Why Expected Return Matters in Investment Decisions

In the world of stock market investing, understanding expected return is crucial for making informed investment decisions. Expected return represents the anticipated profit or loss of an investment over a specific period. It’s a critical component in evaluating the potential performance of a stock and determining its suitability for a portfolio. By grasping the concept of expected return, investors can better navigate the complexities of the stock market and make more informed decisions about their investments. This is especially important when learning how to calculate expected return of a stock, as it helps investors set realistic expectations and manage risk more effectively. In essence, expected return serves as a guiding principle for investment decisions, enabling investors to create a well-diversified portfolio that aligns with their financial goals and risk tolerance.

Understanding the Basics of Stock Return Calculation

In the realm of stock market investing, understanding the different types of returns is essential for making informed investment decisions. Expected return, in particular, plays a critical role in evaluating the potential performance of a stock. It represents the anticipated profit or loss of an investment over a specific period, taking into account the level of risk associated with it. In essence, expected return is a forward-looking measure that helps investors set realistic expectations and make informed decisions about their investments. To calculate expected return, investors need to understand its relationship with risk, as well as the distinction between historical, expected, and required returns. Historical return, for instance, reflects the stock’s past performance, while required return represents the minimum return an investor expects from an investment. By grasping these fundamental concepts, investors can better navigate the complexities of the stock market and learn how to calculate expected return of a stock, ultimately leading to more informed investment decisions.

