Understanding the Fed Funds Rate: The Backbone of Monetary Policy

The Federal Reserve, the central banking system of the United States, plays a crucial role in shaping the country’s monetary policy. At the heart of this policy lies the Fed Funds Rate, a critical interest rate that influences the entire economy. The Fed Funds Rate is the interest rate at which depository institutions, such as banks and credit unions, lend and borrow money from each other overnight. This rate has a ripple effect on the entire financial system, impacting borrowing costs, inflation, and employment rates.

In essence, the Fed Funds Rate serves as a benchmark for other interest rates in the economy, including credit card rates, mortgage rates, and savings account rates. When the Federal Reserve adjusts the Fed Funds Rate, it has a direct impact on the availability and cost of credit, which in turn affects consumer spending, business investment, and economic growth. A lower Fed Funds Rate stimulates economic growth by making borrowing cheaper, while a higher rate slows down the economy by increasing borrowing costs.

Given its significance, the Fed Funds Rate is closely watched by economists, policymakers, and financial market participants. It is a key indicator of the Federal Reserve’s monetary policy stance and has a profound impact on the overall direction of the economy. As the Fed Funds Rate continues to evolve, it is essential to understand its intricacies and implications, particularly in comparison to other interest rates, such as the Secured Overnight Financing Rate (SOFR), which is becoming increasingly important in the post-LIBOR era. In fact, the choice between the Fed Funds Rate and SOFR will depend on various factors, including the specific financial application, risk tolerance, and market conditions.

Enter SOFR: The New Kid on the Block in Interest Rate Landscapes

The Secured Overnight Financing Rate (SOFR) is a relatively new interest rate benchmark that has been gaining traction in the financial markets. Introduced in 2018, SOFR is a broad measure of the cost of borrowing cash overnight, collateralized by U.S. Treasury securities. This rate is designed to replace the London Interbank Offered Rate (LIBOR), which has been plagued by manipulation scandals and is set to be phased out by 2023.

SOFR is significant because it provides a more robust and transparent interest rate benchmark, backed by a large and liquid market. Unlike the Fed Funds Rate, which is set by the Federal Reserve, SOFR is a market-driven rate that reflects the actual cost of borrowing in the overnight repo market. This makes SOFR a more accurate representation of the true cost of credit, which can have a profound impact on financial markets and the economy.

One of the key differences between the Fed Funds Rate and SOFR is their underlying assets. The Fed Funds Rate is based on unsecured lending between banks, whereas SOFR is based on secured lending, backed by U.S. Treasury securities. This difference has significant implications for risk management and financial stability. Additionally, SOFR is a more comprehensive rate, covering a broader range of transactions and market participants, which makes it a more representative benchmark for the entire financial system.

As the financial markets continue to transition from LIBOR to SOFR, it is essential to understand the implications of this shift. The choice between the Fed Funds Rate and SOFR will depend on various factors, including the specific financial application, risk tolerance, and market conditions. In the next section, we will provide a step-by-step guide on how to decide between the Fed Funds Rate and SOFR for various financial applications, such as loans, investments, and risk management.

How to Choose Between Fed Funds Rate and SOFR for Your Financial Needs

When it comes to making informed financial decisions, understanding the differences between the Fed Funds Rate and SOFR is crucial. Both rates have their unique characteristics, advantages, and disadvantages, which can impact your financial applications, such as loans, investments, and risk management. Here’s a step-by-step guide to help you decide between the Fed Funds Rate and SOFR:

Step 1: Determine Your Financial Goals

Identify your financial objectives, whether it’s borrowing, investing, or managing risk. This will help you understand which rate is more suitable for your needs.

Step 2: Assess Your Risk Tolerance

Consider your risk appetite and the level of uncertainty you’re willing to accept. SOFR, being a secured rate, is generally considered less risky than the Fed Funds Rate, which is unsecured.

Step 3: Evaluate the Market Conditions

Analyze the current market conditions, including the state of the economy, inflation, and employment rates. This will help you determine which rate is more reflective of the market’s true cost of credit.

Step 4: Consider the Term Structure

Think about the term structure of your financial application. SOFR is a overnight rate, while the Fed Funds Rate can have a longer term structure. This can impact your borrowing costs and investment returns.

Step 5: Weigh the Benefits and Drawbacks

Compare the benefits and drawbacks of each rate, including their calculation methods, underlying assets, and usage. This will help you make an informed decision based on your financial needs.

By following these steps, you can make a well-informed decision between the Fed Funds Rate and SOFR, ensuring that you’re using the most suitable rate for your financial applications. Remember, understanding the differences between these two rates is crucial in navigating the complex world of interest rates.

