Decoding the Distinct Disciplines of Financial and Economic Studies

The fields of finance and economics, while intrinsically linked, represent distinct areas of study with differing focuses and methodologies. Economics, at its core, is a social science that examines how societies allocate scarce resources to meet unlimited wants and needs. It delves into the mechanisms of production, distribution, and consumption of goods and services, aiming to understand how entire economies function. The discipline seeks to explain broad phenomena like unemployment, inflation, and economic growth, taking a macro-level perspective. In contrast, finance is a more practical field concerned with the management of money and capital. It focuses on how individuals, businesses, and governments acquire, invest, and manage financial resources. While economics provides the theoretical framework for understanding how economies work, finance is concerned with the practicalities of decision-making regarding financial assets and markets. Understanding what is difference between finance and economics requires an appreciation of their divergent approaches, with economics adopting a more holistic, societal perspective and finance taking a more micro-oriented approach.

The overall goals of finance center around optimizing financial decisions, whether it’s through effective investment strategies, risk management, or maximizing shareholder value. This can involve detailed analysis of individual stocks, bonds, or derivatives, as well as formulating strategies for capital budgeting and financial planning. On the other hand, economics has a much broader scope. It aims to understand the forces that drive economic activity, create models for forecasting economic trends, and analyze the effects of government policies on economic outcomes. In essence, economics is focused on the big picture—analyzing the behavior of economies as a whole. To grasp what is difference between finance and economics, it is critical to know that the latter often acts as the foundation upon which financial practices are built. While they are separate, the connection between the two disciplines is vital to understanding the complete picture.

How to Distinguish Between Fiscal Management and Resource Distribution

Delving deeper, the operational aspects of finance and economics reveal their distinct approaches. Finance primarily concerns itself with the management of money, assets, and investments, focusing on decisions made by individuals, corporations, and governments. This involves diverse activities like personal budgeting, where individuals allocate their income for various expenses and savings; corporate financial planning, where companies strategize their capital investments, funding, and profitability; and government fiscal management, which includes taxation, spending, and debt management. Key financial concepts include risk assessment, where the potential for loss is evaluated, investment strategies to grow wealth, and financial markets, where assets are traded. These practicalities show a micro-level concern with efficiency and growth within a financial system. The practical considerations of finance also highlight what is difference between finance and economics, where finance is about managing financial resources effectively. On the other hand, economics is fundamentally about the study of how societies manage their scarce resources to produce and distribute goods and services. This includes understanding concepts like supply and demand, which determine market prices, market structures, ranging from perfect competition to monopolies, and economic policies, which governments use to influence economic conditions. Economics aims to optimize social welfare and is concerned with issues such as inflation, unemployment, and economic growth at a macro level. It looks into the big picture and explores how societies can achieve stability, growth, and equitable distribution of wealth. This demonstrates the crucial distinction: finance manages money; economics manages resources.

Within finance, the focus remains on mechanisms and strategies to generate wealth, manage risk, and ensure the efficient operation of financial institutions and markets. These range from complex financial instruments to basic budgeting practices. In contrast, economics provides the analytical framework to understand the broader consequences of these financial activities. For example, an economist might analyze the impact of a new government fiscal policy on aggregate demand, while a finance professional might evaluate how that policy could affect investment opportunities. The economic models also explore various areas like international trade, economic development, and public finance, while financial practices focus on creating value through effective capital allocation and investment decisions. The real-world applications of financial principles include setting up diversified portfolios, calculating the present value of future earnings, and developing hedging strategies, further illustrating what is difference between finance and economics. Whereas, the applications of economics involve using macroeconomic indicators to predict and influence economic activity, which includes using econometric models to estimate the effects of policy changes. Both finance and economics consider the behavior of individuals and groups, albeit from distinct angles, the financial perspective looks at the efficient use of monetary assets, while the economic viewpoint analyzes how these uses interact with broader social goals.

