Deciphering Market Sentiment Through Option Prices

Understanding how to find implied volatility is fundamental for anyone venturing into options trading. Implied volatility (IV) is not a crystal ball predicting future price movements; instead, it serves as a gauge of market expectations regarding the potential magnitude of price swings for an underlying asset. It’s crucial to recognize that IV reflects the market’s anticipation of volatility, rather than being a direct forecast of it. Options prices are not determined in a vacuum, they are intricately linked to a number of factors with volatility being one of the most important components, it heavily influences how much an option costs. When market participants expect higher price variability, option prices, and consequently, implied volatility, tend to increase. Conversely, if the market anticipates stability, option premiums and IV usually decrease, reflecting a lower risk of substantial price fluctuations. Therefore, while not a predictor, IV is a valuable market indicator embedded in option prices.

The options market provides a dynamic environment where prices constantly fluctuate, and a keen understanding of implied volatility allows traders to interpret how the market perceives risk and uncertainty. It’s not about knowing what will happen but what the market believes is likely to happen in terms of price movement. This is why learning how to find implied volatility becomes important, as it can help to understand the relationship between the probability of price movements and the price of an option. This insight into the perception of market participants, as indicated by the implied volatility, can be a decisive factor when making trading decisions. Options, as derivative securities, derive their value from the underlying assets and, importantly, from the implied volatility. In essence, implied volatility is the volatility that, when plugged into an option pricing model, yields the option’s market price. It’s essential to keep in mind that while implied volatility is a market sentiment indicator, other factors, such as the underlying asset’s price, time to expiration and the strike price, also influence the option price.

How to Estimate Future Price Swings Using Options Data

Transitioning from the concept of implied volatility (IV), it’s crucial to understand how to find implied volatility from actual options prices. The Black-Scholes model, while an idealized representation, serves as a foundational method for grasping this process. The core idea is that the model’s formula, when combined with the current market price of an option, the price of the underlying asset, and the characteristics of the option contract itself, can be reverse-engineered to extract the implied volatility. This process essentially works backward: given the known variables like the option’s price and characteristics, the model calculates the volatility that would need to be input to arrive at the observed option market price. In a nutshell, this is how to find implied volatility using a common mathematical model. It’s worth noting that the Black-Scholes model operates under certain assumptions that might not fully reflect real-world market conditions. As a result, other more sophisticated options pricing models might be employed depending on the particular option and market intricacies. These more complex models may include factors that the Black-Scholes formula does not consider, such as volatility smiles, or the impact of early exercise for American-style options. These advanced models also aim to give an even more accurate estimation of how to find implied volatility.

The implied volatility is not directly observed in the market. Instead, it’s an inference made by observing the current market price of an option. The process of deriving implied volatility involves using a suitable options pricing model with known parameters. This would be similar to solving for the unknown input in a formula, in which the output (option price) is already known. Since these option pricing models are generally not expressed in a way to directly solve for the implied volatility, these calculations are done iteratively. This means that computers will keep trying to solve the equation using different values for the implied volatility, until they get a price that is close to the observed option price in the market. This process is performed by computer software and is available on trading platforms. Investors can therefore observe these values directly, and do not have to manually perform these calculations. The specific method and model used to perform these calculations varies between trading platforms, but they follow this general principle of how to find implied volatility. Different models are used because different options have different sensitivities to different parameters, and for this reason, multiple models have been developed.

Key Factors Affecting Implied Volatility

Several factors can significantly influence implied volatility (IV), impacting how to find implied volatility within options trading. Upcoming events such as earnings announcements, major news releases, and macroeconomic data publications can cause considerable fluctuations in IV. When uncertainty surrounds these events, the market tends to anticipate larger price swings, leading to higher IV levels. Conversely, periods of market stability and calm often result in lower IV, reflecting reduced expectations for significant price movement. This dynamic relationship between market uncertainty and IV highlights the importance of monitoring these key events when assessing options pricing. Moreover, understanding the supply and demand dynamics for specific options contracts is crucial. Increased demand for options can drive up their prices, which in turn translates to higher IV. The interplay of these market-driven forces creates a constantly shifting landscape for options traders.

