What is Yield to Maturity and Why Does it Matter?

Yield to Maturity (YTM) is a critical concept in bond investing, as it represents the total return an investor can expect to earn from a bond if it is held until maturity. To calculate YTM of a bond, investors need to consider the coupon payments, face value, and market price. This comprehensive metric provides a clear picture of a bond’s potential returns, enabling investors to make informed decisions about their investments. In essence, YTM is a vital tool for evaluating the attractiveness of a bond and its potential to meet investment objectives. By understanding YTM, investors can optimize their portfolios, manage risk, and achieve their long-term financial goals.

Understanding Bond Pricing and Yield Calculations

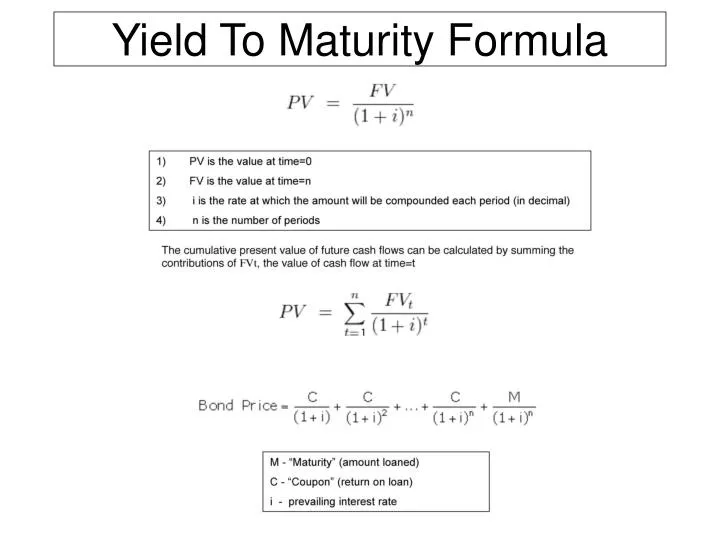

Bond pricing and yield calculations are intricately linked, with each factor influencing the other. The price of a bond is determined by the interaction of several factors, including the coupon rate, face value, and market interest rates. When interest rates rise, bond prices fall, and vice versa. This inverse relationship has a direct impact on yield to maturity (YTM) calculations, as changes in bond prices affect the total return an investor can expect to earn. To accurately calculate YTM of a bond, investors must understand how these factors interact and impact the bond’s overall value. By grasping the basics of bond pricing and yield calculations, investors can make more informed decisions about their bond investments and optimize their portfolios.

How to Calculate Yield to Maturity: A Step-by-Step Guide

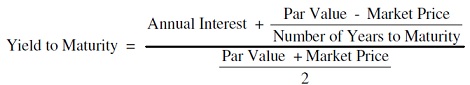

To calculate the yield to maturity (YTM) of a bond, investors need to follow a step-by-step process that takes into account the bond’s coupon rate, face value, market price, and time to maturity. The YTM formula is as follows: YTM = (Coupon Payment + (Face Value – Market Price) / Time to Maturity) / ((Face Value + Market Price) / 2). To illustrate this process, let’s consider an example. Suppose we have a 10-year bond with a coupon rate of 5%, a face value of $1,000, and a market price of $900. To calculate the YTM of this bond, we would plug in these values into the formula and solve for YTM. By following this step-by-step guide, investors can accurately calculate the YTM of a bond and make informed investment decisions. It’s essential to note that to calculate YTM of a bond, investors need to consider the bond’s specific characteristics and market conditions. By doing so, investors can gain a deeper understanding of the bond’s potential returns and optimize their portfolios.

