Understanding the Risks of Put Options

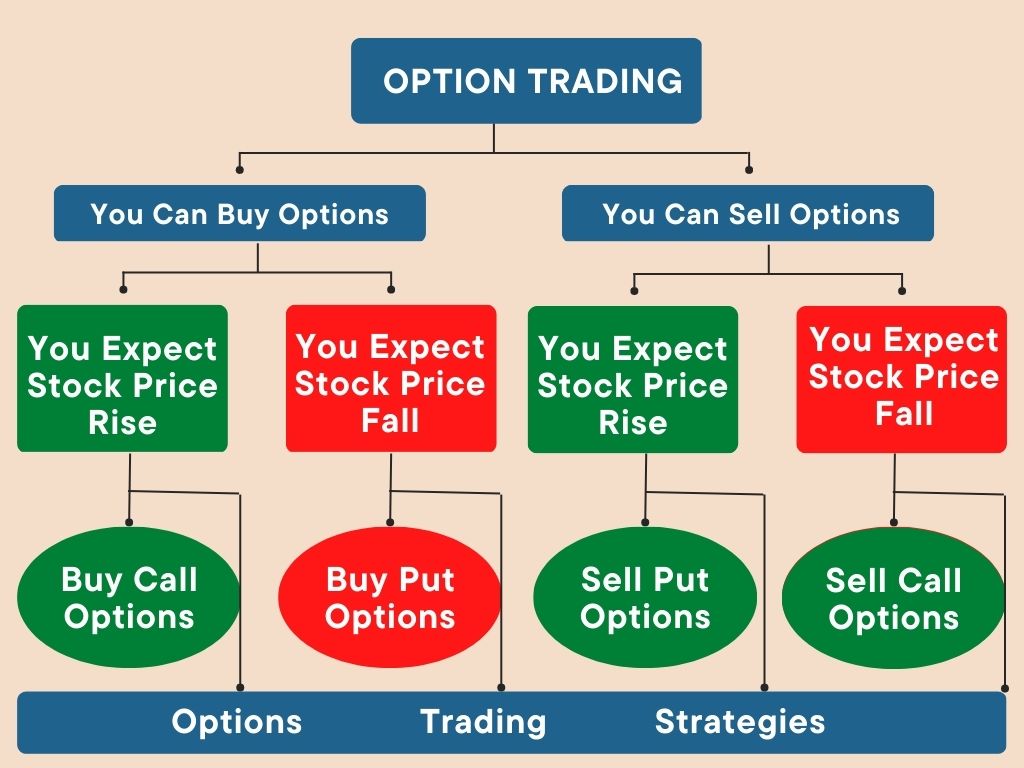

Put options are a popular trading instrument used by investors to hedge against potential losses or speculate on market downturns. However, like any investment, put options come with their own set of risks. One of the most critical risks to understand is the potential for significant losses if not managed properly. In fact, the max loss on a put option can be substantial, making it essential to comprehend the underlying mechanics and risks involved. When trading put options, investors must be aware of the potential risks and take steps to minimize them. This includes understanding the factors that influence the max loss on a put option, such as strike price, premium, and underlying asset price. By grasping these concepts, investors can make informed decisions and develop effective strategies to minimize potential losses.

