Navigating the World of Government Bonds

Government bonds are a cornerstone of the economy, providing a low-risk investment avenue for individuals and institutions alike. These debt securities are issued by governments to raise capital for various purposes, such as financing infrastructure projects or refinancing existing debt. The appeal of government bonds lies in their relatively stable returns, making them an attractive option for investors seeking to diversify their portfolios. To make informed investment decisions, it is essential to understand the underlying dynamics of government bonds, particularly the concept of treasury yields. Treasury yields, such as the Yahoo Finance 10 year treasury yield, serve as a benchmark for long-term interest rates, influencing the overall direction of the economy. By grasping the intricacies of government bonds and treasury yields, investors can optimize their investment strategies and achieve their long-term financial goals.

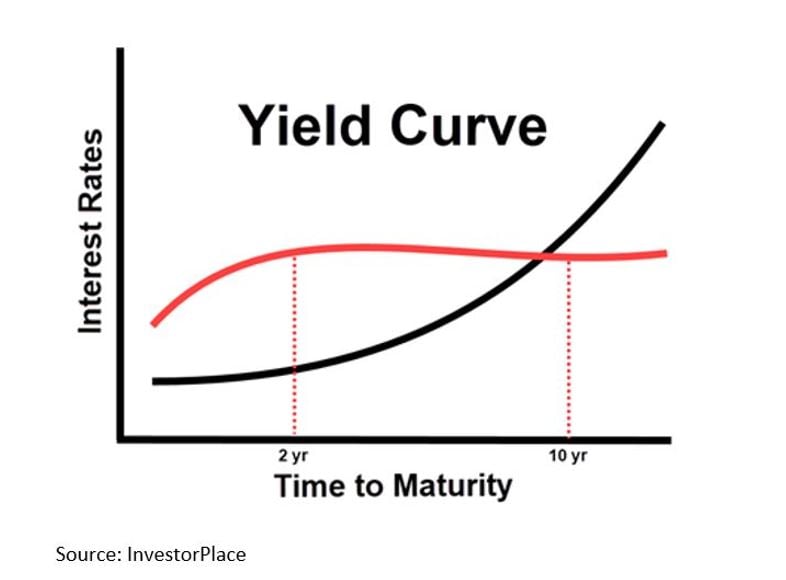

How to Make Sense of Treasury Yield Curves

Treasury yield curves are a powerful tool for investors seeking to predict economic trends and make informed investment decisions. A treasury yield curve is a graphical representation of the relationship between the yield of a treasury bond and its maturity. By analyzing the shape and slope of the yield curve, investors can gain valuable insights into the direction of interest rates, inflation expectations, and the overall health of the economy. Yahoo Finance provides easy access to treasury yield data, allowing investors to analyze and interpret the yield curve to make informed investment decisions. For instance, a steepening yield curve may indicate a growing economy, while a flattening curve may suggest a slowdown. By leveraging Yahoo Finance’s treasury yield data, investors can stay ahead of the curve and adjust their investment strategies accordingly.