The Practical Application of Financial Principles

Financial principles are not confined to textbooks; they are the bedrock of everyday financial decisions across various scales. In personal finance, the application is immediate and tangible. Individuals utilize financial concepts such as budgeting, saving, and investing to manage their income and expenses, plan for future goals, like retirement, and build wealth. The essence of prudent financial management lies in understanding cash flow, risk tolerance, and the power of compounding, all of which are rooted in basic financial principles. For businesses, financial planning is essential for survival and growth. Companies employ financial analysis to evaluate potential investments, secure funding, manage working capital, and make strategic decisions. The application of these principles ranges from simple cost-benefit analysis to complex capital budgeting and valuation techniques. Understanding the intricacies of what is difference between finance and economics becomes paramount as financial decisions influence the operational efficacy and overall profitability of an entity. Moreover, the financial markets are themselves a practical embodiment of financial principles. Stock exchanges, bond markets, and derivative markets facilitate the trading of financial instruments, providing channels for investment, capital allocation, and risk management. These markets are governed by principles of supply and demand, market efficiency, and information asymmetry, demonstrating how theoretical concepts of finance shape real-world activity. Financial institutions, such as banks and insurance companies, play a central role in the economy by channeling funds from savers to borrowers and providing risk transfer services. Their operations directly influence interest rates, credit availability, and ultimately, the overall pace of economic activity. The impact of a robust and well-regulated financial system contributes significantly to economic stability and growth.

The application of financial principles also extends to government entities. Public finance involves the management of government revenues and expenditures, including taxation, budgeting, and debt management. Governments use financial tools and techniques to fund public services, promote economic development, and maintain fiscal stability. Understanding the interplay of financial management in government affairs further underscores what is difference between finance and economics. Ultimately, the practical application of financial principles is broad and multifaceted, affecting the daily lives of individuals, the operations of businesses, the functioning of financial markets, and the stability of governments. Each application requires a keen understanding of basic concepts and a consistent adaptation to a changing landscape.

Exploring Economic Models and Their Real-World Impact

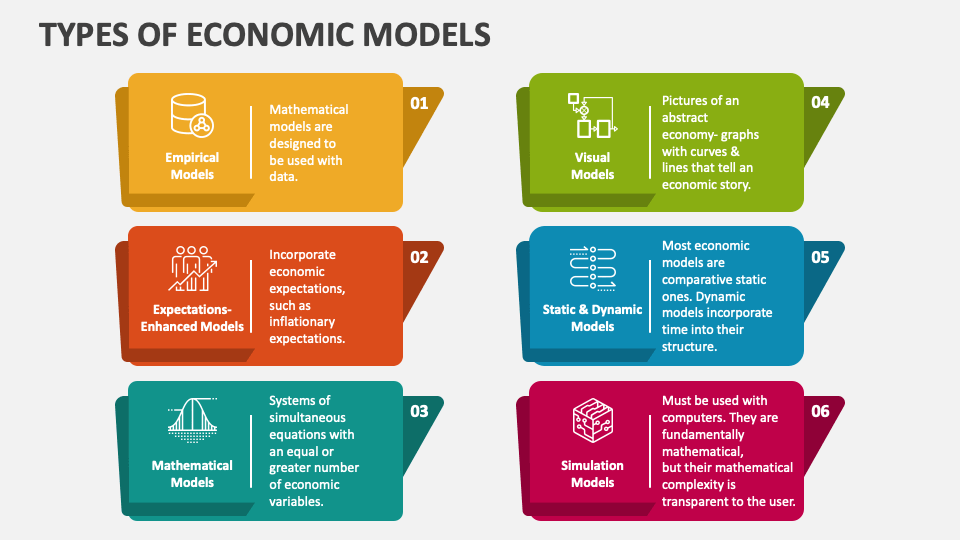

Context_4: Shifting the focus to economics reveals how economic models are essential tools for analyzing and predicting economic trends. These models, while often simplified representations of complex realities, provide invaluable insights into the workings of an economy. For instance, understanding the causes and effects of inflation involves using models that consider factors such as aggregate demand, supply shocks, and monetary policy. Similarly, analyzing unemployment rates requires models that explore labor market dynamics, including job creation, labor force participation, and wage levels. These models are not static; they are constantly refined and updated as economists gain new insights and as economic conditions evolve. Furthermore, economic models are crucial for evaluating the impact of government policies. For example, tax reforms, changes in government spending, and alterations to trade policies are often tested and analyzed using economic models before implementation. This approach allows policymakers to anticipate the potential consequences of their decisions on economic growth, income distribution, and overall societal well-being. It also helps to determine the effectiveness of various strategies in addressing economic challenges such as recessions or financial crises. Therefore, through analyzing economic models and their real-world impact, we further understand what is difference between finance and economics, with economics focusing on broader, macro-level effects on the whole society.