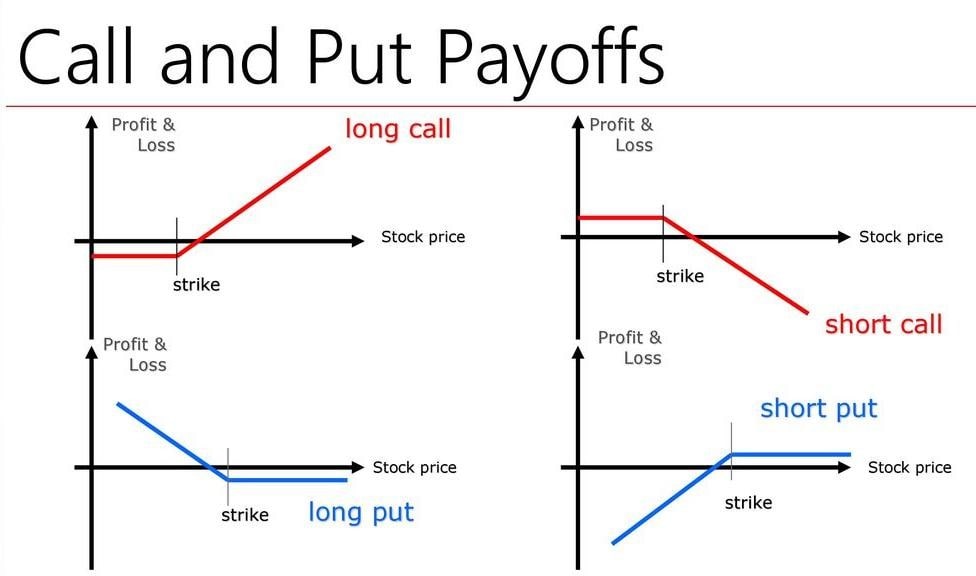

What is the Maximum Loss on a Put Option?

The maximum loss on a put option is a critical concept for investors to understand, as it represents the potential financial risk involved in trading these options. The max loss on a put option occurs when the underlying asset’s price rises above the strike price, rendering the option worthless. In this scenario, the buyer of the put option will incur a loss equal to the premium paid for the option. The maximum loss on a put option is calculated by subtracting the strike price from the underlying asset’s price at expiration, and then multiplying the result by the number of contracts held. Factors that influence the max loss on a put option include the strike price, premium, and underlying asset price. By understanding how to calculate the maximum loss on a put option, investors can better manage their risk and make informed trading decisions.

How to Calculate Maximum Loss on a Put Option

To calculate the maximum loss on a put option, investors can follow a simple step-by-step process. The formula to calculate the max loss on a put option is: Max Loss = Premium Paid. This is because the buyer of a put option will incur a loss equal to the premium paid if the option expires worthless. To illustrate this process, let’s consider an example. Suppose an investor buys a put option on a stock with a strike price of $50 and a premium of $5. If the stock price rises to $60 at expiration, the option will expire worthless, and the investor will incur a loss of $5, which is the premium paid. The calculation can be broken down as follows:

1. Determine the premium paid for the put option.

2. Identify the strike price of the put option.

3. Determine the underlying asset’s price at expiration.

4. If the underlying asset’s price is above the strike price, the option will expire worthless, and the max loss will be equal to the premium paid.

By understanding how to calculate the max loss on a put option, investors can better manage their risk and make informed trading decisions. It is essential to remember that the max loss on a put option is limited to the premium paid, making it a crucial aspect of options trading.

Factors Affecting Maximum Loss on a Put Option

Several factors can impact the maximum loss on a put option, making it essential for investors to understand these influences to manage their risk effectively. One key factor is volatility, which can increase the max loss on a put option by widening the price range of the underlying asset. When volatility is high, the option’s premium increases, resulting in a higher potential loss if the option expires worthless. Time to expiration is another critical factor, as options with longer expirations tend to have higher premiums, leading to a greater max loss on a put option. Interest rates also play a role, as higher interest rates can increase the cost of carrying a position, thereby increasing the max loss on a put option.

In addition to these factors, the underlying asset’s price and the strike price of the option also impact the max loss on a put option. If the underlying asset’s price is close to the strike price, the option is more likely to expire in the money, reducing the max loss. Conversely, if the underlying asset’s price is significantly above the strike price, the option will expire worthless, resulting in a higher max loss on a put option. By understanding these factors, investors can better assess the risks involved and make informed decisions when trading put options.

It is essential to remember that the max loss on a put option is limited to the premium paid, making it a crucial aspect of options trading. By recognizing the factors that influence the max loss on a put option, investors can develop effective strategies to minimize their potential losses and achieve long-term success in options trading.

Strategies to Minimize Maximum Loss on a Put Option

To minimize the max loss on a put option, investors can employ various strategies that help mitigate potential losses. One effective approach is hedging, which involves taking a position in a related asset to offset potential losses. For example, an investor who buys a put option on a stock can also buy a call option on the same stock to limit potential losses. Diversification is another strategy that can help reduce the max loss on a put option. By spreading investments across different assets and options, investors can minimize their exposure to any one particular option, thereby reducing potential losses.

