What is Market Capitalization and Why Does it Matter?

In the business world, market capitalization, or market cap, is a crucial metric that helps investors, entrepreneurs, and stakeholders understand the size and value of a company. Market capitalization represents the total value of a company’s outstanding shares, calculated by multiplying the total number of shares by the current market price of one share. This metric is essential for private companies, as it provides a snapshot of their financial health, growth potential, and competitiveness in the market.

Unlike other valuation methods, such as enterprise value or book value, market capitalization offers a more accurate representation of a company’s market value, as it reflects the collective opinion of investors and the market forces that drive stock prices. As a result, market capitalization has become a key performance indicator (KPI) for private companies, influencing their ability to attract investors, secure funding, and make strategic decisions.

Understanding the market cap of private company is vital, as it helps private companies navigate the complex landscape of funding options, from venture capital and angel investors to initial public offerings (IPOs). By grasping the concept of market capitalization, private companies can better position themselves for success, make informed decisions about their financial strategy, and ultimately drive business growth and profitability.

How to Calculate the Market Capitalization of a Private Company

Calculating the market capitalization of a private company is a straightforward process that requires some basic data and formulas. Market capitalization, or market cap, is the total value of a company’s outstanding shares, calculated by multiplying the total number of shares by the current market price of one share.

To calculate the market capitalization of a private company, you will need the following data:

- Total number of outstanding shares

- Current market price of one share

The formula to calculate market capitalization is:

Market Capitalization = Total Number of Outstanding Shares x Current Market Price of One Share

For example, let’s say a private company has 1 million outstanding shares, and the current market price of one share is $50. The market capitalization would be:

Market Capitalization = 1,000,000 x $50 = $50,000,000

This means that the private company has a market capitalization of $50 million.

In another scenario, if a private company has 5 million outstanding shares, and the current market price of one share is $20, the market capitalization would be:

Market Capitalization = 5,000,000 x $20 = $100,000,000

This means that the private company has a market capitalization of $100 million.

Understanding how to calculate the market cap of private company is crucial for investors, entrepreneurs, and business stakeholders, as it provides a snapshot of a company’s financial health and growth potential.

The Challenges of Valuing Private Companies: Overcoming Data Limitations

One of the significant challenges in determining the market capitalization of private companies is the limited availability of publicly accessible data. Unlike publicly traded companies, private companies are not required to disclose their financial information, making it difficult to estimate their market capitalization.

This lack of transparency can make it challenging for investors, entrepreneurs, and business stakeholders to accurately assess the market cap of private company and make informed decisions. However, there are alternative methods and sources that can be used to estimate market capitalization:

- Industry benchmarks: Analyzing the market capitalization of similar companies within the same industry can provide a rough estimate of a private company’s market capitalization.

- Financial statements: Private companies may provide financial statements, such as balance sheets and income statements, which can be used to estimate their market capitalization.

