Unlocking the Power of OIS: A Comprehensive Guide

Overnight Index Swaps (OIS) have become a cornerstone of fixed income trading, offering a powerful tool for managing interest rate risk and generating returns. By understanding the intricacies of OIS, investors can unlock new opportunities for growth and risk management in their portfolios. One year overnight index swaps, in particular, have gained popularity due to their unique characteristics and advantages.

In the fixed income market, OIS play a crucial role in mitigating the risks associated with floating-rate investments. By providing a fixed rate of return, OIS enable investors to hedge against potential losses or gains arising from fluctuations in interest rates. This makes them an attractive option for investors seeking to stabilize their returns and manage risk.

The significance of OIS in fixed income trading lies in their ability to provide a flexible and efficient means of managing interest rate risk. By using OIS, investors can adjust their exposure to interest rate fluctuations, lock in returns, and optimize their portfolios. As the fixed income market continues to evolve, the importance of OIS is likely to grow, making them an essential tool for investors and traders alike.

Understanding the Mechanics of a One Year Overnight Index Swap

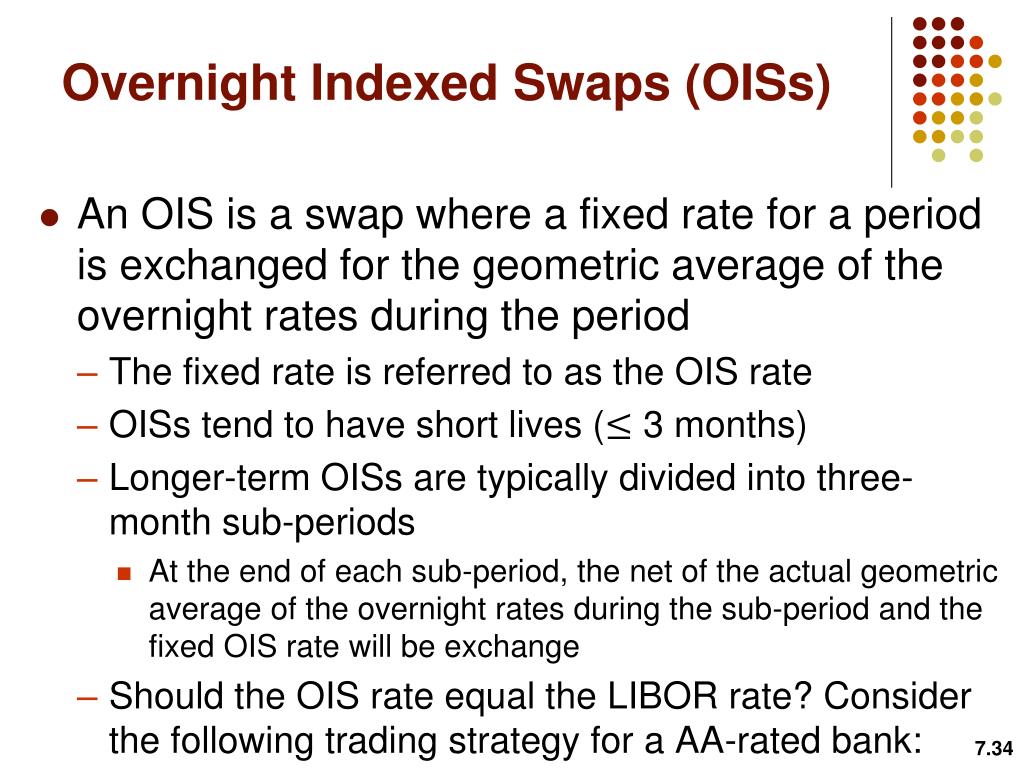

A one year overnight index swap is a type of derivative instrument that allows investors to hedge against interest rate risk or speculate on interest rate movements. The structure and mechanics of a one year overnight index swap are crucial to understanding its applications and benefits.