Adjusting strike prices is another strategy that can help minimize the max loss on a put option. By selecting a strike price that is closer to the current market price of the underlying asset, investors can reduce the premium paid and, subsequently, the max loss on the put option. Additionally, investors can consider selling put options with shorter expirations to reduce the time value of the option and, consequently, the max loss. By combining these strategies, investors can develop a comprehensive approach to managing risk and minimizing the max loss on put options.

It is essential to remember that the max loss on a put option is limited to the premium paid, making it a crucial aspect of options trading. By employing these strategies, investors can minimize their potential losses and achieve long-term success in options trading. By understanding the factors that influence the max loss on a put option and developing effective strategies to manage risk, investors can make informed decisions and optimize their returns.

Real-Life Examples of Maximum Loss on Put Options

One notable example of the max loss on put options is the 2018 volatility spike in the US stock market. During this period, the CBOE Volatility Index (VIX) surged to record highs, causing put options on volatility ETFs to expire worthless. Many investors who had bought put options on these ETFs suffered significant losses, highlighting the importance of understanding and managing the max loss on put options.

Another example is the 2020 COVID-19 pandemic, which led to a sharp decline in global stock markets. Investors who had bought put options on stocks or indices expecting a decline in prices found themselves facing significant losses as the options expired worthless. This event underscored the need for investors to have a thorough understanding of the max loss on put options and to develop strategies to minimize potential losses.

Historical events like the 2008 global financial crisis and the 2011 European sovereign debt crisis also provide valuable lessons on the importance of managing the max loss on put options. During these periods, put options on various assets expired worthless, resulting in significant losses for investors who had not properly managed their risk. By studying these examples, investors can gain a deeper understanding of the risks involved and develop effective strategies to minimize the max loss on put options.

These real-life examples illustrate the potential risks involved in trading put options and the importance of understanding and managing the max loss on put options. By recognizing the factors that influence the max loss on put options and developing effective strategies to minimize potential losses, investors can make informed decisions and optimize their returns in options trading.

Managing Risk: Best Practices for Put Option Trading

Effective risk management is crucial when trading put options, as it helps minimize potential losses and maximize returns. One best practice is to set stop-loss orders, which automatically close a position when it reaches a certain price level, limiting the max loss on put option. This strategy helps investors avoid significant losses and lock in profits.

Another key strategy is to limit position size, which involves allocating a smaller portion of the portfolio to put options. This approach helps reduce the overall risk exposure and minimizes the potential max loss on put option. By limiting position size, investors can avoid over-committing to a single trade and maintain a diversified portfolio.

Monitoring market conditions is also essential for managing risk when trading put options. Investors should stay up-to-date with market news, trends, and analysis to make informed decisions. This includes tracking volatility, interest rates, and other factors that can impact the max loss on put option. By staying informed, investors can adjust their strategies to respond to changing market conditions.

Additionally, investors should consider implementing a hedging strategy, which involves taking a position in a related asset to offset potential losses. For example, an investor who buys a put option on a stock can also buy a call option on the same stock to limit potential losses. This approach helps minimize the max loss on put option and provides a more balanced portfolio.

By following these best practices, investors can effectively manage risk and minimize the max loss on put option. By understanding the factors that influence the max loss on put option and developing effective strategies to manage risk, investors can make informed decisions and optimize their returns in options trading.

Conclusion: Mastering Put Options for Long-Term Success

In conclusion, understanding and managing the max loss on put option is crucial for long-term success in options trading. By grasping the concept of put options, calculating the maximum loss, and recognizing the factors that influence it, investors can make informed decisions and minimize potential losses. Additionally, implementing strategies to minimize the max loss on put option, such as hedging and diversification, can help investors optimize their returns.

Real-life examples of maximum loss on put options highlight the importance of effective risk management and the need for investors to stay vigilant in monitoring market conditions. By following best practices for managing risk, such as setting stop-loss orders and limiting position size, investors can minimize the max loss on put option and achieve long-term success in options trading.

Ultimately, mastering put options requires a deep understanding of the risks involved and a commitment to managing those risks effectively. By doing so, investors can unlock the potential of put options and achieve their investment goals. Remember, understanding and managing the max loss on put option is key to achieving long-term success in options trading.

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)