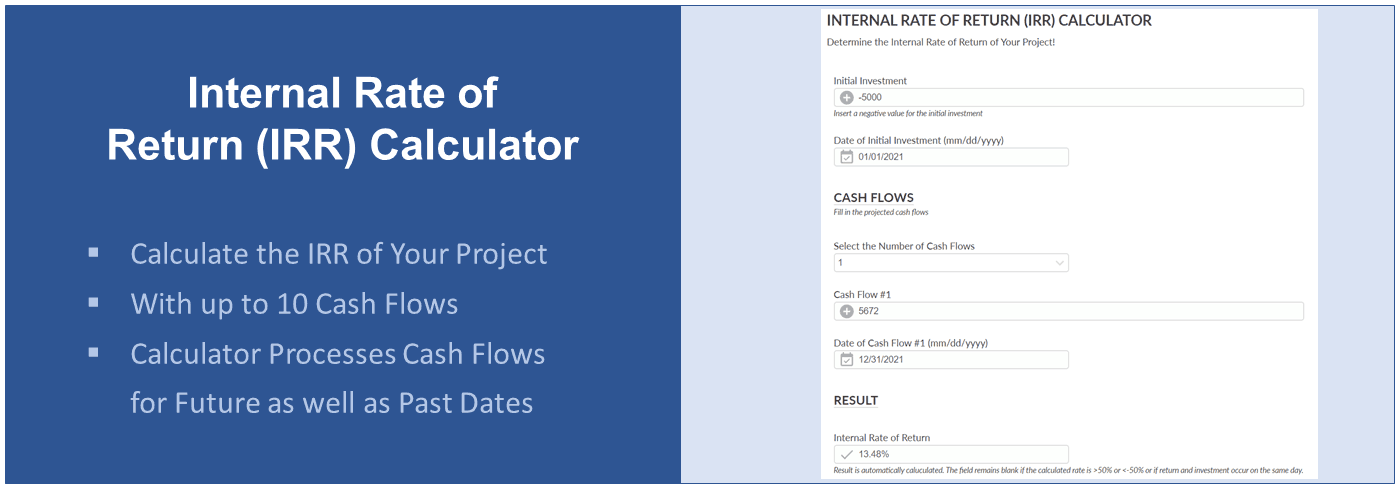

The Internal Rate of Return (IRR) represents another critical metric in investment analysis, indicating the discount rate at which the net present value of all cash flows from a particular project equals zero. In simpler terms, it’s the expected rate of growth a project generates. Understanding how to use cash flow on financial calculator to find the IRR is invaluable as it allows for a direct comparison of returns across different investments, making it a crucial factor in decision-making. After successfully entering your cash flow data, the next step involves accessing the IRR function on your financial calculator. This is typically achieved by pressing the “IRR” key, often found alongside or near the NPV function. The calculator will then process the previously inputted cash flow data to calculate the IRR. Importantly, it is vital to remember that IRR is not to be confused with NPV; while NPV focuses on absolute dollar value of an investment, IRR focuses on the percentage rate of return. Both, however, contribute to a thorough investment evaluation. The IRR is particularly useful when determining if a project’s projected return meets or exceeds the required hurdle rate or cost of capital.

When analyzing cash flow using a financial calculator, the computed IRR becomes a benchmark for assessing whether an investment is considered profitable. Typically, an IRR higher than the cost of capital suggests an attractive investment prospect, however, comparing multiple IRRs can also help rank different projects to identify the most lucrative opportunity. It is important to note that while an investment with a higher IRR can be attractive, the IRR does not measure the absolute profitability or scale of the investment. The IRR is particularly useful when comparing mutually exclusive projects to see which has a better rate of return. It also serves as a valuable comparison tool to analyze investments that require different initial outlays. Understanding how to use cash flow on financial calculator to find the IRR gives users a powerful tool for not only calculating investment returns but also when evaluating a range of alternatives.

Therefore, while NPV is crucial for understanding the overall value addition, the IRR offers insight into the efficiency or growth rate of an investment. These two metrics are complementary and should be used in tandem for comprehensive financial analysis. The financial calculator, by quickly computing these complex measures, empowers individuals to make more informed investment decisions. Mastering the IRR function and knowing how to use cash flow on financial calculator is vital for making accurate investment choices and for the understanding of a project’s overall return, ensuring an investment’s projected rate exceeds the minimum required rate.

