Understanding the Benefits of CDs

Certificates of Deposit (CDs) are a type of savings account that offers a fixed interest rate for a specific period. They are a popular choice for individuals seeking a low-risk investment option with a predictable return. One of the primary advantages of CDs is their fixed interest rate, which provides a sense of stability and security. Additionally, CDs are typically insured by the FDIC, which protects deposits up to $250,000 and provides an added layer of protection for investors. Furthermore, CDs tend to be low-risk investments, making them an attractive option for those who prioritize preserving their capital. By incorporating CDs into their savings strategy, individuals can achieve their long-term financial goals, such as building an emergency fund, saving for a down payment on a house, or simply growing their wealth over time. With competitive CD interest rates, such as those offered by Sovereign Bank, individuals can maximize their returns and make the most of their savings.

How to Choose the Right CD for Your Needs

Selecting the right Certificate of Deposit (CD) for individual circumstances is crucial to achieving long-term savings goals. When choosing a CD, several factors should be considered, including term length, interest rate, and minimum deposit requirements. Term length, which can range from a few months to several years, affects the interest rate and liquidity of the CD. A longer term typically offers a higher interest rate, but also means the funds are locked in for a longer period. Interest rates, which vary among financial institutions, should be compared to find the most competitive option. Sovereign Bank CD interest rates, for example, are often highly competitive and worth considering. Minimum deposit requirements, which can range from a few hundred to several thousand dollars, should also be taken into account. By carefully evaluating these factors, individuals can choose a CD that aligns with their financial goals and risk tolerance, ultimately maximizing their returns.

Sovereign Bank CD Interest Rates: A Competitive Option

Sovereign Bank is a reputable financial institution that offers competitive CD interest rates, making it an attractive option for individuals seeking a low-risk investment with a predictable return. With a long history of providing quality banking services, Sovereign Bank has established itself as a trusted name in the industry. The bank’s commitment to customer service is evident in its user-friendly online banking platform, which allows customers to easily manage their accounts and access their funds. Additionally, Sovereign Bank’s CD accounts are backed by FDIC insurance, providing an added layer of security for depositors. By offering competitive Sovereign Bank CD interest rates, the bank has positioned itself as a leader in the CD market, making it an excellent choice for those seeking a high-yield CD.

Current Sovereign Bank CD Interest Rates

As of [current date], Sovereign Bank offers a range of competitive CD interest rates for various term lengths

How to Open a Sovereign Bank CD Account

Opening a Sovereign Bank CD account is a straightforward process that can be completed online or at a local branch. To get started, individuals will need to gather the required documents, including a valid government-issued ID, proof of address, and social security number or individual taxpayer identification number. Once the necessary documents are in hand, applicants can visit Sovereign Bank’s website to begin the online application process. The online application will guide users through a series of questions, including personal and financial information, to complete the account opening process. Alternatively, individuals can visit a local Sovereign Bank branch to speak with a representative and open an account in person. Funding options for Sovereign Bank CD accounts include transferring funds from an existing bank account, mailing a check, or initiating a wire transfer. With a minimum deposit requirement of [$X], individuals can easily open a Sovereign Bank CD account and start earning competitive Sovereign Bank CD interest rates.

Tips for Getting the Most Out of Your Sovereign Bank CD

To maximize the returns on a Sovereign Bank CD, it’s essential to understand how to optimize the account. One strategy is to ladder CDs, which involves opening multiple CDs with staggered term lengths. This approach allows individuals to take advantage of higher Sovereign Bank CD interest rates on longer-term CDs while still having access to some of their funds periodically. Another tip is to keep an eye out for promotional offers and rate increases, which can provide an opportunity to earn even higher Sovereign Bank CD interest rates. Additionally, it’s crucial to avoid early withdrawal penalties by carefully considering the term length and ensuring that the funds won’t be needed before the CD matures. By following these tips, individuals can get the most out of their Sovereign Bank CD and achieve their long-term savings goals.