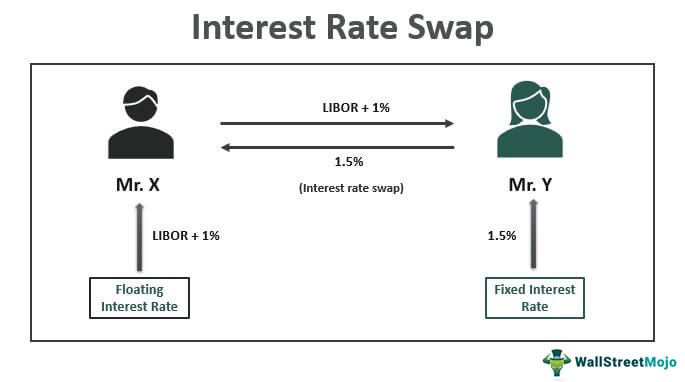

A one year overnight index swap consists of two legs: a fixed leg and a floating leg. The fixed leg is a series of fixed-rate payments made by one party to the other, typically based on a notional amount. The floating leg, on the other hand, is a series of payments based on a floating interest rate, such as the overnight index rate. The settlement process involves the exchange of these fixed and floating payments between the two parties.

For example, suppose an investor enters into a one year overnight index swap with a notional amount of $1 million. The fixed leg of the swap might involve the investor receiving a fixed rate of 2% per annum, while the floating leg involves the investor paying the overnight index rate, which is currently 1.5% per annum. At the end of the year, the investor would receive $20,000 (2% of $1 million) and pay $15,000 (1.5% of $1 million), resulting in a net payment of $5,000.

This simple example illustrates the mechanics of a one year overnight index swap. By understanding how these swaps work, investors can better appreciate their role in managing interest rate risk and generating returns in fixed income trading.

How to Hedge Interest Rate Risk with One Year OIS

One year overnight index swaps (OIS) offer a powerful tool for hedging interest rate risk, allowing investors to reduce their exposure to market fluctuations and lock in returns. By understanding how to effectively use one year OIS, investors can better navigate the complexities of fixed income trading.

One of the primary benefits of using one year OIS to hedge interest rate risk is that they provide a fixed rate of return, regardless of changes in market interest rates. This allows investors to stabilize their returns and avoid potential losses arising from interest rate fluctuations. For example, a company with a floating-rate loan can use a one year OIS to hedge against potential increases in interest rates, ensuring that their borrowing costs remain fixed.

In addition to reducing exposure to market fluctuations, one year OIS can also be used to lock in returns. By entering into a one year OIS, investors can fix their returns at a predetermined rate, providing a degree of certainty in an otherwise uncertain market. This can be particularly useful for investors seeking to generate stable returns over a specific period.

Real-world applications of one year OIS in hedging interest rate risk are diverse and widespread. For instance, banks and financial institutions use one year OIS to manage their interest rate risk exposure, while corporations use them to hedge against potential changes in borrowing costs. Investment portfolios also employ one year OIS to stabilize returns and reduce risk.

In conclusion, one year overnight index swaps offer a versatile and effective tool for hedging interest rate risk. By understanding the benefits and applications of one year OIS, investors can better navigate the complexities of fixed income trading and achieve their investment objectives.

The Role of Central Banks in Shaping Overnight Index Swap Markets

Central banks play a crucial role in shaping overnight index swap (OIS) markets, as their monetary policies have a direct impact on OIS rates. The actions of central banks, such as setting interest rates and implementing quantitative easing, can significantly influence the direction and volatility of OIS markets.

One of the primary ways in which central banks influence OIS markets is through their control of short-term interest rates. By setting interest rates, central banks can affect the entire yield curve, including OIS rates. For example, when a central bank lowers interest rates, it can lead to a decrease in OIS rates, making borrowing cheaper and stimulating economic growth. Conversely, when a central bank raises interest rates, it can lead to an increase in OIS rates, making borrowing more expensive and reducing inflationary pressures.