Handling Uneven Cash Flow Streams with Ease

Many real-world financial scenarios involve cash flows that are not consistent, differing from simple, fixed annuities. These irregular cash flow patterns, known as uneven cash flows, can present challenges when analyzing investment opportunities or project viability. Fortunately, a financial calculator is equipped to manage these complexities with ease. The “CFj” function on your calculator is specifically designed to accommodate such variations. After inputting an initial cash flow (CF0), subsequent cash flows are entered using “CFj”, where j represents the time period. This functionality allows you to assign distinct values to each period of cash flow, regardless of whether they are positive (inflows) or negative (outflows). This capability is essential when assessing a project with fluctuating income streams, where revenue or expenses change significantly over time. Imagine a construction project where large initial outlays are followed by variable profits in each of the next few years, or a business with seasonal sales variations; using the “CFj” function is key to proper analysis. Understanding how to use cash flow on financial calculator with these varied patterns allows for a far more accurate financial overview than you could ever obtain through simplified annual assumptions.

The practical application of the financial calculator’s uneven cash flow handling capabilities is extensive. Consider a start-up business, its early years might consist of negative cash flows as it invests heavily in development and marketing. Then the cash flows may increase significantly as the business matures, and after that may even decline over time depending on changing market conditions. A financial calculator’s “CFj” function makes it simple to input every distinct cash flow point, whether it’s a large, early negative flow or a smaller, positive future value. Another example, might be the valuation of a series of royalty payments from a book or song, these payments can be unpredictable in size and timing and need this flexibility in the calculation process. When you know how to use cash flow on financial calculator to tackle this, you’ll be equipped to manage a whole range of more realistic and complex financial projections than you could with simplified methods. By using CF0 for your initial investment and the CFj function for all of the varying cash flows you are using a powerful tool to assess the true financial worth of these projects and opportunities.

The advantage of using a financial calculator’s “CFj” function is not merely limited to inputting data; it allows for the seamless calculation of Net Present Value (NPV) and Internal Rate of Return (IRR) with uneven cash flow streams. Once all cash flows, whether fixed or uneven, are input into the calculator, it computes the total NPV or IRR accurately, even with these changing patterns. This is crucial in comparing diverse investment opportunities that might have very different cash flow timelines, you can directly compare using consistent assumptions by adjusting the discount rate to the actual time value of money. So mastering how to use cash flow on financial calculator for uneven streams enables far more sophisticated financial analysis. Ultimately, this ensures financial decisions are based on a comprehensive, accurate and realistic evaluation of opportunities, rather than simpler models that might overlook the true underlying profitability or risk.

Troubleshooting Common Issues When Using Cash Flow Functions

One might encounter several challenges when learning how to use cash flow on financial calculator, and it’s crucial to address them effectively. A frequent error is incorrect data entry, which can significantly skew results. It’s imperative to double-check each cash flow amount and its corresponding period. Pay close attention to the decimal points and ensure accurate input. Another common pitfall is the improper use of the calculator’s mode settings, particularly regarding the timing of cash flows. Many financial calculators offer options for both “Begin” and “End” modes, where “Begin” mode assumes cash flows occur at the start of the period, and “End” mode assumes they occur at the end. For example, rent payments are typically made at the beginning of the period, requiring begin mode to calculate it properly. Incorrect mode selection can lead to substantial errors in both Net Present Value (NPV) and Internal Rate of Return (IRR) calculations. Understanding and correctly setting this mode is vital for accurate financial analysis, especially when evaluating leases or annuities. Another aspect to verify, especially with repeated calculations, is to clear the calculator’s memory to prevent previous data from influencing current results. It is good practice to do this before any calculation. If an error message pops up, carefully review the input to identify if a zero value cash flow was missed or if there was any value with an unexpected sign. The calculator screen can also reveal if you are working under the correct parameters. A final suggestion is to start with simpler scenarios, like a few years with easy calculations, to better understand the workflow before trying to calculate complex cash flows.

Users also frequently struggle with the concept of time value of money parameters and their implications. For instance, a misinterpretation of the discount rate can distort the NPV calculation, leading to flawed investment decisions. It’s essential to understand that the discount rate represents the required return or the opportunity cost of capital, and this value greatly influences the valuation of future cash flows. A low discount rate will give more value to the future, whereas a high one will focus on the present cash flow. Another common mistake is confusing the cash flow input for a series of payments with a single future value or present value. Many times, users may not completely grasp the difference between positive and negative cash flows; therefore, the best way to avoid errors is to label each amount when inserting data into the calculator and verify that each cash outflow is denoted with a negative sign while cash inflows are positive. In scenarios where uneven cash flows are involved, understanding how the CFj function works is vital. Each cash flow must be entered with the correct amount, sequence and number of periods, with particular emphasis on the correct negative sign for outflows. Knowing how to use cash flow on financial calculator requires careful attention to detail and a solid comprehension of the underlying financial principles. When all else fails, reviewing the financial calculator manual provides a great way to gain an understanding of all the functions and options available. It is a good idea to have it near when working on more complex cash flow analysis.