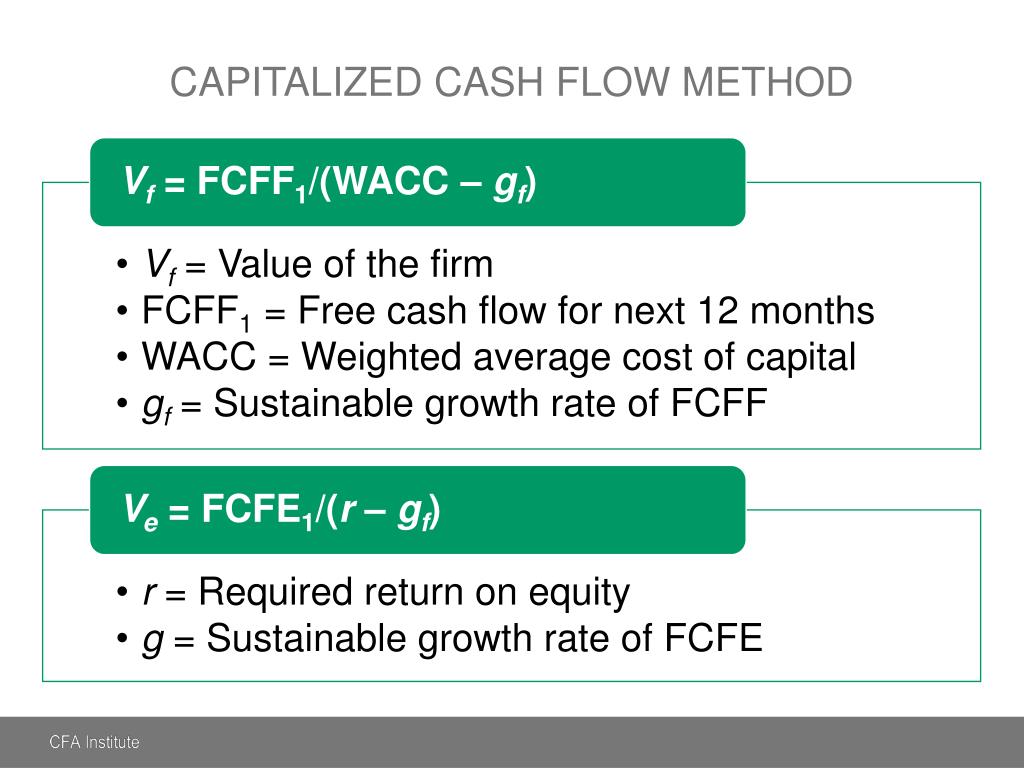

- Valuation models: Using valuation models, such as the discounted cash flow (DCF) model or the venture capital method, can help estimate a private company’s market capitalization.

- Industry reports: Industry reports and research studies can provide valuable insights into the market capitalization of private companies within a specific industry.

By leveraging these alternative methods and sources, investors, entrepreneurs, and business stakeholders can overcome the data limitations and gain a better understanding of a private company’s market capitalization. This, in turn, can help them make more informed decisions about investments, funding, and strategic partnerships.

Understanding the market cap of private company is crucial in today’s business landscape, where private companies are increasingly playing a significant role in driving innovation and growth. By overcoming the challenges of valuing private companies, investors and business stakeholders can unlock the full potential of these companies and drive business success.

Market Capitalization vs. Enterprise Value: Understanding the Difference

When evaluating the financial performance of a private company, two key metrics often come into play: market capitalization and enterprise value. While both metrics provide valuable insights, they serve distinct purposes and have different implications for investors and business stakeholders.

Market capitalization, or market cap, represents the total value of a company’s outstanding shares, calculated by multiplying the total number of shares by the current market price of one share. This metric is particularly useful for investors, as it provides a snapshot of a company’s size and market value.

Enterprise value, on the other hand, is a more comprehensive metric that takes into account a company’s debt, cash, and other liabilities, in addition to its market capitalization. This metric provides a more accurate picture of a company’s total value, as it includes both its equity and debt components.

Understanding the distinction between market capitalization and enterprise value is crucial, as each metric has different implications for investors and business stakeholders. Market capitalization is often used to evaluate a company’s size and market value, while enterprise value is used to assess its total value and potential for growth.

For example, a private company with a market capitalization of $100 million and enterprise value of $150 million may have a significant amount of debt, which would impact its overall value. In this scenario, investors and business stakeholders would need to consider both metrics to gain a comprehensive understanding of the company’s financial performance.

In conclusion, market capitalization and enterprise value are two distinct metrics that serve different purposes in evaluating the financial performance of a private company. By understanding the difference between these metrics, investors and business stakeholders can make more informed decisions about investments, funding, and strategic partnerships, ultimately driving business growth and success.

The Impact of Market Capitalization on Private Company Performance

Market capitalization plays a significant role in shaping the performance of private companies. A company’s market cap can influence its ability to attract investors, secure funding, and make strategic decisions. In this section, we’ll explore the relationship between market capitalization and private company performance.

A high market capitalization can be a major draw for investors, as it indicates a company’s potential for growth and scalability. Private companies with a high market cap are more likely to attract venture capitalists, angel investors, and other funding sources, as they are seen as a lower-risk investment opportunity. This influx of capital can be used to fuel business expansion, drive innovation, and enhance competitiveness.

On the other hand, a low market capitalization can make it challenging for private companies to secure funding. Investors may view these companies as higher-risk investments, making it more difficult to attract capital. This can limit a company’s ability to invest in research and development, hire top talent, and pursue strategic initiatives.