Beyond market events and supply-demand dynamics, option-specific factors also play a vital role in determining IV. The time remaining until an option’s expiration date is a critical determinant. As expiration approaches, the uncertainty surrounding the underlying asset’s price movement diminishes, generally causing a decrease in IV. This is because there is less time for the underlying to move significantly enough for the option to become in or out-of-the-money. Furthermore, the moneyness of an option, which refers to the relationship between the strike price and the current price of the underlying asset, also influences IV levels. Options that are at-the-money typically exhibit the highest IV, while options that are significantly in-the-money or out-of-the-money tend to have lower IV. The effect of moneyness creates what’s commonly known as the volatility smile or skew, which helps illustrate how to find implied volatility relative to its underlying price level. Understanding these nuances will significantly improve a trader’s comprehension of options pricing and how market expectations influence volatility.

Utilizing Online Tools for Volatility Analysis

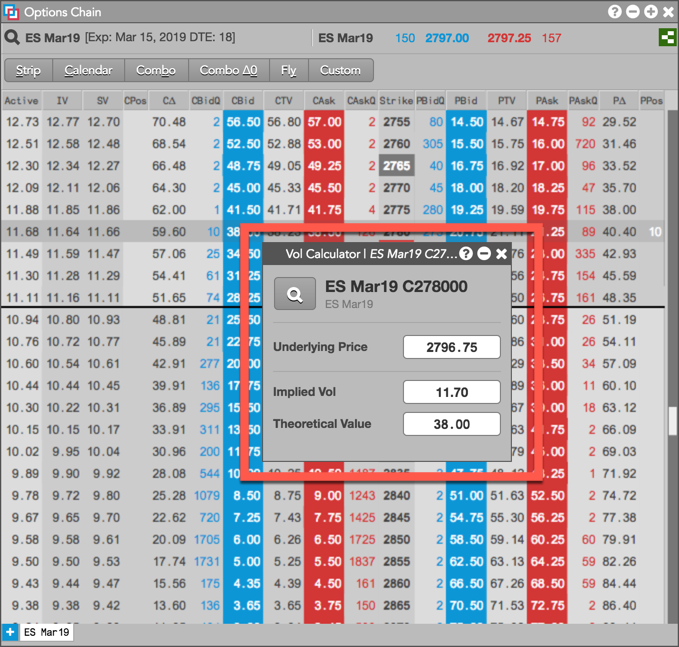

Numerous online resources are readily available for investors seeking to understand how to find implied volatility, greatly simplifying the process of assessing market expectations. Financial websites and brokerage platforms offer a range of tools and features that provide access to implied volatility data. For instance, the options chain feature is a standard tool across most platforms, displaying real-time prices for options contracts, strike prices, and their corresponding implied volatilities. The options chain typically presents the data for different expiration dates, allowing users to compare how the implied volatility changes across time. Furthermore, many platforms offer volatility charts which display the implied volatility of a specific option contract over a set period, providing a visual representation of how the market’s expectation of price movement has evolved. Additionally, these charts can sometimes overlay historical volatility data as a comparison. This visual analysis allows users to quickly spot trends and identify potential trading opportunities based on changes in implied volatility. Another useful tool is the volatility skew, which graphically represents how implied volatility varies across different strike prices for options with the same expiration date. These skews can show market sentiment as well, with a higher IV for out of the money puts, signaling a tendency for downside protection.

Accessing and interpreting the data provided by these online tools is generally straightforward. On an options chain, the implied volatility (often represented as a percentage) is typically listed next to each option price. The volatility charts present the IV movement over time, with clear axes for time and implied volatility levels. Volatility skews show the IV level for each strike price for a given expiration date, indicating how the market perceives the likelihood of the underlying asset reaching that strike. By using these tools, investors can observe how market expectations are priced into options contracts. Understanding how to find implied volatility through these tools provides valuable insights into market sentiment and potential price moves, aiding investors in the decision-making process. Analyzing this data, investors can gauge the market’s perception of risk and reward, thereby making more informed trades. The use of online tools to find implied volatility data empowers the individual investor with a level of transparency previously only accessible to institutional investors. The speed and ease with which investors can now access and interpret implied volatility data has significantly changed the options trading environment, making it more accessible to the average trader.