The Impact of Fed Funds Rate on the Economy: A Deep Dive

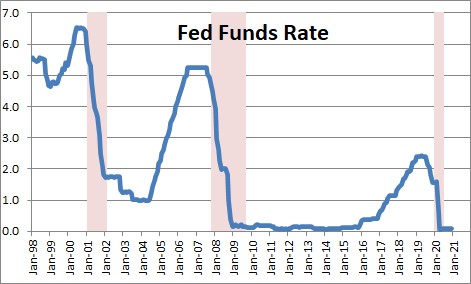

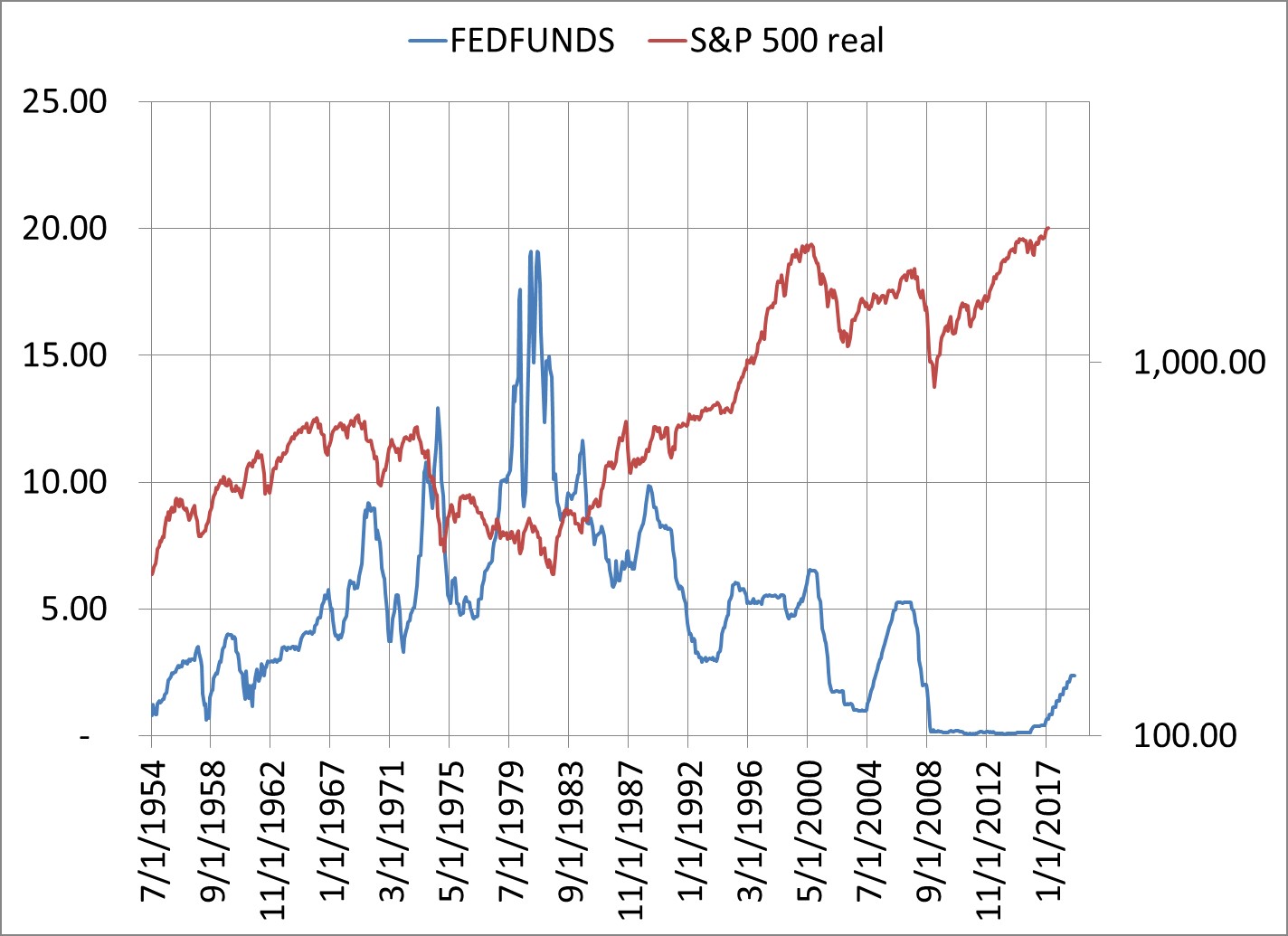

The Fed Funds Rate is a crucial component of the US monetary policy, and its changes can have far-reaching effects on the economy. In this section, we’ll delve into the impact of the Fed Funds Rate on GDP growth, inflation, and employment rates, using historical examples to illustrate the points.