Market capitalization also plays a crucial role in shaping a company’s strategic decisions. A private company with a high market cap may be more likely to pursue aggressive growth strategies, such as acquisitions or expansion into new markets. Conversely, a company with a low market cap may need to focus on cost-cutting measures and optimizing operations to remain competitive.

In addition, market capitalization can impact a company’s ability to attract and retain top talent. A high market cap can be a major draw for skilled employees, as it indicates a company’s potential for growth and success. This can be a major competitive advantage in today’s tight labor market.

In conclusion, market capitalization has a profound impact on the performance of private companies. By understanding the market cap of private company, investors, entrepreneurs, and business stakeholders can gain valuable insights into a company’s potential for growth, scalability, and success.

Real-World Examples of Private Company Market Capitalization

Private companies with notable market capitalization have made headlines in recent years, showcasing the potential for growth and scalability in the private sector. Let’s examine a few examples of private companies with impressive market capitalization and explore the factors that contributed to their success.

Uber, the ride-hailing giant, has a market capitalization of over $80 billion, making it one of the most valuable private companies in the world. Uber’s market cap can be attributed to its rapid expansion into new markets, innovative business model, and significant investments in research and development.

Airbnb, the online marketplace for short-term rentals, has a market capitalization of over $50 billion. Airbnb’s success can be attributed to its unique business model, which has disrupted the traditional hospitality industry. The company’s ability to scale quickly and expand into new markets has also contributed to its impressive market capitalization.

SpaceX, the private aerospace manufacturer and space transport services company, has a market capitalization of over $30 billion. SpaceX’s market cap can be attributed to its innovative technology, significant investments in research and development, and its ability to secure lucrative contracts with government agencies and private companies.

In each of these examples, the market capitalization of the private company has played a crucial role in shaping its business strategy and attracting investors. By understanding the market cap of private company, investors, entrepreneurs, and business stakeholders can gain valuable insights into a company’s potential for growth and success.

These real-world examples demonstrate the importance of market capitalization in the private sector, highlighting the potential for private companies to achieve significant valuations and drive business growth.

Market Capitalization and Private Company Funding: What’s the Connection?

The market capitalization of a private company has a significant impact on its ability to secure funding from various sources. Investors, venture capitalists, and angel investors often use market capitalization as a key metric to evaluate the potential of a private company. A high market capitalization can be a major draw for investors, as it indicates a company’s potential for growth and scalability.

Private companies with a high market capitalization are more likely to attract funding from venture capitalists and angel investors. These investors are drawn to companies with a high market cap, as they offer a higher potential for returns on investment. In addition, a high market capitalization can also make it easier for private companies to secure funding through initial public offerings (IPOs).

On the other hand, private companies with a low market capitalization may struggle to secure funding. Investors may view these companies as higher-risk investments, making it more difficult to attract capital. This can limit a company’s ability to invest in research and development, hire top talent, and pursue strategic initiatives.

The connection between market capitalization and private company funding is critical for entrepreneurs and business stakeholders. By understanding the market cap of private company, entrepreneurs can better position their company to attract funding and drive business growth. Investors, on the other hand, can use market capitalization as a key metric to evaluate the potential of private companies and make informed investment decisions.

In conclusion, the market capitalization of a private company has a profound impact on its ability to secure funding. By understanding the connection between market capitalization and private company funding, entrepreneurs and investors can make informed decisions and drive business growth.

Conclusion: Unlocking the Power of Market Capitalization for Private Companies

In conclusion, understanding the market capitalization of a private company is crucial for investors, entrepreneurs, and business stakeholders. By grasping the concept of market capitalization, private companies can unlock their full potential and drive business growth. The market cap of private company serves as a key metric for evaluating a company’s performance, attracting investors, and securing funding.

Throughout this guide, we have explored the importance of market capitalization, how to calculate it, and its implications for private company performance. We have also examined the challenges of valuing private companies, the distinction between market capitalization and enterprise value, and the connection between market capitalization and private company funding.

By applying the concepts and strategies outlined in this guide, private companies can harness the power of market capitalization to drive business success. Whether you are an investor seeking to evaluate the potential of a private company or an entrepreneur looking to grow your business, understanding the market cap of private company is essential for making informed decisions.

In today’s competitive business landscape, private companies must stay ahead of the curve by leveraging market capitalization to their advantage. By doing so, they can unlock new opportunities, drive growth, and achieve long-term success.