Calculating IV Through Basic Option Math

For readers interested in a more hands-on approach, it’s beneficial to understand how to find implied volatility through a basic options pricing model. While not always necessary for every options trader, manually calculating implied volatility can offer a deeper insight into the mechanics of its derivation. The process is not a straightforward calculation but rather an iterative one. Typically, one would start with an observed option price from the market, and then, with a model such as the Black-Scholes, one would adjust the volatility input until the model’s theoretical option price matches, or is very close to, the actual market price. The implied volatility is, in essence, the volatility that, when input into an options pricing formula, would result in the observed market price. The formula itself, especially for models such as Black-Scholes, is complex and would require a mathematical understanding of its components to be used directly. However, what’s key to grasp is that the calculation is achieved by inputting different volatility values into the model and checking which volatility value matches the market price. This process can be easily done with the help of spreadsheet software like Excel. It is important to remember that the goal is to reverse-engineer the formula, using the actual option’s market price, in order to uncover the implied volatility. The standard options pricing model requires the following inputs: the current price of the underlying asset, the strike price of the option, the time to expiration, the risk free rate, and volatility. How to find implied volatility is usually done by taking all the other parameters, and an observed option price, and calculating the volatility that satisfies the pricing formula. For most investors, and for most standard options, the process of calculating implied volatility this way is not required because of the tools available at trading platforms.

The manual process of how to find implied volatility typically involves a method of trial and error or a more advanced numerical root-finding method, rather than a direct formula, so it’s not a closed equation. Spreadsheet software such as Excel offers the goal seek functionality, or other similar functions that can help find the implied volatility of options. The first step is setting up the spreadsheet to calculate a theoretical option price using an options pricing model. Then, using goal seek, set the objective to match the calculated theoretical price to the market price. The “variable cell” to change in this process would be the cell that represents volatility. The resulting volatility will be the implied volatility. In essence, the function will iterate through different volatility values to find the number that fits. This iterative process is why many tools are provided at brokerages, because this calculation requires a function or algorithm to be automated. This manual process provides a deep insight into the mechanics of how to find implied volatility; it’s a useful understanding even if one does not do it manually in practice, as most traders will opt for using ready-made tools. This approach highlights the underlying principle that implied volatility is not a directly observable parameter, but rather an inferred value based on the market pricing of options.

Interpreting IV in Trading Strategies

Traders utilize implied volatility (IV) as a crucial element in their decision-making process when engaging in options trading. A core concept involves recognizing that options, influenced by IV, can be either overvalued or undervalued. Low IV often indicates that options are relatively inexpensive and might present an opportunity, whereas high IV typically suggests that options are comparatively expensive. It is important to understand that IV isn’t about predicting the future direction of an asset but rather reflects the market’s aggregated expectation of its potential price range. This understanding is fundamental to crafting effective trading strategies. Certain strategies such as straddles and strangles are constructed to profit from increases in IV, which suggests an expected increase in price fluctuation of the underlying asset. An iron condor is a strategy that profits when there is less fluctuation than what the market implies and therefore they will typically benefit from decreases in IV.

To illustrate how to find implied volatility useful, consider the common strategy of buying a straddle, which involves buying both a call and a put option at the same strike price. This strategy is typically employed when a trader anticipates a significant price movement in the underlying asset but is uncertain about the direction. If implied volatility is low relative to its historical levels, it might suggest that the options are undervalued and therefore there is a high probability of positive return if volatility increases. This increase of IV would make the value of the long straddle positions rise. Conversely, during periods of high implied volatility, the price of the straddle could be inflated, signaling it might be wise to sell instead. Therefore, understanding how to find implied volatility and interpret it relative to the historical volatility of an asset or even a specific option contract is essential to identify these opportunities. This will provide traders with an additional insight to assess options prices.