Impact on GDP Growth

Changes in the Fed Funds Rate can influence the overall direction of the economy. When the Fed lowers the Fed Funds Rate, it reduces borrowing costs, making it cheaper for businesses and individuals to access credit. This can lead to increased spending, investment, and consumption, ultimately boosting GDP growth. Conversely, when the Fed raises the Fed Funds Rate, it increases borrowing costs, reducing spending and investment, and potentially slowing down GDP growth.

For example, during the 2008 financial crisis, the Fed lowered the Fed Funds Rate to near zero, stimulating economic growth and helping the economy recover from the recession.

Impact on Inflation

The Fed Funds Rate also plays a critical role in controlling inflation. When the economy is growing rapidly, the Fed may raise the Fed Funds Rate to prevent inflation from rising too quickly. This reduces borrowing and spending, cooling down the economy and keeping inflation in check. On the other hand, when the economy is slowing down, the Fed may lower the Fed Funds Rate to stimulate growth and prevent deflation.

For instance, in the early 1980s, the Fed, under Chairman Paul Volcker, raised the Fed Funds Rate to combat high inflation, which had risen to over 14%. This move helped bring inflation under control, but it also led to a recession.

Impact on Employment Rates

The Fed Funds Rate can also influence employment rates. When the Fed lowers the Fed Funds Rate, it can lead to increased hiring and job creation, as businesses take advantage of cheaper credit to invest and expand. Conversely, when the Fed raises the Fed Funds Rate, it can lead to reduced hiring and job losses, as businesses reduce spending and investment.

For example, during the 2010s, the Fed’s quantitative easing program, which included keeping the Fed Funds Rate low, helped stimulate job growth and reduce unemployment rates.

In conclusion, the Fed Funds Rate has a profound impact on the economy, influencing GDP growth, inflation, and employment rates. Understanding the effects of changes in the Fed Funds Rate is essential for making informed financial decisions and navigating the complex world of interest rates.

SOFR’s Rise to Prominence: What It Means for Financial Markets

The transition from LIBOR to SOFR marks a significant shift in the interest rate landscape. As the financial industry adapts to this change, it’s essential to understand the implications of SOFR’s rise to prominence.

The Need for a New Benchmark

The London Interbank Offered Rate (LIBOR) has been the benchmark for short-term interest rates for decades. However, its credibility was compromised by the 2008 financial crisis, and it was eventually deemed unfit for purpose. The need for a more robust and transparent interest rate benchmark led to the development of SOFR.

SOFR’s Advantages

SOFR offers several advantages over LIBOR. It’s based on a broader set of transactions, making it a more representative benchmark. SOFR is also less susceptible to manipulation, as it’s calculated from actual transactions rather than quotes from banks. Additionally, SOFR is a secured rate, meaning it’s backed by collateral, which reduces the risk of default.

Implications for Financial Markets

The transition to SOFR will have far-reaching implications for financial markets. It will affect the pricing of loans, derivatives, and other financial instruments. The shift to SOFR will also require significant changes to risk management systems, accounting practices, and regulatory frameworks.

Benefits of SOFR

The adoption of SOFR will bring several benefits to financial markets. It will provide a more accurate and reliable benchmark, reducing the risk of manipulation and default. SOFR will also increase transparency, making it easier for investors to make informed decisions. Furthermore, SOFR will promote financial stability by reducing the risk of systemic failures.

In conclusion, SOFR’s rise to prominence marks a significant shift in the interest rate landscape. As the financial industry adapts to this change, it’s essential to understand the implications of SOFR and its benefits for financial markets. By doing so, investors and financial institutions can make informed decisions and navigate the complex world of interest rates with confidence.

Fed Funds Rate vs SOFR: A Side-by-Side Comparison

When it comes to navigating the complex world of interest rates, understanding the differences between the Fed Funds Rate and SOFR is crucial. In this section, we’ll provide a detailed comparison of these two key interest rates, highlighting their calculation methods, underlying assets, and usage.

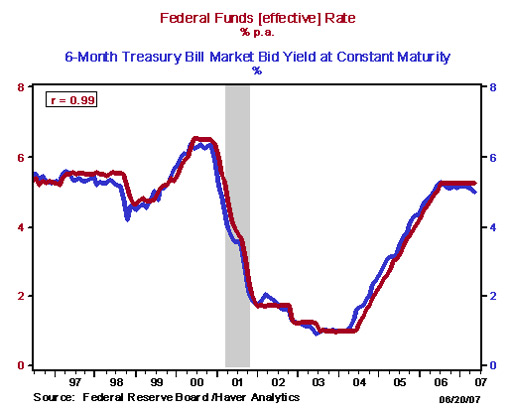

Calculation Methods

The Fed Funds Rate is set by the Federal Reserve, the central bank of the United States, and is calculated as the weighted average of the rates at which depository institutions lend and borrow money from each other overnight. On the other hand, SOFR is calculated by the New York Fed, based on the rates at which banks and other financial institutions lend and borrow money overnight, backed by collateral.

