The Importance of Using Python and Interactive Brokers (IBKR) for an AI Trading Bot

The “steps to create python AI trading bot with IBKR” involve the integration of Python, a powerful programming language, and Interactive Brokers (IBKR), a well-known online trading platform. This combination offers several benefits for traders and investors seeking to optimize their strategies and capitalize on market opportunities. By automating trading processes, AI trading bots reduce the potential for human error and enable real-time data processing, ensuring timely responses to market fluctuations. Moreover, AI techniques can analyze vast amounts of financial data, identifying patterns and trends that might be overlooked by human traders. Consequently, AI trading bots can significantly enhance accuracy, efficiency, and profitability in trading.

Selecting the Right AI Techniques and Libraries for Your Trading Bot

When following the “steps to create python AI trading bot with IBKR,” choosing the appropriate AI techniques and libraries is crucial for the bot’s success. Various AI methodologies, such as machine learning algorithms, deep learning frameworks, and natural language processing tools, can be employed to create a sophisticated trading bot. Here’s a brief overview of these techniques and how to select the most suitable ones for your specific requirements and objectives:

Machine Learning Algorithms

Machine learning (ML) algorithms are mathematical models that enable computers to learn from data without explicit programming. These algorithms can be categorized into supervised, unsupervised, and reinforcement learning. Supervised learning involves training a model using labeled data, while unsupervised learning relies on unlabeled data. Reinforcement learning, on the other hand, involves training a model to make decisions based on feedback from the environment. ML algorithms can be applied to various trading bot tasks, such as predicting stock prices, identifying trends, and detecting anomalies.

Deep Learning Frameworks

Deep learning (DL) is a subset of ML that utilizes artificial neural networks (ANNs) with multiple layers to analyze complex data. DL frameworks, such as TensorFlow, PyTorch, and Keras, provide tools and functions for designing, training, and deploying ANNs. DL models can be used for tasks like image recognition, natural language processing, and time series forecasting, making them suitable for trading bots that require advanced predictive capabilities.

Natural Language Processing Tools

Natural language processing (NLP) is a field of AI that focuses on enabling computers to understand, interpret, and generate human language. NLP tools, such as NLTK, SpaCy, and Gensim, can be employed to analyze text data from news articles, social media posts, and other sources to extract insights about market sentiment, trends, and events. Incorporating NLP techniques into a trading bot can enhance its performance by enabling it to make informed decisions based on qualitative data.

Selecting the Most Suitable AI Techniques and Libraries

When choosing AI techniques and libraries for your trading bot, consider the following factors:

- Data availability: The type and amount of data available will influence the choice of AI techniques and libraries. For instance, ML algorithms may be more suitable for small datasets, while DL frameworks may be more appropriate for large datasets.

- Problem complexity: The complexity of the trading problem will determine the appropriate AI techniques and libraries. For example, DL frameworks may be more suitable for predicting highly volatile stocks, while ML algorithms may be sufficient for predicting relatively stable stocks.

- Computational resources: The computational resources available will impact the choice of AI techniques and libraries. DL frameworks, for instance, typically require more computational resources than ML algorithms.

- User expertise: The user’s expertise in AI and data science will influence the choice of AI techniques and libraries. Users with limited expertise may prefer libraries with user-friendly interfaces and extensive documentation.

Establishing a Connection between Python and Interactive Brokers

To build a successful AI trading bot using Python and Interactive Brokers (IBKR), establishing a connection between the two platforms is essential. This process involves installing the IBKR API and writing the necessary code to establish a link between Python and IBKR. Here’s an in-depth look at the steps required to set up a connection between Python and IBKR:

Installing the IBKR API

The IBKR API is a software package that enables developers to build custom applications that interface with the IBKR trading platform. To install the IBKR API, follow these steps:

- Download the API from the IBKR website. Ensure that you download the version compatible with your operating system.

- Extract the downloaded file to a directory of your choice.