How to Calculate Expected Return: A Step-by-Step Guide

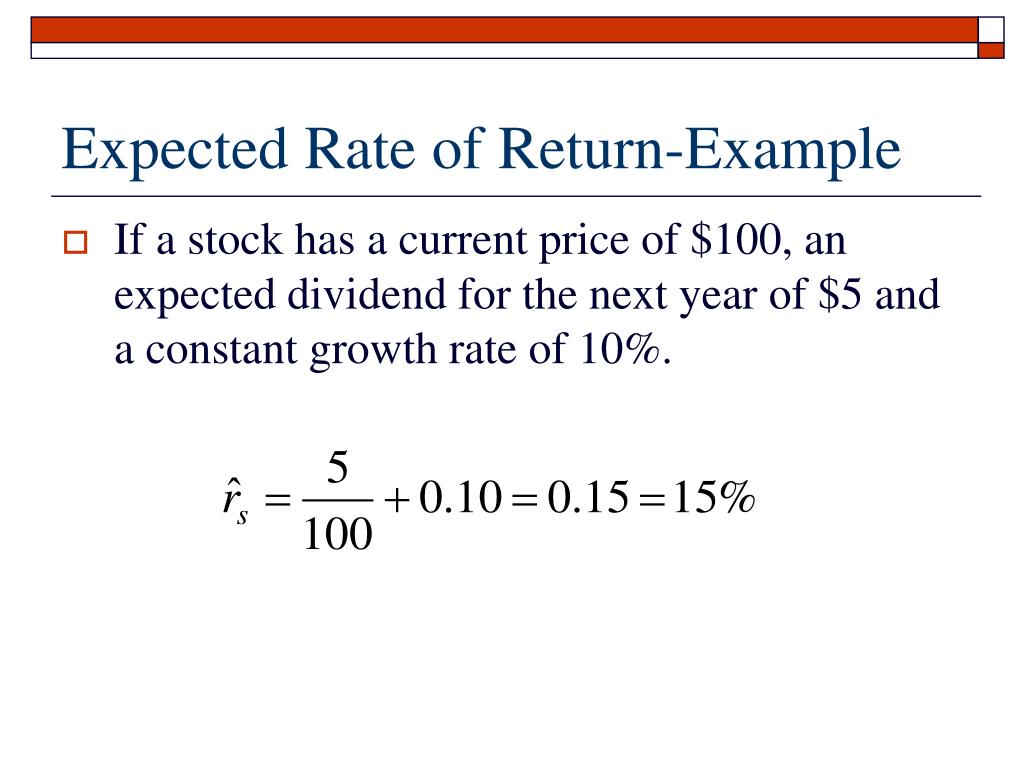

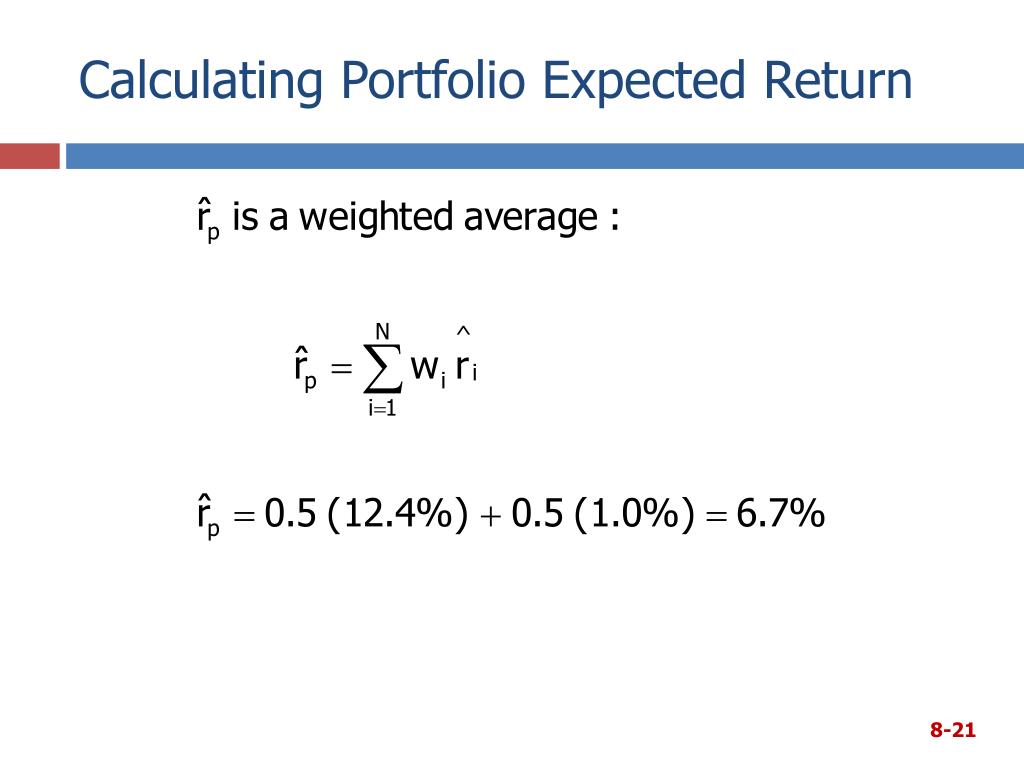

Calculating expected return is a crucial step in evaluating the potential performance of a stock. There are several methods to calculate expected return, including the capital asset pricing model (CAPM) and the dividend capitalization model. The CAPM formula is: Expected Return = Risk-Free Rate + Beta \* (Market Return – Risk-Free Rate). This formula takes into account the risk-free rate, beta, and market return to estimate the expected return of a stock. The dividend capitalization model, on the other hand, is: Expected Return = (Dividend per Share / Current Stock Price) + Growth Rate. This formula is particularly useful for dividend-paying stocks, as it estimates the expected return based on the dividend yield and growth rate. To learn how to calculate expected return of a stock, investors need to understand these formulas and how to apply them in real-world scenarios. By following a step-by-step approach, investors can accurately estimate the expected return of a stock and make informed investment decisions.

Factors Affecting Expected Return: A Deep Dive

Expected return is influenced by a multitude of factors, each playing a crucial role in shaping the potential performance of a stock. Understanding these factors is essential for investors seeking to accurately calculate expected return and make informed investment decisions. One of the primary factors affecting expected return is market risk, which represents the overall volatility of the market. Company-specific risk, on the other hand, is unique to each individual stock and is influenced by factors such as management quality, industry trends, and competitive landscape. Dividend yield, which represents the ratio of annual dividend payment to current stock price, also has a significant impact on expected return. Furthermore, growth rate, which reflects the rate at which a company’s earnings are expected to grow, is another critical factor in expected return calculation. Additionally, macroeconomic factors such as inflation, interest rates, and economic growth also influence expected return. By grasping the intricacies of these factors, investors can better understand how to calculate expected return of a stock and make more informed investment decisions.