Underlying Assets

The Fed Funds Rate is an unsecured rate, meaning it’s not backed by any collateral. In contrast, SOFR is a secured rate, backed by high-quality collateral such as Treasury securities. This makes SOFR a more reliable and stable interest rate benchmark.

Usage

The Fed Funds Rate is used as a benchmark for short-term interest rates, influencing the prime lending rate, credit card rates, and other consumer loan rates. SOFR, on the other hand, is used as a benchmark for a wide range of financial instruments, including loans, derivatives, and securities.

Volatility

The Fed Funds Rate is more volatile than SOFR, as it’s influenced by the Federal Reserve’s monetary policy decisions. SOFR, being a market-based rate, is less volatile and more reflective of market conditions.

History

The Fed Funds Rate has been in existence since the 1950s, while SOFR was introduced in 2018 as a replacement for LIBOR. SOFR is still a relatively new interest rate benchmark, but it’s quickly gaining traction in the financial markets.

In conclusion, understanding the differences between the Fed Funds Rate and SOFR is essential for making informed financial decisions. By recognizing the strengths and weaknesses of each interest rate benchmark, investors and financial institutions can navigate the complex world of interest rates with confidence. The “fed funds rate vs sofr” debate is an important one, and this comparison provides a comprehensive overview of the two interest rates.

The Future of Interest Rates: Trends, Predictions, and Insights

The world of interest rates is constantly evolving, and understanding the trends, predictions, and insights is crucial for making informed financial decisions. In this section, we’ll explore the potential impact of technological advancements, regulatory changes, and shifting economic landscapes on the future of interest rates.

Tech-Driven Innovation

The rise of fintech and digital banking is transforming the way interest rates are set and managed. With the increasing use of artificial intelligence, machine learning, and blockchain technology, interest rates may become more dynamic and responsive to market conditions. This could lead to more efficient and accurate interest rate setting, benefiting both lenders and borrowers.

Regulatory Changes

Regulatory bodies are continually refining their approaches to interest rate management. For instance, the Federal Reserve’s shift towards a more data-driven approach to monetary policy may lead to more nuanced and targeted interest rate decisions. Similarly, the adoption of SOFR as a replacement for LIBOR may lead to a more robust and transparent interest rate benchmark.

Shifting Economic Landscapes

The global economy is undergoing significant shifts, with emerging markets gaining prominence and trade policies influencing economic growth. These changes may lead to new interest rate dynamics, with central banks adapting to new economic realities. For example, the rise of emerging markets may lead to a more decentralized interest rate landscape, with regional interest rates playing a more significant role.

Predictions and Insights

Based on these trends, we can expect the following predictions and insights for the future of interest rates:

- The Fed Funds Rate and SOFR will continue to play important roles in the US monetary policy, with the latter gaining more prominence in the post-LIBOR era.

- Interest rates will become more dynamic and responsive to market conditions, driven by technological advancements and regulatory changes.

- The global economy will continue to evolve, leading to new interest rate dynamics and a more decentralized interest rate landscape.

In conclusion, understanding the trends, predictions, and insights for the future of interest rates is essential for navigating the complex world of interest rates. By recognizing the potential impact of technological advancements, regulatory changes, and shifting economic landscapes, investors and financial institutions can make informed decisions and stay ahead of the curve. The “fed funds rate vs sofr” debate will continue to evolve, and staying informed about the future of interest rates will be crucial for success.

Conclusion: Navigating the Complex World of Interest Rates

In conclusion, understanding the Fed Funds Rate and SOFR is crucial for making informed financial decisions in today’s complex interest rate landscape. By grasping the differences between these two key interest rates, individuals and institutions can better navigate the world of finance and make more informed decisions about loans, investments, and risk management.

The “fed funds rate vs SOFR” debate is not just about choosing between two interest rates; it’s about understanding the underlying mechanisms that drive the economy, inflation, and employment. By recognizing the strengths and weaknesses of each rate, individuals can make more informed decisions that align with their financial goals and risk tolerance.

As the world of interest rates continues to evolve, it’s essential to stay informed about the latest trends, predictions, and insights. By doing so, individuals and institutions can stay ahead of the curve and make the most of the opportunities presented by the Fed Funds Rate and SOFR.

In this comprehensive guide, we’ve provided a detailed overview of the Fed Funds Rate and SOFR, including their definitions, roles, and differences. We’ve also explored the impact of each rate on the economy, inflation, and employment, and provided a step-by-step guide on how to choose between them for various financial applications.

By applying the knowledge and insights gained from this guide, individuals and institutions can navigate the complex world of interest rates with confidence, making informed decisions that drive financial success.