Understanding Bond Yields: Current Yield Versus Yield to Maturity

Investors in the bond market seek to understand the potential returns from their investments, and two key metrics help in this analysis: current return and full maturity return, also known as yield to maturity. These measures offer different perspectives on bond income, serving distinct purposes for investors. The core comparison lies between a simple annual income assessment and the total return achievable by holding the bond until its maturity date. Current yield provides a snapshot of the income a bond generates in a year, while yield to maturity offers a more comprehensive view of the total return, encompassing both income and any capital gains or losses incurred if the bond is held to maturity. It’s important to distinguish between these two as the relationship between current yield versus yield to maturity is crucial to understanding the true value of a bond investment.

The current return focuses solely on the annual coupon payments relative to the current market price of the bond. This measure provides a straightforward view of the income stream one can expect from a bond based on its current pricing. On the other hand, full maturity return, or yield to maturity, factors in not just the coupon payments, but also the difference between the purchase price of the bond and its face value, which is received at maturity. Thus, the full maturity return gives a more complete picture of the total return an investor would make over the bond’s lifespan. The significant difference is that current yield considers only annual income, while yield to maturity includes the income and any gain or loss on the bond’s principal at maturity. Thus understanding current yield versus yield to maturity is vital for informed bond investment decision making.

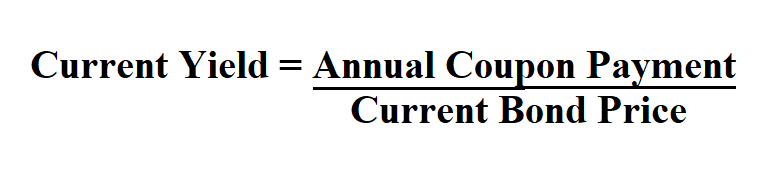

How to Calculate Current Yield: A Simple Income Perspective

Calculating current yield offers a straightforward method to assess a bond’s immediate income potential. This metric is determined by dividing the annual coupon payment by the bond’s current market price. For instance, consider a hypothetical bond with a face value of $1,000 that pays a 5% annual coupon, resulting in $50 per year in interest payments. If this bond is currently trading at $950, the current yield calculation is as follows: $50 (annual coupon payment) / $950 (current bond price) = 0.0526 or 5.26%. This calculation demonstrates that investors would receive a 5.26% return based solely on the annual income generated from the bond, at its current market price. The strength of current yield lies in its simplicity, providing an easily understandable snapshot of the bond’s immediate income. Importantly, this calculation doesn’t consider whether the bond is trading at a premium or a discount to its face value, which is essential to understand when comparing current yield versus yield to maturity. This metric is useful for income focused investors, and does not reflect the total return of the investment.

It’s crucial to recognize the limitations of relying solely on current yield for evaluating a bond investment. The simplicity of this metric means it doesn’t account for potential capital gains or losses that will be realized when the bond matures. For example, if the bond was purchased at $950 and will mature at $1000, the yield calculation does not factor in the $50 capital gain that the bondholder will receive at maturity. It only focuses on the immediate annual income generated by the bond’s coupon payments. Likewise, if the bond was purchased at a premium, the current yield would not reflect the capital loss that would be realized at maturity. Therefore, while current yield offers a quick understanding of annual income, it should not be the only factor considered when evaluating a bond, particularly when comparing current yield versus yield to maturity, which provides a more complete picture of potential returns. This method is valuable for investors seeking predictable income streams, but it is not a good metric for evaluating total return.

Delving into Yield to Maturity: The Comprehensive Return Calculation

Understanding the concept of full maturity return, often referred to as yield to maturity (YTM), is crucial for bond investors seeking a more complete picture of their potential investment returns. Unlike current yield, which focuses solely on the annual income from coupon payments, yield to maturity provides a more comprehensive view by considering not only the interest income but also any potential capital gain or loss that may occur if the bond is held until its maturity date. This calculation takes into account the price you paid for the bond, its coupon rate, and its face value at the time of maturity, offering a more holistic measure of investment performance. The difference between current yield versus yield to maturity becomes most apparent when bonds are purchased at a discount or premium to their face value. When a bond is purchased at a discount, meaning below its par value, the investor will receive not only the coupon payments but also a capital gain when the bond matures at its face value. Conversely, purchasing a bond at a premium means that the investor will receive the stated coupon payments, but will experience a capital loss at maturity as the bond’s value decreases to its face value. The yield to maturity encapsulates both of these scenarios providing a more accurate reflection of the overall expected return if the bond is held until its maturity date, this is the key difference between current yield versus yield to maturity.

The calculation of yield to maturity is more complex than the calculation for current yield, and while the exact formula can appear intimidating, it essentially seeks to find the discount rate that equates the present value of a bond’s future cash flows—coupon payments and face value—to its current market price. This complexity is what enables YTM to provide an accurate portrayal of the bond’s total potential return at maturity. The calculation for YTM is often done using financial calculators or software. It is important to note that yield to maturity assumes that all coupon payments received are reinvested at the same yield, and while this may not be realistic for most investors, it allows for a consistent and comparable metric to evaluate bond investments, making it a superior measure of return when compared to current yield, especially when not buying bonds at par. For investors comparing different bonds, the yield to maturity is more useful than current yield because it reflects the true annualized rate of return if the bond is held to its maturity date. It encompasses all income from the bond and is a useful tool for making investment decisions. Therefore, in understanding the nuances of current yield versus yield to maturity, investors are better equipped to evaluate the potential returns of bond investments.