- Install the necessary dependencies, such as TWS or IB Gateway, and ensure that they are running.

- Set the environment variables for the API. This step may vary depending on your operating system. For instance, on Windows, you can set the environment variables by right-clicking on “Computer,” selecting “Properties,” and then “Advanced System Settings.” From there, click on “Environment Variables” and set the necessary variables.

Writing the Necessary Code to Establish a Connection

Once the IBKR API is installed, you can write the necessary code to establish a connection between Python and IBKR. Here’s an example of how to do this:

- Import the necessary libraries, such as ibapi.client and ibapi.wrapper.

- Create an instance of the IBKR API client and wrapper classes.

- Define the necessary callback functions for handling events, such as market data updates and order executions.

- Connect to the IBKR trading platform by calling the “connect” method of the API client instance.

- Start the API by calling the “run” method of the API client instance.

Here’s an example code snippet that demonstrates how to establish a connection between Python and IBKR:

from ibapi.client import EClient from ibapi.wrapper import EWrapper from ibapi.contract import Contract class IBKRClient(EWrapper, EClient): def __init__(self): EClient.__init__(self, self) app = IBKRClient() app.connect("127.0.0.1", 7497, 123) app.run() In this example, the code imports the necessary libraries, creates an instance of the IBKR API client and wrapper classes, defines the necessary callback functions (not shown), and establishes a connection to the IBKR trading platform by calling the “connect” method of the API client instance. The API is then started by calling the “run” method of the API client instance.

By following these steps, you can successfully establish a connection between Python and IBKR, enabling you to build a sophisticated AI trading bot that leverages the benefits of automation, accuracy, and real-time data processing.

Designing the Trading Bot’s Core Functionality

The core functionality of an AI trading bot involves several critical steps, including data collection, preprocessing, strategy implementation, and order execution. Here’s an in-depth look at each of these steps and the importance of backtesting and optimization in the process.

Data Collection

Data collection is the first step in designing the trading bot’s core functionality. This step involves gathering historical and real-time market data, such as prices, volumes, and orders, from various sources. The data should be relevant to the user’s trading strategy and objectives. The IBKR API provides access to real-time and historical market data, making it an ideal platform for data collection.

Preprocessing

Once the data is collected, it needs to be preprocessed to ensure that it is clean, accurate, and relevant. Preprocessing involves removing any irrelevant data, filling in missing values, and converting the data into a format that can be used by the trading bot’s algorithms. This step is crucial for ensuring the accuracy and reliability of the trading bot’s predictions and decisions.

Strategy Implementation

After preprocessing the data, the next step is to implement the user’s trading strategy. This step involves using various AI techniques, such as machine learning algorithms, deep learning frameworks, and natural language processing tools, to analyze the data and make predictions about future market trends. The user’s requirements and objectives should guide the choice of AI techniques and libraries.

Order Execution

Once the trading strategy is implemented, the next step is to execute orders based on the bot’s predictions. This step involves using the IBKR API to send orders to the market, monitor their execution, and manage any associated risks. Order execution is a critical step in the trading bot’s core functionality, as it directly impacts the bot’s performance and profitability.

Backtesting and Optimization

Backtesting and optimization are essential steps in designing the trading bot’s core functionality. Backtesting involves testing the trading bot’s algorithms on historical data to evaluate their performance and accuracy. Optimization involves adjusting the bot’s parameters and settings to improve its performance and adaptability. These steps are crucial for ensuring that the trading bot is effective, reliable, and adaptable to changing market conditions.

By following these steps, users can design a sophisticated AI trading bot with IBKR that leverages the benefits of automation, accuracy, and real-time data processing. The bot’s core functionality should be thoroughly tested and optimized to ensure its effectiveness and reliability.

Implementing Advanced Features for Your AI Trading Bot

Once the core functionality of the AI trading bot is established, users can consider implementing advanced features to enhance its performance and adaptability. Here are some advanced features to consider and how they can improve the bot’s effectiveness.

