Understanding the Alphabet Soup of Google’s Stock Tickers

Investing in Google can be a daunting task, especially when faced with the question: what’s the difference between GOOG and GOOGL? The tech giant’s dual-class stock structure has led to confusion among investors, making it essential to grasp the nuances of each ticker symbol. GOOG and GOOGL are not interchangeable terms, and understanding their differences is crucial for making informed investment decisions. In this article, we’ll explore the history behind Google’s stock structure, the key distinctions between GOOG and GOOGL, and provide guidance on investment strategies for these stocks.

How to Identify the Right Google Stock for Your Investment Portfolio

In 2014, Google underwent a significant restructuring, resulting in the creation of two distinct stock classes: GOOG and GOOGL. This dual-class stock structure was designed to preserve the company’s founders’ control while still allowing for public investment. The main reason behind this move was to ensure that Larry Page and Sergey Brin, Google’s co-founders, could maintain their influence over the company’s direction and decision-making process. This unique structure has led to the existence of two separate stocks, each with its own characteristics and implications for investors.

The Key Distinctions Between GOOG and GOOGL Shares

When it comes to understanding what’s the difference between GOOG and GOOGL, it’s essential to delve into the main differences between these two stock classes. The primary distinction lies in their voting rights, with GOOGL (Class A shares) carrying one vote per share and GOOG (Class C shares) carrying no voting rights. This significant difference has a direct impact on shareholder power and influence over the company’s decision-making process. Additionally, GOOG and GOOGL shares have distinct stock price trends and dividend payment policies, which can affect investment decisions and overall portfolio performance. By grasping these key differences, investors can make informed decisions about which stock to invest in and how to optimize their investment strategy.

Voting Rights and Shareholder Power: What You Need to Know

One of the most critical differences between GOOG and GOOGL lies in their voting rights. GOOGL, also known as Class A shares, carry one vote per share, giving shareholders a say in the company’s decision-making process. On the other hand, GOOG, or Class C shares, have no voting rights, effectively limiting the influence of their shareholders. This dual-class structure was designed to ensure that Google’s founders, Larry Page and Sergey Brin, maintained control over the company while still allowing for public investment. Understanding the implications of voting rights is crucial for investors, as it can significantly impact their ability to shape the company’s future. When considering what’s the difference between GOOG and GOOGL, investors must weigh the importance of voting rights in their investment decisions.

Stock Performance and Price Differences: A Comparative Analysis

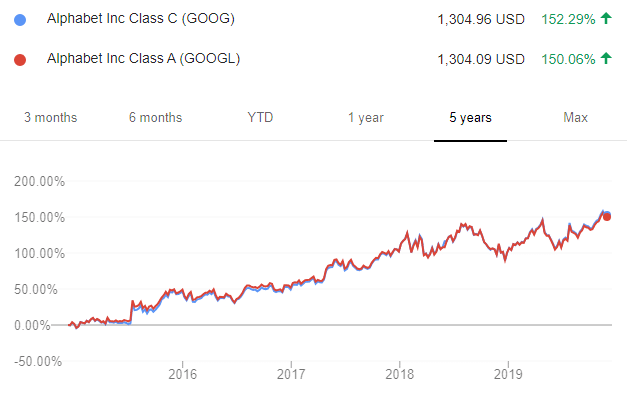

When evaluating what’s the difference between GOOG and GOOGL, it’s essential to examine their historical performance and price trends. Since their inception, both stocks have exhibited distinct patterns, with GOOGL (Class A shares) generally trading at a premium to GOOG (Class C shares). This price difference can be attributed to the voting rights associated with GOOGL shares, which are perceived as more valuable by investors. A comparative analysis of the two stocks reveals that GOOGL has historically been more volatile, with greater price fluctuations in response to market changes. In contrast, GOOG has tended to be more stable, with less pronounced price movements. Understanding these differences in stock performance and price trends is crucial for investors seeking to make informed decisions about their investment portfolios.

Dividend Payments and Shareholder Value

When considering what’s the difference between GOOG and GOOGL, investors should also examine the dividend payment policies of these two stocks. Historically, both GOOG and GOOGL have followed the same dividend payment schedule, with no significant differences in the dividend yield or payout ratio. This is because Alphabet, the parent company of Google, has a single dividend policy that applies to both classes of shares. As a result, shareholders of both GOOG and GOOGL receive the same dividend payments per share. However, the impact of dividend payments on shareholder value can differ between the two stocks. For instance, the voting rights associated with GOOGL shares may lead to a higher valuation of these shares, which can, in turn, affect the dividend yield. Understanding the nuances of dividend payments and their impact on shareholder value is essential for investors seeking to maximize their returns from GOOG and GOOGL stocks.

Investment Strategies for GOOG and GOOGL Stocks

When deciding what’s the difference between GOOG and GOOGL and how to incorporate them into an investment portfolio, it’s essential to consider various investment strategies. For long-term investors, a buy-and-hold approach may be suitable for both GOOG and GOOGL, as Alphabet’s strong financial position and growth prospects can provide a stable source of returns. Short-term traders, on the other hand, may focus on exploiting the price differences between the two stocks, taking advantage of market inefficiencies to generate profits. Diversification is also a key consideration, as spreading investments across both GOOG and GOOGL can help mitigate risk and increase potential returns. Additionally, investors may consider a dollar-cost averaging strategy, investing a fixed amount of money at regular intervals to reduce the impact of market volatility. By understanding the distinct characteristics of GOOG and GOOGL, investors can develop a tailored investment strategy that aligns with their financial goals and risk tolerance.

Conclusion: Navigating the Complexities of GOOG and GOOGL Stocks

In conclusion, understanding what’s the difference between GOOG and GOOGL is crucial for making informed investment decisions. By grasping the distinct characteristics of these two stocks, including their voting rights, stock prices, and dividend payments, investors can develop a tailored investment strategy that aligns with their financial goals and risk tolerance. Whether you’re a long-term investor or a short-term trader, recognizing the nuances of GOOG and GOOGL can help you navigate the complexities of Alphabet’s dual-class stock structure and unlock potential returns. Remember, understanding the differences between GOOG and GOOGL is key to making informed investment decisions and achieving success in the stock market.