Economic theories and models don’t only inform academic studies; they directly influence policy decisions and development strategies at both national and international levels. Governments and international organizations regularly use the analysis of economic models to develop strategies for promoting sustainable economic growth, reducing poverty, and managing fiscal and monetary policies. For example, when a central bank sets interest rates, it relies on macroeconomic models to anticipate the effects on inflation, investment, and consumer spending. Similarly, when governments invest in infrastructure, education, or healthcare, they use economic analysis to determine how to maximize economic growth and social well-being. Consequently, the practical application of these models is extensive and diverse, encompassing everything from long-term strategic planning to short-term crisis management. The insights gained from these models allow for informed decision-making across various spheres of public and private life, highlighting the difference between finance and economics in their application and impact on a broader scale. The study of economics also provides a framework to understand how the interaction of individual behavior contributes to larger market trends, which also plays a crucial role in analyzing economic stability.

The integration of advanced quantitative techniques and data analytics in economic modeling has further enhanced their ability to predict and respond to complex economic phenomena. Modern econometric models can handle vast datasets and employ sophisticated algorithms to identify patterns and relationships that may not be apparent through traditional analysis. This capability is particularly valuable in understanding the intricate interactions between different sectors of the economy and in anticipating the impact of disruptive events. For example, economic models have been instrumental in analyzing the effects of technological advancements, globalization, and climate change on the economy. Furthermore, the use of economic models has become indispensable in assessing the economic impacts of global pandemics or financial crises, helping governments implement timely and effective policies to mitigate economic shocks. Therefore, comprehending the role of economic models offers a perspective on what is difference between finance and economics where economics studies wider implications and impact on societies and populations by using complex modeling systems.

Similarities Between Economic Theories and Financial Practice

While finance and economics are distinct disciplines, they share several fundamental concepts that bridge the gap between them. One notable overlap is the application of the time value of money, a principle central to both fields. In finance, this concept underpins investment decisions, illustrating that money available today is worth more than the same amount in the future due to its potential earning capacity. Simultaneously, in economics, the time value of money influences intertemporal choices, such as decisions about saving and consumption patterns. Risk and uncertainty, another shared concept, play a crucial role in shaping both financial and economic strategies. Financial decision-makers constantly assess risk when selecting investments, considering the probabilities of different outcomes, while economic models often incorporate uncertainty to analyze market behavior and predict economic trends. What is the difference between finance and economics, when exploring the impact of behavioral factors, is also important. Both fields increasingly recognize how psychological biases affect individual decision-making. In finance, behavioral finance highlights the ways in which psychological factors influence investment choices and market anomalies. Economics also incorporates behavioral insights into its models, for example, to comprehend consumer spending habits and how individuals respond to policy incentives. The concepts of scarcity and opportunity cost, cornerstones of economics, directly affect financial choices. For instance, when a company decides to invest in a particular project, it must weigh the opportunity costs of foregoing other potential investments; this is both a financial and economic consideration. Thus, many financial decisions are fundamentally rooted in core economic principles, highlighting the intersection between the disciplines and answering in part what is the difference between finance and economics. These common conceptual bases showcase the interconnected nature of these fields, emphasizing the need for financial professionals to understand basic economic principles and vice versa.

The understanding of market efficiency is another area where economic theories and financial practice intersect. Economists study market structures, efficiency, and market failures, whilst financial professionals seek to capitalize on these very dynamics. For instance, financial analysts utilize economic theories of efficient market hypothesis to inform investment strategies, looking for potential areas where market value does not align to intrinsic value. However, they might also look for potential areas where the market may not be working correctly to capitalize on it. The concept of supply and demand, although primarily considered an economic principle, has very real implications on financial markets, affecting prices of equities, bonds, and other financial instruments. Macroeconomic conditions such as interest rate changes directly influence the cost of borrowing and the valuation of assets, creating a link between how economic policy affects financial strategies. The role of institutions, be they financial institutions such as banks and investment firms, or government bodies that regulate economic activity, impacts both the financial and economic sphere, shaping the direction of markets and the overall functioning of economies. The flow of capital, its pricing, its risks, all of this is influenced by economic conditions as much as by financial activity. Understanding the interplay between the two, reveals what is the difference between finance and economics, while also highlighting their mutual reliance on each other, showing that one influences the other constantly. Therefore, a thorough understanding of one field enhances comprehension of the other, improving overall expertise.