Risk Management

Risk management is a crucial aspect of any trading strategy, and AI trading bots are no exception. Implementing risk management features, such as position sizing, stop-loss orders, and diversification, can help minimize potential losses and maximize profits. These features can be implemented using various AI techniques, such as machine learning algorithms and probability theory.

Sentiment Analysis

Sentiment analysis involves analyzing social media, news articles, and other text-based sources to gauge market sentiment. This information can be used to inform trading decisions and improve the accuracy of the trading bot’s predictions. Natural language processing tools, such as NLTK and spaCy, can be used to perform sentiment analysis on large volumes of text data.

Machine Learning Model Tuning

Machine learning model tuning involves adjusting the parameters and settings of the bot’s machine learning algorithms to improve their performance and adaptability. This process can be automated using various AI techniques, such as genetic algorithms and Bayesian optimization. Model tuning can help ensure that the trading bot is always operating at peak performance, even in changing market conditions.

Real-Time Data Processing

Real-time data processing involves analyzing and responding to market data in real-time, allowing the trading bot to make quick and accurate decisions. This feature can be implemented using various AI techniques, such as stream processing and complex event processing. Real-time data processing can help the trading bot take advantage of market opportunities as they arise, improving its overall performance and profitability.

Implementing these advanced features can help enhance the performance and adaptability of the AI trading bot, providing users with a sophisticated and effective trading tool. However, it is essential to thoroughly test and optimize these features to ensure their effectiveness and reliability.

By following these steps, users can create a proficient AI trading bot with Python and Interactive Brokers that leverages the benefits of automation, accuracy, and real-time data processing. The bot’s advanced features should be thoroughly tested and optimized to ensure their effectiveness and reliability.

Testing and Validating Your AI Trading Bot

Once the AI trading bot has been developed with the necessary features and functionality, it is crucial to test and validate its performance before deploying it in a live trading environment. Testing and validation help ensure that the bot is operating correctly and making profitable trades. Here are the steps to create a Python AI trading bot with IBKR that includes testing and validation.

Backtesting

Backtesting involves testing the trading bot’s strategy using historical data. This process allows users to evaluate the bot’s performance and identify any potential issues or areas for improvement. Backtesting can be performed using various Python libraries, such as Backtrader and PyAlgoTrade. These libraries provide tools for simulating trades, analyzing performance, and optimizing strategy parameters.