Quantitative easing, a monetary policy tool used by central banks to inject liquidity into the economy, can also have a significant impact on OIS markets. By purchasing government bonds and other securities, central banks can reduce the supply of bonds available for trading, leading to lower yields and OIS rates. This can have a ripple effect throughout the economy, influencing borrowing costs and investment decisions.

The impact of central banks’ monetary policies on one year overnight index swaps is particularly significant. As a key benchmark for short-term interest rates, one year OIS rates are closely tied to central banks’ policy decisions. For example, when a central bank lowers interest rates, it can lead to a decrease in one year OIS rates, making it cheaper for companies to borrow and invest.

In addition to their direct impact on OIS rates, central banks’ monetary policies can also influence the overall direction and volatility of OIS markets. By setting the tone for monetary policy, central banks can shape market expectations and influence investor sentiment, leading to changes in OIS rates and market volatility.

In conclusion, central banks play a vital role in shaping overnight index swap markets, and their monetary policies have a direct impact on OIS rates. By understanding the role of central banks in OIS markets, investors can better navigate the complexities of fixed income trading and make more informed investment decisions.

Comparing One Year Overnight Index Swaps with Other Derivatives

One year overnight index swaps (OIS) are a popular fixed income derivative used to manage interest rate risk and generate returns. However, they are not the only derivative available to investors. In this section, we will compare and contrast one year OIS with other fixed income derivatives, such as futures and options, highlighting their unique characteristics and advantages.

Futures contracts, such as Eurodollar futures, are another popular fixed income derivative used to manage interest rate risk. While both one year OIS and futures contracts can be used to hedge interest rate risk, they differ in their structure and mechanics. Futures contracts are marked-to-market, meaning that gains and losses are settled daily, whereas one year OIS are settled at maturity. Additionally, futures contracts are typically traded on an exchange, whereas one year OIS are over-the-counter (OTC) derivatives.

Options, such as interest rate options, are another type of fixed income derivative that can be used to manage interest rate risk. Options give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. One year OIS, on the other hand, are a type of swap agreement where two parties agree to exchange fixed and floating cash flows based on a notional amount. While options provide flexibility and can be used to speculate on interest rate movements, one year OIS are more commonly used to hedge interest rate risk and generate returns.

One year OIS have several advantages over other fixed income derivatives. They offer a high degree of customization, allowing investors to tailor the terms of the swap to their specific needs. Additionally, one year OIS are often more liquid than other derivatives, making it easier to enter and exit positions. Furthermore, one year OIS are typically less complex than other derivatives, making them more accessible to a wider range of investors.

In conclusion, one year overnight index swaps are a unique and powerful tool for managing interest rate risk and generating returns. While they share some similarities with other fixed income derivatives, such as futures and options, they offer a distinct set of advantages and characteristics that make them an attractive option for investors.

Managing Counterparty Risk in One Year Overnight Index Swaps

Counterparty risk is a critical consideration when trading one year overnight index swaps (OIS). Counterparty risk refers to the risk that the other party in the swap agreement will default on their obligations, resulting in a loss for the investor. In this section, we will discuss the importance of managing counterparty risk in one year OIS and explore the various strategies and techniques used to mitigate this risk.

Credit ratings play a crucial role in assessing counterparty risk in one year OIS. Investors should carefully evaluate the creditworthiness of their counterparty, taking into account factors such as credit ratings, financial health, and market reputation. A higher credit rating indicates a lower risk of default, while a lower credit rating suggests a higher risk of default.

Collateralization is another key strategy used to manage counterparty risk in one year OIS. Collateralization involves posting collateral, such as cash or securities, to cover potential losses in the event of a default. This can help to reduce the risk of counterparty default and provide an added layer of protection for investors.

Netting agreements are also commonly used to manage counterparty risk in one year OIS. Netting agreements allow investors to net out their exposures to a particular counterparty, reducing the overall risk of default. For example, if an investor has multiple one year OIS with a particular counterparty, a netting agreement would allow them to net out their exposures, reducing the risk of default.

In addition to these strategies, investors can also use various risk management techniques to manage counterparty risk in one year OIS. These include diversifying their counterparty exposure, regularly monitoring credit ratings and market conditions, and maintaining a robust risk management framework.