Using Historical Data to Estimate Expected Return

Historical data plays a crucial role in estimating expected return, as it provides valuable insights into a stock’s past performance. When using historical data, it’s essential to choose the right time period and data sources to ensure accurate estimates. A common approach is to use a minimum of 5-10 years of historical data to capture the stock’s performance during different market conditions. Additionally, investors can use data sources such as Yahoo Finance, Quandl, or Alpha Vantage to access reliable and accurate historical data. When analyzing historical data, investors should consider factors such as the stock’s average return, volatility, and correlation with the broader market. By understanding how to calculate expected return of a stock using historical data, investors can make more informed investment decisions and develop a more accurate understanding of a stock’s potential performance. Furthermore, historical data can also be used to estimate the beta of a stock, which is a critical component of the capital asset pricing model (CAPM) formula. By combining historical data with other factors, investors can develop a comprehensive approach to estimating expected return and achieving long-term investment success.

Common Mistakes to Avoid When Calculating Expected Return

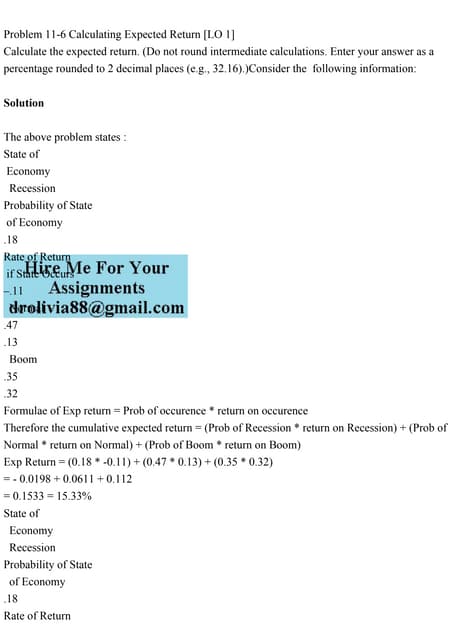

When it comes to calculating expected return, even the most seasoned investors can make mistakes that can significantly impact their investment decisions. One of the most common errors is ignoring risk, which can lead to an inaccurate estimate of expected return. Failing to account for inflation is another mistake that can result in an overestimation of expected return. Additionally, using incorrect or outdated data can lead to flawed calculations, while neglecting to consider the impact of dividends and growth rates can also skew expected return estimates. Furthermore, investors may also make the mistake of relying too heavily on historical data, without considering the potential for changes in market conditions or company-specific factors. By understanding how to calculate expected return of a stock and avoiding these common mistakes, investors can develop a more accurate and comprehensive approach to expected return calculation, ultimately leading to more informed investment decisions. It’s essential to be aware of these potential pitfalls and take a meticulous approach to expected return calculation to ensure long-term investment success.

Real-World Examples of Expected Return Calculation

To illustrate the practical application of expected return calculation, let’s consider a few real-world examples. Suppose we want to calculate the expected return of a stock in the technology sector, such as Apple Inc. (AAPL). Using the capital asset pricing model (CAPM), we can estimate the expected return of AAPL as follows: Expected Return = Risk-Free Rate + Beta \* (Market Return – Risk-Free Rate). Assuming a risk-free rate of 2%, a beta of 1.2, and a market return of 8%, the expected return of AAPL would be approximately 10.4%. This calculation provides a valuable insight into the potential return of AAPL, helping investors make informed decisions about their investment portfolio. Another example is calculating the expected return of a dividend-paying stock, such as Coca-Cola (KO). Using the dividend capitalization model, we can estimate the expected return of KO as follows: Expected Return = Dividend Yield + Growth Rate. Assuming a dividend yield of 3% and a growth rate of 5%, the expected return of KO would be approximately 8%. By understanding how to calculate expected return of a stock and applying it to real-world examples, investors can gain a deeper understanding of the stock market and make more informed investment decisions.

Putting it All Together: A Comprehensive Approach to Expected Return

In conclusion, mastering the calculation of expected return is a crucial aspect of achieving long-term investment success in the stock market. By understanding the significance of expected return, the different types of returns, and the factors that influence it, investors can make informed decisions about their investment portfolio. Additionally, by learning how to calculate expected return of a stock using the capital asset pricing model (CAPM) and the dividend capitalization model, investors can gain a deeper understanding of the stock market and make more accurate predictions about future returns. Furthermore, by avoiding common mistakes and using historical data to estimate expected return, investors can develop a comprehensive approach to expected return calculation. By incorporating these concepts into their investment strategy, investors can increase their chances of achieving long-term investment success and reaching their financial goals. Remember, a thorough understanding of expected return calculation is essential for making informed investment decisions and achieving success in the stock market.

:max_bytes(150000):strip_icc()/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)