Why Current Return Can Be Misleading: Limitations to Consider

Relying solely on current yield as a gauge of a bond’s overall investment performance can be misleading. The current yield, which is calculated by dividing the annual coupon payment by the bond’s current market price, offers a snapshot of the bond’s immediate income-generating potential. However, it fails to incorporate the potential gains or losses that occur when a bond is held to its maturity date. This limitation is particularly significant when a bond is purchased at a price that is different from its par value, also known as face value. For instance, consider a bond purchased at a premium, meaning the price paid was higher than the face value. The current yield may appear favorable, but this calculation does not reflect the capital loss that will occur at maturity when the bond’s face value is received. Conversely, if a bond is purchased at a discount, the current yield will not factor in the capital gain realized when the investor receives face value at maturity. This discrepancy between the current yield and the total return makes it crucial for investors to understand the limitations of using only this metric in their investment decisions.

The core issue with focusing solely on current yield is that it overlooks a critical component of a bond’s total return: the difference between the purchase price and the bond’s face value at maturity. For bonds bought at a price other than par, the current yield doesn’t tell the full story of what the actual returns will be if the bond is held until it matures. This is essential knowledge for bond investors, as they must understand what they will receive if they hold the bond to maturity. The difference between current yield versus yield to maturity highlights this discrepancy: yield to maturity takes into account the purchase price, the coupon payments, and the bond’s face value to give a comprehensive picture of what an investor can expect to earn if they hold the bond until the end of its term. Investors need to be aware of the differences between current yield versus yield to maturity to make informed decisions. Therefore, while current yield can be a simple and easily calculated measure, its failure to account for capital gains or losses at maturity renders it an inadequate tool for assessing a bond’s true investment potential. The relationship between current yield versus yield to maturity is essential for bond evaluation.

YTM’s Accuracy: Reflecting the True Potential of Holding Bonds

The full maturity return, often referred to as yield to maturity (YTM), stands out as a more holistic indicator of a bond’s earning potential compared to the simpler current yield. While current yield focuses solely on the annual coupon payment relative to the bond’s current price, YTM takes a much broader view. It encapsulates the total return an investor can expect if they hold the bond until its maturity date. This total return is not just the coupon payments; it also includes any capital gain or loss that arises from purchasing the bond at a discount or premium relative to its face value. For instance, if an investor buys a bond at a price lower than its face value, they will realize a capital gain at maturity when the bond pays the full face value. Conversely, if they buy a bond at a premium, the difference will represent a capital loss over the life of the bond. The yield to maturity calculation accounts for all of these factors, providing a more precise reflection of the bond’s true return potential.

Understanding the nuances of yield to maturity is crucial, especially when comparing different bonds. The current yield versus yield to maturity comparison highlights that YTM is particularly useful when a bond trades at a price that is different from its face value. Because YTM encompasses both the current income and any price appreciation or depreciation, it offers a better perspective of investment outcomes. Investors can use this metric to compare bonds with different coupon rates, prices, and times to maturity and make well informed investment decisions, seeing the actual return they can expect to receive if they hold the bond to maturity. This perspective also allows investors to evaluate and compare bonds, even if they have different current yields. By including these critical factors, the yield to maturity provides a more complete and reliable gauge of investment potential, making it a more effective tool for assessing the total potential return on individual bonds.

Comparing and Contrasting: When to Use Each Metric

Understanding when to utilize current yield versus yield to maturity is essential for bond investors. Current yield, with its straightforward calculation, serves as a practical tool for those primarily focused on immediate income generation. It’s particularly relevant when bonds are purchased at or near their par value, as it provides a clear snapshot of the annual income relative to the current investment. For example, if an investor seeks a steady stream of income from a bond held near par, the current yield provides a useful measure of expected yearly cash flow. This is because there is no substantial difference between the price paid and the face value at maturity. This approach is common among income-focused investors, where the main goal is to receive regular coupon payments. However, it’s crucial to recognize that current yield alone doesn’t reveal the full picture of potential returns, especially for bonds trading at a significant discount or premium.

Yield to maturity, on the other hand, is most valuable when evaluating bonds intended to be held until maturity, especially when the bond is purchased at a premium or discount. It gives a more complete picture of the overall return potential, including both the periodic coupon payments and the capital gain or loss experienced at maturity. If a bond is bought at a discount (below par value), the yield to maturity will be higher than the current yield, as the investor will receive the difference between the discounted purchase price and the par value at maturity, in addition to coupon payments. Conversely, if the bond is bought at a premium (above par value), the yield to maturity will be lower than the current yield as the premium reduces the overall return. Investors utilizing a buy-and-hold strategy, should heavily weigh the yield to maturity when comparing different investment options. Therefore, for those looking to compare the total potential return of bonds with differing coupon rates and purchase prices, yield to maturity offers a more accurate basis for evaluation. This is a key part of understanding the difference between current yield versus yield to maturity.