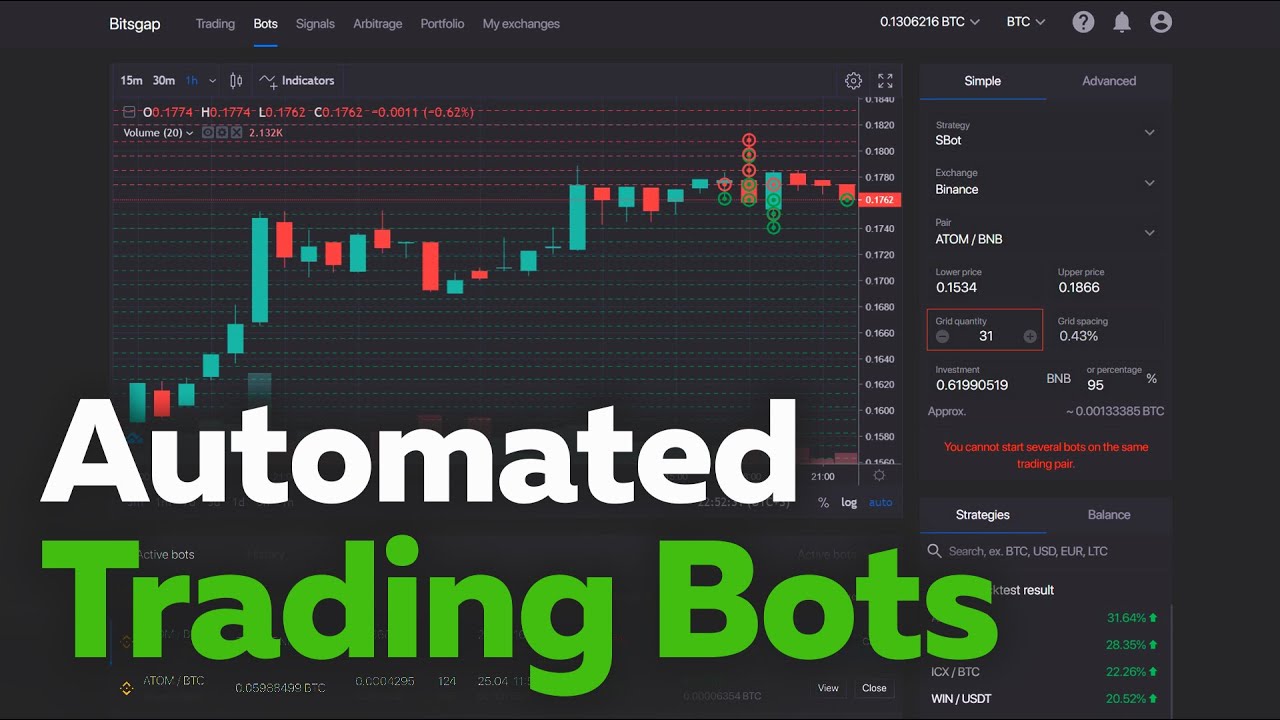

Paper Trading

Paper trading involves testing the trading bot’s strategy using simulated trades in a live market environment. This process allows users to evaluate the bot’s performance in real-time, without risking real capital. Paper trading can be performed using various Python libraries, such as Interactive Brokers’ Paper Trading API. This API provides a simulated trading environment that mimics the functionality of the live trading environment.

Live Trading

Once the trading bot has been thoroughly tested and validated using backtesting and paper trading, it can be deployed in a live trading environment. Live trading involves executing trades using real capital and market data. It is essential to monitor the bot’s performance closely during this stage, as real capital is at risk. Users should also have a contingency plan in place in case of unexpected market events or technical issues.

Monitoring and Evaluation

Monitoring and evaluating the bot’s performance over time is crucial to ensure its continued effectiveness and profitability. Users should regularly review the bot’s performance metrics, such as profitability, drawdown, and risk-adjusted return. They should also stay up-to-date with market conditions and adjust the bot’s strategy as needed. Monitoring and evaluation can be performed using various Python libraries, such as Zipline and Catalyst.

Testing and validating the AI trading bot is a critical step in the development process. By following these steps, users can ensure that their bot is operating correctly and making profitable trades. Regular monitoring and evaluation can also help users identify potential issues and adjust the bot’s strategy as needed, ensuring its continued effectiveness and profitability.

By following these steps, users can create a proficient AI trading bot with Python and Interactive Brokers that leverages the benefits of automation, accuracy, and real-time data processing. Testing and validating the bot’s performance is crucial to ensure its effectiveness and profitability. Regular monitoring and evaluation can also help users identify potential issues and adjust the bot’s strategy as needed, ensuring its continued success in the market.

Maintaining and Updating Your AI Trading Bot

Maintaining and updating the AI trading bot is crucial to ensure its continued performance and adaptability. As market conditions and market trends change, the bot’s strategy may become less effective, and its performance may decline. Regular maintenance and updates can help prevent this and ensure the bot’s continued success in the market.

Monitoring Performance

Monitoring the bot’s performance over time is essential to identify any potential issues or areas for improvement. Users should regularly review the bot’s performance metrics, such as profitability, drawdown, and risk-adjusted return. They should also stay up-to-date with market conditions and adjust the bot’s strategy as needed. Monitoring and evaluation can be performed using various Python libraries, such as Zipline and Catalyst.