The 10-Year Treasury Yield: A Key Indicator of Economic Health

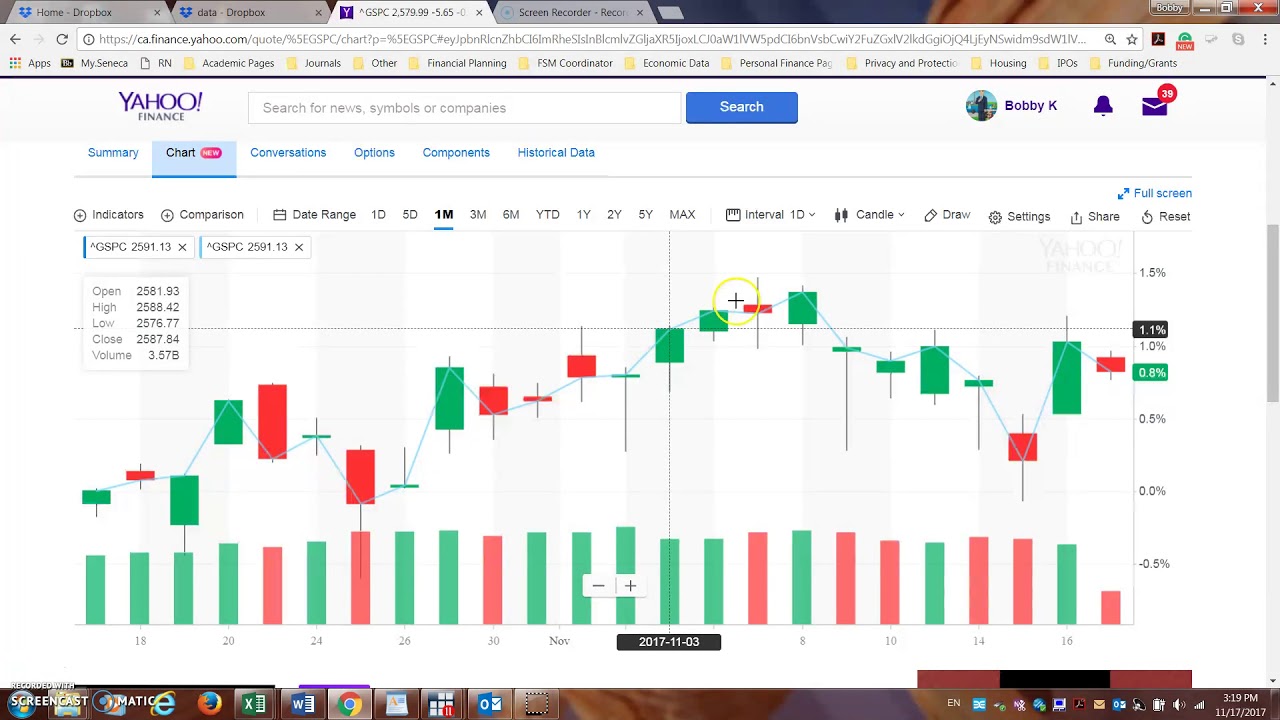

The 10-year treasury yield is a widely followed benchmark for long-term interest rates, providing valuable insights into the overall health of the economy. As a key indicator of economic trends, the 10-year treasury yield has a significant impact on the direction of interest rates, inflation expectations, and the overall performance of the stock market. Yahoo Finance provides real-time data on the 10-year treasury yield, allowing investors to stay informed and make timely investment decisions. Historical trends of the 10-year treasury yield can also be accessed on Yahoo Finance, providing a valuable perspective on the evolution of interest rates and the economy. For instance, a rising 10-year treasury yield may indicate a growing economy, while a declining yield may suggest a slowdown. By leveraging Yahoo Finance’s real-time data on the 10-year treasury yield, investors can gain a deeper understanding of the economy and make informed investment decisions. With the “yahoo finance 10 year treasury” yield serving as a benchmark for long-term interest rates, investors can optimize their investment strategies and achieve their long-term financial goals.

Using Yahoo Finance to Track Treasury Yields and Make Informed Decisions

To make informed investment decisions, it’s essential to stay up-to-date with the latest treasury yield data. Yahoo Finance provides a comprehensive platform for tracking treasury yields, allowing investors to access historical data, set up custom charts, and receive alerts on yield changes. By leveraging Yahoo Finance’s treasury yield data, investors can gain valuable insights into the direction of interest rates, inflation expectations, and the overall health of the economy. To get started, investors can simply navigate to the Yahoo Finance website, select the “Bonds” tab, and choose the desired treasury yield maturity. From there, investors can access a wealth of historical data, including daily, weekly, and monthly charts. By setting up custom charts, investors can visualize the data and identify trends, making it easier to make informed investment decisions. Additionally, Yahoo Finance allows investors to set up alerts for yield changes, ensuring that they stay informed and can respond quickly to changes in the market. By using Yahoo Finance to track treasury yields, investors can optimize their investment strategies and achieve their long-term financial goals.