A Career Perspective: Professional Paths in Finance and Economics

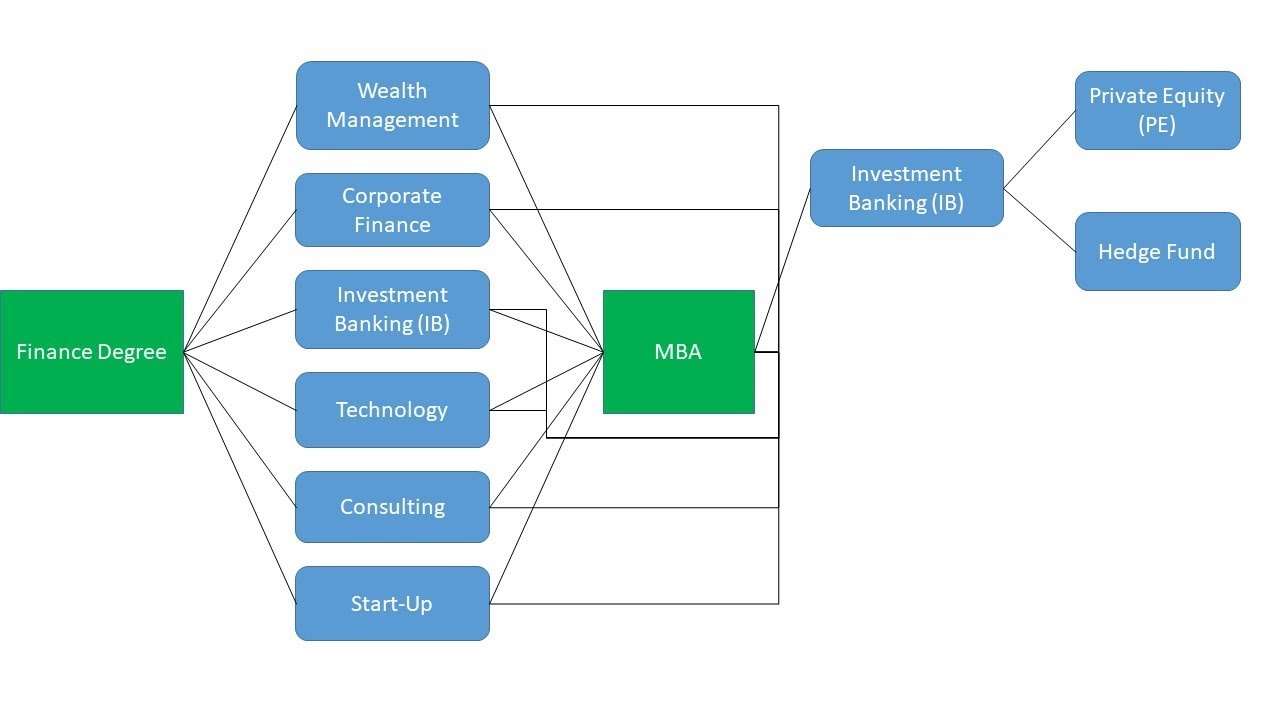

Navigating the professional landscape reveals distinct career trajectories for those pursuing finance and economics, reflecting the core differences in their focus. Finance-oriented careers typically involve roles focused on the management of money and investments. A financial analyst, for example, meticulously examines financial data to provide insights and recommendations for investment decisions. Investment bankers facilitate the raising of capital for companies, assisting with mergers and acquisitions. Portfolio managers oversee the management of investment portfolios, seeking to maximize returns while mitigating risk. These roles, among others, demand a strong grasp of financial instruments, market dynamics, and risk assessment techniques. The skill set required often includes quantitative analysis, financial modeling, and a keen understanding of market trends. Educational paths usually involve degrees in finance, accounting, or business administration, often supplemented by certifications such as the CFA.

In contrast, careers in economics are centered on the analysis of how societies allocate resources. Economists investigate a broad spectrum of topics, including market behavior, the impact of government policies, and economic trends. Policy analysts work within governmental or non-governmental organizations, utilizing economic principles to evaluate policies and suggest improvements. Academic researchers delve into the development of economic theories and models, contributing to the body of knowledge. The skillset required for these roles includes a strong foundation in economic theory, statistical analysis, and econometric modeling. Educational backgrounds typically involve degrees in economics, econometrics, or public policy, frequently extending to the doctoral level for research-oriented roles. Understanding the nuances of what is difference between finance and economics is crucial when choosing between these professional paths, as one focuses on the micro-level management of money while the other delves into the macro-level dynamics of resource allocation.

While the core focuses differ, there are areas of overlap where individuals in both fields may collaborate. For instance, both economists and financial professionals need an understanding of macroeconomic conditions to effectively perform their jobs. Individuals may also switch careers from one field to another, with additional skills and training. Furthermore, many roles require a hybrid understanding of what is difference between finance and economics. The job market reflects the need for individuals with knowledge across both finance and economics, including roles like market analysts who need to understand both financial markets and the economic environment. Therefore, the distinctions are not always clear cut and each discipline benefits from knowledge of the other.