Alternatives to Sovereign Bank CDs: Exploring Other Options

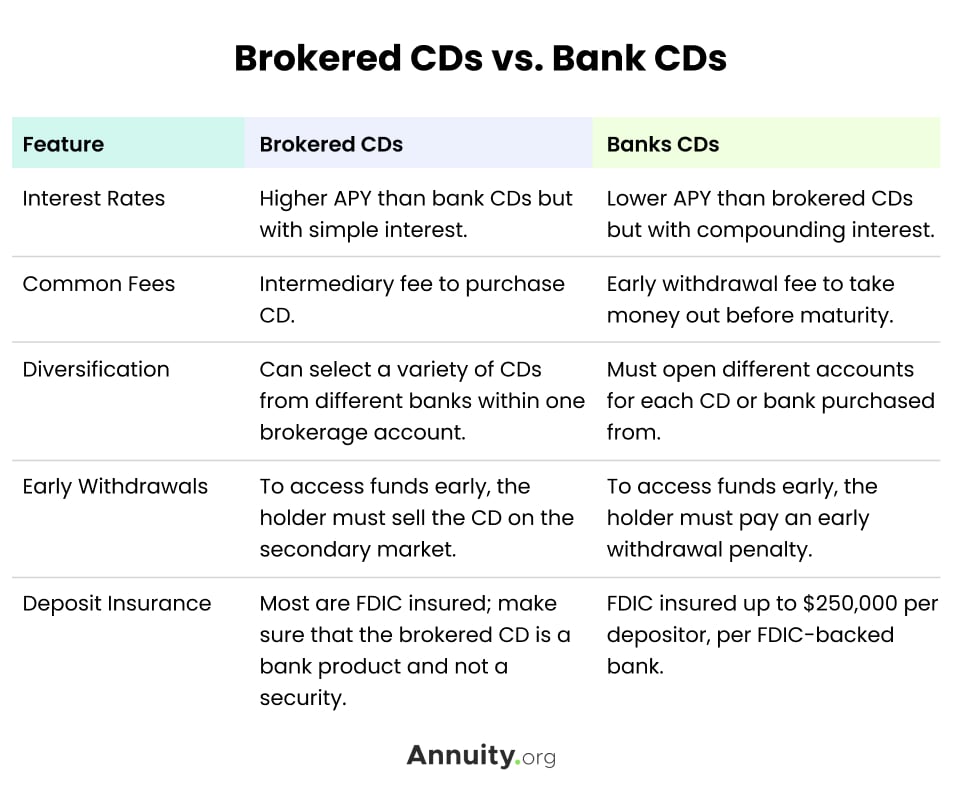

While Sovereign Bank CD interest rates are competitive, it’s essential to explore alternative CD options from other banks and credit unions to find the best fit for individual circumstances. For example, CIT Bank offers a range of CDs with competitive interest rates and low minimum deposit requirements. Barclays Bank also provides online CDs with competitive rates and no minimum balance requirements. Credit unions, such as Navy Federal Credit Union, offer CDs with competitive rates and more flexible terms. When comparing these alternatives to Sovereign Bank CDs, consider factors such as interest rates, term lengths, minimum deposit requirements, and customer service. By researching and comparing different CD options, individuals can make an informed decision and choose the CD that best aligns with their long-term savings goals. Additionally, it’s crucial to review the features and benefits of each CD, including online banking capabilities, mobile banking apps, and customer support, to ensure that the chosen CD meets individual needs and preferences.

Conclusion: Making the Most of Your Savings with Sovereign Bank CDs

In conclusion, Sovereign Bank CDs offer a competitive option for individuals seeking to maximize their savings with a low-risk investment. By understanding the benefits of CDs, choosing the right CD for individual circumstances, and taking advantage of Sovereign Bank’s competitive CD interest rates, individuals can achieve their long-term savings goals. Additionally, by exploring alternative CD options and following tips for getting the most out of a Sovereign Bank CD, individuals can make informed decisions and optimize their savings. Ultimately, careful planning and research are crucial when selecting a CD account, and Sovereign Bank CDs can provide a valuable addition to a diversified savings portfolio. With Sovereign Bank’s history of customer service and online banking capabilities, individuals can feel confident in their decision to invest in a Sovereign Bank CD and take a step towards achieving their financial goals.