In practical terms, consider an investor choosing between two bonds. Bond A, selling near par, has a current yield that closely matches its full maturity return; for this bond, the current yield is a reasonable approximation of the overall return. Bond B, selling at a discount, shows a current yield lower than its yield to maturity. An investor solely relying on current yield might misjudge Bond B’s total return potential, missing a significant return at maturity. Therefore, investors must align the metric with their specific investment objective: income focus or total return optimization, making informed decisions when evaluating current yield versus yield to maturity.

Real World Examples: Applying the Concepts

Consider a hypothetical US Treasury bond with a face value of $1,000, a coupon rate of 3%, and a current market price of $950. The annual coupon payment is $30 (3% of $1,000). The current yield is calculated by dividing the annual coupon payment by the current market price: $30 / $950, resulting in a current yield of approximately 3.16%. Now, let’s look at the full maturity return, or yield to maturity (YTM), which takes into consideration that an investor would receive $1,000 at maturity despite purchasing the bond for only $950. This $50 difference represents a capital gain at maturity. The YTM would be significantly higher than 3.16%, and would require a more complex calculation, or an approximation using a financial calculator or software. This example illustrates how the current yield only provides a snapshot of the bond’s annual income, but fails to capture the total return potential that would result when holding the bond to maturity. If a similar bond is bought at a premium, say for $1050 instead of $950, the current yield would be the same at 3.16%, but the YTM would be significantly less as the investor will experience a capital loss when the bond pays out its $1000 face value. The example clearly shows how focusing only on the current yield versus yield to maturity can lead to an incomplete understanding of a bond’s true return.

Let’s examine a corporate bond, hypothetically issued by ABC Corp., with a face value of $1,000, a coupon rate of 5%, and a current market price of $1,020. The annual coupon payment is $50 (5% of $1,000). The current yield is calculated as $50 / $1,020, which is about 4.90%. However, an investor is paying a premium of $20 to purchase the bond. When held to maturity, this $20 premium will not be recovered, reducing the overall total return. Because of this loss of $20, the yield to maturity would be less than the current yield, even though the bond pays the coupon rate of 5%. The current yield versus yield to maturity will vary, sometimes very little and other times significantly, based on whether the bond is bought at par, a discount, or premium. This difference is important to understand. Consider the table below to further visualize the differences between the current yield and the yield to maturity.

| Bond Type | Face Value | Coupon Rate | Current Price | Current Yield | Approximate YTM |

|---|---|---|---|---|---|

| US Treasury Bond | $1,000 | 3% | $950 | 3.16% | ~ 3.65% |

| Corporate Bond | $1,000 | 5% | $1,020 | 4.90% | ~ 4.70% |

The table above demonstrates how the current yield versus yield to maturity can differ based on the market price relative to the bond’s par value and shows why considering both metrics is important for bond investing.

While understanding a bond’s potential return is crucial, the method of evaluation significantly impacts the perspective. The current yield versus yield to maturity debate often leaves investors pondering which metric best reflects their investment goals. Current yield, calculated by dividing the annual coupon payment by the bond’s current price, provides a snapshot of the immediate income a bond generates. This calculation is straightforward and useful for investors focused solely on immediate cash flow. However, it’s important to understand that the current return fails to incorporate the potential for capital gains or losses that occur when a bond is held until its maturity date. This means that if a bond is purchased at a price different from its face value, the current yield will not capture the full return realized at maturity. An investor buying a bond at a discount will actually earn more than the current yield, while an investor paying a premium will earn less if they hold it to maturity, making the current yield alone a potentially misleading measure of total return.

Current yield versus yield to maturity highlights the difference between a simple income snapshot versus a comprehensive analysis of a bond’s total return when held to maturity. Yield to maturity (YTM), on the other hand, presents a more holistic view, encompassing all potential gains or losses alongside the income generated by coupon payments. YTM factors in the difference between the purchase price of the bond and its face value, essentially calculating the annualized total return an investor would receive if they hold the bond until maturity. This measure is essential because it accounts for the capital gain if purchased at a discount, or the capital loss if purchased at a premium. For example, a bond bought below par and held to maturity will result in a return that is higher than the current return because the investor also profits from receiving the bond’s full face value at maturity. Similarly, a bond bought above par will result in a return that is lower than the current return for the same reason. Therefore, yield to maturity provides a more accurate assessment of the investment’s overall return potential.

In conclusion, understanding both current yield versus yield to maturity is important for informed bond investment decisions. Current yield serves well for income-focused strategies, particularly when bonds are purchased close to par value. However, when assessing the total return potential of holding a bond to maturity, yield to maturity is an indispensable tool that takes into account both income and any potential capital gains or losses, which gives a more complete picture. For investors holding bonds to maturity, or making comparisons between different bond investments, the importance of the yield to maturity measure cannot be overstated.