The Impact of Monetary Policy on Treasury Yields

Monetary policy decisions made by central banks have a significant impact on treasury yields, influencing interest rates and subsequently affecting the economy. Understanding the relationship between monetary policy and treasury yields is crucial for investors seeking to make informed investment decisions. Central banks, such as the Federal Reserve in the United States, use monetary policy tools to regulate the money supply, inflation, and employment rates. These decisions, in turn, affect the direction of interest rates, including treasury yields. For instance, when central banks lower interest rates to stimulate economic growth, treasury yields tend to decrease, making borrowing cheaper and increasing the attractiveness of treasury bonds. Conversely, when central banks raise interest rates to combat inflation, treasury yields tend to increase, making borrowing more expensive and reducing the appeal of treasury bonds. Yahoo Finance provides a platform for investors to track monetary policy announcements and their effect on treasury yields. By accessing real-time data on the “yahoo finance 10 year treasury” yield, investors can gain valuable insights into the impact of monetary policy decisions on the economy and make informed investment decisions. For example, investors can use Yahoo Finance to analyze the historical relationship between Federal Reserve rate hikes and the subsequent impact on the 10-year treasury yield. By staying informed about monetary policy decisions and their effect on treasury yields, investors can optimize their investment strategies and achieve their long-term financial goals.

Risk Management Strategies for Investing in Treasury Bonds

When investing in treasury bonds, it’s essential to understand the risks associated with treasury yields and implement effective risk management strategies. One key strategy is diversification, which involves spreading investments across different maturities and types of treasury bonds to minimize exposure to any one particular bond. Laddering is another strategy, where investors stagger the maturity dates of their treasury bonds to ensure a steady stream of income and reduce the impact of interest rate changes. Hedging is also a useful strategy, where investors use derivatives or other financial instruments to offset potential losses from changes in treasury yields. By understanding these risk management strategies and using Yahoo Finance to monitor and adjust investment portfolios, investors can optimize their returns and minimize potential losses. For example, investors can use Yahoo Finance to track the “yahoo finance 10 year treasury” yield and adjust their investment portfolios accordingly. By staying informed and proactive, investors can navigate the risks associated with treasury yields and achieve their long-term financial goals.

Comparing Treasury Yields Across Different Maturities

When investing in treasury bonds, it’s essential to understand the differences between treasury yields across various maturities. The 2-year, 5-year, and 30-year treasury yields, for instance, offer distinct investment opportunities and risks. The 2-year treasury yield is often seen as a benchmark for short-term interest rates, while the 30-year treasury yield is a key indicator of long-term interest rates. The 10-year treasury yield, such as the “yahoo finance 10 year treasury” yield, is a widely followed benchmark for long-term interest rates. By comparing and contrasting yields across different maturities, investors can make informed investment decisions and optimize their returns. Yahoo Finance provides a platform for investors to access and analyze treasury yield data across different maturities. For example, investors can use Yahoo Finance to compare the historical trends of the 2-year and 10-year treasury yields to identify potential investment opportunities. By staying informed and up-to-date with treasury yield data, investors can make timely investment decisions and achieve their long-term financial goals.

Staying Ahead of the Curve with Yahoo Finance’s Treasury Yield Data

In today’s fast-paced investment landscape, staying informed and up-to-date with treasury yield data is crucial for making informed investment decisions. With Yahoo Finance, investors have access to a wealth of treasury yield data and analysis, empowering them to stay ahead of the curve. By leveraging Yahoo Finance’s real-time data on the 10-year treasury yield, such as the “yahoo finance 10 year treasury” yield, investors can make timely investment decisions and optimize their returns. Moreover, Yahoo Finance’s platform provides a range of tools and features, including historical data, custom charts, and alerts, to help investors track treasury yields and adjust their investment portfolios accordingly. By staying informed and proactive, investors can navigate the complexities of the treasury yield market and achieve their long-term financial goals. With Yahoo Finance as a trusted source for treasury yield data and analysis, investors can confidently make informed investment decisions and stay ahead of the curve.