Moreover, historical volatility serves as a benchmark against which to compare implied volatility. Historical volatility is a measure of the actual price fluctuations of the underlying asset over a past period. When IV is significantly higher than the historical volatility, the market’s expectations for future price swings are greater than what has been experienced in the past. This difference between IV and historical volatility can be indicative of an overpricing of options, which would lead to implementing a short option strategy. By comparing these two metrics, traders can evaluate the relative expensiveness of options and develop informed trading strategies. The ability to differentiate between high and low IV periods, using the historical volatility as a reference, makes the analysis of how to find implied volatility and utilize it an essential skill for any serious options trader, enabling them to better navigate the market’s perception of risk and potential profit opportunities.

Avoiding Common Pitfalls When Assessing Market Volatility

When learning how to find implied volatility, it’s crucial to be aware of common pitfalls that can lead to misinterpretations and poor trading decisions. One frequent mistake is relying solely on a single implied volatility (IV) data point without considering the broader context. For example, an unusually high IV reading might seem like a clear signal to sell options, but it could be a temporary spike due to an imminent event, like an earnings announcement. Failing to analyze the reasons behind IV fluctuations can result in missed opportunities or unwarranted losses. Another error is not considering the volatility term structure, which looks at IV across different expiration dates; simply comparing current IV to past readings may not be informative without understanding the term structure. Therefore, it’s important not to treat IV in isolation, but rather, to consider it in relation to other market dynamics.

Another significant pitfall when learning how to find implied volatility is the over-reliance on IV as a sole predictor of future market movements. While IV reflects the market’s expectation of potential price swings, it is not a foolproof crystal ball. It’s crucial to understand that even though options pricing models are sophisticated, they can’t take into account all variables that could potentially influence a security’s price. Overly focusing on IV might lead traders to neglect other essential factors like historical volatility, the underlying asset’s price movements, liquidity, and current news that may impact the underlying asset price, or changes in the overall market sentiment. A comprehensive approach involves analyzing IV alongside other technical and fundamental market indicators to make well-informed trading decisions. Additionally, it’s important to be aware that very high IV readings might be a result of thin trading of the options contracts. This, in turn, can affect the reliability of IV calculations. Therefore, traders should be especially careful when using IV data of options with low trading volumes.

Finally, it’s crucial to avoid the temptation of making rash decisions based purely on implied volatility data. Successful options trading depends on a deep understanding of the market and a well-defined risk management strategy. A trader should not only know how to find implied volatility, but also understand the inherent risks of options trading and always utilize appropriate risk management techniques such as position sizing, stop losses, and diversification, to mitigate potential negative outcomes. When assessing market volatility, proper due diligence and research are always recommended. It’s also key to remember that there is no magical formula or single measure that can predict market movements with certainty. Therefore, IV should be viewed as a useful tool in a trader’s arsenal and not as a guarantee of profits.

Practical Applications of Implied Volatility

Understanding implied volatility is crucial for any serious options trader. It serves as a vital metric for evaluating the market’s perception of potential price movement. However, it’s essential to remember that implied volatility is not a crystal ball; it does not forecast the direction of price movement, only the magnitude of expected swings. Therefore, it should be used with caution and with a solid grasp of options trading mechanics and risk management principles. Knowing how to find implied volatility provides an extra edge, allowing traders to potentially enhance their profit opportunities and better manage risk. For instance, an understanding of implied volatility allows traders to identify whether options are relatively expensive or cheap compared to historical volatility, and if the current IV levels are relatively high or low given specific market situations. This is useful when establishing options positions, considering that options with lower volatility will have a smaller premium and options with higher volatility will have a larger premium.

Beyond its trading implications, the knowledge of how to find implied volatility can also be invaluable for making informed investment decisions, especially when it comes to assessing market sentiment. A spike in implied volatility across a broad market index, for example, might signal a period of heightened uncertainty, prompting a review of existing investments and risk tolerance levels. Similarly, low implied volatility can indicate market complacency and the potential for a future price move. Investors should note that implied volatility is derived from the option’s premium, and because options are leveraged instruments, they tend to be more sensitive to major market events. This can cause the implied volatility of an option contract to have a higher volatility than the underlying instrument. Therefore, understanding how to find implied volatility and interpret it is important to better gauge risk exposure and refine trading strategies, aligning them with the perceived risk environment and ultimately facilitating more informed, strategic decisions. The savvy options trader recognizes that this is not a stand-alone metric but rather a key input within a well-rounded investment process.