Factors Affecting Yield to Maturity: What You Need to Know

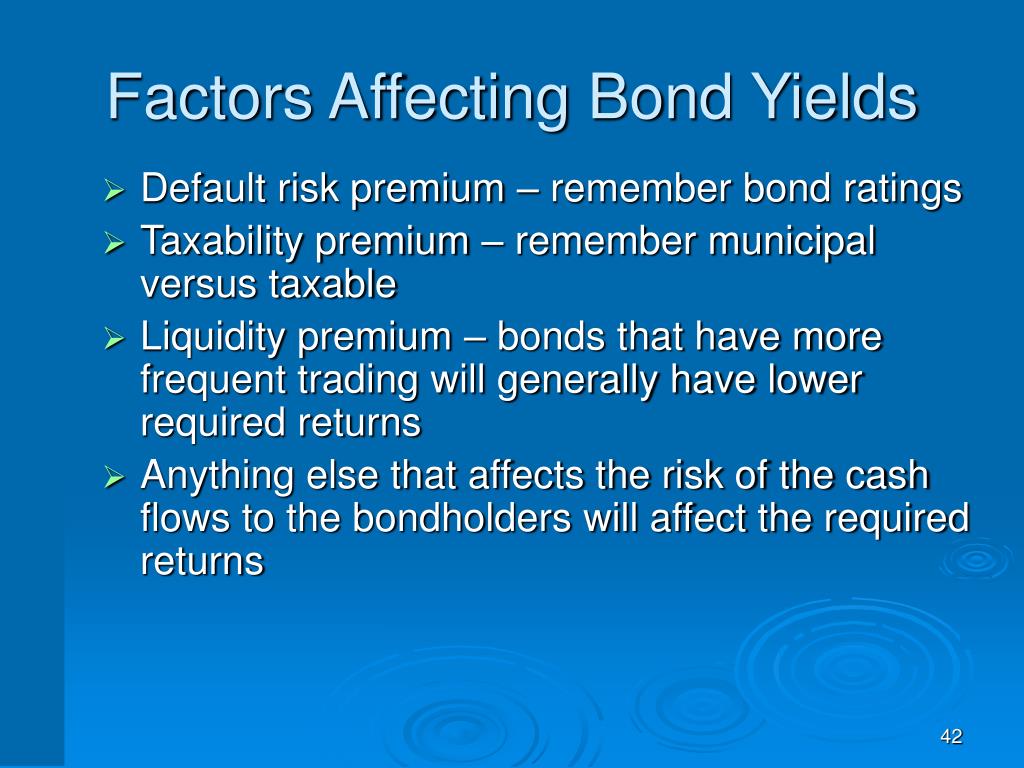

When calculating the yield to maturity (YTM) of a bond, it’s essential to consider the various factors that influence this metric. Credit ratings, bond duration, and market conditions are just a few of the key factors that can impact YTM and, ultimately, investment decisions. A bond’s credit rating, for instance, can significantly affect its YTM, as higher-rated bonds typically offer lower yields to compensate for their lower default risk. Bond duration, which measures a bond’s sensitivity to interest rate changes, also plays a crucial role in YTM calculations. Longer-duration bonds are more sensitive to interest rate fluctuations, which can lead to higher yields to maturity. Market conditions, such as inflation expectations and monetary policy, can also influence YTM by affecting the overall demand for bonds and the yields investors are willing to accept. To accurately calculate the YTM of a bond, investors must consider these factors and how they interact with one another. By doing so, investors can gain a deeper understanding of the bond’s potential returns and make more informed investment decisions. For example, when trying to calculate YTM of a bond, investors may need to adjust their expectations based on the bond’s credit rating and duration, as well as the prevailing market conditions. By considering these factors, investors can refine their YTM calculations and optimize their portfolios.

YTM vs. Current Yield: What’s the Difference?

When analyzing bonds, investors often come across two important metrics: yield to maturity (YTM) and current yield. While both metrics are used to evaluate a bond’s potential returns, they are calculated differently and serve distinct purposes. Understanding the distinction between YTM and current yield is essential for making informed investment decisions. The current yield, also known as the coupon yield, represents the bond’s annual coupon payment as a percentage of its current market price. In contrast, YTM takes into account the bond’s entire cash flow, including the coupon payments and the return of principal at maturity. To calculate YTM of a bond, investors need to consider the bond’s coupon rate, face value, market price, and time to maturity. In contrast, current yield is a simpler metric that only considers the bond’s coupon payment and market price. While current yield provides a snapshot of a bond’s current income generation, YTM offers a more comprehensive picture of a bond’s potential returns over its entire lifespan. By understanding the differences between YTM and current yield, investors can make more informed decisions about their bond investments and optimize their portfolios. For instance, an investor may use current yield to evaluate a bond’s income generation potential, while using YTM to assess its total return potential. By considering both metrics, investors can gain a more complete understanding of a bond’s investment potential.