Comparing Different Investment Opportunities Using Calculator Data

The power of the financial calculator truly shines when comparing multiple investment opportunities. To effectively use cash flow on a financial calculator for this purpose, begin by methodically inputting the cash flows for each investment scenario. For example, consider two potential projects, Project A and Project B. Project A requires an initial investment of $100,000 and is expected to generate cash inflows of $30,000, $40,000, $50,000, and $20,000 over four years, respectively. Project B, on the other hand, requires an initial investment of $120,000 and is anticipated to generate cash flows of $25,000, $50,000, $60,000, and $35,000 over the same period. Input the cash flows for Project A, starting with the initial outflow as a negative value (-$100,000) followed by the subsequent positive inflows. Once completed, compute the Net Present Value (NPV) at a chosen discount rate, such as 10%. Store or note this NPV. Repeat the same procedure for Project B, entering its respective initial outflow and subsequent inflows, again calculating the NPV at the same discount rate. The financial calculator simplifies this process significantly, allowing for swift comparisons by evaluating and storing different cash flows. Similarly, calculate the Internal Rate of Return (IRR) for both projects, and then comparing the IRR values for both alternatives.

The calculated NPV and IRR figures will provide crucial insights for how to use cash flow on a financial calculator to make informed decisions. If the calculated NPV for Project A is $15,000 and Project B’s NPV is $18,000, then based purely on NPV, Project B would be considered the more profitable option, given its higher present value of future cash flows. The Internal Rate of Return (IRR) offers another lens through which to compare. Suppose Project A has an IRR of 14% while Project B’s is 13%. Here, Project A is providing higher returns but lower overall profitability. Deciding which project is optimal may hinge on the organization’s particular goals: if the priority is maximizing absolute profit, then Project B may be preferred. But if the focus is maximizing percentage return, Project A might be more desirable. By quickly generating these results, the financial calculator greatly enhances the speed and accuracy of the investment appraisal process. The financial calculator’s capacity to handle multiple cash flow sequences means that even complex portfolios involving several projects can be easily assessed, making it an invaluable tool for strategic financial planning. This enables users to make more confident decisions in the face of multiple opportunities.

Elevating Your Financial Analysis Skills with a Calculator

The adept application of a financial calculator for cash flow analysis presents a significant advantage in the realm of financial management. By mastering the techniques discussed, users can substantially enhance their efficiency and precision when handling complex financial calculations. This mastery translates to considerable time savings and a notable reduction in the potential for errors that can arise from manual computations. Learning how to use cash flow on financial calculator equips individuals with the ability to swiftly analyze investment opportunities, loan amortization schedules, and project viability with a degree of accuracy that is often unattainable through traditional methods. This is because the calculator automates calculations that would be tedious and time consuming to complete by hand. The result is more time spent on understanding results rather than obtaining them. The use of these tools empowers professionals and individuals alike to take a more strategic approach to their financial decisions.

The benefits of understanding how to use cash flow on financial calculator extend beyond mere calculation speed. This understanding fosters a deeper comprehension of underlying financial principles, such as the time value of money and the impact of discount rates on project valuation. By applying the calculator’s cash flow functions, one gains a clearer insight into the financial implications of their decisions, thus enabling more informed and strategic planning. The ability to quickly perform NPV and IRR analysis, for example, allows for a more direct comparison between multiple investment options. These tools provide a powerful means to evaluate project potential under various financial scenarios, leading to improved risk management and resource allocation. Therefore, an investment in learning how to use cash flow on financial calculator yields continuous improvements in financial decision-making.

In conclusion, the financial calculator is more than a mere tool; it is a catalyst for elevating one’s financial acumen. Understanding how to use cash flow on financial calculator is not just about performing calculations but about embracing a more efficient, accurate, and insightful method of financial analysis. These skills are crucial for improving capabilities in personal financial planning, corporate financial management, and overall investment analysis. The ability to quickly and accurately assess cash flow scenarios makes for more strategic, data-driven decisions that directly impact one’s financial well-being. In essence, mastering how to use cash flow on financial calculator is not just an advantage—it’s a necessity for anyone seeking to navigate the complexities of the financial world with confidence and precision.