The Interplay Between Macroeconomic Conditions and Financial Markets

Macroeconomic conditions exert a significant influence on the performance of financial markets, creating a dynamic interplay between the broader economy and the financial landscape. Economic factors such as interest rates, inflation, and Gross Domestic Product (GDP) growth act as key determinants of asset prices and shape investor behavior. For example, when central banks raise interest rates to combat inflation, borrowing costs increase, which may lead to reduced corporate investments and lower stock valuations. Similarly, high inflation can erode the real returns on investments, prompting investors to adjust their portfolios. GDP growth, on the other hand, typically signals a healthy economy and can boost investor confidence, leading to increased market activity and higher valuations. These interconnections highlight why understanding macroeconomic conditions is essential for anyone involved in financial markets. The complexities involved help illustrate what is difference between finance and economics, highlighting how both areas are intertwined.

The relationship between macroeconomics and finance is not unidirectional; the financial markets themselves can impact macroeconomic conditions. Financial crises, for instance, can trigger recessions, and the availability of credit, influenced by financial institutions, can directly impact consumer spending and business investments, which are crucial components of GDP. Therefore, individuals working in either finance or economics must grasp the bidirectional impact. Financial analysts and portfolio managers, for instance, carefully monitor economic indicators to predict market movements and make informed investment decisions. Similarly, economists often use market data to assess the effectiveness of economic policies and forecast economic trends. This reciprocal relationship demonstrates the necessity for professionals in both fields to possess a working knowledge of each other’s domain, contributing significantly to the ongoing discussion surrounding what is difference between finance and economics. Understanding this interplay is also critical in risk assessment, particularly when managing investments or designing economic policies to ensure a stable economic environment.

Moreover, the interconnectedness of macroeconomic conditions and financial markets also plays a crucial role in global economies. Changes in economic policies or market conditions in one country can have ripple effects across international borders, impacting currency values, trade flows, and investment decisions worldwide. For example, a significant increase in interest rates in the United States can lead to capital outflows from emerging markets, impacting their financial stability. Therefore, individuals involved in finance and economics must analyze global economic trends to make well-informed financial and policy decisions. This constant monitoring helps in understanding the overall landscape of what is difference between finance and economics, offering a perspective that goes beyond domestic boundaries. The interdependence of global financial markets and economic activity highlights the importance of integrating both finance and economics for accurate analysis and effective decision-making.

Synthesizing Economic Insights and Financial Strategies: A Concluding Perspective

Finance and economics, while distinct, are deeply intertwined disciplines crucial for understanding the complexities of the modern world. The core difference lies in their primary focus: finance centers on the management of money and assets, emphasizing how individuals, corporations, and governments make decisions regarding investment, budgeting, and risk. On the other hand, economics is concerned with the broader allocation of resources within a society, analyzing how markets function, the forces of supply and demand, and the impact of economic policies. While finance operates largely on a micro level, dealing with specific entities and transactions, economics takes a macro view, examining aggregate trends and systemic impacts. The key distinction when considering what is difference between finance and economics, rests on their scopes. Finance, at its core, provides the mechanisms for economic activity, while economics offers a framework for understanding the forces that shape those activities.

Despite their differing perspectives, finance and economics share significant overlaps. Many financial decisions are grounded in economic principles, such as the time value of money, risk assessment, and understanding market behavior. The link between macroeconomic conditions and financial markets cannot be overstated; factors like interest rates, inflation, and GDP growth heavily influence asset prices and investor sentiment. Therefore, understanding the interplay between these disciplines is essential for informed financial strategies. Professionals in both fields must appreciate how broader economic trends impact financial planning and market dynamics, enabling more accurate projections and more effective decision-making. Both disciplines contribute to the overall efficiency and stability of markets, working in tandem to shape both micro and macro economic landscapes. When considering what is difference between finance and economics, it’s also essential to note their shared intellectual underpinnings and practical interactions.

In summary, finance and economics are complementary, not competing fields. Finance provides the tools and techniques to manage capital and evaluate investments, while economics offers the theoretical framework to understand how resources are allocated and how economies function. This understanding of what is difference between finance and economics allows individuals, businesses, and governments to make sound financial decisions and contribute to a more robust and sustainable economy. Readers are encouraged to deepen their understanding of both fields based on their own interests and goals, as both offer valuable perspectives on the complexities of wealth creation and distribution.