Identifying Issues

Identifying potential issues with the bot’s performance is crucial to ensure its continued effectiveness. Users should regularly review the bot’s performance metrics and look for any signs of declining performance. They should also monitor the bot’s logs and error messages to identify any technical issues or bugs. Once an issue has been identified, users should take steps to address it as soon as possible.

Implementing Updates

Implementing updates to the bot’s strategy or functionality can help improve its performance and adaptability. Users should regularly review the bot’s performance and identify areas for improvement. They should then update the bot’s strategy or functionality as needed, using the latest market data and market trends. Updates can be implemented using various Python libraries, such as Backtrader and PyAlgoTrade.

Best Practices

When maintaining and updating the AI trading bot, users should follow best practices to ensure its continued effectiveness and profitability. These best practices include:

- Regularly reviewing the bot’s performance metrics and adjusting the strategy as needed.

- Monitoring the bot’s logs and error messages to identify any technical issues or bugs.

- Implementing updates using the latest market data and market trends.

- Testing and validating the bot’s performance after implementing updates.

- Keeping the bot’s software and libraries up-to-date.

Maintaining and updating the AI trading bot is crucial to ensure its continued performance and adaptability. By following these steps and best practices, users can ensure that their bot is operating correctly and making profitable trades. Regular monitoring and evaluation can also help users identify potential issues and adjust the bot’s strategy as needed, ensuring its continued success in the market.

In summary, maintaining and updating the AI trading bot is an essential step in the development process. By following these steps and best practices, users can ensure that their bot is operating correctly and making profitable trades. Regular monitoring and evaluation can also help users identify potential issues and adjust the bot’s strategy as needed, ensuring its continued success in the market.

Navigating Regulations and Best Practices for AI Trading Bots

When creating an AI trading bot using Python and Interactive Brokers (IBKR), it is essential to consider the legal and ethical considerations surrounding AI trading bots. Compliance with regulations and responsible use are crucial to ensure the bot’s success and avoid potential risks.

Understanding Regulations

Regulations surrounding AI trading bots vary depending on the jurisdiction and the specific use case. In general, AI trading bots must comply with the same regulations as human traders, such as anti-money laundering (AML) and know-your-customer (KYC) regulations. It is essential to research and understand the regulations in the jurisdiction where the bot will be used to ensure compliance.

Best Practices

In addition to complying with regulations, AI trading bot creators should follow best practices to ensure responsible use. These best practices include:

- Ensuring transparency in the bot’s decision-making process.

- Implementing robust risk management strategies to minimize potential losses.

- Regularly monitoring and evaluating the bot’s performance to ensure continued effectiveness.

- Providing clear and concise instructions for using the bot.

- Implementing security measures to protect the bot and its users from potential threats.

Potential Risks

AI trading bots can pose potential risks, such as market manipulation, insider trading, and systemic risks. It is essential to be aware of these risks and take steps to mitigate them. For example, implementing robust risk management strategies and ensuring transparency in the bot’s decision-making process can help minimize potential risks.

Responsible Use

Responsible use of AI trading bots is crucial to ensure their continued success and avoid potential risks. Users should follow best practices, comply with regulations, and be aware of potential risks. By doing so, they can ensure that their AI trading bot is operating correctly and making profitable trades.

Navigating regulations and best practices for AI trading bots is an essential step in the development process. By following these steps and best practices, users can ensure that their bot is operating correctly and making profitable trades. Responsible use and compliance with regulations are crucial to ensure the bot’s continued success and avoid potential risks.

In summary, navigating regulations and best practices for AI trading bots is an essential step in the development process. By following these steps and best practices, users can ensure that their bot is operating correctly and making profitable trades. Responsible use and compliance with regulations are crucial to ensure the bot’s continued success and avoid potential risks. By understanding regulations, following best practices, and being aware of potential risks, users can ensure that their AI trading bot is operating correctly and making profitable trades.