In conclusion, managing counterparty risk is a critical component of trading one year overnight index swaps. By understanding the importance of credit ratings, collateralization, and netting agreements, investors can better mitigate the risk of counterparty default and ensure a more stable and secure trading environment.

One Year Overnight Index Swap Valuation and Pricing

Valuation and pricing are critical components of one year overnight index swap (OIS) trading. Accurate valuation and pricing enable investors to make informed investment decisions, manage risk, and optimize returns. In this section, we will delve into the valuation and pricing mechanisms of one year OIS, exploring the key factors that influence their value.

The valuation of a one year OIS involves discounting the expected future cash flows of the swap using a discount curve. The discount curve is a yield curve that reflects the market’s expectations of future interest rates. The discount curve is typically constructed using a combination of market data, such as LIBOR rates, and mathematical models, such as the Black-Scholes model.

The forward rate is another key component of one year OIS valuation. The forward rate represents the expected future interest rate at a specific point in time. Forward rates are used to calculate the expected future cash flows of the swap, which are then discounted using the discount curve.

Credit spreads also play a crucial role in one year OIS valuation. Credit spreads reflect the market’s perception of the creditworthiness of the counterparty. A higher credit spread indicates a higher risk of default, which increases the value of the swap. Conversely, a lower credit spread indicates a lower risk of default, which decreases the value of the swap.

The pricing of a one year OIS involves calculating the present value of the expected future cash flows of the swap. This is typically done using a pricing model, such as the Black-Scholes model, which takes into account the discount curve, forward rates, and credit spreads. The pricing model produces a theoretical value for the swap, which can be used to determine the fair market value of the swap.

In addition to these factors, other market and economic conditions can influence the valuation and pricing of one year OIS. These include changes in interest rates, inflation expectations, and market volatility. Investors must carefully consider these factors when valuing and pricing one year OIS to ensure accurate and informed investment decisions.

In conclusion, the valuation and pricing of one year overnight index swaps are complex processes that involve a deep understanding of discount curves, forward rates, credit spreads, and other market and economic factors. By grasping these concepts, investors can better navigate the one year OIS market and make informed investment decisions.

Real-World Applications of One Year Overnight Index Swaps

One year overnight index swaps (OIS) have a wide range of real-world applications in various industries, including asset liability management, treasury operations, and investment portfolios. In this section, we will explore some of the most common uses of one year OIS and their benefits.

In asset liability management, one year OIS are used to hedge interest rate risk and manage cash flows. For example, a bank may use a one year OIS to hedge its exposure to changes in interest rates, ensuring that its assets and liabilities are matched and minimizing the risk of losses.

In treasury operations, one year OIS are used to manage cash flows and optimize returns. For instance, a corporation may use a one year OIS to lock in a fixed interest rate for a period of one year, ensuring that its cash flows are predictable and stable.

In investment portfolios, one year OIS are used to generate returns and manage risk. For example, a hedge fund may use a one year OIS to speculate on changes in interest rates, generating returns from the difference between the fixed and floating legs of the swap.

One year OIS are also used in mortgage-backed securities, where they are used to hedge the interest rate risk of mortgage portfolios. This helps to reduce the risk of losses and ensures that the cash flows from the mortgage portfolio are stable and predictable.

In addition to these applications, one year OIS are also used in other areas, such as risk management, derivatives trading, and financial engineering. Their flexibility and versatility make them a valuable tool for managing interest rate risk and generating returns in a wide range of contexts.

The benefits of using one year OIS in these applications are numerous. They provide a flexible and efficient way to manage interest rate risk, generate returns, and optimize cash flows. They also offer a high degree of customization, allowing users to tailor the terms of the swap to their specific needs and objectives.

In conclusion, one year overnight index swaps have a wide range of real-world applications in various industries. Their flexibility, versatility, and customization make them a valuable tool for managing interest rate risk and generating returns in a rapidly changing market environment.