Real-World Applications of Yield to Maturity Calculations

Yield to maturity (YTM) calculations have numerous real-world applications in bond investing, portfolio management, and risk assessment. By understanding how to calculate YTM of a bond, investors and financial professionals can make more informed investment decisions and optimize their portfolios. One common application of YTM calculations is in portfolio management, where investors use YTM to evaluate the potential returns of different bonds and construct a diversified portfolio that meets their investment objectives. For instance, an investor may use YTM to compare the potential returns of a high-yield bond with a lower-rated credit rating to a high-grade bond with a higher credit rating. By considering the YTM of each bond, the investor can make a more informed decision about which bond to include in their portfolio. YTM calculations are also essential in investment analysis, where analysts use YTM to evaluate the attractiveness of a bond investment opportunity. By calculating the YTM of a bond, analysts can determine whether the bond’s potential returns justify the risks associated with the investment. Additionally, YTM calculations are used in risk assessment, where investors and financial professionals use YTM to evaluate the potential risks associated with a bond investment. For example, an investor may use YTM to evaluate the potential impact of interest rate changes on a bond’s returns, and adjust their investment strategy accordingly. By understanding the real-world applications of YTM calculations, investors and financial professionals can make more informed investment decisions and achieve their investment objectives.

Common Mistakes to Avoid When Calculating Yield to Maturity

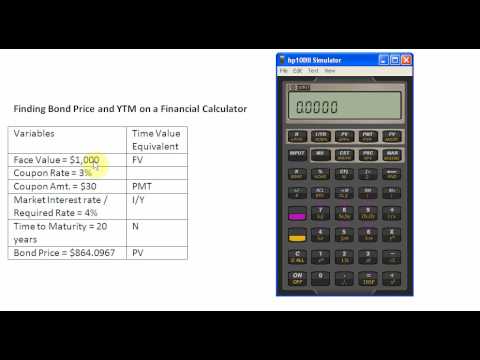

When calculating yield to maturity (YTM) of a bond, investors and financial professionals must be aware of common mistakes that can lead to inaccurate results. One common error is using the wrong discount rate, which can significantly impact the calculated YTM. To avoid this mistake, it is essential to use the correct market discount rate, which reflects the current market conditions. Another mistake is failing to consider the bond’s cash flow, including the coupon payments and the return of principal at maturity. By ignoring these cash flows, investors may underestimate or overestimate the bond’s potential returns. Additionally, investors may make the mistake of assuming that the bond’s yield to maturity is the same as its current yield. However, as discussed earlier, YTM and current yield are distinct metrics that serve different purposes in bond analysis. To calculate YTM of a bond accurately, investors must understand the differences between these metrics and use the correct formula and variables. Furthermore, investors may encounter mistakes when using financial calculators or software to calculate YTM. To avoid these mistakes, it is essential to understand the underlying calculations and to verify the results using different methods. By being aware of these common mistakes, investors and financial professionals can ensure that their YTM calculations are accurate and reliable, and make informed investment decisions based on these calculations. By mastering the calculation of YTM of a bond, investors can gain a competitive edge in the bond market and achieve their investment objectives.

Conclusion: Mastering Yield to Maturity Calculations for Informed Investment Decisions

In conclusion, understanding how to calculate yield to maturity (YTM) of a bond is a crucial skill for investors and financial professionals seeking to make informed investment decisions. By grasping the concepts and techniques outlined in this guide, readers can unlock the full potential of bond investing and optimize their portfolios. Whether in portfolio management, investment analysis, or risk assessment, YTM calculations play a vital role in evaluating bond investment opportunities and mitigating potential risks. By avoiding common mistakes and mastering the calculation of YTM of a bond, investors can gain a competitive edge in the bond market and achieve their investment objectives. As the bond market continues to evolve, it is essential to stay up-to-date with the latest techniques and best practices in YTM calculations. By applying the knowledge and insights gained from this guide, readers can navigate the complexities of bond investing with confidence and make informed decisions that drive long-term success.